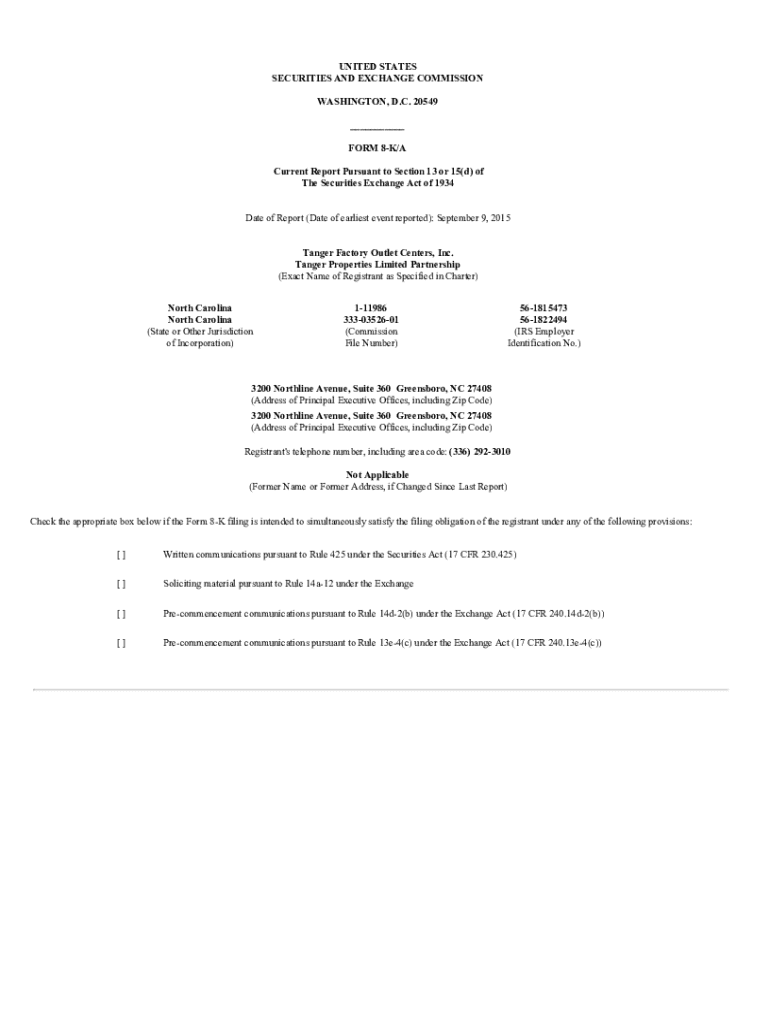

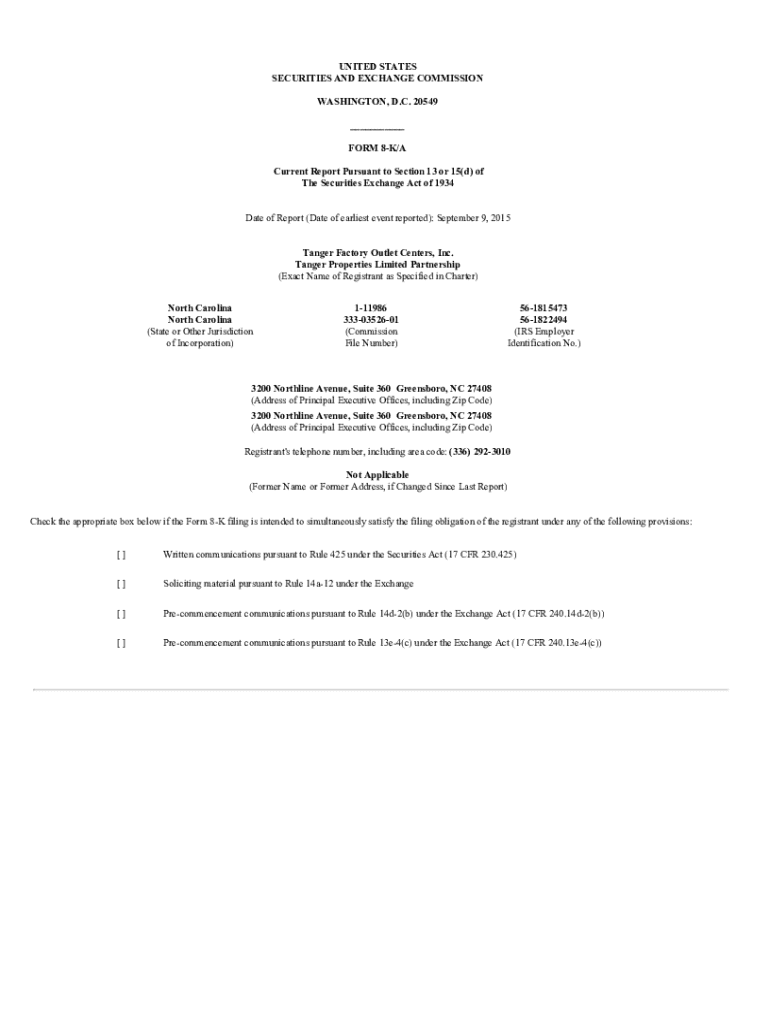

Get the free Form 8-k/a

Get, Create, Make and Sign form 8-ka

Editing form 8-ka online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-ka

How to fill out form 8-ka

Who needs form 8-ka?

How to Fill Out Form 8-K: A Comprehensive Guide

Understanding Form 8-K

Form 8-K serves as a critical reporting vehicle that publicly-traded companies use to notify investors and the Securities and Exchange Commission (SEC) of significant events that may affect their financial status. Unlike quarterly (10-Q) or annual (10-K) reports, Form 8-K provides immediate disclosure, ensuring that investors are promptly informed of material events. This rapid communication helps maintain transparency, addressed to the ever-changing dynamics of corporate operations.

