Get the free 2024 Medicare Supplement (medigap) Application Form

Get, Create, Make and Sign 2024 medicare supplement medigap

How to edit 2024 medicare supplement medigap online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 medicare supplement medigap

How to fill out 2024 medicare supplement medigap

Who needs 2024 medicare supplement medigap?

Understanding the 2024 Medicare Supplement Medigap Form

Understanding Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, commonly known as Medigap, serves as a security blanket for individuals enrolled in Original Medicare. It is designed to cover specific out-of-pocket costs that Medicare does not fully pay, such as copayments, coinsurance, and deductibles. These supplemental plans are crucial for many beneficiaries, as they help reduce the financial burden of health care expenses that can accumulate. Having a Medigap policy ensures greater peace of mind, knowing that many unexpected costs related to medical care are covered.

One of the key benefits of obtaining a Medigap policy is the predictability it offers regarding health care costs. Beneficiaries can anticipate their expenses for doctor visits, hospital stays, and other medical services. Additionally, most Medigap plans include coverage for foreign travel emergencies, which can be a critical feature for those who travel abroad frequently.

Medigap works in conjunction with Original Medicare, meaning beneficiaries must be enrolled in Medicare Part A and Part B to apply for a Medigap plan. It is essential to understand that Medigap does not cover services not covered by Medicare itself, like long-term care or dental care. In contrast to Medicare Advantage plans, which are an all-in-one alternative to Original Medicare, Medigap strictly supplements Medicare and allows beneficiaries to retain their original Medicare coverage.

Key features of the 2024 Medigap form

Applying for Medigap in 2024 involves utilizing a structured application process that ensures you provide the necessary information to your prospective insurer. The application typically requires basic personal details, health history, and plan selection. The first crucial step in applying is to fill out the 2024 Medigap form accurately and thoroughly, making sure to meet the set deadlines for submission, which varies depending on the state.

To simplify the application process, tools such as pdfFiller can significantly enhance your experience. With interactive features for completing the form, beneficiaries can easily navigate through various fields, ensuring that every section is correctly filled out before submission. Additionally, digital signatures and document management tools on pdfFiller allow users to sign their forms electronically, saving time and reducing paper waste.

Getting started with your 2024 Medigap application

Before beginning your Medigap application, determining your eligibility is essential. Generally, you qualify for Medigap if you are 65 years or older and already have Medicare Part A and Part B. Some insurers may offer coverage to under-65 individuals who are disabled or have end-stage renal disease. However, regulations can differ between states, so it's crucial to be aware of local guidelines.

Factors affecting your eligibility can include your age at the time of application, your health status, and whether you're applying during your open enrollment period, which begins the first month you're 65 and enrolled in Medicare. This period typically lasts for six months and guarantees your acceptance into any Medigap plan without medical underwriting.

Before applying for Medigap, gather necessary documents such as your Medicare card, a list of medications you currently take, and details about any existing health policies. This information is vital for filling out the application form accurately. By ensuring you have all required documentation on hand, you can streamline the application process and avoid unnecessary delays.

