Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding Form 10-Q: A Comprehensive Guide

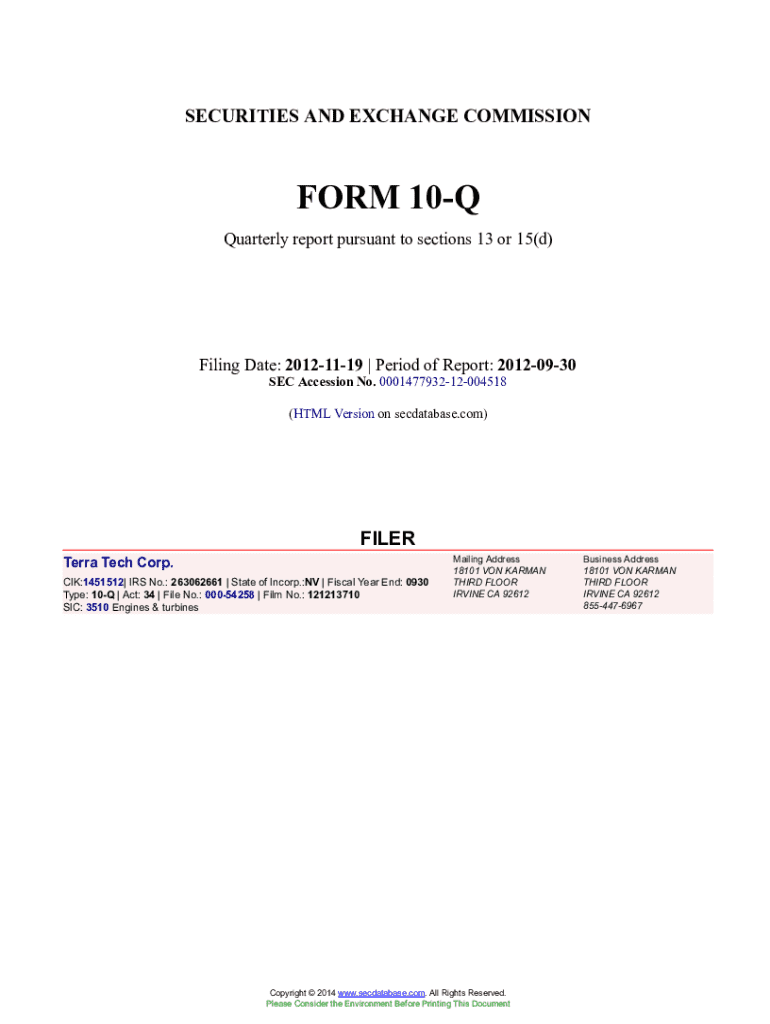

Overview of Form 10-Q

Form 10-Q is a mandatory quarterly report that publicly traded companies in the U.S. must file with the Securities and Exchange Commission (SEC). This document plays a crucial role in providing investors and the market with comprehensive insights into a company’s financial performance and operational status over a specific quarter. It helps maintain transparency and provides stakeholders with timely information, facilitating informed decision-making.

For publicly traded companies, the Form 10-Q serves as an essential tool for regulatory compliance and corporate governance. It presents a snapshot of a company's financial health and operational efficiency, revealing critical factors that could impact investor confidence. The filing frequency is quarterly, allowing a flexible yet consistent schedule to relay ongoing developments to shareholders and the public.

Structure of Form 10-Q

The Form 10-Q is divided into two main parts: Part I focuses on financial information, while Part II contains other essential disclosures. This structure allows stakeholders to navigate through vital data efficiently, ensuring that all necessary financial and operational information is accessible and comprehensive.

A. Part : Financial Information

Part I of Form 10-Q encompasses the financial statements that capture the company's performance for the quarter. The primary financial statements include the balance sheet, income statement, and statement of cash flows.

Management’s Discussion and Analysis (&A)

Following the financial statements, the MD&A section offers management’s insights into operational and financial results. Companies discuss trends in results, future outlooks, and identified risks, helping users understand not just the numbers, but the context behind them.

