Get the free Form 50-856

Get, Create, Make and Sign form 50-856

Editing form 50-856 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 50-856

How to fill out form 50-856

Who needs form 50-856?

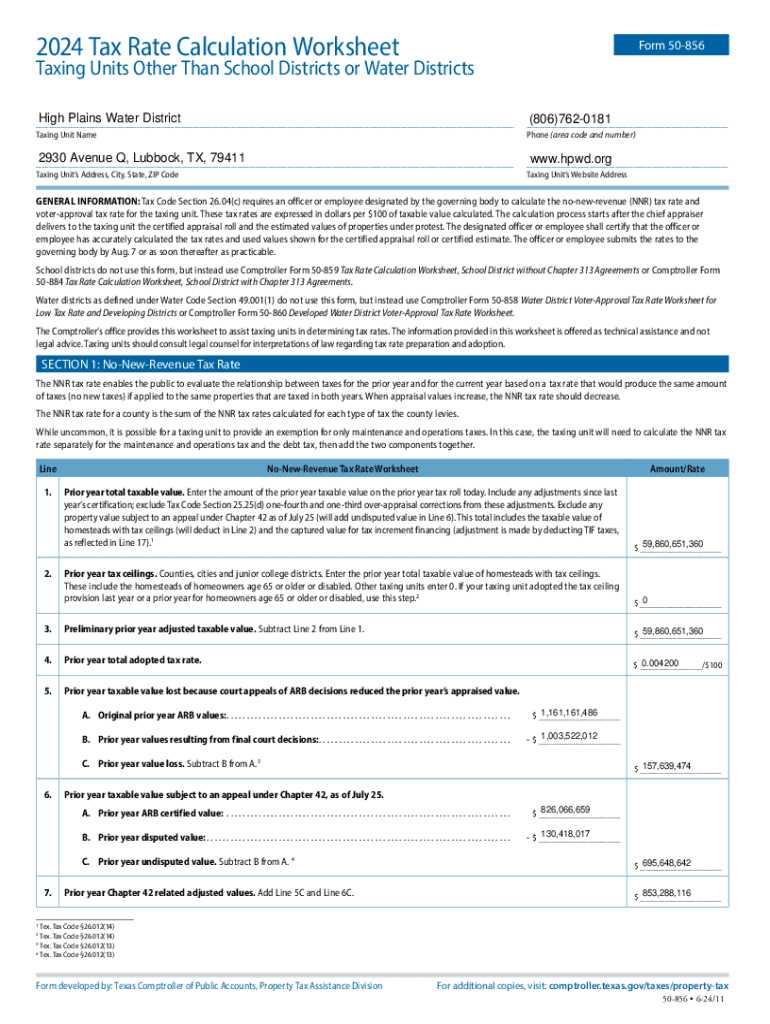

A Comprehensive Guide to Form 50-856: Everything You Need to Know

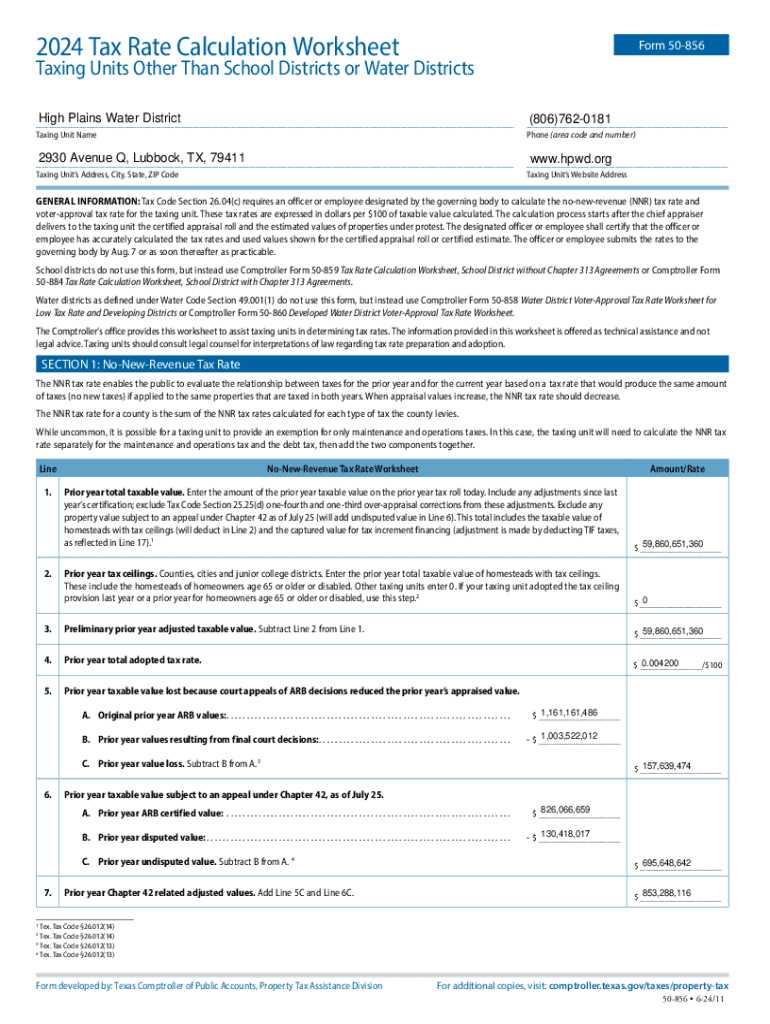

Understanding Form 50-856

Form 50-856 is an essential document used primarily for reporting tax information. Its main purpose is to facilitate accurate tax calculations for both individuals and businesses, ensuring they meet their filing requirements. By understanding the nuances of this form, taxpayers can avoid costly mistakes and ensure compliance with tax regulations.

The importance of Form 50-856 extends beyond mere compliance; it holds significant value for individuals, teams, and organizations involved in financial planning. Knowing how to navigate this form can result in substantial savings through eligible deductions and credits. Additionally, understanding its various use cases helps taxpayers prepare their financial documents more efficiently, allowing for easier tax filing.

Preparing to complete Form 50-856

To fill out Form 50-856 accurately, it is crucial to gather all necessary documentation ahead of time. This includes income statements, previous tax returns, and any supporting documents that validate deductions or claims being made. Organizing these materials systematically will streamline the process significantly and reduce the risk of errors.

Here are some essential documents you should consider before diving into the form:

Accessing Form 50-856 is straightforward; official versions can be found on the IRS website and other reliable tax-related platforms. Utilizing pdfFiller provides an efficient way to access and manage your documents digitally, allowing for seamless editing and collaboration.

Step-by-step instructions for filling out Form 50-856

Filling out Form 50-856 can be simplified by breaking it down into sections. Start with your personal information, where accuracy is crucial in ensuring there are no mismatches in identification. This includes your full name, address, Social Security Number (SSN), and any other relevant identifiers.

Next comes reporting income. Make sure to provide total income from all sources, including wages, salaries, and additional earnings. Common pitfalls in this section include underreporting income or neglecting to account for side jobs. Double-check this section to ensure complete accuracy.

Tax deductions and credits are essential for reducing your overall tax liability. Identifying eligible deductions such as student loan interest or mortgage interest can notably impact your final tax obligation. Various interactive tools can assist in calculating potential savings, ensuring you maximize your entitled benefits.

Important notes to remember include checking for common errors like incorrect income reporting or missing information. If you encounter questions while filling out the form, refer to FAQs or consult a tax expert for guidance.

Editing your Form 50-856

