Get the free Form B

Get, Create, Make and Sign form b

How to edit form b online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form b

How to fill out form b

Who needs form b?

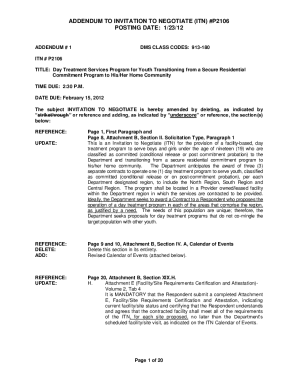

Comprehensive Guide to Form B: Instructions, Editing, Signing, and Management

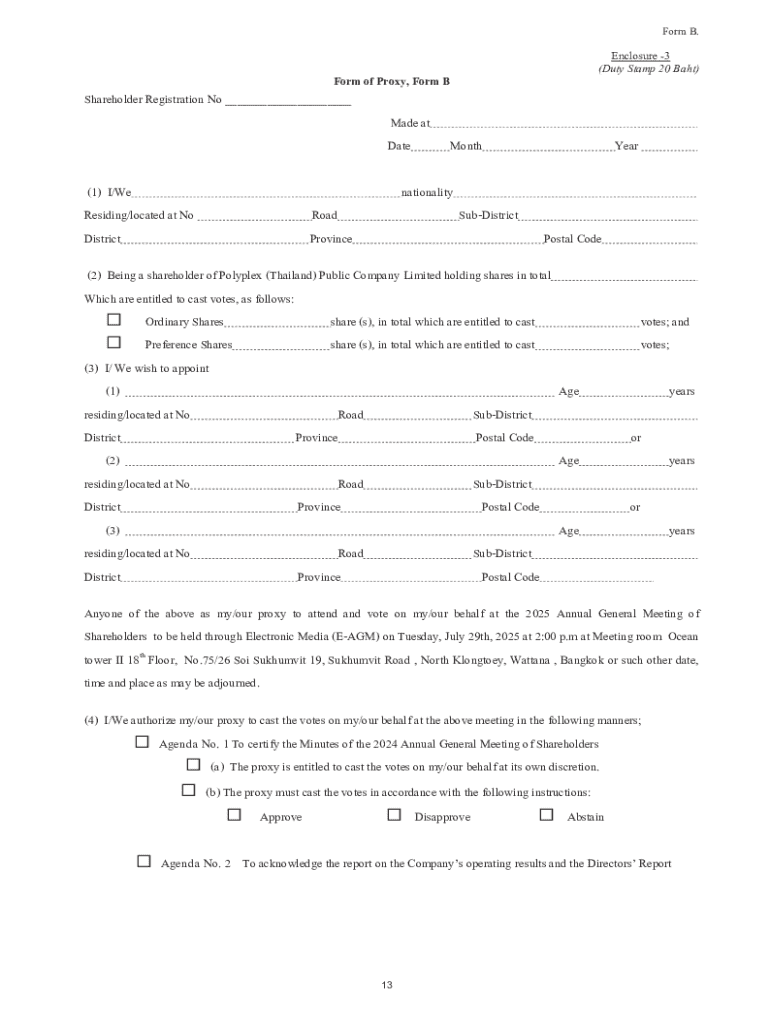

Overview of Form B

Form B serves as a critical component in various reporting and compliance scenarios. It is designed to gather essential information from individuals and organizations for regulatory purposes. This form can vary by industry but typically falls under financial reporting, tax compliance, or other standards set by governmental bodies.

The importance of Form B cannot be overstated. It directly impacts a business's credibility and compliance status, ensuring that all required data is reported accurately and on time. Whether for tax records or organizational requirements, completing Form B accurately is vital.

Individuals typically in need of Form B include business owners, tax preparers, and corporate compliance officers. Depending on the sector, specific organizations or entities are mandated to submit this form to meet regulatory standards.

Key components of Form B

Understanding the structure of Form B is crucial for accurate completion. The form usually includes several sections that guide users through the required information needed for compliance.

Familiarity with common terms used in Form B is also essential for users. Terms like 'compliance,' 'disclosure,' and 'reporting period' are prevalent and critical for understanding how to fill the form accurately.

Step-by-step instructions for completing Form B

Before diving into the actual form filling, it’s essential to gather all necessary documentation. Essential items include business records, previous tax returns, financial statements, and any relevant organizational policies.

Starting with Section 1, users should focus on entering complete and accurate personal or organizational information. This includes names, addresses, and identification numbers. In Section 2, users will input specific data as mandated by the requirements of Form B.

Completing Section 3 involves certifying the accuracy of the submitted information. Here, users must ensure they have the appropriate authority to sign and acknowledge the document.

