Get the free Form 4

Get, Create, Make and Sign form 4

Editing form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4

How to fill out form 4

Who needs form 4?

A Comprehensive Guide to Form 4 Form: Filling, Managing, and Best Practices

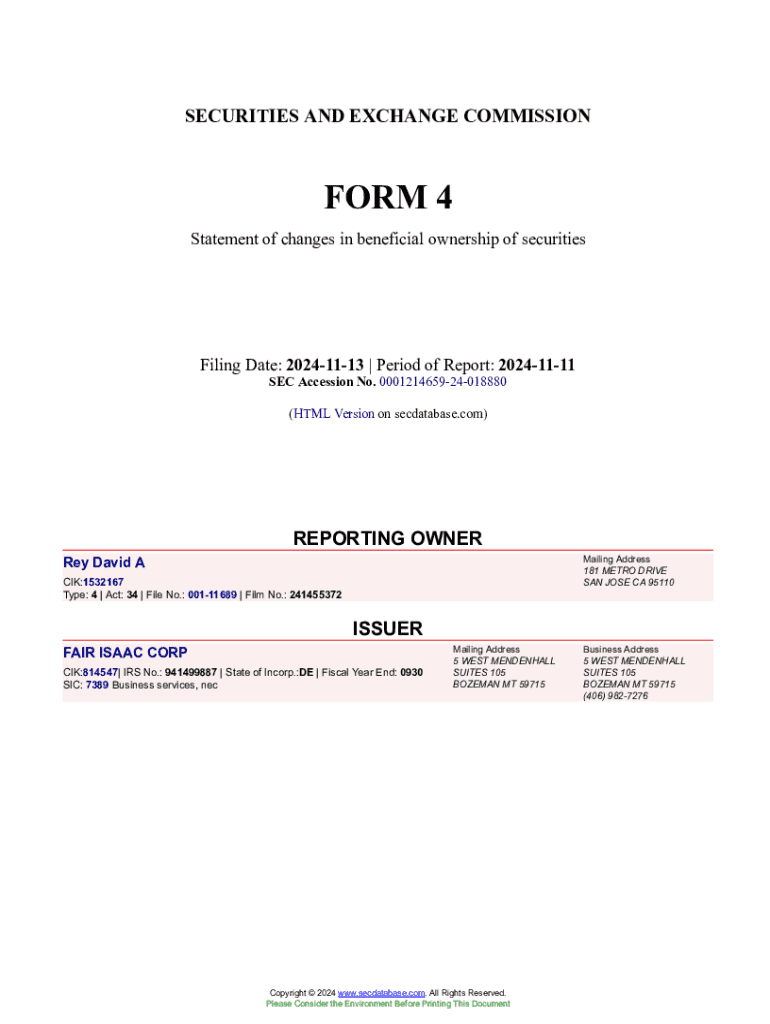

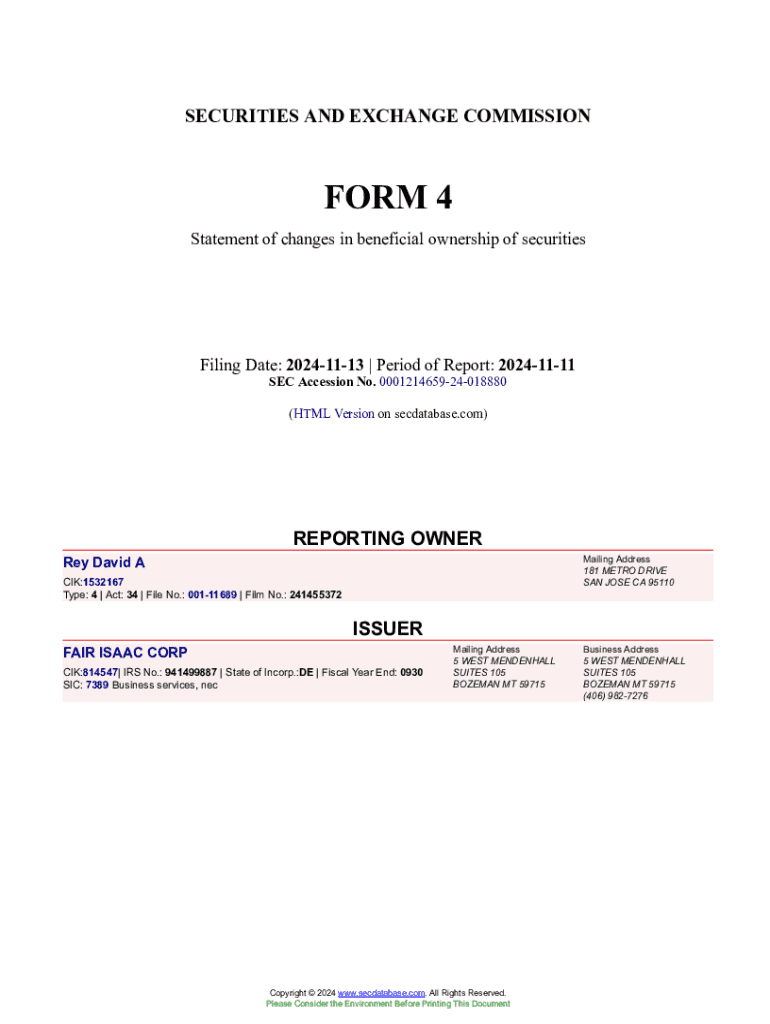

Understanding Form 4

Form 4 is a critical compliance document that individuals and businesses must submit to report certain transactions. Designed by regulatory bodies, this form plays a vital role in maintaining transparency and accountability in various sectors, particularly in financial reporting. Its primary purpose is to document changes in ownership and transactions involving securities, ensuring that regulators have accurate data to oversee trading activities.

The importance of Form 4 cannot be overstated, as it is a mandatory filing for those who engage in buying or selling equity securities. With penalties for non-compliance, the form ensures that all parties are aware of ownership changes, enhancing market integrity and investor confidence.

Who needs to fill out Form 4?

Individuals such as corporate insiders (executives, directors) and institutions are often required to fill out Form 4 when they engage in stock transactions. The form captures critical transaction details, providing the necessary transparency in the trading of company stocks.

Common scenarios requiring Form 4 submission include stock options exercise, purchases of company stock, or the sale of shares by insiders. Non-compliance can lead to investigations and sanctions, making it imperative for relevant parties to understand when and how to fill out this document.

Essential components of Form 4

To effectively complete Form 4, it's imperative to understand its structure. The form comprises several sections, each serving a specific purpose in communicating essential information to regulatory bodies.

Common terminology explanation

Understanding the terminology associated with Form 4 is crucial for accurately completing it. Essential terms include 'insider trading,' which refers to buying or selling stocks based on non-public information, and 'reporting person,' which refers to the individual required to file the form. Familiarity with these terms ensures that users can fill out Form 4 with confidence.

Filling out Form 4: Step-by-step instructions

Preparing to complete Form 4 starts with gathering the necessary documents. It's vital to have access to transaction records and personal identification details to ensure accuracy and compliance. Missing information can jeopardize the report's validity.

Filling out the sections requires careful attention. In Section 1, accurately input your personal information, ensuring there's no ambiguity. For Section 2, provide precise transaction details, as inaccuracies here could result in serious compliance issues. Section 3 necessitates your signature and date, confirming the accuracy of the report.

Common mistakes to avoid include overlooking required signatures, misreporting transaction amounts, and neglecting to submit by the filing deadline. Always double-check entries and maintain a checklist to minimize errors.

