Get the free California Deed of Trust Form Pdf

Get, Create, Make and Sign california deed of trust

How to edit california deed of trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california deed of trust

How to fill out california deed of trust

Who needs california deed of trust?

California Deed of Trust Form - Your Comprehensive Guide

Understanding the California Deed of Trust

A California Deed of Trust is a legal document used in real estate transactions to secure a loan. This instrument involves three key parties: the borrower (also referred to as the trustor), the lender (the beneficiary), and a third-party trustee. It effectively creates a lien against the property being financed, allowing the lender to reclaim the property in case of a default on the loan.

The California Deed of Trust differs from a traditional mortgage primarily in the manner of enforcement and the parties involved. While a mortgage typically involves two parties—the borrower and the lender—a deed of trust utilizes a third party, the trustee, to hold the title until the debt is repaid. This arrangement streamlines the foreclosure process, making it quicker and less costly.

In California, the Deed of Trust serves a vital role by protecting the lender’s financial interests while also providing the borrower access to necessary funding for property acquisition. Its prevalence in the state’s real estate market emphasizes its importance to both parties engaged in property transactions.

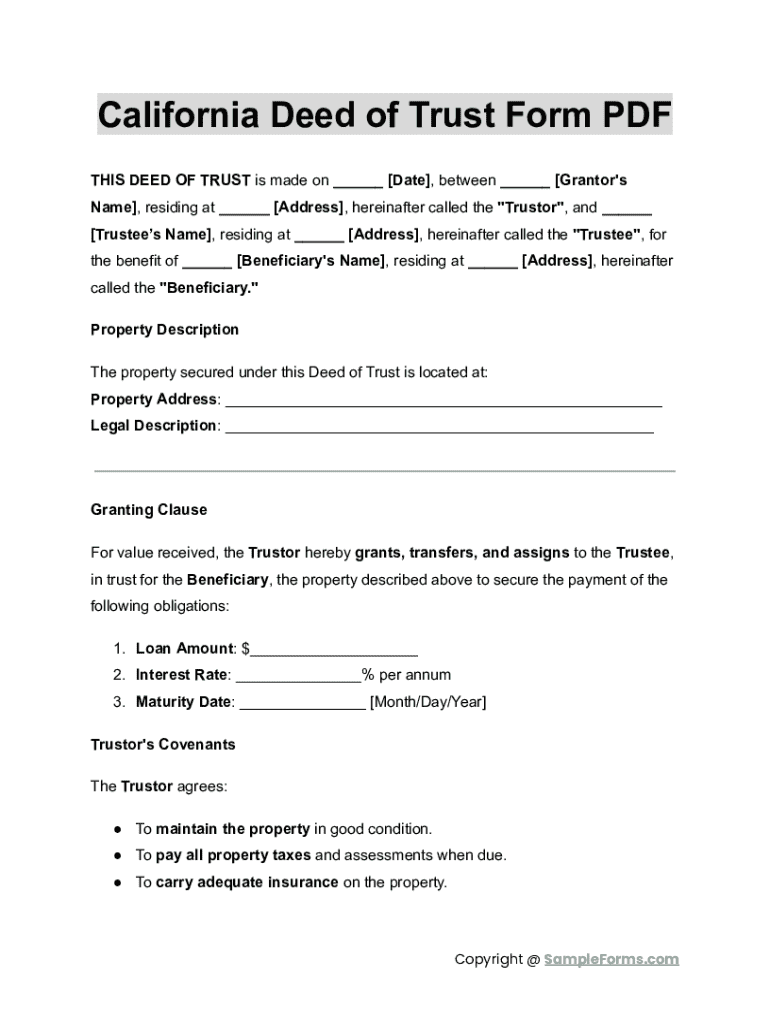

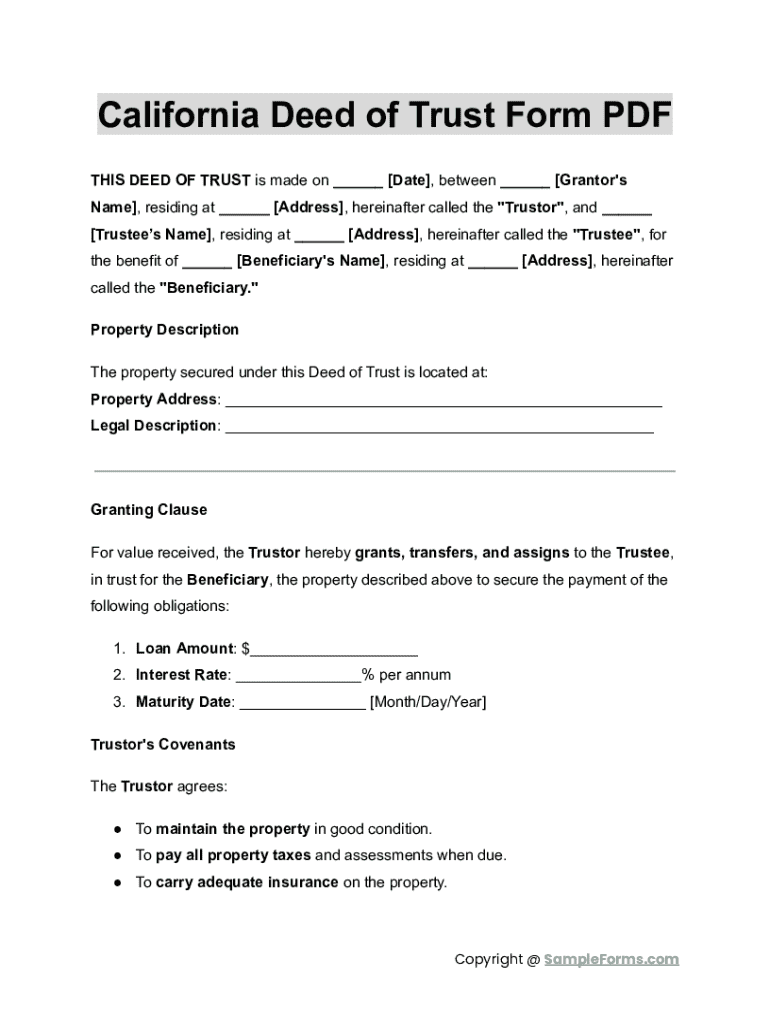

Key components of the California Deed of Trust form

Understanding the key components of the California Deed of Trust form is essential for anyone involved in real estate financing. Key elements include a detailed description of the property, identifying the parties involved, and outlining the loan amount along with its terms. These components provide clarity and legal grounding for the agreement.

1. **Property Description:** This section must accurately describe the real estate being financed. This includes legal identifiers such as the APN (Assessor’s Parcel Number) and the street address.

2. **Parties Involved:** Clearly outline the roles of each party; the borrower (trustor), lender (beneficiary), and trustee. Each party's obligations should be crystal clear to avoid future disputes.

3. **Loan Amount and Terms:** Specify the principal amount being borrowed, interest rates, payment schedules, and any pre-payment penalties. Accuracy in detailing these financial conditions is crucial for legal enforceability.

Ensuring all information is accurate and complete within the form helps prevent legal complications, ensuring that both parties are aware of their rights and responsibilities.

Preparing the California Deed of Trust

Preparing a California Deed of Trust requires careful consideration and organization. It is essential to follow a structured approach to ensure all necessary information is accurately documented.

By organizing these steps effectively, you can streamline the document preparation process, minimize errors, and ensure compliance with California laws.

Filling out the California Deed of Trust form

Filling out the California Deed of Trust form requires attention to detail and a thorough understanding of each section. Each component serves a purpose that directly affects the legality of the document.

Begin by ensuring that the property description is accurate and matches public records. For the parties involved, use full legal names to avoid confusion. When detailing the loan amount, be explicit about interest rates and payment terms. It’s crucial to avoid typographical errors and omission of vital details, as these can lead to disputes down the line.

