Get the free Rt-100

Get, Create, Make and Sign rt-100

Editing rt-100 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rt-100

How to fill out rt-100

Who needs rt-100?

Comprehensive Guide to the RT-100 Form

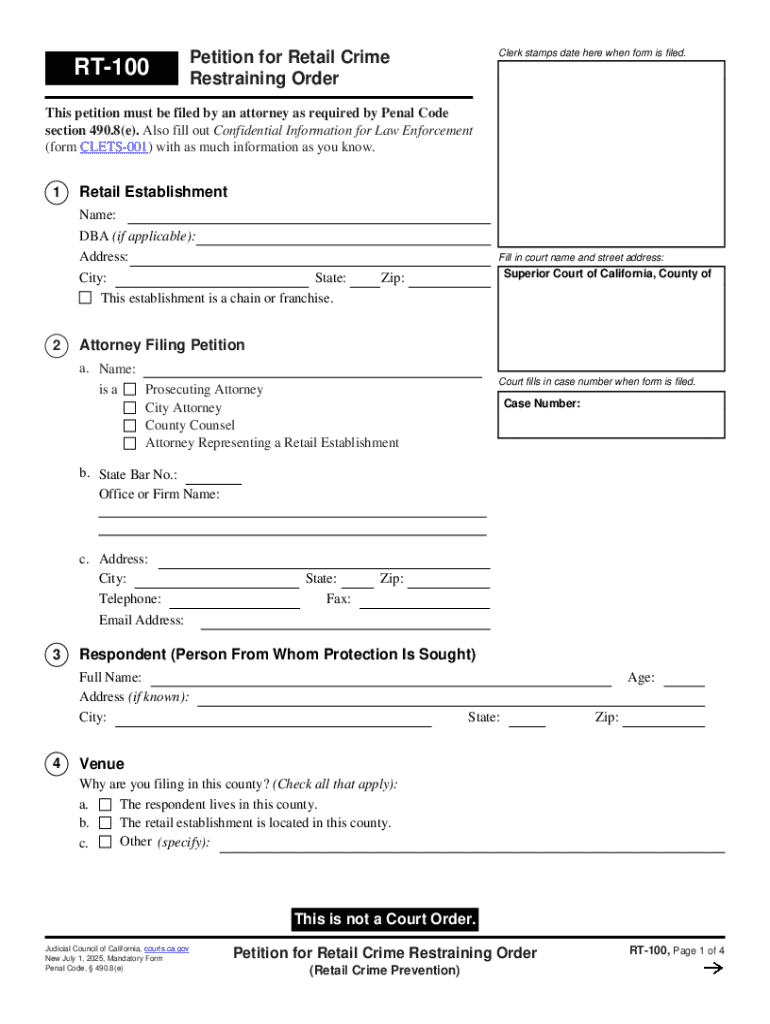

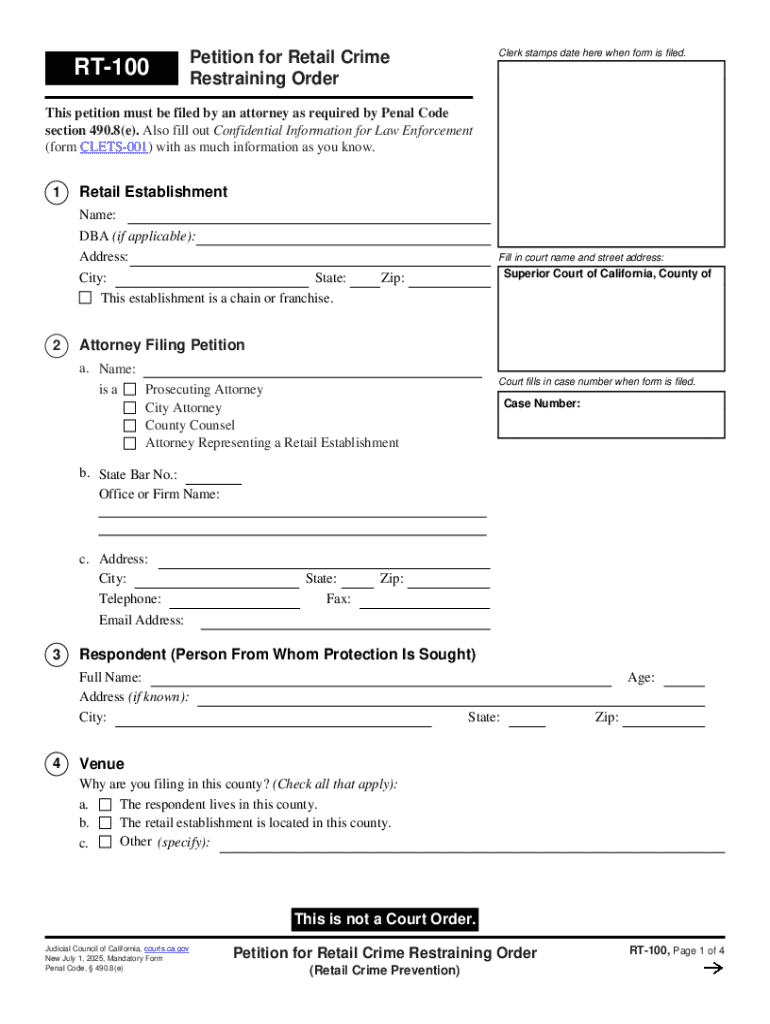

Overview of the RT-100 form

The RT-100 form is a critical document utilized in various regulatory and compliance situations, primarily aimed at providing clear and structured information for tax and reporting purposes. It is often required in transactions related to business and individual tax filings, helping streamline processes for both taxpayers and regulatory bodies. Understanding when and how to submit the RT-100 form can significantly improve compliance and ensure accuracy in your reporting activities.

Accurate completion of the RT-100 form is essential, as errors can lead to significant consequences such as penalties from tax authorities or delays in processing. Timely and precise submission can be facilitated through platforms like pdfFiller, which ensure that forms are filled out correctly and submitted without the usual hassle.

Key features of the RT-100 form

The RT-100 form comprises several key sections that require detailed input. Each section of the form serves a distinct purpose and must be completed with accuracy to avoid common mistakes. Familiarity with the form's structure is essential for effective completion.

In each section, it’s important to avoid common pitfalls, such as omitting required fields or providing inconsistent information, which can lead to processing delays or further inquiries from regulatory authorities.

How to fill out the RT-100 form: Step-by-step guide

Filling out the RT-100 form might seem daunting, but breaking it down into manageable steps can simplify the process.

Editing and customization of the RT-100 form

Once your RT-100 form is completed and submitted, there may be instances where you need to modify existing forms. pdfFiller makes this process seamless.