Detailed walkthrough of the 2024 Medicare Supplement Medigap form

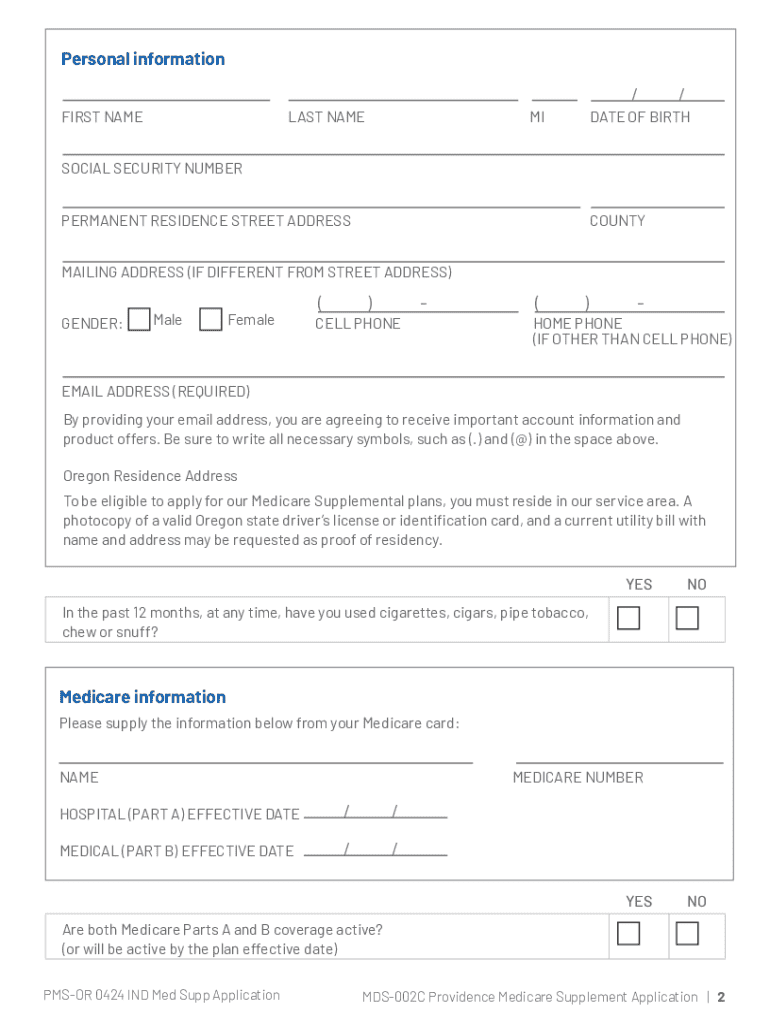

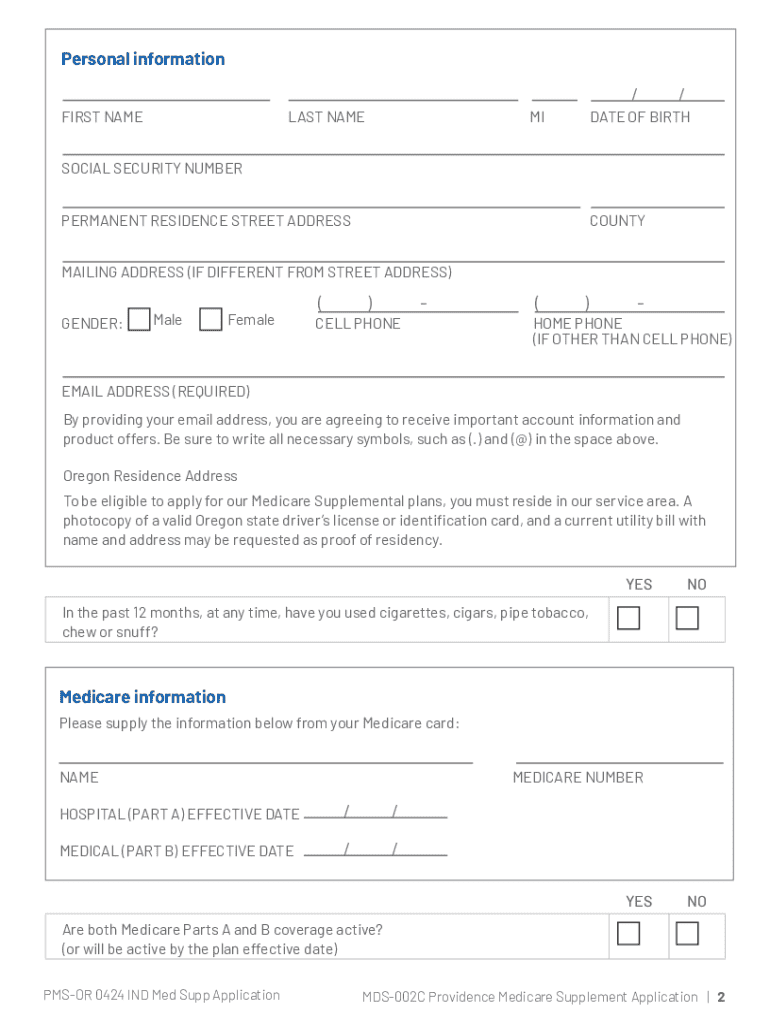

Once you have gathered the necessary information, it is time to delve into the actual Medigap application form. The form is segmented into specific sections, starting with personal information. This section requires you to provide your name, address, date of birth, and Medicare number. It is crucial to ensure that all details match your identification documents to avoid complications.