To avoid mistakes, it is critical to double-check for completeness and accuracy. Common pitfalls include missing signatures, incorrect figures, or failing to follow submission guidelines. To mitigate these risks, users should ensure that all fields are filled out wholly and accurately before submission.

Editing and modifying Form B

Using pdfFiller for editing Form B offers users a streamlined approach for making changes. After creating or downloading the form, the user can upload it directly into pdfFiller's interface.

Collaborative features of pdfFiller allow team members to provide input or conduct reviews seamlessly. By sharing the form via email or collaboration links, users can collect feedback directly within the platform.

Signing Form B

eSigning options through pdfFiller streamline the signing process for Form B. Users can add their signature electronically within the document, which is especially handy for remote teams or individuals.

Understanding the implications of eSigning in your specific location is crucial, especially in industries with strict regulations around documentation.

Submitting Form B

Form B can be submitted through various methods, primarily electronic submission or traditional physical mailing. Choosing the right method depends on the requirements set out by the organization receiving the form.

Tracking submissions is also vital. Users should maintain a record of submission confirmation, receipts, or tracking numbers to verify the timely delivery of their form.

Troubleshooting common issues

After submission, users may encounter common issues related to Form B. If a mistake is made after submission, it is crucial not to panic. Many organizations have procedures in place for amendments or corrections.

Having access to support resources through pdfFiller can provide additional guidance and troubleshooting options, ensuring that users navigate common issues with confidence.

Managing Form B post-submission

Once Form B is submitted, proper archiving and storage are critical. Users should save the final version of the form along with any confirmation or communication received post-submission.

This organized approach ensures that users remain compliant and ready for any follow-up queries regarding their Form B submission.

Additional features of pdfFiller relevant to Form B

pdfFiller offers a range of additional features that can enhance users' interaction with Form B and other related documents. Its capability to integrate Form B with other necessary documentation allows for a fluid workflow.

This empowers users to manage their documentation efficiently, fostering a streamlined and collaborative environment for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form b directly from Gmail?

How do I edit form b in Chrome?

Can I edit form b on an Android device?

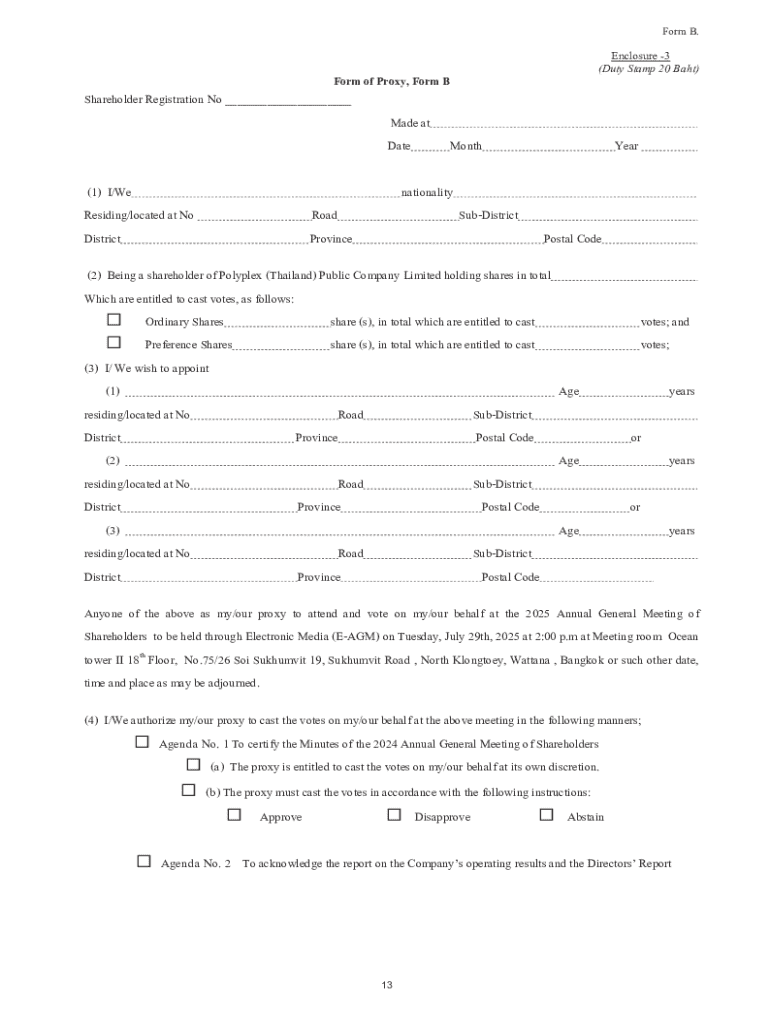

What is form b?

Who is required to file form b?

How to fill out form b?

What is the purpose of form b?

What information must be reported on form b?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.