Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

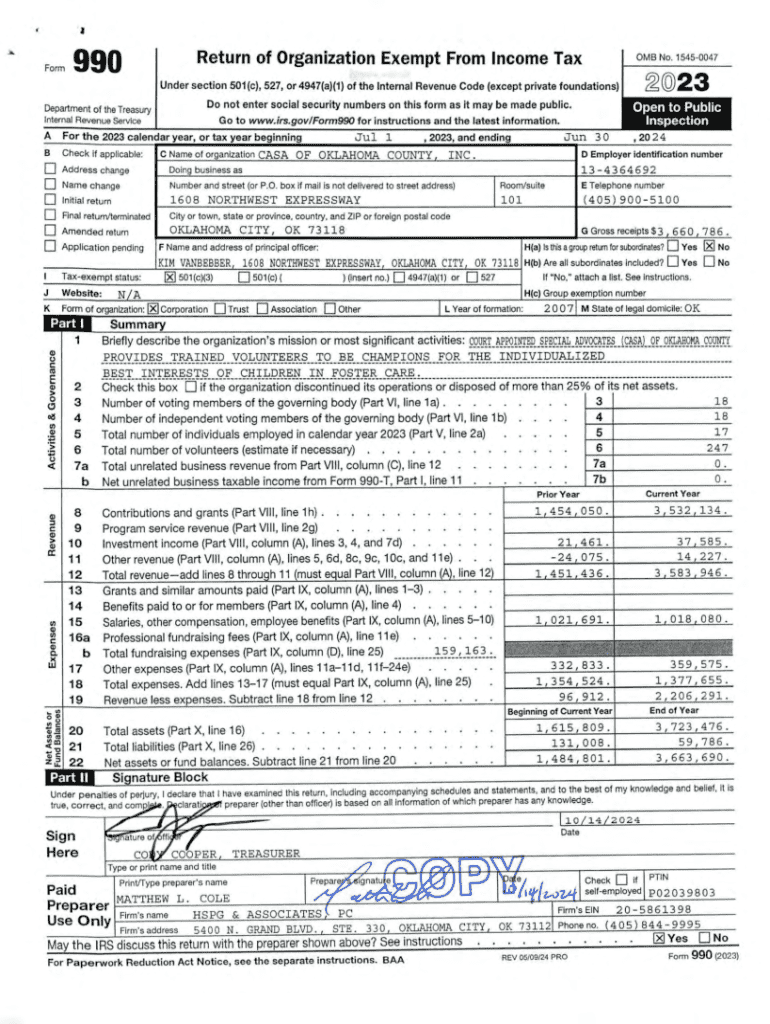

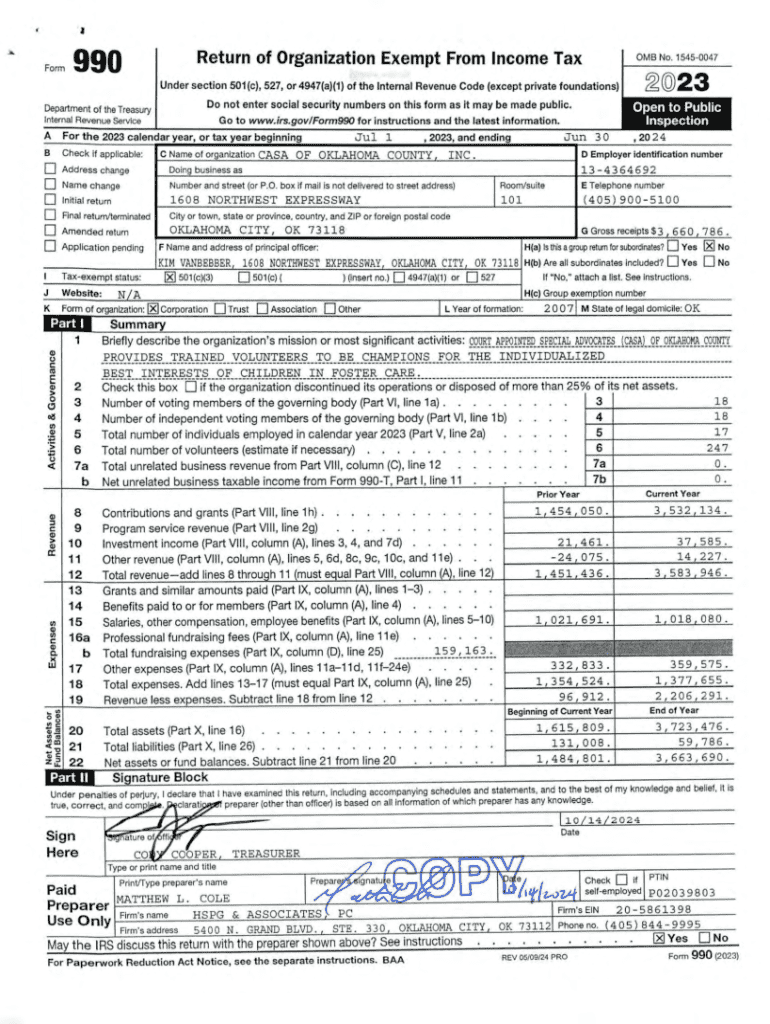

Overview of the Form 990

The Form 990 is an essential component of the financial transparency landscape for nonprofit organizations in the United States. It acts as the primary tax form that tax-exempt organizations are required to file annually with the Internal Revenue Service (IRS). This form serves multiple purposes, including providing the IRS with information on the organization’s mission, programs, revenues, and expenditures.

For nonprofits, Form 990 holds significant importance, as it is not only a reflection of financial health but also a tool for accountability to donors, stakeholders, and the public at large. By scrutinizing Form 990 filings, potential donors can gauge the financial practices of organizations before committing their support.

Understanding the different variants of Form 990

Form 990 comes in various versions tailored to different kinds of organizations, each designed to accommodate specific reporting needs. Understanding these variants is crucial for ensuring compliance with IRS requirements and effectively communicating an organization’s financial information.

Filing requirements for Form 990

Organizations must be aware of the specific IRS requirements for filing Form 990. These requirements vary based on factors such as total revenue and the type of the organization. Generally, nonprofits with gross receipts above $200,000 or total assets exceeding $500,000 are mandated to file the full Form 990.

Penalties for non-compliance

Failing to file Form 990 or submitting it late can lead to significant penalties for organizations. The IRS imposes fines based on the organization’s size and the duration of the delay. For example, an organization may incur a penalty of $20 per day for the first 10 days, capping at $600, with increased penalties for larger organizations.

Additionally, chronic non-compliance can jeopardize an organization’s tax-exempt status, making it vital to ensure timely and accurate submissions of Form 990 annually.

How to access and download Form 990

Accessing Form 990 is straightforward, thanks to the resources available on the IRS website. Organizations can easily locate the form by navigating to the Forms and Publications section or using the search function for Form 990.

