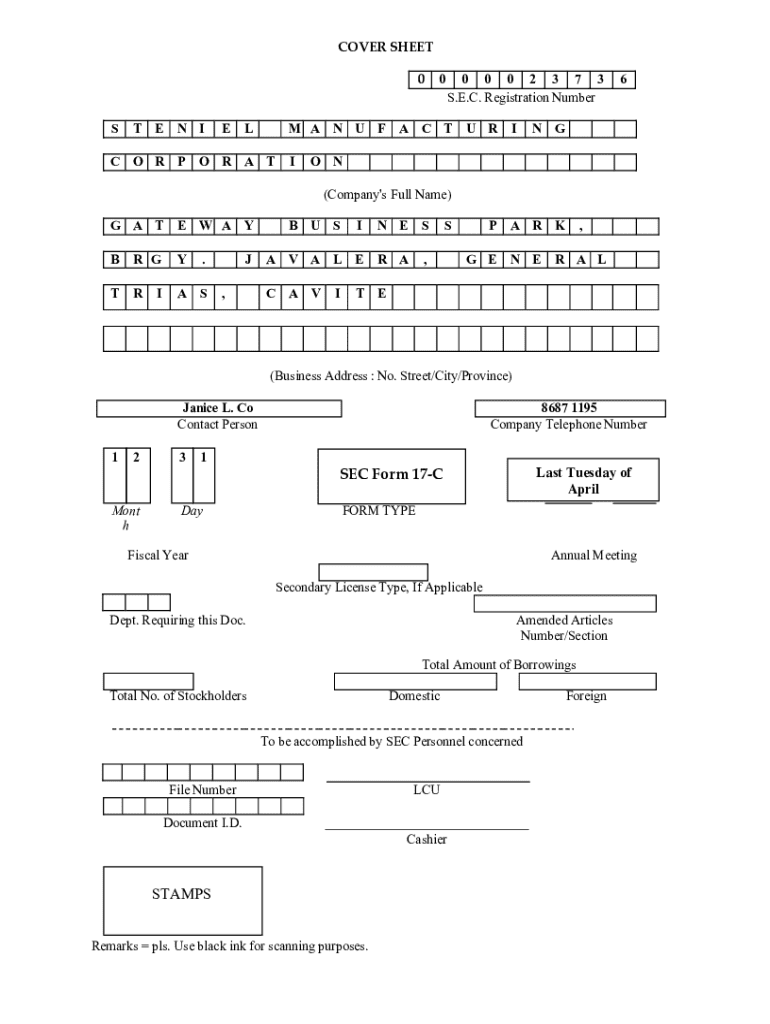

Get the free Sec Form 17-c

Get, Create, Make and Sign sec form 17-c

Editing sec form 17-c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 17-c

How to fill out sec form 17-c

Who needs sec form 17-c?

Understanding SEC Form 17-: A Comprehensive Guide

Understanding SEC Form 17-

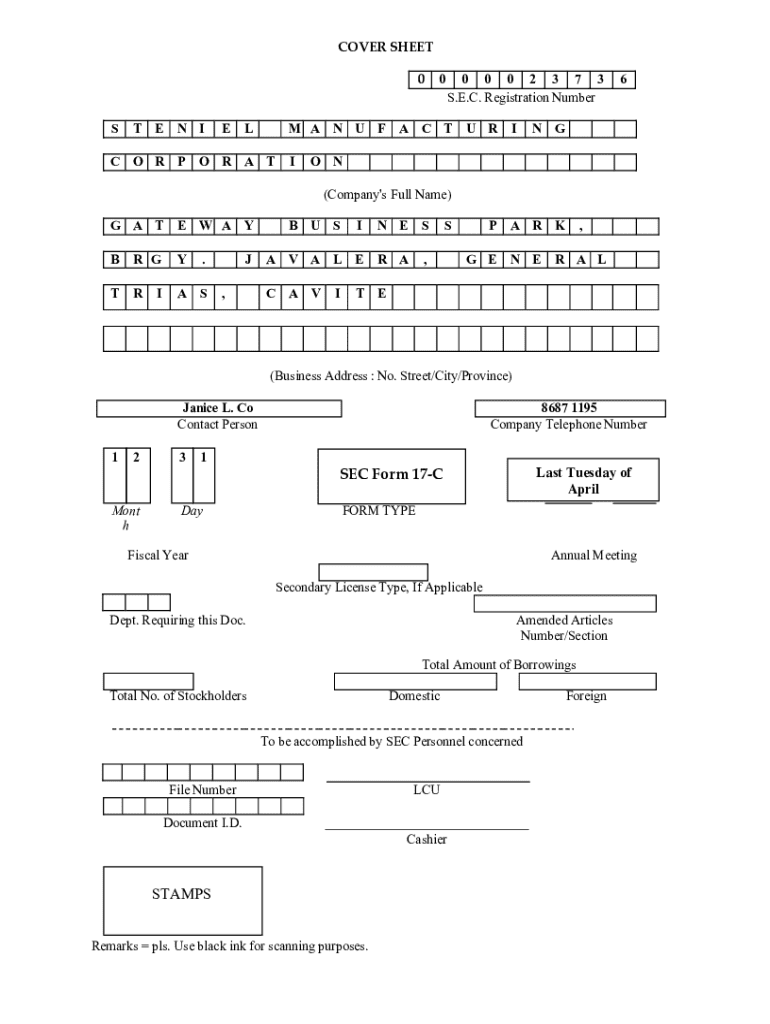

SEC Form 17-C is a critical document required for public companies to report significant events that could influence their business operations or financial status. This form is vital for maintaining transparency and keeping the investment community informed about important changes. Not only does it serve as a communication tool between the company and its shareholders, but it also ensures compliance with the Securities and Exchange Commission (SEC) regulations.

