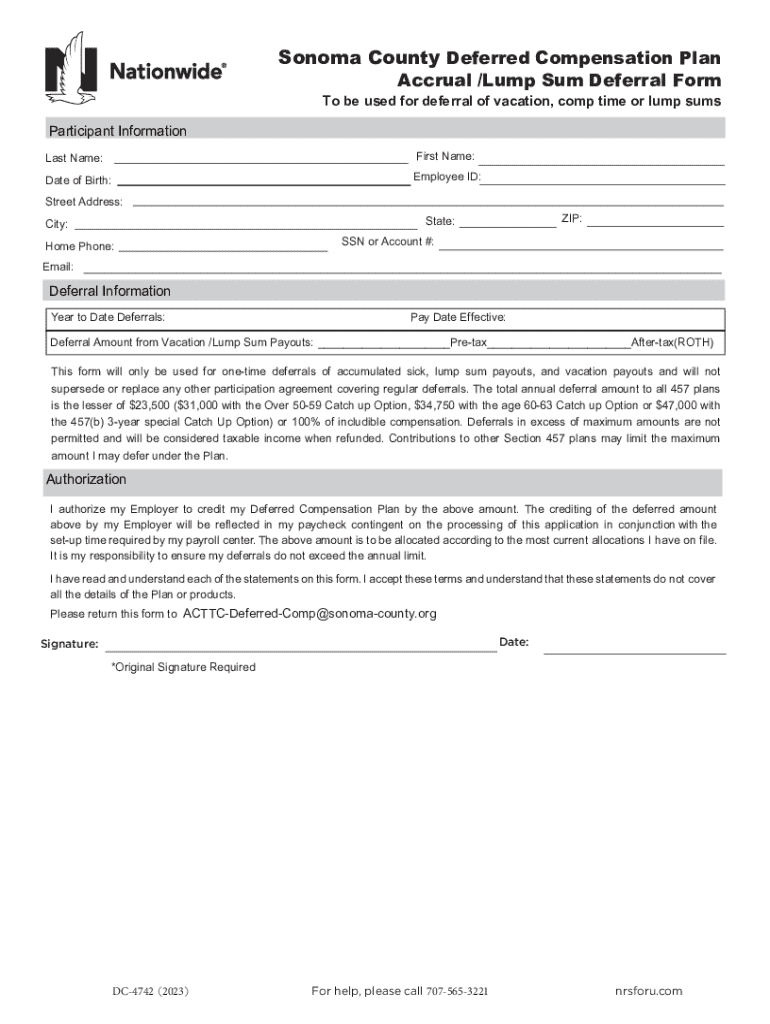

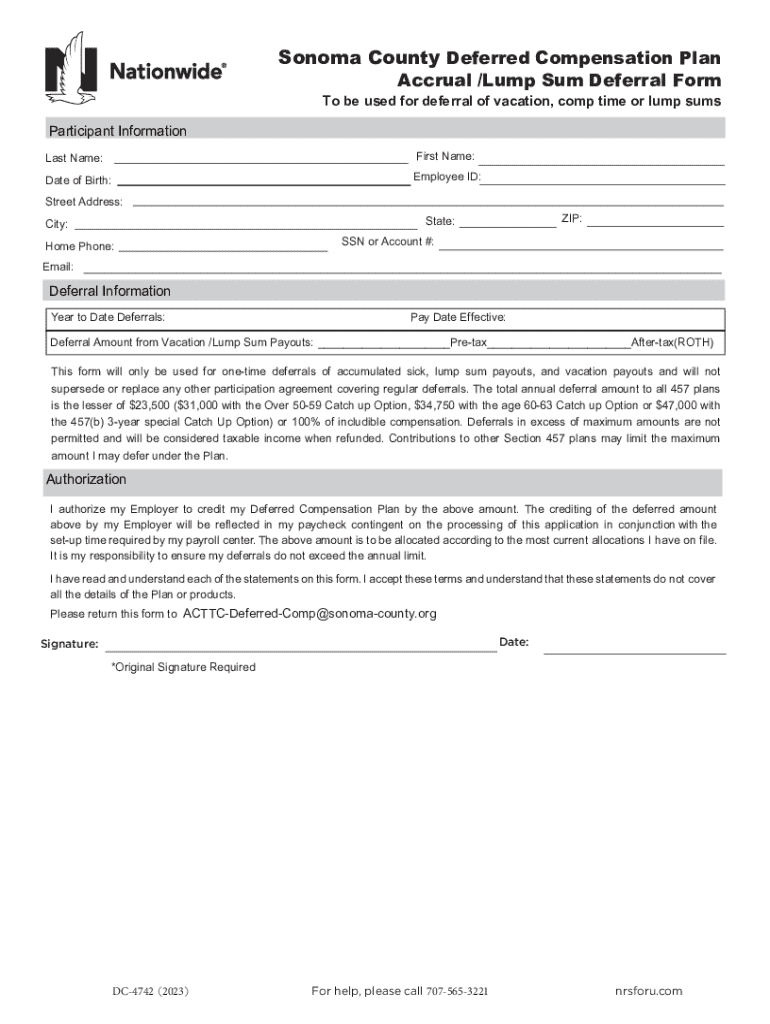

Get the free Sonoma County Deferred Compensation Plan Accrual /lump Sum Deferral Form

Get, Create, Make and Sign sonoma county deferred compensation

Editing sonoma county deferred compensation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sonoma county deferred compensation

How to fill out sonoma county deferred compensation

Who needs sonoma county deferred compensation?

