Get the free 10ac

Get, Create, Make and Sign 10ac

How to edit 10ac online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10ac

How to fill out 10ac

Who needs 10ac?

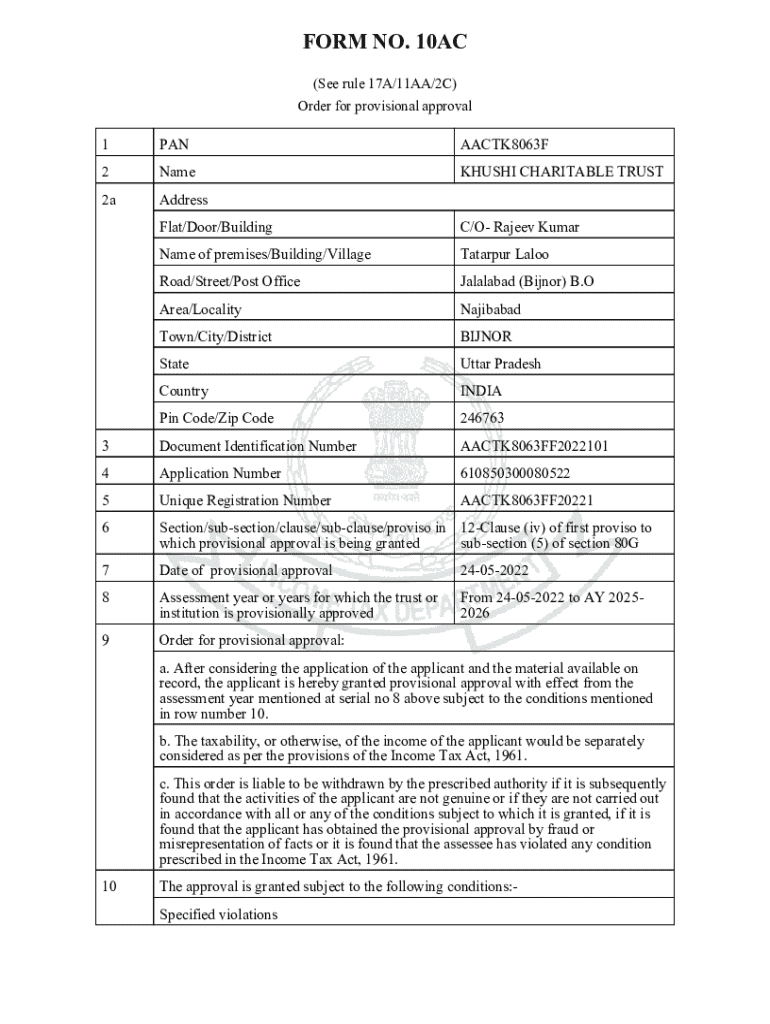

A Comprehensive Guide to the 10AC Form for Charitable and Religious Trusts

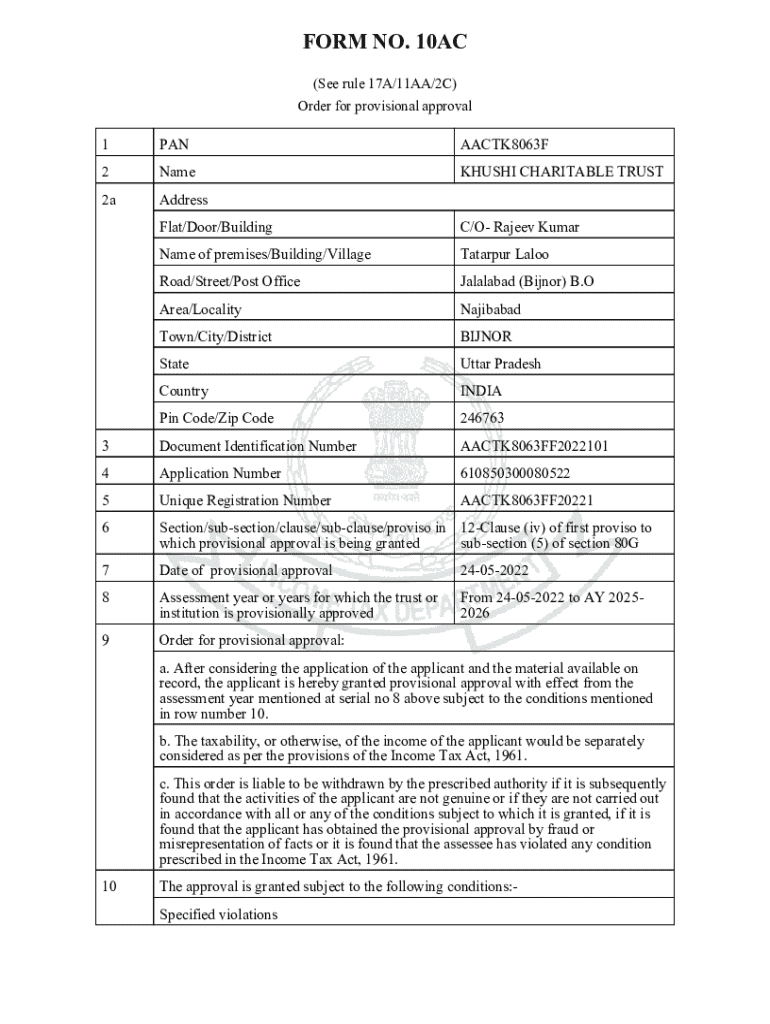

Understanding the 10AC Form

The 10AC Form is a crucial document for organizations looking to obtain tax registration in India. Primarily designed for charitable and religious trusts, this form offers a structured way to apply for registration under Section 12A of the Income Tax Act. By filling out the 10AC Form, organizations can ensure compliance with legal requirements while also accessing certain tax benefits.

The importance of the 10AC Form cannot be overstated, especially for entities that aim to operate with integrity and transparency. Not only does this form facilitate tax exemption for eligible organizations, but it also aligns them with the stipulations set forth by the Income Tax Department, thereby providing credibility within the community.

Who should use the 10AC Form?

Eligibility to use the 10AC Form extends primarily to charitable institutions and trusts that are engaged in philanthropic activities. To qualify, organizations must have a charitable purpose as defined by law and adhere to guidelines set forth by the Income Tax Department.

Specific types of entities that benefit from the 10AC Form include:

Why the 10AC Form matters

Obtaining registration via the 10AC Form comes with several advantages that can significantly impact an organization’s operations. Firstly, tax exemption benefits are critical for nonprofits that rely on donations and voluntary contributions. By securing a tax-exempt status, an organization can reassure its donors about the financial efficiency of their contributions.

