Get the free form def14a

Get, Create, Make and Sign form def14a

How to edit form def14a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form def14a

How to fill out form def 14a

Who needs form def 14a?

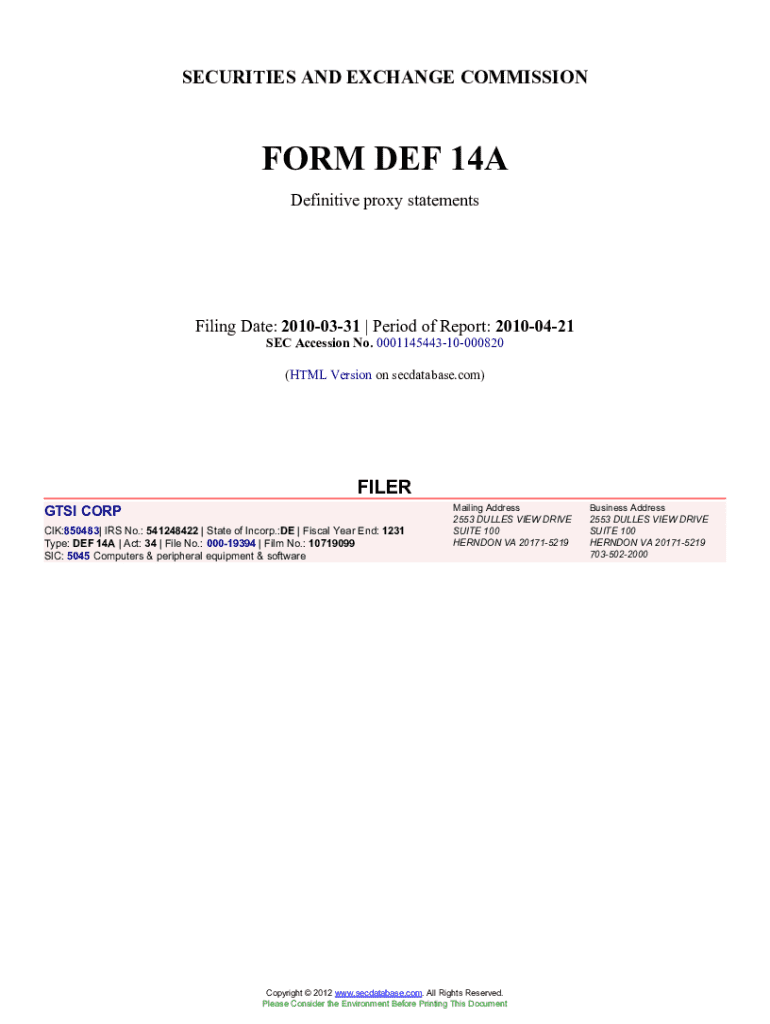

Understanding SEC Form DEF 14A: A Comprehensive Guide

Overview of SEC Form DEF 14A

SEC Form DEF 14A, commonly known as the proxy statement, plays a crucial role in the corporate world. This form is required for publicly traded companies to disclose key information to shareholders before annual or special meetings. The objective of the form is to provide shareholders with the necessary details to make informed decisions regarding corporate matters, especially concerning proposals that are to be voted upon.

Companies that have to file a DEF 14A include all publicly registered entities, but it is particularly significant for those whose shareholders are entitled to vote on critical matters like mergers, acquisitions, or changes in governance. The importance of this form lies in its function as a cornerstone of corporate governance—it ensures transparency and fosters trust between shareholders and management.

Key elements of SEC Form DEF 14A

A robust understanding of the key elements within SEC Form DEF 14A is essential for stakeholders. Each component serves an important purpose, ensuring that shareholders can adequately assess the proposals before them.

Each of these elements is critical for investor communications, as they collectively empower shareholders to make informed voting decisions.

Filing requirements and deadlines for Form DEF 14A

Filing SEC Form DEF 14A has specific deadlines and requirements that all companies must follow. Typically, companies should file the DEF 14A at least 20 days before the scheduled annual meeting to ensure shareholders have ample time to review the information. This timeline is crucial for maintaining smooth corporate governance.

To successfully file a DEF 14A, companies need to prepare several documents, including a complete draft of the proposed proxy statement, financial statements, and any required disclosures. Failure to comply with these timelines or to submit complete filings can lead to serious consequences, including delayed shareholder meetings or legal repercussions.