The importance of Form 8-K lies in its role in maintaining trust with investors. By revealing critical happenings such as mergers, acquisitions, executive changes, or financial setbacks, companies can uphold the integrity of their disclosures and support informed investment decisions.

When is Form 8-K required?

The SEC mandates filing a Form 8-K when certain events transpire that could materially impact a company's stock price or operational stability. Some prevalent events that require disclosure include, but are not limited to, the completion of an acquisition, the departure of key executives, changes in control, bankruptcy filings, and significant asset sales.

Filing timeliness is crucial. Form 8-K must typically be submitted within four business days of the triggering event, ensuring that the information remains relevant and investors are kept abreast of corporate actions.

Key components of Form 8-K

Form 8-K is structured to include various sections that provide vital information regarding the events being reported. The SEC defines 9 items for disclosure, each focusing on different aspects of corporate activities. Each section is designed to convey clear, precise facts about the event and its implications.

The fundamental components of Form 8-K include a header to identify the company, a list of the applicable items that need reporting, and a description section detailing the event in question. Understanding each item is crucial for accurate reporting.

Step-by-step instructions on filling out Form 8-K

Filling out Form 8-K requires meticulous attention to detail and organization. Before beginning, gather all pertinent information, including details of the event and any supporting documents that validate your claims. This preparation provides clarity and ensures completeness in your disclosure.

When filling out each section, remain focused on providing straightforward and objective descriptions of the events. Avoid jargon unless it is industry-standard and necessary. Ensuring clarity here minimizes the risk of misinterpretation, which is particularly important in legal and financial contexts.

Editing and reviewing your Form 8-K

Once the Form 8-K is filled out, the importance of editing and reviewing cannot be overstated. Errors in dates, figures, or descriptions can lead to significant repercussions not just in terms of compliance, but also regarding public perception. Utilizing robust proofreading tools can aid in catching typographical and factual errors before submission.

Collaboration among your team—particularly involving legal and financial departments—ensures each aspect of the filing is correctly represented. Secure tools, such as those provided by pdfFiller, allow teams to work collectively while maintaining document confidentiality.

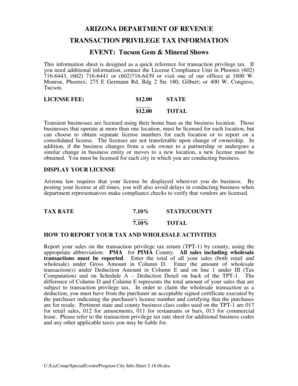

Submission and management of Form 8-K

The submission of Form 8-K should be conducted through the SEC’s EDGAR system, which allows online filings. Ensure you follow the specific guidelines and formats required to avoid delays in processing. This step is crucial because it makes your submission part of the public record, ensuring transparency.

After submitting, it is advisable to track the status of your filing. Addressing potential issues promptly is key to maintaining compliance and assuring stakeholders that the company is proactive in its communications.

Keeping current with Form 8-K regulations

As regulations evolve, it’s critical for companies to stay informed of updates to Form 8-K requirements. In 2024, several changes have been proposed that could affect how companies report specific events. Understanding these changes will not only help in compliance but also enhance a company’s response strategy to reporting requirements.

Resources such as SEC updates and compliance training programs can provide invaluable insights for teams. Engaging in continuous education ensures that your filing practices remain robust and informed, safeguarding your company from potential risks.

Common questions and answers about Form 8-K

Many individuals and teams may have queries about Form 8-K, whether it's regarding the filing process or the interpretation of specific items. Addressing common questions helps demystify the filing and ensures that everyone involved understands their responsibilities.

For instance, one common question is whether minor events require reporting; generally, only significant events materially affecting financial performance mandate a Form 8-K filing. Understanding these nuances can greatly reduce the risk of missed obligations.

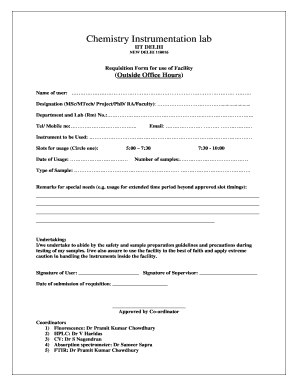

Interactive PDF tools

pdfFiller facilitates the completion of Form 8-K through its user-friendly PDF tools, enabling you to fill, sign, and edit the form comfortably and seamlessly. The platform streamlines document management, allowing you to keep all necessary information at your fingertips, making the entire process efficient.

Utilizing pdfFiller’s interactive features not only simplifies the filling process but also enhances collaboration among team members. With tools for real-time editing and secure signing, you can ensure that everyone involved is on the same page, significantly improving workflow efficiency.

Collaboration and security

Ensuring documents remain secure and accessible is paramount in corporate filing processes. pdfFiller offers several features for secure sharing which are essential for handling sensitive information associated with Form 8-K filings. Protecting your documents ensures that only authorized personnel can access critical data.

Furthermore, cross-departmental collaboration can be greatly enhanced through the platform. By setting permissions and sharing features, team members can efficiently collaborate on Form 8-K filings. This process enhances overall file integrity while ensuring compliance across all communications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8-ka from Google Drive?

How do I edit form 8-ka straight from my smartphone?

How do I complete form 8-ka on an Android device?

What is form 8-ka?

Who is required to file form 8-ka?

How to fill out form 8-ka?

What is the purpose of form 8-ka?

What information must be reported on form 8-ka?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.