Secondly, legal recognition for charitable institutions enhances credibility. This recognition facilitates partnerships, grants, and collaborations with government bodies and private funds. The formal status allows organizations to comply with the law while actively contributing to societal development.

Application process for Form 10AC: Step-by-step

The application process for Form 10AC consists of several structured steps, starting with preparing the required documents. Essential legal documents include the trust deed or memorandum of association, along with the registration details of the organization. Accurate financial statements for the past few years are crucial to demonstrate the organization’s financial health and transparency.

Filling out the Form 10AC requires attention to detail. Each section of the form must be completed carefully to avoid common errors such as typos or incomplete fields, which can delay processing time. It's recommended to double-check entries against supporting documents.

Once the form is filled, applicants can submit it to the relevant Income Tax Authority. Depending on the jurisdiction, submissions may need to be handled electronically or via postal mail. While there’s typically no charge for registration, some states may have nominal processing fees, so it’s wise to verify beforehand.

Timeline and procedures for issuance

After submission, organizations can expect varying processing times, which typically range from several weeks to a few months. Factors such as the completeness of documentation and the workload of the tax office can affect how quickly a registration request is processed. Once submitted, organizations should actively monitor their application status through online portals provided by Income Tax authorities.

The transparency in tracking your application status helps maintain an organized workflow. It's beneficial for organizations to have a designated point of contact at the authority to expedite any queries or issues that may arise during processing.