Comprehensive Guide to Sonoma County Deferred Compensation Form

Overview of deferred compensation forms in Sonoma County

Deferred compensation refers to a portion of an employee's income that is set aside to be paid out at a later date, typically during retirement. In Sonoma County, this structured savings plan allows employees to allocate earnings toward retirement, ensuring financial security as one transitions out of active work. The importance of such a plan cannot be overstated, especially given the rising cost of living and healthcare in retirement.

Participating in Sonoma County's deferred compensation plan comes with key benefits that make it an attractive choice for employees. Firstly, contributions can be made pre-tax, lowering your taxable income for the year. Moreover, these funds grow tax-deferred until withdrawal, enhancing the overall retirement savings potential. Employees have the flexibility to choose investment options aligned with their financial goals.

Getting started with Sonoma County deferred compensation

Before diving into enrollment, it’s essential to understand the eligibility criteria. Generally, any regular employee of Sonoma County can participate, provided they have successfully completed their probationary period. Specific job types and classifications may have different requirements, so it’s advisable to check with the county HR for precise criteria.

Sonoma County offers two primary types of deferred compensation plans: the 457(b) plan and the 401(a) plan. The 457(b) plan is a voluntary plan that allows employees to defer a portion of their salary before taxes, while the 401(a) plan may entail mandatory participation depending on job classification. Understanding the differences between pre-tax contributions and Roth contributions is crucial; pre-tax reduces current taxable income while Roth contributions are taxed upfront, allowing tax-free withdrawals in retirement.

Step-by-step guide to completing the Sonoma County deferred compensation form

Completing the Sonoma County deferred compensation form can be straightforward if you follow the proper steps. First, access the form through the Sonoma County Human Resources website, where you can find it in the retirement planning section. Utilize the pdfFiller platform to easily fill out the PDF form online, allowing for seamless editing and eSigning.

Here’s a detailed walkthrough of the key sections you'll encounter in the form:

To ensure accuracy, double-check all entries and consider having a colleague or supervisor review your form before submission.

Interactive tools for managing your deferred compensation

Using pdfFiller provides additional benefits for managing your deferred compensation documents. The platform comes equipped with powerful editing tools, allowing you to modify your forms effortlessly. eSigning capabilities make it easy to sign documents electronically, and collaboration features support team efforts to manage documents efficiently.

You can also track your contributions and changes over time within the platform’s secure environment, promoting transparency and peace of mind as you plan for your future.

Managing your deferred compensation account

Once your deferred compensation account is set up, you'll want to manage it proactively. Changes to your contributions can be submitted via a Contribution Change Form, which can also be accessed through the Sonoma County HR website. It's advisable to check IRS maximum contribution limits annually, as these may change, and understanding your options for distributions is equally essential.

Before taking a distribution, consider the tax implications. Withdrawals from pre-tax contributions will be taxed as income, while Roth withdrawals are more favorable if the account has been held for the required time frame.

Frequently asked questions about Sonoma County deferred compensation

As you engage with your deferred compensation plan, questions may arise. Here are responses to some common inquiries:

Resources and support

For any questions or clarifications regarding your deferred compensation plan, contact Sonoma County's Human Resources department. They offer comprehensive support and resources to help you navigate the benefits associated with the plan. Furthermore, additional online resources, including links to IRS guidelines and California public retirement systems, can provide further insight into your retirement planning.

Future planning and considerations

Planning for retirement requires ongoing efforts, and your deferred compensation plan should be part of a holistic strategy. Regularly evaluate your contributions in response to changes in your financial situation and adjust as necessary. Moreover, keep informed about different investment options available through the plan, assessing how these can align with your long-term retirement goals.

Retirement planning entails not only saving but also envisioning a lifestyle that aligns with your financial capacity. Establish a comprehensive picture of your expected expenses and anticipated lifestyle during retirement to ensure that your deferred compensation aligns well with your goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sonoma county deferred compensation to be eSigned by others?

Where do I find sonoma county deferred compensation?

How can I fill out sonoma county deferred compensation on an iOS device?

What is sonoma county deferred compensation?

Who is required to file sonoma county deferred compensation?

How to fill out sonoma county deferred compensation?

What is the purpose of sonoma county deferred compensation?

What information must be reported on sonoma county deferred compensation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.