Get the free Return of Private Foundation 990-pf I

Get, Create, Make and Sign return of private foundation

How to edit return of private foundation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of private foundation

How to fill out return of private foundation

Who needs return of private foundation?

Return of Private Foundation Form: A Comprehensive Guide

Understanding the return of private foundation form

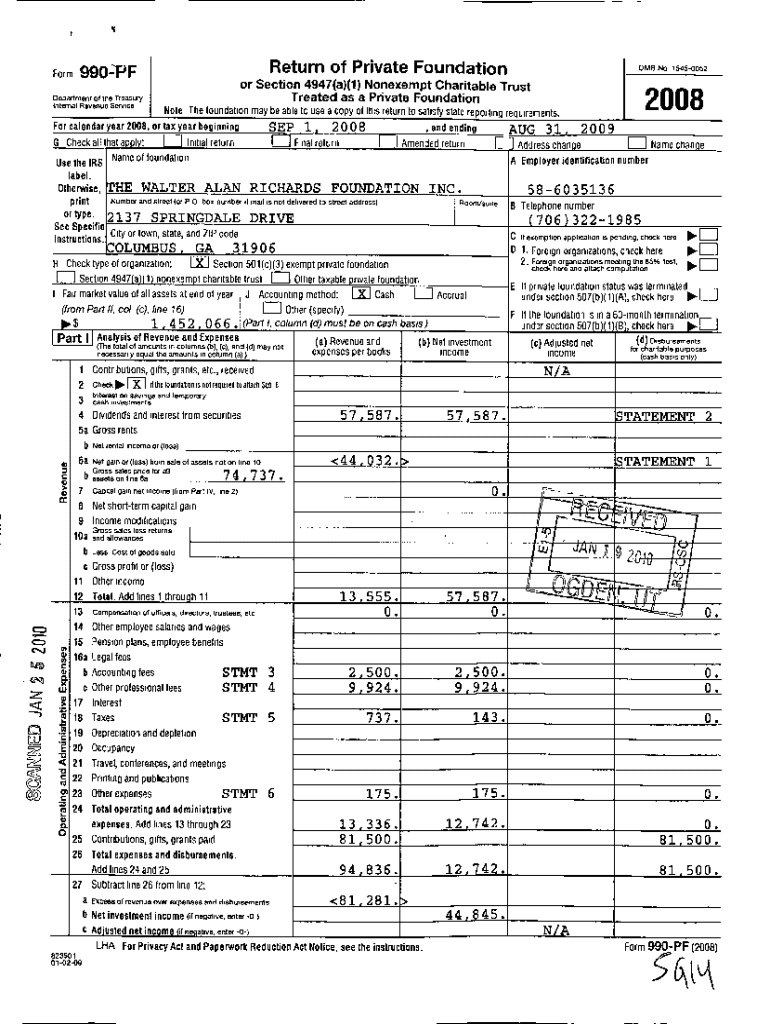

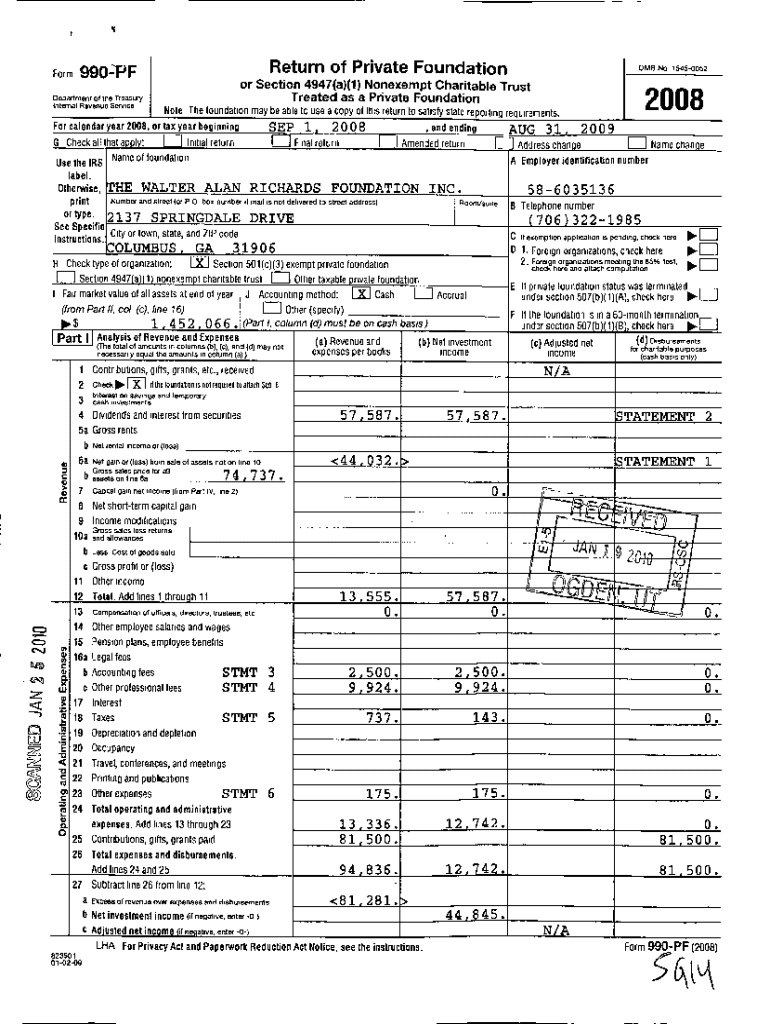

Form 990-PF, officially known as the Return of Private Foundation Form, is a specific income tax return required by the Internal Revenue Service (IRS) for private foundations. Private foundations are non-profit organizations typically established by individuals, families, or corporations to pool resources to distribute funding for charitable causes. The importance of this form cannot be understated; it serves not only as a transparency mechanism reflecting a foundation's financial health, activities, and charitable distributions but also ensures compliance with federal regulations. Accurate filings are crucial as they contribute to the foundation’s reputation and longevity.

