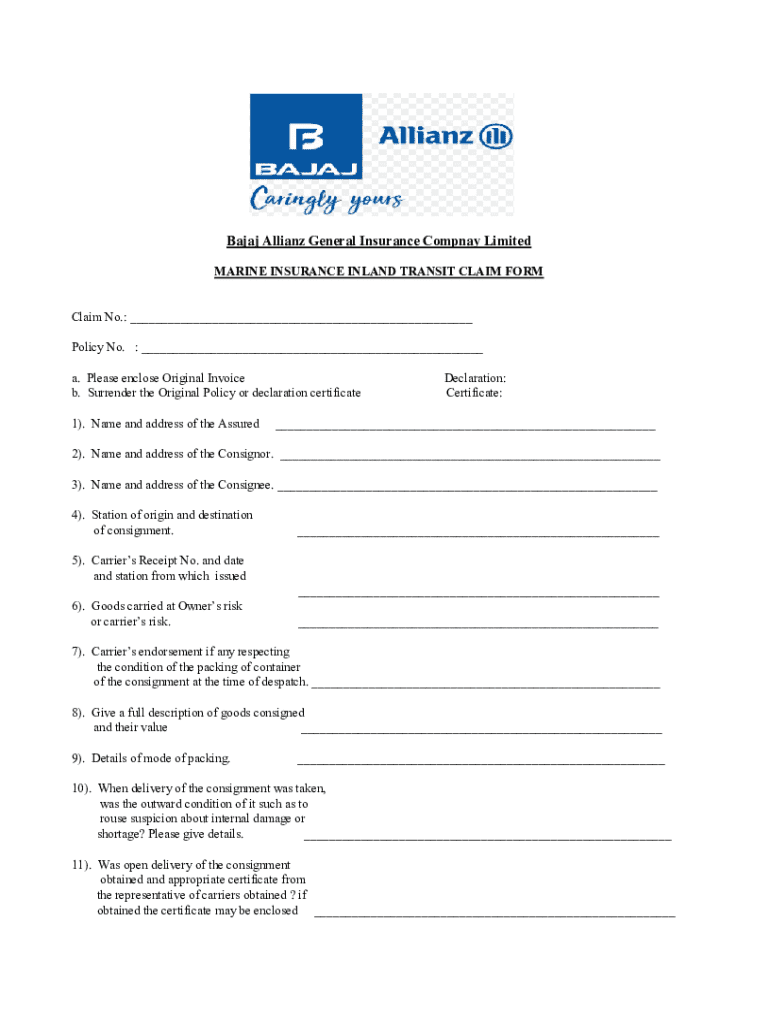

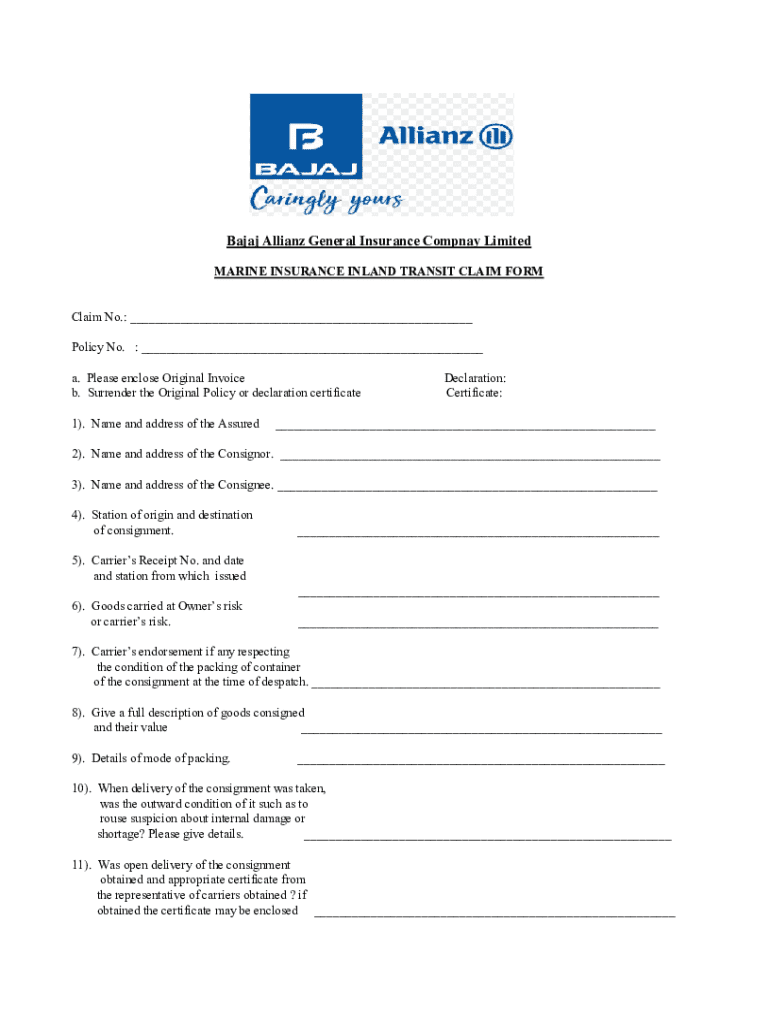

Get the free Marine Insurance Inland Transit Claim Form

Get, Create, Make and Sign marine insurance inland transit

How to edit marine insurance inland transit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marine insurance inland transit

How to fill out marine insurance inland transit

Who needs marine insurance inland transit?

Understanding the Marine Insurance Inland Transit Form

Understanding marine insurance inland transit

Marine insurance pertains to the coverage of goods transported over bodies of water. However, inland transit insurance plays a crucial role for businesses and individuals involved in the land-based transportation of goods. This type of insurance acts as a safeguard against potential losses or damages that may occur while goods are in transit over land, whether by truck, train, or other modes of transportation.

The importance of marine insurance for inland transit cannot be overstated. It provides financial protection and peace of mind in the event that goods are lost, damaged, or stolen during transportation. Coverage options can vary widely, from basic to comprehensive plans tailored to the specific needs of individuals and businesses.

How marine insurance inland transit works

The structure of inland transit insurance policies typically provides coverage while goods are in motion. This means that the insurance covers risks associated with loading and unloading, as well as the entire movement of goods from the point of origin to the final destination. It's imperative to note that inland marine insurance differs from ocean marine insurance, primarily in its focus on land-based transport.

