Get the free Nys - Real Property System

Get, Create, Make and Sign nys - real property

How to edit nys - real property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nys - real property

How to fill out nys - real property

Who needs nys - real property?

A Comprehensive Guide to NYS Real Property Form: RP-5217

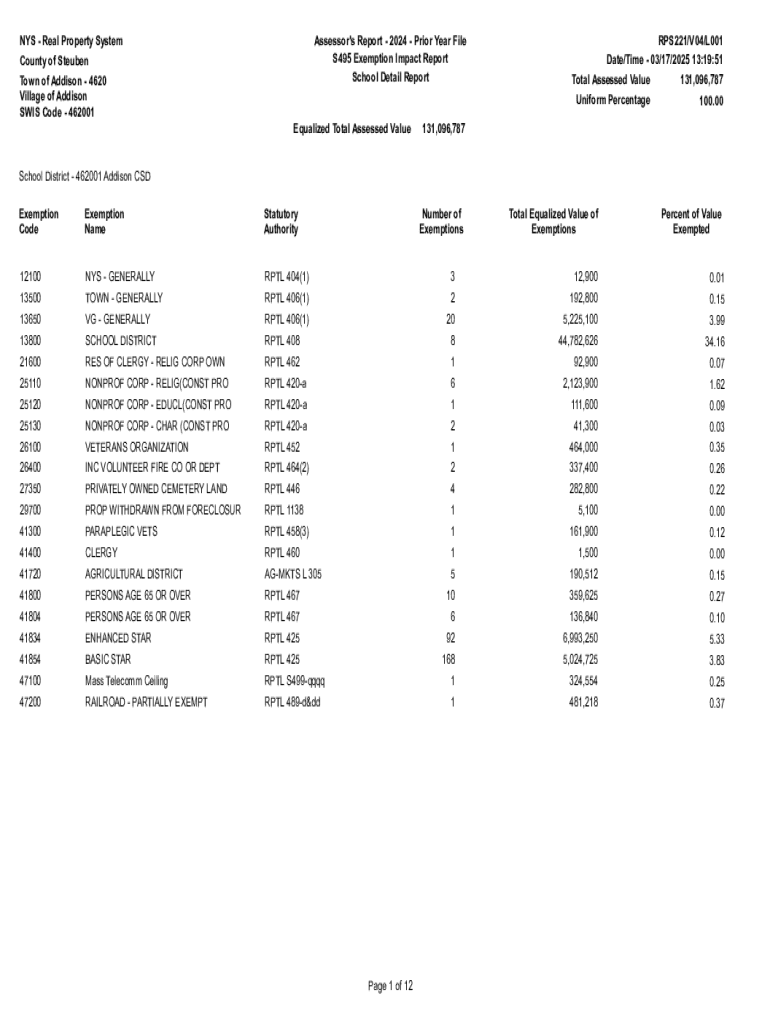

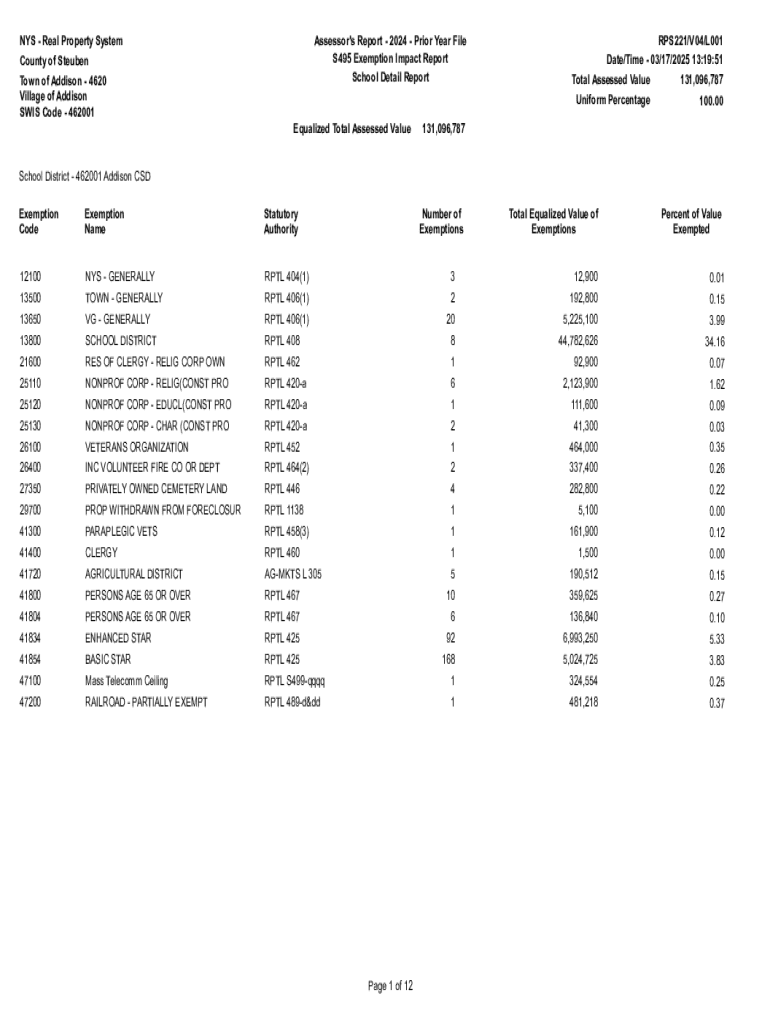

Overview of New York State Real Property Forms

Real property forms in New York State play a pivotal role in the transfer, management, and taxation of properties. These forms ensure that every transaction adheres to the legal requirements set forth by state regulations, thereby safeguarding the interests of all parties involved.

