Get the free Credit Card Form

Get, Create, Make and Sign credit card form

How to edit credit card form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card form

How to fill out credit card form

Who needs credit card form?

Understanding Credit Card Forms: A Comprehensive Guide

Understanding credit card forms

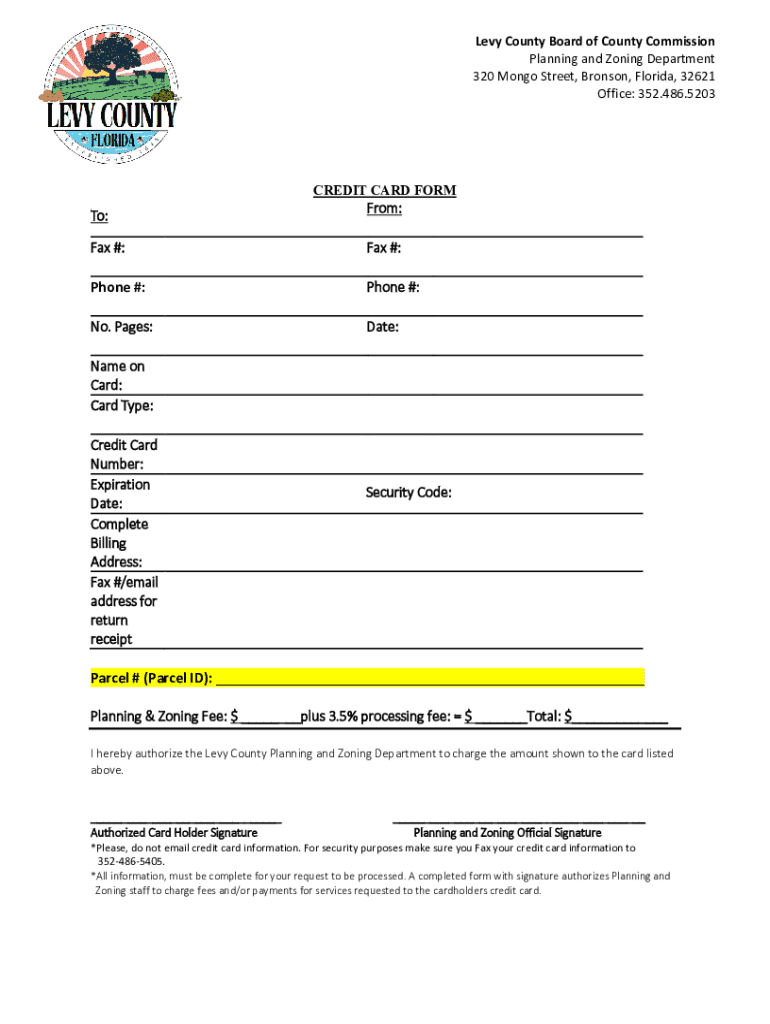

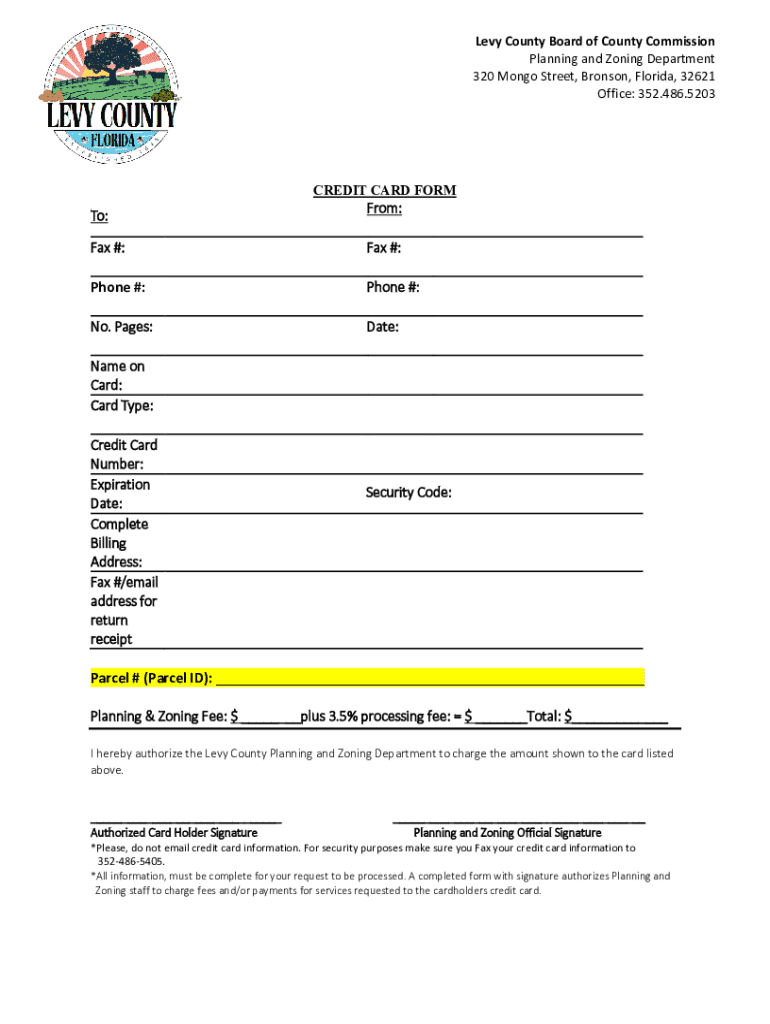

A credit card form is designed to facilitate the secure collection and storage of credit card information for transactions. Its primary purpose is to ensure that businesses can process payments while keeping sensitive customer data safe. These forms typically include essential details like the cardholder's name, billing address, card numbers, expiration date, and often, a signature for authorization.

There are various types of credit card forms utilized in different scenarios, including credit card authorization forms that grant permission for transactions, and credit card payment forms that directly process payments. Utilizing a credit card form is crucial for businesses seeking to protect against fraudulent transactions and streamline their payment processes effectively.

Key features of a credit card authorization form

A well-designed credit card authorization form includes several essential elements. At a minimum, it must capture customer details like their name and billing address, alongside critical card information such as the card number, expiration date, and CVV. Additionally, a designated area for the customer's signature is vital to signify authorization for the transaction.

Best practices for designing effective credit card forms should prioritize simplicity and clarity. Ensure that fields are clearly labeled and that the layout is intuitive, allowing for effortless completion by the customers. Compliance is also a critical consideration; forms must adhere to PCI compliance standards to mitigate risks associated with fraud and data breaches.

How to fill out a credit card form

Filling out a credit card form correctly is essential to ensure successful transactions. Here’s a step-by-step guide to help you complete a credit card form accurately:

Some common mistakes to avoid when completing a credit card form include misplacing decimal points, entering incorrect expiration dates, or failing to sign the form. Providing filled examples of authorization forms can serve as a useful reference for ensuring correctness.

The role of credit card forms in preventing fraud

Credit card authorization forms play a vital role in preventing chargeback abuse and facilitating secure transactions. By requiring explicit authorization through a signed form, businesses can establish a clear record of consent, which can be essential in the event of disputes. These forms help to mitigate fraud risks by ensuring that only authorized transactions go through.

