Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: How-to Guide

Understanding Form 990

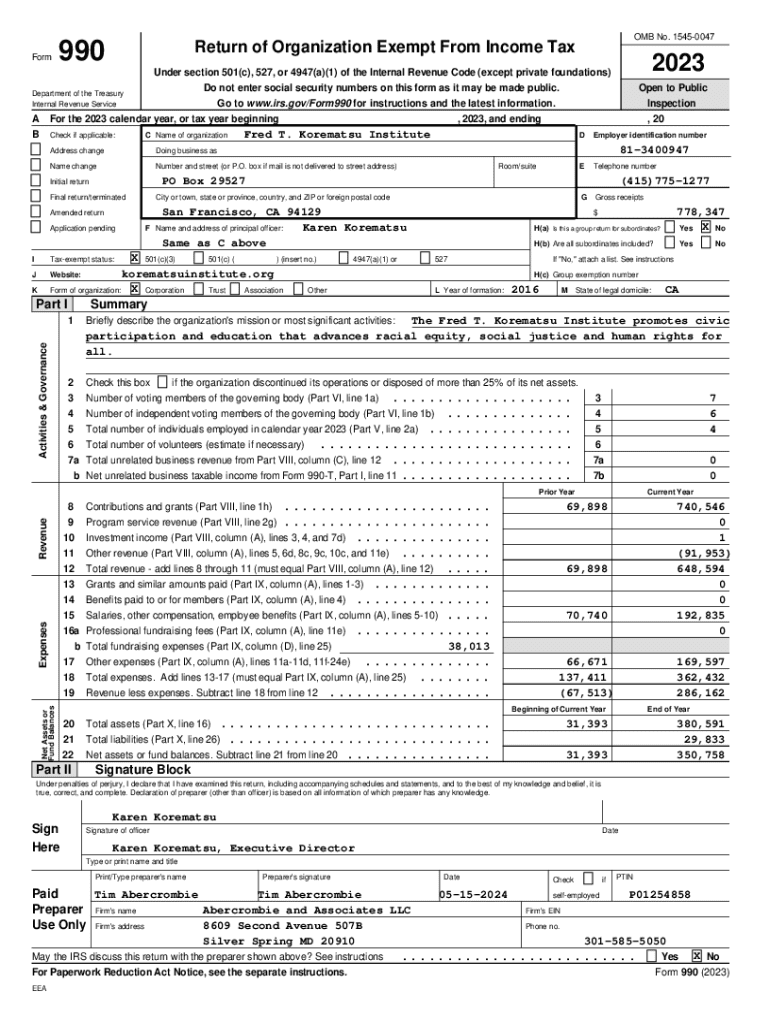

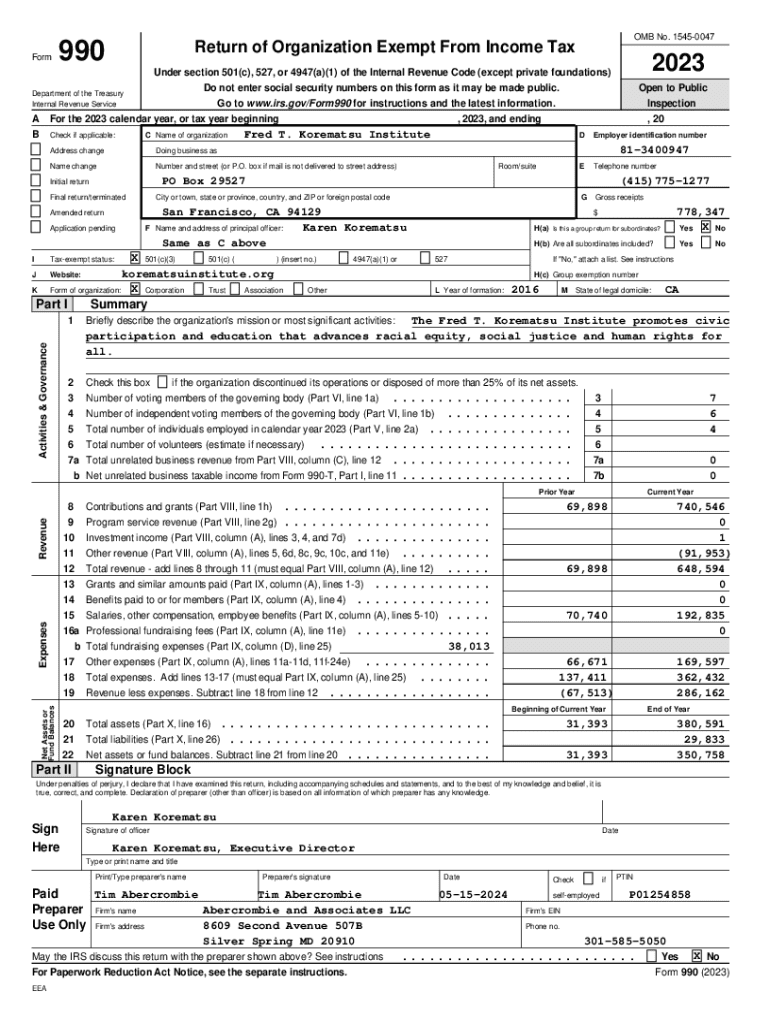

Form 990 is an essential document for tax-exempt organizations in the United States, serving as a comprehensive annual report on their financial status and activities. It provides vital information to the IRS and the public about the organization's mission, governance, finances, and programs. As a cornerstone of nonprofit accountability, Form 990 plays a significant role in ensuring transparency within the nonprofit sector.