Moreover, pdfFiller provides interactive tools that guide users through the completion of the form, further reducing the chances for mistakes. Review each field thoroughly before moving on to the next.

Editing and customizing the document

After completing the form, the next step is to edit and customize it as needed. This ensures that the document not only meets the basic legal requirements but also reflects the specific agreement between the parties.

Utilizing pdfFiller’s editing features can simplify this process. You can add clauses specific to your agreement, such as special contingencies or borrower responsibilities, and remove unnecessary sections that do not apply to your situation. It’s essential, however, to make certain your modifications comply with California state laws to maintain the deed’s enforceability.

Signing the California Deed of Trust

The signing process is a critical step in validating the California Deed of Trust. In California, electronic signature options are widely accepted, especially when facilitated through services like pdfFiller.

After completing the document, ensure that all party signatures are collected. Notarization is also required, adding an extra layer of verification that the signatures are authentic. This step is crucial, as the notarized deed serves as proof of the parties' intent and commitment to the agreement.

Recording the deed of trust

Once signed, the next phase is recording the Deed of Trust with the local county recorder's office. This step is essential for making the deed part of public record, thus giving public notice of the lender's interest in the property.

What to do after completing the deed of trust

After the California Deed of Trust has been executed and recorded, it’s vital to manage the document properly. This entails keeping copies in a secure location and being aware of key obligations outlined in the deed.

In the event of default or foreclosure situations, both the borrower and lender must understand their rights and responsibilities. Resources or legal advice may be necessary to navigate these complex situations, ensuring that all actions align with local statutes.

Additional considerations and common questions

As with any significant financial transaction, questions may arise concerning the California Deed of Trust. It's important to have clarity regarding potential scenarios.

Understanding these aspects will empower both borrowers and lenders, instilling confidence in their transactions. For further assistance, consider resources available through legal professionals.

Accessing and utilizing pdfFiller for your document needs

pdfFiller offers a robust cloud-based document management platform ideal for creating, editing, signing, and managing your California Deed of Trust and other important forms. Its user-friendly interface can ease the burden of formal document processes.

Users can take advantage of the extensive library of templates available, making it simple to find and customize the necessary documents. Furthermore, features like secure cloud storage and collaborative editing facilitate seamless workflow, encouraging users to explore pdfFiller's vast offerings for various document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california deed of trust to be eSigned by others?

Can I create an electronic signature for the california deed of trust in Chrome?

Can I edit california deed of trust on an iOS device?

What is california deed of trust?

Who is required to file california deed of trust?

How to fill out california deed of trust?

What is the purpose of california deed of trust?

What information must be reported on california deed of trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.