Get the free Form 990 - static texastribune

Get, Create, Make and Sign form 990 - static

Editing form 990 - static online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 - static

How to fill out form 990

Who needs form 990?

Form 990 - Static Form: A Comprehensive Guide for Tax-Exempt Organizations

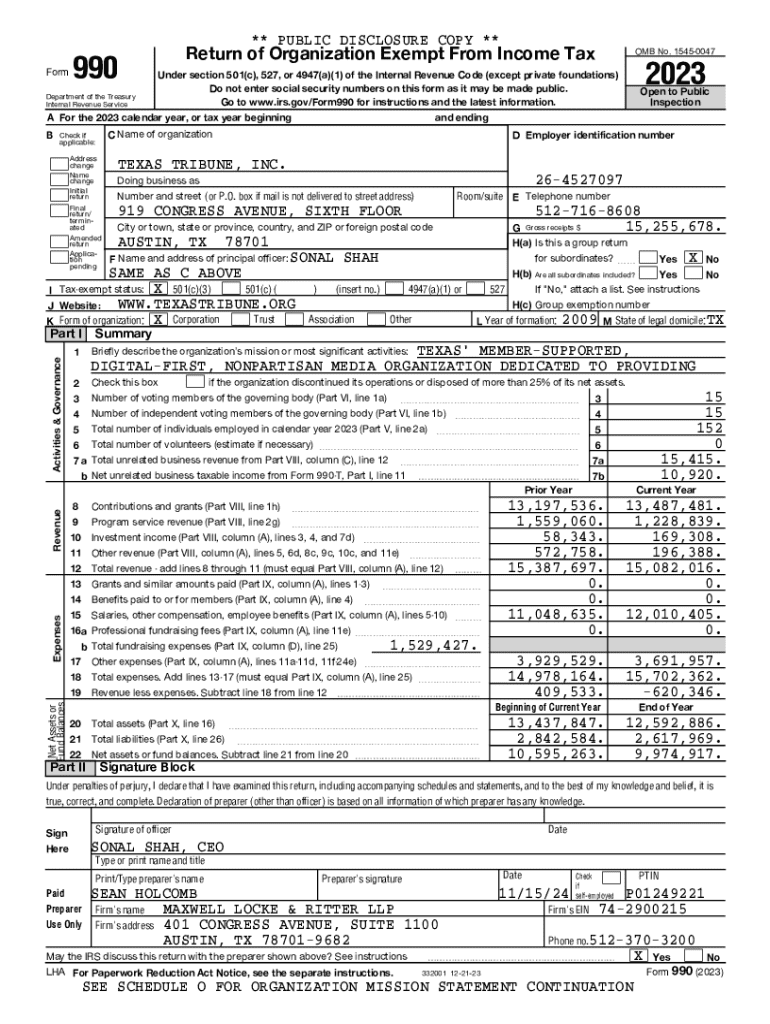

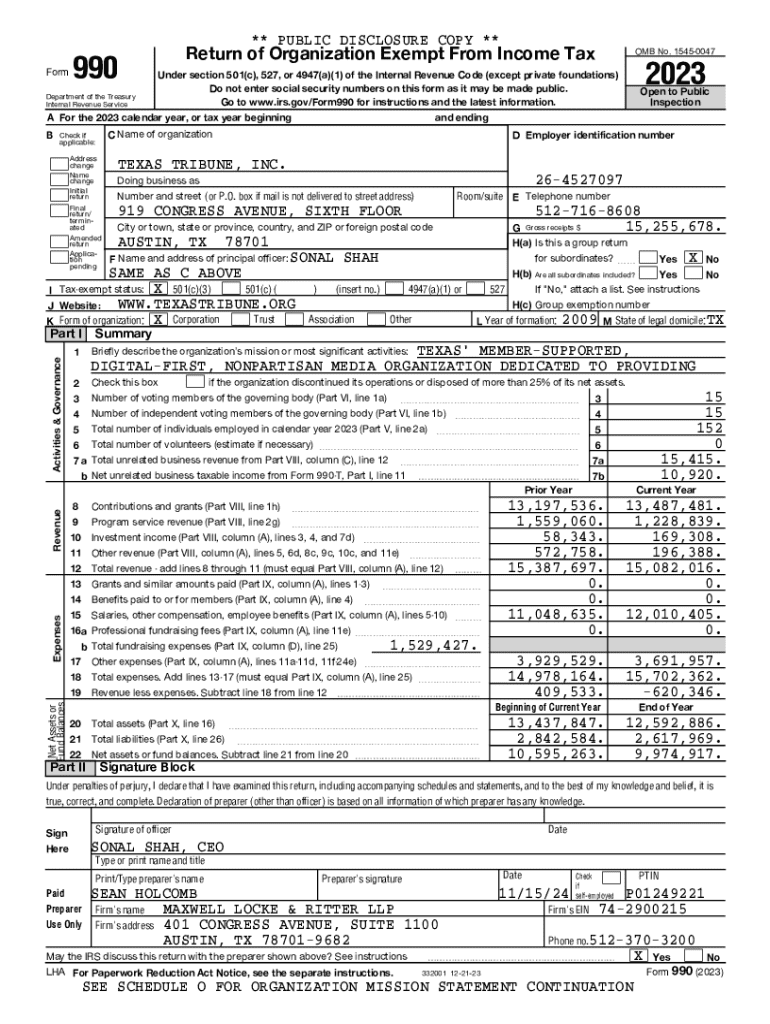

Understanding Form 990

Form 990 is a critical document required by the IRS for tax-exempt organizations in the United States. Its primary purpose is to provide transparency about an organization's financial activities, governance, and compliance with tax regulations. Nonprofits use this form to report on their operations, financial situation, and ensure accountability to the public and the IRS. By filing Form 990, these organizations not only comply with tax obligations but also build trust with donors and the community.

