Get the free Broker-dealer Client Relationship Summary (form Crs)

Get, Create, Make and Sign broker-dealer client relationship summary

How to edit broker-dealer client relationship summary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker-dealer client relationship summary

How to fill out broker-dealer client relationship summary

Who needs broker-dealer client relationship summary?

Comprehensive Guide to the Broker-Dealer Client Relationship Summary Form

Understanding the broker-dealer relationship

A broker-dealer is a person or firm that is in the business of buying and selling securities. They play a critical role in financial markets, acting as an intermediary between buyers and sellers. Understanding this dynamic relationship is essential for building trust and ensuring compliance with industry standards.

Client relationships are the backbone of brokerage operations, impacting everything from compliance to investment outcomes. The quality of these relationships can determine client retention and overall satisfaction. Regulators have instituted specific requirements to foster transparency and protect investors. For instance, the SEC mandates the creation of a Client Relationship Summary Form (CRS) to ensure that clients are fully informed about their broker-dealer’s services, fees, and potential conflicts of interest.

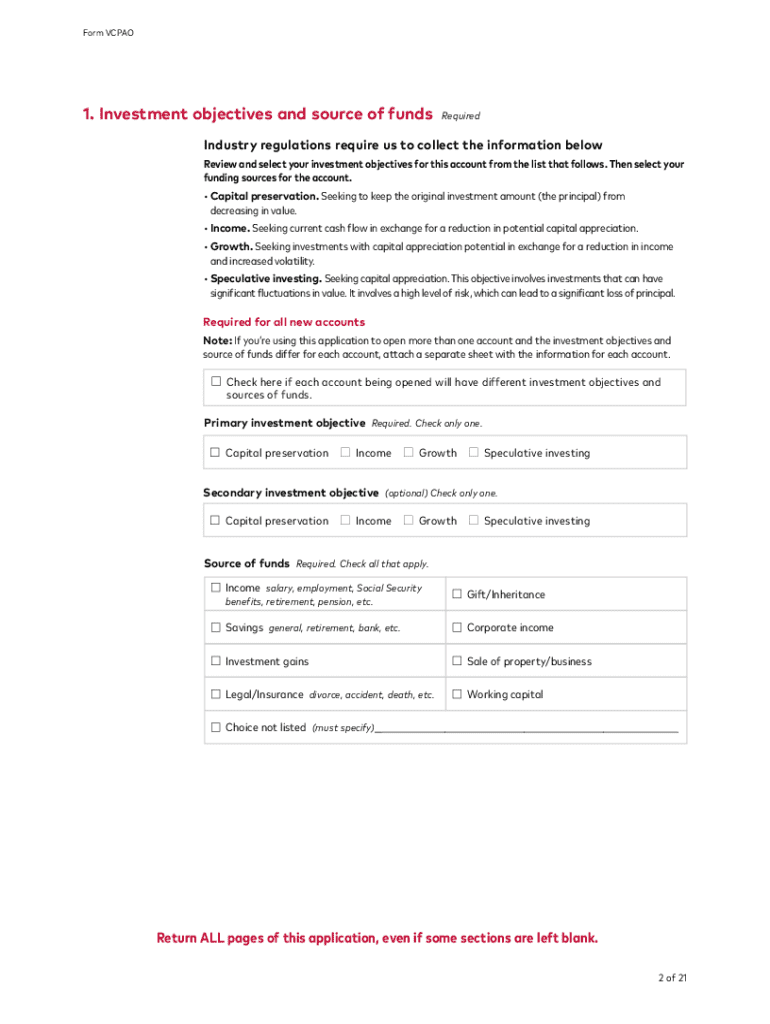

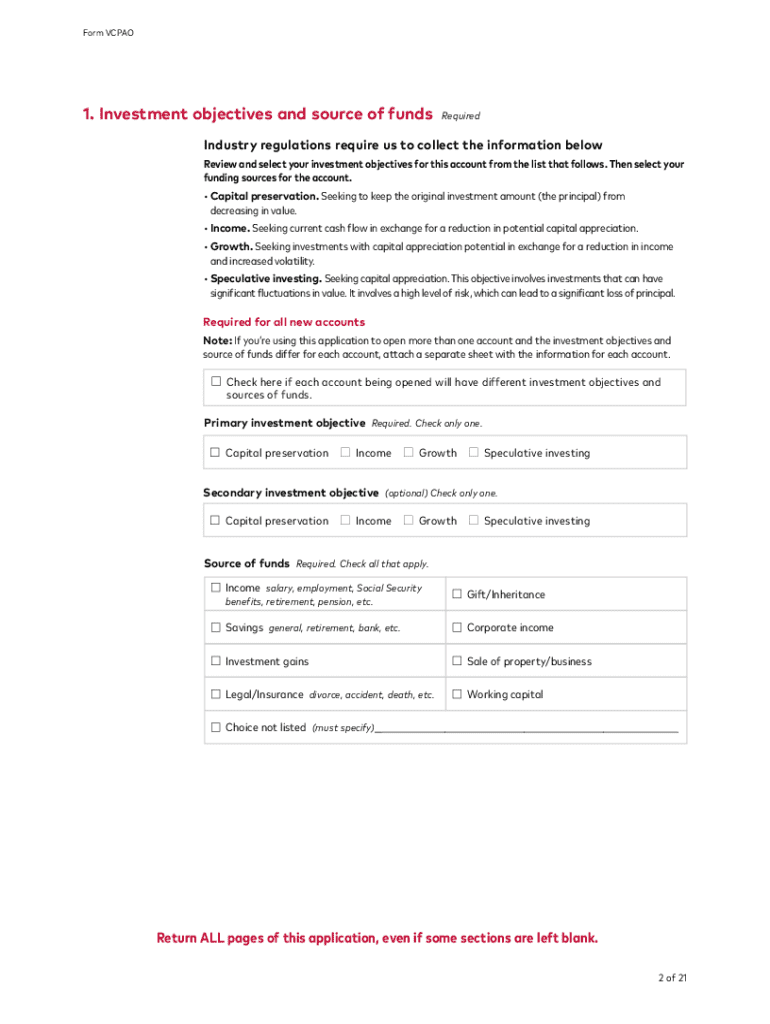

Key components of the broker-dealer client relationship summary form

The Broker-Dealer Client Relationship Summary Form is structured to deliver essential information clearly and concisely. It aims to provide clients with an overview of the services offered while collecting pertinent details about the client’s financial circumstances.

Step-by-step guide to completing the summary form

Completing the Broker-Dealer Client Relationship Summary Form requires careful attention to detail. Follow this structured approach to ensure accuracy and thoroughness.

