Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive Guide

Understanding the Return of Organization Exempt Form

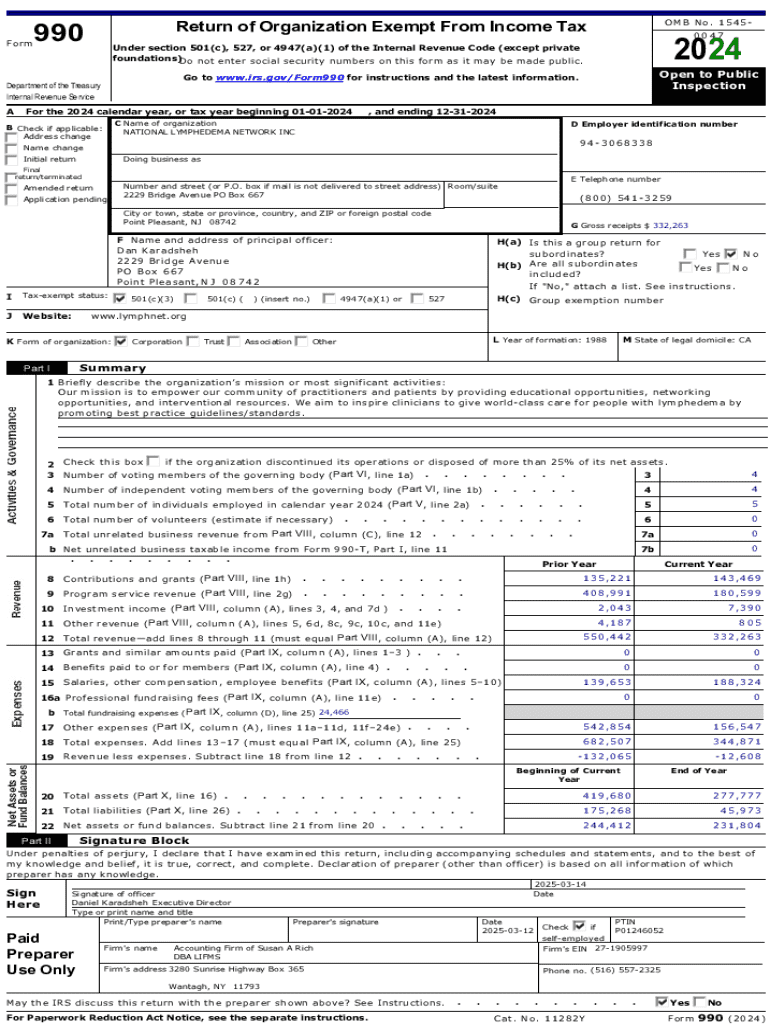

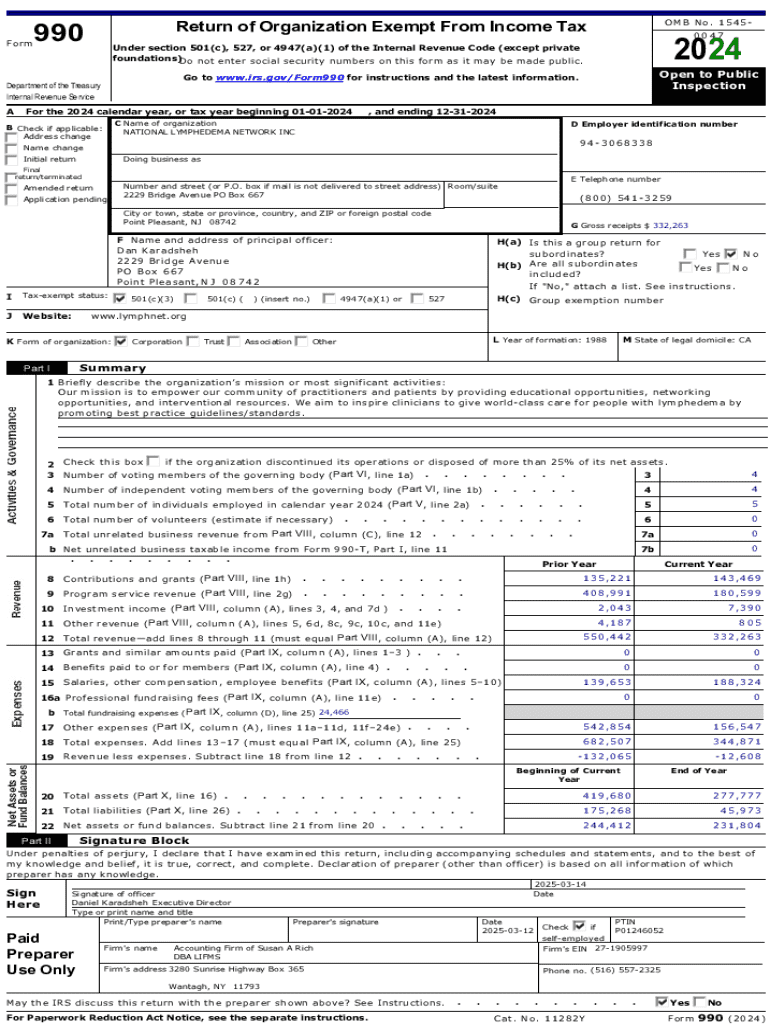

The Return of Organization Exempt Form, commonly known as Form 990, is an essential document for tax-exempt organizations in the United States. This form serves to provide transparency regarding the financial activities of these entities, ensuring that they comply with federal laws and regulations that govern tax-exempt statuses. By requiring organizations to report their income, expenditures, and governance practices, the form emphasizes accountability to the public and the IRS.