Utilizing pdfFiller for Form 4

pdfFiller is designed to enhance the Form 4 completion experience significantly. The platform makes it easy to edit PDFs and ensures that the form is completed accurately, ultimately saving users time and reducing stress. With a cloud-based solution, users can access their forms anywhere, anytime.

The interactive tools on pdfFiller enhance collaboration, allowing multiple team members to work on the same document efficiently. Users can also easily navigate the pdfFiller interface to find specific templates, including Form 4, and utilize workflow tools for managing all submissions.

Transaction codes associated with Form 4

Transaction codes are integral to understanding the specific types of transactions that need to be reported on Form 4. These codes help regulators categorize different trading activities, enabling easier tracking and compliance checking.

Locating transaction codes can usually be done via regulatory body resources, which provide comprehensive lists. Understanding and using these codes correctly can prevent misinterpretation and ensure that compliance is maintained with the necessary reporting guidelines.

Best practices for managing Form 4 submissions

Once Form 4 is submitted, it’s crucial to monitor the completion and response effectively. Keeping track of submission dates can help avoid penalties for late filings, which are important to your or your organization’s reputation.

In case you need to submit amendments to Form 4, familiarize yourself with the guidelines for revisions. A timely and accurate amendment process is just as critical as the initial submission. Understanding when an update is necessary will also help in maintaining proper records over time.

Real-world examples and case studies

Looking at successful Form 4 submissions illuminates best practices. For instance, companies that ensure their executives understand the reporting requirements typically experience fewer compliance issues. Analysis shows that frequent reporting can build a culture of accountability and transparency.

Conversely, organizations that neglect proper oversight have faced significant penalties. Learning from these case studies can provide invaluable lessons on the importance of diligence and the costs of non-compliance, emphasizing the need for effective training and a clear understanding of Form 4 filing requirements.

Frequently asked questions (FAQs)

While many nuances surround Form 4, certain questions are frequently asked by users. One common query involves the timeline for submission. Filers must submit Form 4 within two business days of the transaction date to ensure compliance.

For further assistance, resources such as regulatory body websites or legal advisors specializing in securities law can provide additional clarification on complex issues related to Form 4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form 4 form on my smartphone?

Can I edit form 4 on an iOS device?

How do I edit form 4 on an Android device?

What is form 4?

Who is required to file form 4?

How to fill out form 4?

What is the purpose of form 4?

What information must be reported on form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.