Several key events trigger coverage under a marine insurance inland transit policy. Loading and unloading are critical moments where goods are susceptible to damage, as are potential risks like accidents, theft, or natural disasters during transportation. An understanding of these risks helps consumers select appropriate coverage options.

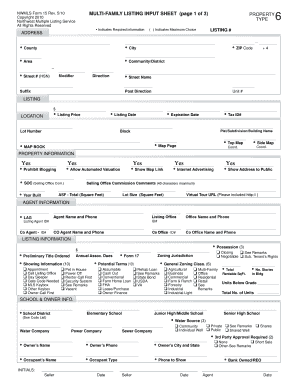

Essential components of the inland transit form

The inland transit form is essential for obtaining marine insurance coverage for transported goods. This document requires accuracy and completeness to ensure that claims can be processed efficiently should issues arise. The form typically consists of several key sections that need to be filled out meticulously.

Key sections of the inland transit form often include details on the specific goods being transported, the value of those goods, and information about the transport method. Each section holds significance for determining coverage and limits in case of a claim.

Step-by-step guide to filling out the marine insurance inland transit form

Filling out the marine insurance inland transit form requires careful attention to detail. Here’s a step-by-step guide to ensure you submit a complete and accurate form.

Step 1: Gather necessary information, including your contact details, a full description of the goods being transported, and expected delivery details. Collecting this information beforehand will streamline the form completion process.

Step 2: Complete each section of the form, ensuring all required fields are filled in accurately. Pay attention to terms and ensure you understand what is being asked. Misinterpretation can lead to costly errors.

Step 3: Review and verify all information to ensure it's accurate. Inaccuracies can delay the claims process or result in claim denials.

Step 4: Submit the completed form via preferred methods (online, mail, or in-person). Track the submission to verify it's been received.