Who needs to file the return of private foundation form?

Any organization operating as a private foundation as defined by the IRS must file Form 990-PF. This includes foundations that are established with significant endowments primarily to support philanthropic activities. It is essential to note that not all organizations are subject to this requirement. For instance, foundations that have their gross receipts normally not exceeding $50,000 may qualify for a streamlined filing with Form 990-N, a simpler electronic submission. However, if a foundation's status changes due to increases in assets or activities, it becomes imperative to transition to the standard Form 990-PF.

Special cases also exist, such as supporting organizations and public charities, which may have different filing requirements. It's crucial for organizations to evaluate their designation and consult IRS guidelines accordingly.

Filing deadlines for Form 990-PF

Filing Form 990-PF is a time-sensitive responsibility for private foundations. The standard due date for this form typically falls on the 15th day of the 5th month following the end of the foundation's tax year. For most organizations operating on a calendar year (January to December), the deadline would be May 15. However, if a foundation operates on a fiscal year, for example, from July 1 to June 30, the deadline shifts accordingly to November 15.

Extensions are available for filing Form 990-PF. Foundations can file for a six-month extension, granting additional time, usually until November 15 for calendar-year organizations. However, it is crucial to note that an extension only applies to the filing of the form; it does not extend the date for any owed taxes or taxes related to any fees. Late filings can lead to penalties, making it necessary for foundations to maintain diligent records and adhere to filing schedules.

Step-by-step guide to completing Form 990-PF

Completing Form 990-PF involves several critical sections, each requiring accurate and detailed information. The following is a step-by-step guide to ensure comprehensive completion:

Breakdown of key sections in Form 990-PF

While Form 990-PF may initially seem daunting due to its extensive sections, a breakdown of its essential parts can provide clarity. Foundations should pay particular attention to the following sections to ensure compliance and accuracy:

Additional requirements and considerations for Form 990-PF

When completing the form, it's pivotal for organizations to recognize that additional attachments and supplementary documents may be required. This might include detail on any non-cash contributions, a detailed list of grants made during the fiscal year, and financial statements audited by independent accountants.

In addition to federal requirements, some states impose nonprofit state filing requirements. Each state has its own specific regulations regarding what must be submitted and by when, therefore it is essential for organizations to be aware of their state’s laws to maintain compliance. Engaging with a professional or using tailored resources can help organizations navigate these complexities.

Monitoring your form submission and managing changes

Once Form 990-PF is filed, it’s important for foundations to confirm receipt of the filed form from the IRS. Foundations should keep a meticulous record of their submissions, as well as utilize resources such as the IRS e-File system to check file status. Should any amendments need to be made post-filing due to inaccurate data or updates, the IRS allows for amended submissions for Form 990-PF. Foundations must clearly indicate that they are filing an amended return to avoid confusion.

Tracking and managing subsequent changes to foundation operations also requires diligence; any modifications in grant choices, revenue changes, or governance structure should promptly reflect in filings to maintain compliance and transparency.

Consequences of late filing of Form 990-PF

Failing to file Form 990-PF by the deadline can lead to significant repercussions for private foundations. The IRS imposes a variety of penalties for late filings, which can escalate quickly — starting from $20 per day for late filings up to a maximum of $10,500. Such penalties can impact not only the financial resources of the foundation but also its status with various grant-making entities that prefer compliance and transparency.

Beyond financial penalties, late filings can disrupt operational functions, harm public trust, and pose risks to the foundation's exemption status. To mitigate these risks, foundations should prioritize early preparations, maintain organized financial records, and consider digital filing solutions that streamline and automate the process efficiently.

Frequently asked questions (FAQs) surrounding Form 990-PF

Navigating the complexities of Form 990-PF raises several common questions. Below are some of the frequently asked queries that private foundations encounter:

Leveraging pdfFiller for your form completion and management

Using a comprehensive platform like pdfFiller enables private foundations to efficiently handle the intricacies of Form 990-PF. With features designed specifically for filing such forms, pdfFiller allows users to fill out, edit, and manage their forms seamlessly. The interactive toolset makes it easier to catch errors before submission, preserving both time and resources.

Additional functionalities, like eSigning and collaboration tools, empower teams to work together on the same document without the hurdles of traditional filing methods. With secure cloud access provided by pdfFiller, organizations can manage important documents from anywhere, ensuring streamlined annual reporting that enhances accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find return of private foundation?

How do I execute return of private foundation online?

Can I edit return of private foundation on an iOS device?

What is return of private foundation?

Who is required to file return of private foundation?

How to fill out return of private foundation?

What is the purpose of return of private foundation?

What information must be reported on return of private foundation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.