The purpose of filing Form 990 is two-fold: it allows the IRS to evaluate compliance with tax-exempt requirements and enables donors and the public to assess the organization’s financial health and operational effectiveness. Consequently, understanding the nuances of different types of Form 990 and its importance is crucial for every nonprofit organization.

Filing requirements for Form 990

Understanding who must file Form 990 is crucial for compliance. Generally, organizations that qualify as tax-exempt under Section 501(c)(3) of the Internal Revenue Code are required to file Form 990 annually. However, there are specific exemptions and exceptions which organizations should be aware of.

Some organizations may be exempt from filing altogether, such as churches, their integrated auxiliaries, and conventions or associations of churches. Furthermore, organizations with annual gross receipts of less than $50,000 can opt for the simpler Form 990-N. Navigating these requirements can be complex, but understanding them ensures compliance and avoids penalties.

Filing modalities can vary, with many organizations favoring electronic filing due to the convenience it provides, while others may still opt for traditional paper submissions. An understanding of these modalities enhances efficiency and ensures proper handling of documents.

Key components of Form 990

Form 990 consists of multiple sections that require careful consideration and accurate reporting. The form is structured to convey crucial information regarding the organization’s mission, governance framework, revenues, and expenses.

Each section serves a purpose — for example, aligning the organization's mission and goals with reported activities helps stakeholders assess effectiveness. Besides, detailing revenue and expenses offers a clear picture of the organization’s financial health.

How to prepare for filing Form 990

Preparation for filing Form 990 involves a comprehensive review and compilation of relevant data. Efficient financial tracking is vital for this process, as organic organizations must maintain accurate, detailed records of all transactions. Best practices can significantly enhance accuracy and ease during the filing period.

Additionally, recording donor information and documenting activities and accomplishments throughout the year ensures that all necessary details are at hand during the filing process. Gathering supporting documents, such as financial statements, policies, and past forms, facilitates a smooth workflow.

Best practices for completing Form 990

Completing Form 990 effectively requires a thorough understanding of its format and fields. Take the time to read and comprehend each section, as it ensures accurate representation of your organization’s financial activities and intentions. It’s essential to look for discrepancies or incomplete information before submission to avoid unnecessary delays and penalties.

Frequent mistakes include misreporting financial figures, failing to provide required documentation, or misunderstanding IRS guidelines. Therefore, being aware of these pitfalls, along with strong preparatory measures, can lead to more successful filings.

Filing Form 990: Step-by-step guide

Filing Form 990 can seem daunting, but following a structured approach simplifies the process. Initially, gather all necessary documents and ensure that your financial records are accurate. It's best practice to maintain an updated accounting system for easy access to required information.

Next, carefully complete each section of the form, paying close attention to details. Once you've filled out the form, conduct a thorough review to ensure everything is accurate and complete. Finally, submit the form through the appropriate channels—e-filing is often preferred to expedite processing.

Penalties for non-compliance

Failure to comply with Form 990 filing requirements has serious consequences. Organizations that do not file or file late may incur significant penalties, which can range from a few hundred dollars to thousands, depending on the organization’s gross receipts.

Moreover, continued non-compliance can lead to the loss of tax-exempt status, effectively disqualifying the organization from numerous opportunities and funding sources. Understanding these penalties underscores the importance of timely and accurate filing.

Public inspection regulations

Form 990 is generally subject to public inspection, which promotes transparency in the nonprofit sector. Organizations must make their completed Form 990 available to the public upon request, contributing to the overall accountability of tax-exempt organizations.

Anyone interested in an organization’s financials can access its Form 990 through various platforms. Many organizations also post their filings on their websites, further enhancing accessibility.

Utilizing Form 990 for charity evaluation research

Form 990 serves as a valuable resource for potential donors and stakeholders evaluating the effectiveness and financial health of nonprofit organizations. By analyzing the data within Form 990, donors can assess various aspects such as financial stability, operational effectiveness, and clarity in reporting, which are critical for informed decision-making.

Additionally, third-party evaluators and watchdog organizations utilize Form 990 to produce ratings and insights about nonprofit organizations. This creates a significant opportunity for organizations to improve transparency and increase credibility among stakeholders.

Form 990 data and resources

Accessing Form 990 data is crucial for public scrutiny and research. The IRS provides an online database where users can easily search for Form 990 filings from various organizations. This data serves as a foundation for comparative analyses within the nonprofit sector.

In addition to the IRS database, various third-party sources offer insights and data analytics tools tailored for researchers and donors. These resources allow users to review the financials of comparable organizations and assess areas of strength and weakness.

Hiring professional assistance

Considering the intricacies involved in preparing and filing Form 990, many organizations benefit from the expertise of nonprofit tax professionals. They not only aid in compliance but also provide insights into strategic approaches for effective reporting.

When choosing a tax professional, factors such as experience with nonprofit tax laws, accreditation, and previous client testimonials are essential to ensure quality assistance. Collaborative approaches tend to improve accuracy and effectiveness in the filing process.

Leveraging digital solutions for Form 990 management

With the increasing complexity of Form 990, leveraging digital platforms has become a pivotal strategy for organizations. pdfFiller is a powerful tool that allows users to effortlessly edit, eSign, and manage Form 990s within a single, user-friendly interface.

By utilizing pdfFiller and its capabilities for online collaboration and document management, organizations can streamline preparation processes, reduce human error, and ensure compliance with IRS requirements efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990 online?

Can I edit form 990 on an Android device?

How do I fill out form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.