The significance of Form 990 cannot be overstated. It serves as a public record that informs potential contributors, government entities, and the public about the organization's mission and spending. This level of transparency is crucial for receiving donations and grants, as stakeholders want to know how funds are being allocated and used.

Who needs to file Form 990?

Generally, organizations recognized as tax-exempt under Section 501(c)(3) and other categories must file Form 990. There are specific thresholds based on annual gross receipts and total assets that determine which version of Form 990 is required. Common categories that must file include charitable organizations, social welfare organizations, and labor unions. Failure to file can result in penalties, making it essential for these groups to understand their obligations.

Key components of Form 990

Form 990 consists of several key components, each designed to give pertinent information about the nonprofit organization's financial and operational status. Major sections include:

Common mistakes in Form 990 preparation

Accuracy in filing Form 990 is paramount. Errors can lead to misunderstandings or legal issues, which may result in penalties or even loss of nonprofit status. Common preparation errors include misreporting income, failing to include required schedules, or providing incomplete information. Such inaccuracies can distort the financial picture presented to stakeholders and regulatory authorities.

To ensure compliance and accuracy, organizations should take note of frequent errors to avoid. Common pitfalls include:

To avoid these mistakes, consider using checklists for accurate filing. These lists can outline critical items to verify before submission, ensuring that every part of the form is completed and accurate.

Detailed instructions for filling out Form 990

Filling out Form 990 can feel daunting with its numerous sections and specific requirements. Here’s a step-by-step breakdown of the form, designed to guide you through the process effectively.

Additionally, specific entries might require detailed information. These can include the organization’s mission statement, detailed financial data, and information about governance. Addressing common queries about the filling process can also be immensely helpful; consider preparing FAQs to assist in understanding complex sections.

Editing and customizing Form 990

Using pdfFiller to edit Form 990 streamlines the process of filling out this important document. pdfFiller offers several key features that help nonprofits manage their forms effectively. Users can easily upload and edit PDFs, fill out forms directly online, and save progress.

One of the standout features is the e-signature functionality. Organizations can easily add e-signatures, allowing for quick completion without needing to print and scan documents. Collaborating with team members becomes seamless, as pdfFiller enables multiple users to work on the document in real-time, perfect for organizations with remote teams.

Sharing and managing your Form 990

Once your Form 990 is complete, pdfFiller provides versatile options for document tracking and sharing. You can manage your submitted forms effortlessly, ensuring compliance and making it simple to retrieve information at any point. Even after submission, utilizing pdfFiller helps maintain an organized document management system that supports your compliance efforts and archive accessibility.

Resources and tools for effective form filing

Engaging with interactive tools available on pdfFiller not only simplifies the filing process but also enhances the overall experience. Users can access templates specifically designed for Form 990, eliminating the guesswork in formatting. These tools help ensure that all required information is included and accurately reported, making the filing process more efficient.

Moreover, it’s beneficial to familiarize yourself with complementary forms like Form 990-EZ and Form 990-PF. Each serves distinct purposes for different types of organizations, and understanding their nuances can help in filing the correct form as necessary.

Real-world scenarios can provide valuable insights into the successful filing of Form 990. Reviewing case studies that highlight common challenges and solutions can serve as a guide for best practices, helping organizations navigate the complexities of compliance.

Legal and compliance considerations

Navigating the legal landscape surrounding Form 990 requires an understanding of IRS regulations. Organizations must stay informed about changes to tax laws that may impact their filing requirements. Regularly consulting IRS publications or resources can help organizations remain compliant and avoid pitfalls.

It’s important to be aware of the consequences of non-compliance, which can include penalties, fines, or more severe repercussions such as losing tax-exempt status. Engaging with legal professionals for guidance on complex issues can also help mitigate risks associated with improper filings.

Resources for legal guidance

Seeking legal guidance is advisable for organizations new to Form 990 filings or those undergoing structural changes. Numerous resources are available, including legal aid clinics, tax advisory services specializing in nonprofits, and online platforms that offer consultations on compliance issues.

Engaging with the filing community

Networking with other nonprofit filers can help amplify your organization’s understanding and expertise regarding Form 990. Joining forums, attending webinars, and participating in workshops are excellent ways to learn from others' experiences and share best practices.

Engagement in these communities not only fosters a supportive environment but also provides opportunities to stay updated on the latest trends in compliance strategies. Advocating for and sharing effective practices ensures that organizations continuously improve their filing procedures and enhance accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 - static to be eSigned by others?

How can I get form 990 - static?

How do I complete form 990 - static on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.