Benefits of using pdfFiller for your inland transit insurance needs

pdfFiller offers a range of advantages for users seeking to complete their inland transit insurance forms efficiently. The platform features a user-friendly interface that simplifies editing and managing documents, making the form-filling process a breeze.

Collaboration becomes effortless with pdfFiller's tools for eSigning and sharing documents. You can easily collaborate with team members or agents by sending forms for review or additional input. With cloud-based access, you can manage your documents whenever and wherever you need to, ensuring that you are able to act quickly and effectively.

Common mistakes when completing the marine insurance inland transit form

Filling out the inland transit form can be straightforward, but several common pitfalls can arise during the process. Understanding these mistakes can save you time and frustration when filing claims.

One common mistake is leaving necessary fields incomplete or filled incorrectly. It's vital to double-check that all mandatory information is provided. Additionally, ensure the coverage amounts are accurate, as selecting an amount lower than required can leave you exposed in case of a claim.

Frequently asked questions (FAQs) about marine insurance inland transit forms

Understanding the nuances of marine insurance inland transit can be challenging. Below are some frequently asked questions that can help clarify common concerns.

Real-life scenarios: Why you need marine insurance inland transit coverage

The real-world consequences of not having marine insurance inland transit coverage can be dire. Numerous case studies reveal the catastrophic results of poorly protected shipments, such as substantial financial losses due to theft or unexpected damages during transport.

Testimonials from businesses underscore the importance of proactive risk management in the supply chain. For example, a local food distributor noted how marine insurance saved their company during a catastrophic event where goods were damaged in transit due to flooding. Such safeguards make a significant difference.

Understanding claims: What to expect after submission

Filing a claim under a marine insurance inland transit policy can be a straightforward process, provided you have the necessary documentation and information ready. Typically, the claims process begins once you submit your completed claim form.

Ensure you have comprehensive documentation, such as proof of value for the transported goods and any receipts that validate losses incurred. Be prepared for common reasons for claim denials, which can include inadequate documentation, failure to report within a reasonable timeframe, or not adhering to the insurance policy's terms.

Industry insights and trends in marine insurance

The marine insurance industry is constantly evolving. Current market trends, influenced by global shifts and innovations in technology, affect inland transit practices. Businesses must remain updated with these changes to make informed decisions regarding their insurance coverage.

Emerging technologies have introduced novel approaches to managing and mitigating risks associated with inland transit. For instance, advancements in tracking and documentation systems provide enhanced transparency and can expedite claims processes. These developments are beneficial for both insurance providers and clients.

Tools and guides for managing your insurance

To assist businesses and individuals in navigating their insurance needs, various interactive tools can help estimate coverage requirements and potential risks. Utilizing reputable resource links can further guide users in understanding marine insurance intricacies.

These tools often include calculators for assessing coverage based on different types of goods, shipment routes, and potential risks. By leveraging these resources, users can ensure they maintain adequate insurance as the transit environment evolves.

Who we are: pdfFiller’s commitment to empowering document management

pdfFiller is dedicated to enhancing user experience in document management. Our platform streamlines the process of filling out, editing, eSigning, and managing forms, ensuring users can focus on what matters most.

We support your marine insurance needs with innovative tools that facilitate a seamless experience for inland transit insurance documentation. Our mission centers on making document management accessible and efficient for everyone.

Important terms related to marine insurance and inland transit

Understanding specific terms associated with marine insurance and inland transit is crucial for effective communication with providers and proper policy utilization. Familiarity with legal and insurance vocabulary can prevent misunderstandings and clarify expectations.

Customer feedback and support

We value user insights and continually seek feedback to enhance our service quality. Users can provide input regarding their experiences with inland transit insurance through dedicated feedback channels, ensuring that concerns are addressed promptly.

Our customer support options are readily available for those needing ongoing assistance with their marine insurance inquiries. Professional support is just a click away through our support portal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit marine insurance inland transit online?

How do I edit marine insurance inland transit straight from my smartphone?

How do I complete marine insurance inland transit on an Android device?

What is marine insurance inland transit?

Who is required to file marine insurance inland transit?

How to fill out marine insurance inland transit?

What is the purpose of marine insurance inland transit?

What information must be reported on marine insurance inland transit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.