To ensure a valid authorization, criteria should include complete and accurate card details, a matching signature, and adherence to proper transaction protocols. Merchants must also be aware of their legal obligations and liability considerations, particularly when handling and processing sensitive payment information.

Frequently asked questions (FAQ)

Various questions arise concerning the utilization of credit card authorization forms. One common inquiry is whether individuals are legally obligated to use them; while not mandatory, they provide a significant protective measure for both parties in a transaction.

Downloadable templates and tools

To streamline the usage of credit card forms, pdfFiller offers downloadable PDF credit card form templates that can be easily filled out and customized. The platform provides interactive tools for creating and editing forms, allowing users to tailor them to their specific needs.

Customization options available in pdfFiller ensure that businesses can align their forms with their branding and communication style. Various sectors, such as e-commerce and service industries, can greatly benefit from standardized credit card forms, enhancing customer experience while ensuring compliance and security.

Optimize your payment process with pdfFiller

pdfFiller excels in facilitating seamless document management and offers invaluable features like collaboration tools that allow teams to work together on credit card forms. The platform supports e-signing capabilities to ensure swift transactions and approvals, eliminating delays that could impede the payment process.

Managing and storing forms securely in the cloud adds an extra layer of protection for sensitive data. Users can access their forms from anywhere, ensuring that they can process payments on the go without compromising security or compliance.

Related topics to explore

Additional learning resources

In-depth resources on document management and eSignatures are essential for businesses looking to enhance their workflow. Articles on financial best practices can aid in optimizing payment processes, while webinars focusing on the legalities of digital transactions and customer data protection can empower teams with the knowledge needed to navigate complex regulatory environments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card form in Gmail?

Can I create an electronic signature for the credit card form in Chrome?

Can I create an electronic signature for signing my credit card form in Gmail?

What is credit card form?

Who is required to file credit card form?

How to fill out credit card form?

What is the purpose of credit card form?

What information must be reported on credit card form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.