This flexibility allows users to keep their documents up to date without starting from scratch, making document management effortless.

Collaboration features for teams

For teams that need to work together on the RT-100 form, pdfFiller offers powerful collaboration features that streamline the editing process.

These collaborative features not only enhance workflow efficiency but also ensure a meticulous approach to form filling, which is vital for compliance.

Managing your RT-100 forms

Once submitted, effective document management is crucial for ongoing compliance and future reference. pdfFiller offers tools specifically designed for organizing RT-100 forms.

These management features not only help you maintain order but also reduce the stress that comes with regulatory deadlines.

Troubleshooting common issues with the RT-100 form

Encountering issues while filling out the RT-100 form can be frustrating. However, knowing common errors and how to address them can help alleviate this.

For additional support, users can access pdfFiller’s customer service to resolve challenges efficiently, ensuring timely submissions.

Additional tools for document management using pdfFiller

Beyond the RT-100 form, pdfFiller serves as a comprehensive document management solution. Users can manage various forms and documents seamlessly.

By employing these features, users can create a robust system for managing all their document needs effectively.

Future updates and changes to the RT-100 form

Staying updated with regulatory changes related to the RT-100 form is essential for compliance. pdfFiller provides resources to help users remain informed.

This commitment to keeping documentation up-to-date ensures users remain compliant and informed about important deadlines and changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete rt-100 online?

How do I make changes in rt-100?

Can I create an eSignature for the rt-100 in Gmail?

What is rt-100?

Who is required to file rt-100?

How to fill out rt-100?

What is the purpose of rt-100?

What information must be reported on rt-100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.