Moving on to the coverage selection section, applicants will choose from plans labeled A through N, each providing different levels of coverage. Understanding these plans will help you select one that aligns with your health care needs and budget. Lastly, the health questions section asks about your medical history. While it’s essential to answer truthfully, misleading information can lead to denial of coverage later on.

Common mistakes in form completion can include overlooking crucial details or misinterpreting coverage options. To avoid these pitfalls, utilize pdfFiller's tools for correction and editing. The platform’s user-friendly interface makes it easy to make adjustments, ensuring that you can present a polished application to your insurer.

Submitting your Medigap application

When your application is complete, the next step is to submit it. Best practices suggest considering your options for submission carefully. You can usually submit your Medigap application online using the insurer’s portal, by mail, or in person at a local insurance office. Whichever method you choose, ensure that you keep a copy of the submitted application for your records.

Once submitted, monitoring your application status is crucial. Insurance companies typically provide an update within a few weeks, informing you if your application has been approved or if they require additional information for processing. Understanding this timeline can help you remain patient and informed during the waiting period.

Managing your Medigap policy post-application

Once you have submitted your Medigap application and received approval, understanding your policy coverage is vital. Each Medigap plan offers specific benefits and covers certain costs associated with Medicare. Learning how to read and interpret your Medigap policy document can help you maximize your benefits. Be sure to discuss renewals and potential changes to your plan over time with your insurer to stay informed about any shifts in your coverage.

Furthermore, utilizing pdfFiller can help you manage your documents effectively. You can keep track of your Medigap policy and any related documentation in an organized manner, allowing for quick access when needed. The platform’s features let you update and manage all your Medigap documents as life circumstances change, ensuring you are always prepared.

Additional support and resources

Finding reliable information about Medigap can be a challenge, but there are numerous resources available to assist you. Medicare's official website provides detailed information about Medigap coverage options, eligibility, and application procedures. You can also explore forums and community groups dedicated to Medicare discussions, offering insight from fellow beneficiaries. These shared experiences can provide valuable perspectives regarding different Medigap plans.

If you require personalized assistance with your application or policy details, don’t hesitate to access customer service. Contact your chosen insurance agent or use pdfFiller's customer support for questions related to document management or form filling. Having the right support network can ease the burden of navigating the world of Medigap insurance.

Future trends in Medicare supplement plans

The landscape of Medicare Supplement Plans is poised for changes as regulations and coverage options continue to evolve. In 2024 and beyond, beneficiaries may notice shifts in the types of coverage available or changes in premium costs driven by various factors, including legislative adjustments and market demands. Staying aware of these trends will help individuals make informed decisions about their Medigap options.

It is also possible that we may see improvements in digital tools aimed at helping beneficiaries manage their Medigap applications and policy details. For example, platforms like pdfFiller could further enhance user experience by integrating additional features that streamline the application process or document management. As the health insurance industry adapts to technological advancements, remaining informed will be essential for effectively managing your Medigap policy.

Engaging with your Medigap community

Connecting with others who are navigating the complexities of Medigap can provide tremendous support and insight. Online forums and community groups focused on Medicare issues allow beneficiaries to share their experiences, pose questions, and seek advice. This networking can lead to discovering useful strategies for ensuring optimal utilization of Medigap coverage. Engaging with a community of fellow policyholders not only enriches your understanding but can also result in lasting friendships and support systems.

While pursuing your Medigap journey, consider participating in discussion groups or local meet-ups related to Medicare education. These platforms present the opportunity to learn from those who may have faced similar challenges and successes in their Medigap applications. Ultimately, building a supportive network can ease some of the complexities associated with health insurance decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 medicare supplement medigap online?

How do I edit 2024 medicare supplement medigap online?

How do I edit 2024 medicare supplement medigap straight from my smartphone?

What is medicare supplement medigap?

Who is required to file medicare supplement medigap?

How to fill out medicare supplement medigap?

What is the purpose of medicare supplement medigap?

What information must be reported on medicare supplement medigap?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.