Editing Form 50-856 can often be handled effortlessly with pdfFiller's robust editing tools. If you need to make adjustments after the initial completion, accessing the form online allows for straightforward changes. Additional remarks or relevant information can easily be added, as needed.

When it comes to version control and document management, safeguarding your valuable data is paramount. Establish clear saving and naming conventions to make future retrieval convenient. Regular backups can prevent the loss of irreplaceable information.

Signing and submitting Form 50-856

The process of signing Form 50-856 has been modernized with the acceptance of electronic signatures. eSignatures are legally accepted on tax documents, simplifying submission processes for many users. pdfFiller provides a clear, step-by-step guide on how to eSign your document, ensuring it’s done correctly.

For submission, various options exist. Electronic submission is the most convenient; however, mailing the form is still viable. When opting for physical submission, adhere to best practices, such as using certified mail or requiring delivery confirmations to trace the status of your submission.

Managing your tax documents post-submission

Once you’ve submitted Form 50-856, managing your tax documents remains critical. Set reminders for any necessary follow-ups, as well as for record-keeping and audits. Maintaining a well-organized document retention system can greatly benefit your future filing endeavors.

Using pdfFiller allows for easy retrieval and management of your filings. Should you need to access past documents, this platform simplifies the search process. Additionally, employing backup strategies will help protect against data loss.

FAQs about Form 50-856

Addressing common questions regarding Form 50-856 can clarify essential aspects of the filing process. For instance, many users are unsure about eligibility criteria for various deductions or how to correct an error on the form once submitted. Answering these misconceptions can alleviate concerns and streamline the process.

Tips from tax experts include seeking assistance early during the tax season and maintaining organized records throughout the year. Engaging with tax professionals can offer personalized insights tailored to individual situations.

Getting further assistance

For those needing extra help with Form 50-856, multiple resources are at your disposal. Tax preparation services can provide expert assistance, while online forums and communities often feature discussions that can offer additional support and guidance.

pdfFiller also boasts customer support options tailored to help users navigate their document management effectively. Engaging with their support can turn challenges into learning experiences, enhancing your understanding of Form 50-856.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 50-856 from Google Drive?

Can I create an electronic signature for signing my form 50-856 in Gmail?

How do I edit form 50-856 on an Android device?

What is form 50-856?

Who is required to file form 50-856?

How to fill out form 50-856?

What is the purpose of form 50-856?

What information must be reported on form 50-856?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.