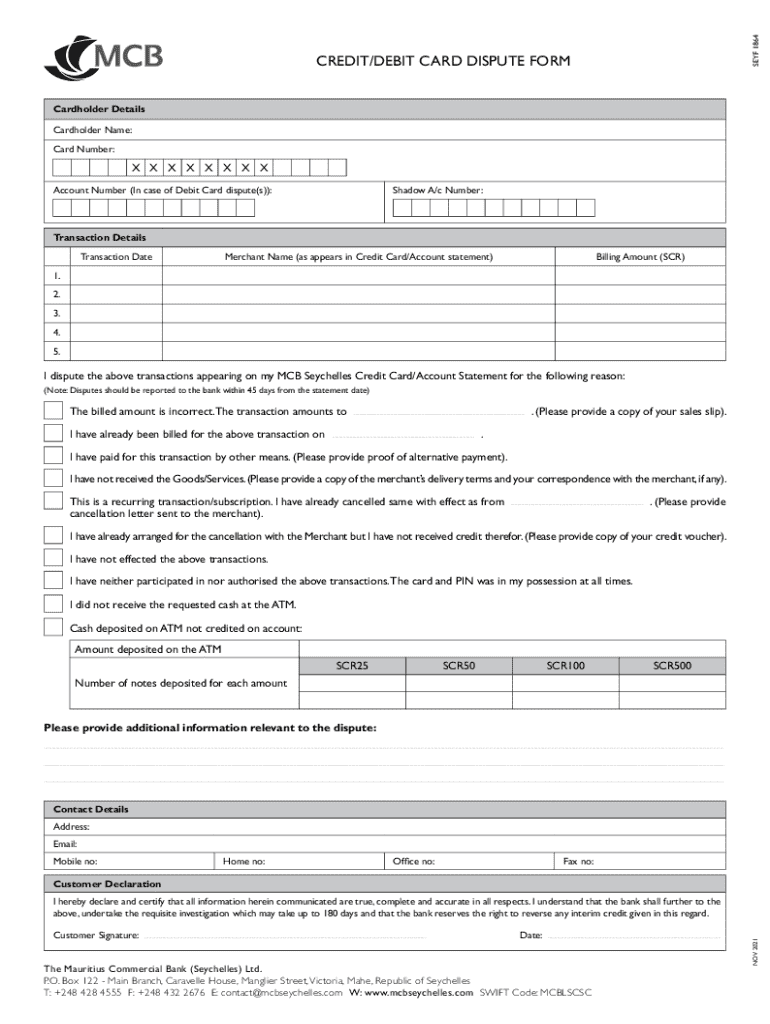

Get the free Credit/debit Card Dispute Form

Get, Create, Make and Sign creditdebit card dispute form

How to edit creditdebit card dispute form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out creditdebit card dispute form

How to fill out creditdebit card dispute form

Who needs creditdebit card dispute form?

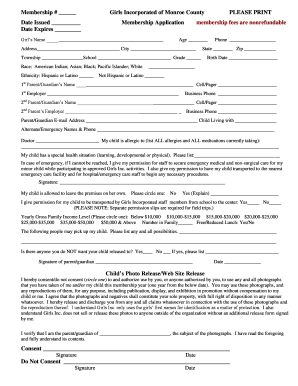

Credit/Debit Card Dispute Form: A Comprehensive How-to Guide

Understanding the credit/debit card dispute process

A credit/debit card dispute arises when a cardholder contests a charge on their account, often due to unauthorized transactions, fraud, or merchant errors. The dispute process is essential in protecting consumers from erroneous charges and ensuring accountability in credit card transactions.

Common reasons for initiating a dispute include:

Filing a dispute in a timely manner is crucial. Most financial institutions require cardholders to submit disputes within 60 days of the transaction date to be considered for investigation and resolution.

Preparing to fill out the credit/debit card dispute form

Before diving into the dispute form, gather essential information. This preparation is vital for a smooth filing process and includes important details such as:

Understanding your rights as a consumer is equally important. Consumer protection laws, such as the Fair Credit Billing Act, grant you specific rights when disputing charges, empowering you to protect your financial interests.

Financial institutions also play a part in this process, as they are obligated to investigate disputed transactions and report back with their findings.

Step-by-step guide to completing the credit/debit card dispute form

To begin your dispute, access the credit/debit card dispute form through pdfFiller. You can easily navigate to the relevant page on their website, where you have multiple options for downloading or editing the form directly online.

Follow these steps to complete the form effectively:

Editing and customizing your dispute form

pdfFiller’s platform provides user-friendly editing tools that allow you to customize your dispute form thoroughly.

Take advantage of features such as:

If you are working within a team, utilize the platform to share forms for review before submitting. Collaboration can enhance clarity and improve accuracy.

Managing your dispute after submission

Once your submission is complete, it’s crucial to stay informed. Here’s what to expect after submitting your dispute:

For effective management, follow up with your bank or credit provider periodically to inquire about the status of your dispute.

Common mistakes to avoid when filing a dispute

Navigating the dispute process can be challenging, and certain pitfalls can hinder your progress. Be mindful of these common mistakes:

FAQs about credit/debit card disputes

When it comes to credit/debit card disputes, many questions arise. Here are answers to some frequently asked queries:

Resources and support

For further assistance, consider reaching out to consumer protection agencies or the fraud departments of your specific bank. Helpful resources include:

Engaging with pdfFiller's solutions for ongoing document management

pdfFiller not only assists with dispute forms but is also a robust solution for ongoing document management. With features enabling the easy creation and editing of documents in a secure digital environment, users can streamline their workflows effectively.

The benefits of utilizing pdfFiller include:

Encouraging regular check-ins on financial transactions is a proactive way to maintain financial health and address issues before they escalate into disputes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify creditdebit card dispute form without leaving Google Drive?

How do I execute creditdebit card dispute form online?

How do I make changes in creditdebit card dispute form?

What is creditdebit card dispute form?

Who is required to file creditdebit card dispute form?

How to fill out creditdebit card dispute form?

What is the purpose of creditdebit card dispute form?

What information must be reported on creditdebit card dispute form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.