The primary purpose of SEC Form 17-C is to trigger immediate disclosure of corporate events, thereby safeguarding investors' interests. By ensuring public awareness through the timely filing of this form, companies can help sustain trust within the capital markets. The key components of SEC Form 17-C include company identification details, the nature of the reported event, and a detailed description of the occurrence.

When to file SEC Form 17-

Understanding when to file SEC Form 17-C is crucial for compliance. A variety of triggering events necessitate the filing of this form. Companies must be vigilant and identify circumstances that require disclosure. Key events include:

Timeliness is vital; companies must file SEC Form 17-C within four business days of the triggering event. Failure to adhere to this deadline could result in penalties or regulatory scrutiny.

Filling out SEC Form 17-

SEC Form 17-C consists of specific sections that must be meticulously filled out. Each component has its significance, and understanding how to navigate the structure is essential. Here’s a step-by-step guide to completing each section:

Common mistakes in Form 17-C include omitting critical details or failing to describe the event adequately. Reviewing the form thoroughly before submission can help avoid such pitfalls.

Electronic filing of SEC Form 17-

The SEC mandates the electronic filing of Form 17-C through its EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. This system is user-friendly, allowing companies to submit their filings quickly and efficiently.

The electronic submission process includes the following steps:

To ensure adherence to SEC regulations during electronic filing, companies should consider using tools that facilitate compliance checks, such as those offered by pdfFiller.

Reviewing and editing SEC Form 17-

Before submitting SEC Form 17-C, it’s crucial to conduct a thorough review to ensure accuracy and clarity. An overlooked detail can lead to issues later on, including regulatory penalties.

Key aspects to double-check include:

Using tools like pdfFiller simplifies the editing process, allowing for efficient corrections and enhancements where necessary.

Collaborating on SEC Form 17- preparation

Collaboration within teams is essential when preparing SEC Form 17-C. This involves gathering insights from various departments, ensuring a comprehensive understanding of the event being reported.

Effective team communication can be facilitated through several tools and methods, including:

These collaborative efforts can significantly enhance the accuracy and completeness of the SEC Form 17-C submission.

Signing SEC Form 17-

eSigning requirements for SEC documents add another layer of compliance to the filing process. Electronic signatures must comply with certain criteria to ensure legal validity and authenticity.

Companies can utilize pdfFiller to eSign SEC Form 17-C through the following steps:

By adhering to eSigning requirements, companies reinforce the integrity of their SEC filings, building trust with stakeholders.

Managing and storing SEC Form 17-

Post-submission management of SEC Form 17-C is critical. Best practices for document management include maintaining organized records that are easily retrievable for future audits or reviews.

Using pdfFiller enhances document storage and retrieval capabilities. Key advantages include:

Tracking changes and historical records fosters accountability within the organization, ensuring all stakeholders are informed of past decisions.

Understanding SEC regulations around Form 17-

An understanding of SEC regulations governing Form 17-C is imperative for compliance. Relevant rules and policies revolve around the timely and accurate reporting of material events that impact stakeholders.

Consequences of non-compliance can be severe, including fines and sanctions against the company and its executives. Regularly staying updated with SEC guidelines ensures that organizations remain compliant and informed.

Real-world examples and case studies

Notable SEC Form 17-C filings provide insights into how certain disclosures impacted companies and their stakeholder perceptions. For instance, when a major corporation reported a merger through this form, the stock prices experienced a notable fluctuation, illustrating the form's influence.

Lessons learned from previous companies' experiences with the form emphasize the importance of clarity and promptness in disclosures. Furthermore, organizations utilizing platforms like pdfFiller have reported enhanced compliance and smoother filing processes.

FAQs about SEC Form 17-

Numerous questions arise regarding SEC Form 17-C, including how to handle specific filing requirements or troubleshooting common issues. Clarity on these points can empower companies in their filing endeavors.

Addressing these common queries assists companies in navigating the complexities of SEC Form 17-C.

Utilizing interactive tools for SEC Form 17-

Interactive tools available on pdfFiller can significantly streamline the SEC Form 17-C filing process. Users gain access to various resources that simplify document preparation and submission.

Interactive templates allow for efficient data entry, while additional features on pdfFiller enhance user experience. Key resources include:

Accessing and using these tools empowers teams to navigate the requirements for SEC Form 17-C more effectively.

Key takeaways for users

Preparing SEC Form 17-C involves meticulous attention to detail and timely completion. Leveraging technology, such as the offerings by pdfFiller, aids in document management and enhances compliance.

The role of SEC Form 17-C in corporate governance cannot be overstated. It keeps stakeholders informed and upholds the transparency required in public companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 17-c without leaving Google Drive?

How can I edit sec form 17-c on a smartphone?

How do I edit sec form 17-c on an Android device?

What is sec form 17-c?

Who is required to file sec form 17-c?

How to fill out sec form 17-c?

What is the purpose of sec form 17-c?

What information must be reported on sec form 17-c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.