Editing and customizing the summary form

Once the form is completed, many opt to edit it for clarity or to personalize it. pdfFiller makes this process seamless with a range of interactive tools.

Signing the broker-dealer client relationship summary form

Electing to eSign the Broker-Dealer Client Relationship Summary Form can streamline the process significantly. Understanding the legality and security involved in eSigning is crucial.

Collaborating on the summary form

Collaboration can enhance the process of filling out the summary form, especially when input from different stakeholders is required. pdfFiller simplifies sharing and team collaboration.

Managing your documents securely

In a world increasingly reliant on digital documentation, managing your files securely is paramount. The cloud capabilities of pdfFiller facilitate effective document management.

Troubleshooting common challenges

Filling out the Broker-Dealer Client Relationship Summary Form can sometimes lead to challenges. Being prepared with solutions can ease the process.

Enhancing your client relationships post-form submission

Once the Broker-Dealer Client Relationship Summary Form is submitted, proactive measures should be taken to strengthen the relationship. This ongoing engagement is essential for building trust and ensuring compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my broker-dealer client relationship summary directly from Gmail?

How can I get broker-dealer client relationship summary?

How do I fill out broker-dealer client relationship summary using my mobile device?

What is broker-dealer client relationship summary?

Who is required to file broker-dealer client relationship summary?

How to fill out broker-dealer client relationship summary?

What is the purpose of broker-dealer client relationship summary?

What information must be reported on broker-dealer client relationship summary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.