Step-by-step guide to filling out Form 990

Filling out Form 990 requires careful attention to detail. Each section serves a unique purpose, and organizations should ensure they provide accurate and comprehensive information. The following breakdown outlines the primary sections of the form and key points to consider.

Collecting accurate data and avoiding common pitfalls, such as incomplete information or discrepancies in financial reports, is vital for a successful filing.

Interactive tools for enhanced preparation

Using interactive tools can significantly ease the preparation process for Form 990. Platforms like pdfFiller offer a variety of document editing features that can simplify these tasks.

Reviewing and verifying your Form 990 before filing

Conducting a thorough review of Form 990 before submission is crucial for ensuring that all information is accurate and complete. Organizations should verify that they have included all necessary sections and that the data presented is consistent and well-supported.

Post-filing considerations

Once Form 990 is filed, organizations must consider the implications of its public availability. Form 990 is a public document, which means it can be accessed by anyone interested in reviewing the organization’s finances.

Resources for further learning and support

For organizations looking to improve their understanding of Form 990, a variety of resources are available. Numerous online workshops and webinars can offer insights into best practices and updates regarding the filing process.

Maximizing the utility of Form 990 data

Form 990 not only serves as a critical compliance tool but also provides a wealth of data that can be utilized by a variety of stakeholders. Public access to these records allows individuals to extract valuable insights regarding nonprofit performance.

Exploring the future of nonprofit reporting

As the landscape of nonprofit reporting continues to evolve, trends indicate that greater emphasis will be placed on transparency and accountability. This shift will likely push organizations to adopt more user-friendly filing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990?

How do I edit form 990 in Chrome?

Can I create an eSignature for the form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.