For tax-exempt organizations, the significance of the Return of Organization Exempt Form extends beyond mere compliance; it also plays a crucial role in promoting trust and credibility amongst donors and stakeholders. Maintaining transparency encourages funding and supports the mission of providing public benefit.

Filing requirements

Understanding who must file the Return of Organization Exempt Form is crucial for compliance. Generally, all organizations with tax-exempt status under Section 501(c)(3) of the IRS code, including charities, nonprofits, and other tax-exempt entities, are required to file this form. However, specific income thresholds and criteria apply to different types of organizations.

For instance, smaller organizations with gross receipts under a certain threshold are not required to file the full Form 990 but must submit Form 990-N, a simpler e-postcard option. It is essential for organizations to verify their eligibility requirements specific to their classification and funding levels to avoid potential penalties.

Preparing your form

Filling out the Return of Organization Exempt Form can be a straightforward process when done systematically. Begin by gathering necessary financial documents such as balance sheets, revenue statements, and prior year's 990 forms. As you prepare to fill the form, breaking it down into manageable sections ensures that no essential information is overlooked, which is critical for accurate reporting.

Completing each section requires careful attention; governance information, operational data, and donor disclosures must be present to meet IRS requirements. Utilizing examples from previously filed forms can guide the structure and highlights needed in your submission.

Tips for editing and managing your submission

Utilizing editing tools like pdfFiller can simplify the submission process of the Return of Organization Exempt Form. The platform offers features that enable real-time collaboration among team members, ensuring all information is accurate before submission. The editing functionalities allow organizations to make changes effortlessly, which is crucial for compliance and clarity.

Additionally, utilizing eSignature options eliminates the need for physical signatures, further streamlining the process. These e-signatures are legally recognized and allow for quicker completions, ensuring that deadlines are met without compromising the validity of the submission.

Consequences of not filing

Failing to file the Return of Organization Exempt Form on time can lead to severe repercussions. Penalties range from financial fines to the loss of tax-exempt status, which can severely impact an organization’s ability to function effectively. Depending on the delay, the penalties can accumulate, making timely filings critical to maintaining operational continuity.

Additionally, there are public inspection requirements associated with this form. Returns are made available to the public after filing, which allows stakeholders and the public to hold organizations accountable for transparency and proper governance. Maintaining compliance mitigates risks associated with non-receipt of funding and loss of public confidence.

Special cases and variants

Various organizations may face distinct filing requirements for the Return of Organization Exempt Form. For instance, public charities and private foundations have differing protocols and forms based on their funding sources and operational modalities. Additionally, certain states offer unique guidelines or state-specific forms that organizations must adhere to, emphasizing the need for localized compliance.

Once submitted, organizations may find it necessary to submit amendments due to needed changes or updates. The process for filing an amended return should follow prescribed procedures to ensure all revisions are officially documented, reflecting the latest financial and operational conditions.

Utilizing the form for research and evaluation

The Return of Organization Exempt Form is not just a compliance document; it serves as a vital tool for evaluation by donors and grantmakers. Through the comprehensive financial and operational data provided in this form, stakeholders can assess an organization's effectiveness, financial health, and adherence to its stated mission. Platforms and resources that aggregate this public information make it more accessible for analysis and decision-making.

Case studies of organizations that successfully navigate compliance highlight the importance of regular, thoughtful submissions. Not only do these successful filings demonstrate adherence to IRS regulations, but they also serve as examples of best practices that can inspire confidence in potential donors and partners. Maintaining compliance also allows organizations to highlight their achievements and impact within their communities.

Fiduciary reporting and compliance

The responsibility for filing the Return of Organization Exempt Form lies not only with the organization but also extends to its officers and board members. Their fiduciary duties demand accurate reporting to uphold the organization’s integrity and compliance with federal regulations. Ensuring that all financial reports are truthful and complete is not just a legal obligation but a moral one to stakeholders and the communities served.

Even with diligent filing, organizations must be prepared for potential audits from regulatory bodies. Maintaining clear and transparent records supports both compliance and the organization's reputation, while best practices around risk management can mitigate the likelihood of audit issues arising and protect the organization’s standing.

Additional considerations

When it comes to future changes in legislation affecting tax-exempt organizations, staying informed is essential. Over time, regulations concerning the Return of Organization Exempt Form may evolve, impacting filing processes, requirements, and potential penalties. Organizations should actively seek out resources that offer updates and interpretive guidance on these shifts.

Platforms like pdfFiller consistently adapt to user needs, ensuring that the tools and templates reflect the latest regulations and assist users in maintaining compliance. Regular updates, customer feedback loops, and product improvements help organizations manage the return process efficiently and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send return of organization exempt to be eSigned by others?

How can I get return of organization exempt?

How do I fill out return of organization exempt using my mobile device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.