Get the free Business Credit Card Authorized User Request Form

Get, Create, Make and Sign business credit card authorized

Editing business credit card authorized online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business credit card authorized

How to fill out business credit card authorized

Who needs business credit card authorized?

Understanding the Business Credit Card Authorized Form: A Comprehensive Guide

Understanding business credit card authorization forms

A business credit card authorized form is a crucial document used by businesses to obtain permission from a customer or a client to charge their credit card for goods or services rendered. This form is designed to provide legal protection for both the business and the cardholder by ensuring the cardholder's consent before any transaction takes place.

The importance of this form extends beyond mere consent; it serves as a safeguard against potential disputes and chargebacks. When a business has a signed authorization form, it can more effectively defend itself against unauthorized charge claims, which ultimately helps in maintaining trust with both clients and customers through clear communication and secure financial practices.

Purpose and uses of business credit card authorized forms

Businesses often require authorization forms for several critical reasons. First and foremost, they serve to protect against chargebacks, enabling businesses to validate that customers have agreed to the transaction. Furthermore, these forms facilitate recurring payments, which are essential for subscription-based services and other memberships. Lastly, they ensure that customer consent is documented clearly, creating a transparent agreement that can be referred to later if needed.

Common industries utilizing these forms include hospitality, where hotels and restaurants often request authorization for reservations and services; eCommerce, for online transactions; and service providers, for appointments or subscriptions. This wide usage underscores the versatility and necessity of having a robust business credit card authorized form in place.

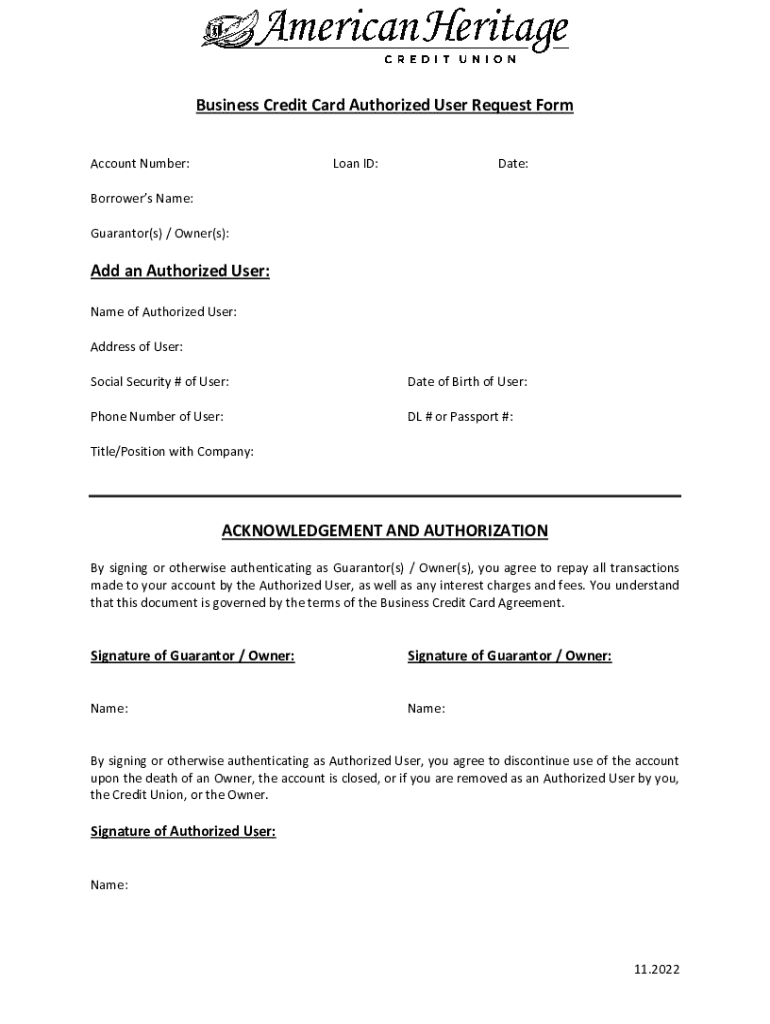

Key components of a business credit card authorized form

When creating or filling out a business credit card authorized form, several essential fields must be included to make the form valid. At a minimum, these components include the cardholder’s name, card number, expiration date, and CVV. However, given the sensitive nature of this information, businesses must also consider security measures when handling CVV data.

Another critical aspect of the form is obtaining the authorization signatures that confirm consent. Optional fields can also enhance the effectiveness of the form. Information such as the billing address or contact details for disputes can provide added layers of security and clarity, making it easier for businesses to manage and resolve any potential issues.