B. Part : Other Information

Part II of the Form 10-Q provides additional information that investors need to assess potential risks and impacts on the company’s operations. This section often includes legal proceedings, unregistered sales of equity securities, and any defaults on senior securities.

Step-by-step guide to completing Form 10-Q

Completing Form 10-Q requires meticulous attention to detail and specific steps to ensure accuracy. Companies must gather financial data, format it according to SEC requirements, and avoid common errors to ensure compliance.

A. Preparing financial information

The first step in preparing the Form 10-Q is gathering financial data from various departments, including accounting and finance. It's crucial to ensure that this data is current and accurately reflects the company's financial status.

B. Writing the &A

The MD&A section requires strategic writing that communicates the company’s performance succinctly. Key metrics such as revenue growth and profit margins should be emphasized, while managers should provide insights into both past results and future forecasts.

. Filling out the other information section

When completing the Other Information section, companies must assess the materiality of various disclosures. Legal implications are significant; thus, it's essential to consult with legal advisors to ensure all necessary disclosures are accurate and comply with regulatory standards.

Filing process

The filing process for Form 10-Q involves submitting the document electronically via the SEC’s EDGAR system. Companies must adhere to the strict deadlines set by the SEC, ensuring that filings are timely and accurate to maintain compliance.

A. Submitting the Form 10-Q

E-filing through the EDGAR system streamlines the process of submitting Form 10-Q. Companies must prepare their filings ahead of the submission deadline, typically within 45 days after the end of each quarter.

B. Post-filing considerations

Once the Form 10-Q is filed, companies should maintain documentation of the submission and stay alert for any comments or requirements from the SEC. Being proactive in addressing these issues can safeguard against potential regulatory challenges.

Tools and resources to simplify Form 10-Q preparation

Using interactive tools can significantly enhance the efficiency of preparing Form 10-Q. pdfFiller offers a host of features, including PDF editing capabilities, eSignature options, and team collaboration tools, allowing teams to streamline their document management processes.

A. Interactive tools available on pdfFiller

pdfFiller stands out as a comprehensive platform for document management. Users can edit PDFs directly, ensuring that all financial statements and disclosures are accurate and professional.

B. Templates and examples

Access to templates and real-life examples can provide great guidance in structuring Form 10-Q filings. Utilizing custom templates saves time and ensures adherence to the required format.

Best practices for managing Form 10-Q preparation

Developing a systematic approach to prepare Form 10-Q is essential for ensuring timely and accurate disclosures. By establishing a filing schedule and designating responsibilities within teams, companies can enhance their efficiency throughout the filing process.

A. Establishing a filing schedule

Having a clear filing schedule plays a critical role in streamlining the 10-Q preparation process. Companies should plan quarterly reporting timelines well in advance to manage workload effectively.

B. Continuous compliance monitoring

To ensure ongoing compliance with SEC regulations, companies should establish a robust monitoring process. This includes tracking any changes in regulatory requirements and ensuring team members are well-informed about these updates.

Additional considerations

While preparing Form 10-Q, companies often face questions regarding compliance and implications of filing. Understanding these complexities is crucial for effective reporting and management.

A. Common FAQs about Form 10-Q

B. The role of Form 10-Q in investor relations

The transparency offered by Form 10-Q enhances investor relations, as it provides timely updates about a company’s financial circumstances. This document fosters trust and aids in maintaining a healthy relationship between companies and their stakeholders.

Related forms and documents

In addition to Form 10-Q, companies often need to file other documentation to ensure complete compliance with SEC regulations. Understanding these related documents helps in the overall reporting framework.

Incorporating Form 10-Q into your document workflow

Integrating Form 10-Q filings into a digital document management workflow can significantly enhance productivity and oversight. Solutions from pdfFiller provide the strategic advantage needed to streamline this complex undertaking.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10-q?

How do I complete form 10-q online?

How do I complete form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.