Impact of SEC Form DEF 14A on corporate governance and investor relations

The SEC Form DEF 14A significantly enhances transparency between shareholders and management. By providing detailed disclosures, companies foster an environment where investors feel informed and engaged in major decisions affecting their investments.

This transparency is vital for building investor trust and loyalty, which can directly influence a company's stock performance. Notably, some case studies reveal that companies with clearer communications through their proxy statements tend to have a higher level of shareholder satisfaction, leading to more favorable voting outcomes.

The SEC review process and amendments

After submission, SEC Form DEF 14A undergoes a review process, which typically takes around 30 days. The SEC's scrutiny focuses on ensuring that all disclosures are complete and comply with regulatory standards. If the filing meets expectations, it will move forward; otherwise, the SEC may issue comments requiring revisions before final approval.

If amendments are needed post-filing, companies must follow specific guidelines. This can include submitting an amended filing with detailed justifications for the changes made. Being proactive and responsive to SEC comments can significantly smoothen the review process and help address any potential compliance issues.

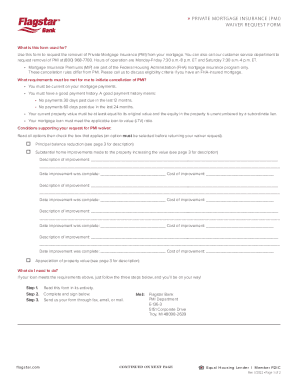

Using pdfFiller for seamless DEF 14A document management

Managing SEC Form DEF 14A can be complex, but pdfFiller offers a streamlined solution to simplify this task. Users can easily edit DEF 14A forms, ensuring that all necessary information is accurately presented. The platform allows for customization, enabling companies to tailor their filings according to their specific circumstances.

With pdfFiller, eSigning and collaboration become seamless. Team members can work together on the same form, and changes can be tracked in real-time. Moreover, the cloud-based solution means you can access your DEF 14A forms from anywhere, making document management more efficient than ever.

Related tools and solutions for document creation

Beyond DEF 14A, pdfFiller provides a suite of complementary forms and templates that can enhance corporate document management. These additional tools empower teams to create, edit, and manage various documents required during the corporate governance process.

By integrating with other platforms, pdfFiller ensures that users have a comprehensive solution for managing all aspects of document creation and filing. Such integration promotes efficiency and reduces time spent on paperwork, allowing teams to focus on more strategic initiatives.

Support and expert assistance for SEC Form DEF 14A

Handling SEC Form DEF 14A filings can be daunting, but having access to expert assistance can alleviate many concerns. Companies should consider reaching out to professionals to confirm the accuracy of their filings and ensure compliance with SEC regulations.

Resources are available specifically for teams managing multiple filings. With pdfFiller, users can access live support to address any pressing questions they may have during the filing process.

Regulatory compliance considerations

Understanding the legal ramifications of SEC Form DEF 14A is essential for companies. Non-compliance with SEC guidelines can lead to significant penalties and damage to a company’s reputation. Thus, aligning your filings with SEC guidelines should be a top priority.

Moreover, preparing for audits and compliance checks is crucial. Companies should maintain meticulous records of filings and be ready to provide additional documentation to SEC prosecutors, illustrating their adherence to the regulations.

Additional document preparation tips

Prior to filing SEC Form DEF 14A, thorough review and approval processes should be in place. Ensure that all content is accurate and appropriately reflects the company's position on matters requiring shareholder voting.

Essential tips for accuracy include second reviews by legal and financial teams, ensuring that proposed changes align with both shareholder interests and regulatory requirements. Additionally, common mistakes to avoid include overlooking procedural instructions and failing to meet submission deadlines, which can lead to unnecessary complications.

Final thoughts on document management with pdfFiller

Utilizing pdfFiller for SEC filings provides significant advantages. Its comprehensive features cater to the complexities involved in preparing and submitting Form DEF 14A. With options for easy document management, teams can streamline their processes and alleviate the stress associated with filing deadlines.

Ultimately, an efficient document management strategy fosters organization and promotes process improvement, paving the way for successful filings and stronger investor relations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form def14a in Gmail?

How can I edit form def14a from Google Drive?

Can I sign the form def14a electronically in Chrome?

What is form def 14a?

Who is required to file form def 14a?

How to fill out form def 14a?

What is the purpose of form def 14a?

What information must be reported on form def 14a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.