Understanding these forms is essential for homeowners, real estate professionals, and buyers alike. They not only facilitate smoother transactions but also provide a safeguard against potential disputes or legal concerns that might arise post-transaction. The key types of forms include the RP-5217 and various tax exemption applications, each serving specific purposes.

Eligibility criteria for these forms tend to vary. For instance, homeowners may need to demonstrate residency to qualify for certain exemptions, while real estate professionals must familiarize themselves with the nuances of these forms to avoid compliance issues.

The NYS Real Property Form: RP-5217 Overview

Form RP-5217, or the Real Property Transfer Report, is a required document when a property changes ownership in New York State. It captures essential details about the property and the transaction, providing vital information to the local property tax authority.

This form is crucial because it helps assess property taxes accurately and informs the local government about new ownership, which affects local school and municipal funding. Whether you're buying a single-family home or a commercial property, completing this form is non-negotiable.

Anyone involved in a property transfer, including buyers, sellers, and their respective attorneys or real estate agents, will need to complete Form RP-5217. It’s essential that all parties involved ensure its accuracy to avoid future legal complications.

How to Download Form RP-5217

Accessing Form RP-5217 is straightforward. The New York State Department of Taxation and Finance provides the form online. Here’s how you can download it:

Alternatively, you can obtain Form RP-5217 directly from local county offices or other offline resources, ensuring you have a physical copy if necessary. PDF resources are also available for those who prefer traditional documentation.

Filling out Form RP-5217: Step-by-Step Instructions

Completing Form RP-5217 correctly is key to fulfilling New York State requirements. Here’s a breakdown of how to fill out each section accurately.

Common mistakes include incorrect property identification numbers and missing signatures. Double-check all entries to ensure compliance and accuracy. This minimizes the risk of delays in processing your property transfer report.

For best results, consider using an electronic form-filling tool like pdfFiller, which offers intelligence checks that help catch common errors before submission.

Editing and managing your RP-5217 form

After filling out Form RP-5217, it’s imperative to manage it effectively. Using platforms like pdfFiller allows for straightforward editing. If you discover any errors post-filling, you can easily make adjustments right from your device without having to print or rewrite.

Collaborative tools available on pdfFiller also make it easier to share documents for review with team members or legal advisors. You can work together in real-time, ensuring everyone involved has input and no critical information is overlooked.

Once completed, securely store your RP-5217 form in the cloud, allowing you easy access to documents whenever needed, ensuring that important paperwork is at your fingertips.

Signing your real property form with electronic signatures

E-signatures have gained popularity in New York State, streamlining the signature process for real estate transactions. Utilizing electronic signing methods can save time and reduce paperwork.

To eSign Form RP-5217 using pdfFiller, follow these straightforward steps:

Benefits of using e-signatures include faster turnaround times and enhanced tracking capabilities, further ensuring the compliance and proper documentation of property transfers.

Troubleshooting and frequently asked questions

While navigating Form RP-5217 may seem daunting at first, common issues can usually be resolved with a few simple steps. Many users encounter problems related to digital signatures, form errors, or unclear instructions.

For further guidance, refer to the New York Department of Taxation and Finance website, which provides extensive resources and FAQs specifically tailored to real property forms.

Next steps after submission of RP-5217

After submitting Form RP-5217, it’s crucial to understand what happens next in the process. Typically, the local tax authority will review the submission to ensure all information is accurate and complies with state requirements.

Essential follow-up actions include:

Understanding the timeline for processing the RP-5217 can vary depending on your local jurisdiction, so always clarify expected turnaround times with local authorities.

Resources for new homeowners

As a new homeowner in New York, there are important resources available to help ease the transition into property ownership. One significant program is the School Tax Relief (STAR) program, which allows eligible homeowners to exempt a portion of their home’s value from school taxes, resulting in substantial savings.

By tapping into these resources, new homeowners can better understand their responsibilities and make informed decisions, easing the transition to property ownership.

Other related forms and documentation

In addition to Form RP-5217, numerous other real property forms exist that may be relevant depending on your specific circumstances. Understanding these related forms ensures more comprehensive management of property transactions.

Ensure to check the New York State Department of Taxation and Finance website for links to download other essential property forms, which will help you maintain compliance with state regulations efficiently.

Contact information for assistance

If you have any questions or require further assistance regarding Form RP-5217 or any other real property forms, reaching out to the New York Department of Taxation and Finance is advisable. Their dedicated staff can provide clarity on various issues related to property transactions.

Seeking timely assistance can help prevent non-compliance penalties and ensure your property transactions are smooth from start to finish.

About pdfFiller

pdfFiller stands out as an invaluable tool for managing your real property forms efficiently. With its range of features, users can seamlessly edit PDFs, eSign, and collaborate on documents from a single platform.

The comprehensive document management solutions provided by pdfFiller empower both individuals and teams to streamline their document workflows. Enhanced user experience, combined with innovative cloud-based tools, makes it an excellent choice for those looking to manage their real property forms effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nys - real property without leaving Google Drive?

Where do I find nys - real property?

How do I edit nys - real property in Chrome?

What is nys - real property?

Who is required to file nys - real property?

How to fill out nys - real property?

What is the purpose of nys - real property?

What information must be reported on nys - real property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.