Details included in Form 10AC

Form 10AC requires specific information that must be filled out accurately. Key fields include the organization's name, address, contact information, and objectives. Furthermore, there are sections dedicated to listing trustees and their respective roles, which is crucial for establishing governance and accountability.

Providing accurate information is paramount since any discrepancies can lead to delays or rejection of the application. Therefore, organizations should ensure that all details reflect official documents, as this builds trust and demonstrates professionalism.

Maintaining your registration

Once registration is granted, it’s vital to understand the validity and renewal processes associated with Form 10AC. The initial registration is typically valid for a long term, but organizations must adhere to compliance requirements to maintain their tax-exempt status.

Renewal procedures are essential; organizations need to submit relevant documentation and financial disclosures periodically. Timely renewals are crucial to avoid risks of losing tax exemption status, which could impede service delivery and funding.

Handling non-compliance issues

Non-compliance with Form 10AC conditions can lead to severe consequences, including withdrawal of registration and retroactive tax liabilities. Organizations must be proactive in addressing issues that could affect their compliance status. Establishing a compliance calendar to track requirements can help mitigate these risks.

If errors or compliance issues arise, organizations have options to rectify the situation. Consulting with tax professionals or legal advisors knowledgeable about CBDT circulars and amendments can provide guidance on how to navigate the complexities introduced by changing regulations.

Recent updates and clarifications on Form 10AC

Staying informed about recent changes in policy and procedural updates is key for organizations using Form 10AC. Recent amendments have clarified some provisions and tightened compliance measures, ensuring that newly registered organizations meet specific guidelines strictly. These updates not only impact new registrations but can also affect the status of previously registered entities.

Keeping abreast of such developments ensures organizations adapt effectively to changes, thereby safeguarding their operational legitimacy. Regularly reviewing government sources and subscribing to newsletters can enhance awareness of relevant changes.

FAQs related to the 10AC Form

Understanding common questions surrounding the 10AC Form can expedite the application process. Applicants often inquire about the most frequently missed sections or what financial documentation is necessary for a smooth submission. For instance, financial statements must demonstrate a clear view of incoming grant funds and expenditure over the last few years.

Other queries may include timeframes for approval and whether changes in organizational leadership affect their registered status. Continuous vigilance on compliance and completion of forms can preempt many issues.

Engaging with the community

Engaging with peer organizations creates a strong community around tax compliance. Discussion forums can serve as platforms for shared experiences, thereby offering valuable insights on navigating the complexities of Form 10AC.

Moreover, feedback from users who have successfully registered can illuminate best practices, shedding light on effective strategies and common pitfalls. Establishing a culture of continuous learning allows organizations to adapt swiftly to changes and improve their grant management practices.

Resources for further learning

Continued education is vital for organizations to stay compliant and informed. Links to related articles on tax registration and compliance can help users expand their knowledge base. The pdfFiller website also provides an overview of upcoming workshops and webinars specific to Form 10AC, where applicants can learn from industry experts.

Utilizing official government resources can clarify procedural nuances and offer up-to-date guidelines, ensuring organizations remain informed at every stage of the application process.

Interactive tools available on pdfFiller

pdfFiller equips users with interactive tools designed to simplify the Form 10AC process. Their online form fill and edit features enable organizations to enter their data effortlessly without needing complex software. eSignature solutions streamline the submission process, allowing for efficient signing and management of necessary documents.

Additionally, pdfFiller's document management tools can help organizations maintain compliance, ensuring that all necessary records and submissions are organized and easily accessible, thus enhancing overall operational efficiency.

Conclusion

Navigating the complexities of the 10AC Form is crucial for charitable and religious organizations seeking to thrive in their missions. By understanding its significance, adhering to compliance, and utilizing effective tools like those offered by pdfFiller, organizations can greatly enhance their operational capacities. Staying informed and engaged with the community further enriches practices, ensuring organizations can continually adapt and fulfill their charitable objectives successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 10ac for eSignature?

How do I complete 10ac online?

How do I fill out the 10ac form on my smartphone?

What is 10ac?

Who is required to file 10ac?

How to fill out 10ac?

What is the purpose of 10ac?

What information must be reported on 10ac?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.