Types of business credit card authorized forms

Various templates of business credit card authorized forms exist, tailored for different contexts and needs. A standard business credit card authorization form is used for general transactions, while one-time payment authorizations are ideal for occasional services or sales. Recurring payment authorizations are critical for subscription models, ensuring regular payments are collected without hassle.

Specific industries may have specialized forms as well, such as hotel credit card authorizations that provide hotels the ability to secure held funds for reservations. E-commerce credit card authorizations are tailored for online transactions, streamlining the checkout process while ensuring authorization is captured effectively.

How to fill out a business credit card authorized form

When filling out a business credit card authorized form, it's important to proceed with care and attention to detail. First, gather all necessary information from the cardholder. This includes card details and personal information that will help in processing the payment correctly. Once all details are collected, accurately fill out the form to reflect this information.

Before finalizing, double-check the form for any errors or omissions. This step is crucial as inaccuracies can lead to payment delays or disputes. Once verified, the form should be signed and dated by the appropriate party to confirm authorization. Finally, ensure that the filled form is securely stored or transmitted to safeguard sensitive data from unauthorized access.

Legal considerations when using business credit card authorized forms

The use of business credit card authorized forms involves various legal implications that businesses must understand. These forms act as a binding agreement between parties, and if disputes arise, having a properly filled and signed form can be vital in legal proceedings. Additionally, regulations surrounding credit card transactions can vary by region, necessitating that businesses stay informed about laws applicable in their area.

In certain regions, such as the European Union, laws like the General Data Protection Regulation (GDPR) introduce specific requirements regarding personal data handling. Thus, it is imperative to maintain accurate records of these authorization forms to comply with existing law and protect the business against potential losses.

Best practices for managing business credit card authorized forms

Effectively managing business credit card authorized forms requires adopting best practices to safeguard sensitive information. It is crucial to implement secure storage solutions, whether digital or physical, to prevent unauthorized access to these documents. Regular audits of authorization forms help businesses ensure compliance with legal and regulatory standards, providing an additional layer of protection.

Furthermore, educating employees about the importance of handling these forms properly fosters a culture of security within the organization. This can significantly reduce the risk of data breaches or misuse of sensitive information. By adopting these practices, businesses can cultivate a secure and legally compliant environment that protects client data and enhances operational efficiency.

Technology and tools for business credit card authorization

Utilizing technology for managing business credit card authorized forms not only enhances efficiency but also ensures security. pdfFiller provides various features that empower businesses to create and manage these forms seamlessly. With editing capabilities that allow businesses to customize forms to their specifications, pdfFiller ensures that users can adapt to their specific needs.

The eSignature integration provided allows for quick and legally binding approvals, which is a vital aspect of the authorization process. Furthermore, collaboration tools on the pdfFiller platform enable teams to work together effectively, regardless of location. By leveraging these technological solutions, businesses can streamline document management, ultimately reducing the risk of human error while enhancing the security of their financial transactions.

FAQs about business credit card authorized forms

Understanding the nuances of business credit card authorized forms can help navigate common issues. For instance, if an authorization form is incomplete, the transaction may be at risk of rejection. Should a dispute arise regarding unauthorized charges, having a signed authorization form can be invaluable in resolving the matter.

Businesses are advised to keep authorization forms on file for a designated period, typically for a few years, to mitigate risks associated with chargebacks. In cases where a customer disputes a charge, proactive engagement and a review of the authorization form can aid in swiftly addressing the situation.

Related considerations in financial transactions

In the realm of financial transactions, the role of a payment gateway is crucial when processing payments that involve authorization forms. Payment gateways securely transmit customer data to the payment processor, ensuring that sensitive information remains protected throughout the transaction process. Businesses should also implement security measures to mitigate the risks of fraud in credit card transactions, such as encryption and two-factor authentication.

Additionally, adopting safe online payment practices can enhance customer trust and confidence. Techniques such as providing clear transaction information, utilizing secure payment options, and maintaining robust customer service channels can significantly impact customer satisfaction and retention.

Conclusion

Implementing a well-structured business credit card authorized form is a strategic step for businesses aiming to secure their transactions and establish trust with their clients. pdfFiller offers a range of templates and features that can streamline the creation and management of these forms, making it easier for teams to operate securely and efficiently.

By staying informed and adapting practices that ensure legal compliance, transparency, and security, businesses can navigate the complexities of financial transactions with confidence, ultimately leading to enhanced operational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my business credit card authorized in Gmail?

How can I edit business credit card authorized on a smartphone?

How can I fill out business credit card authorized on an iOS device?

What is business credit card authorized?

Who is required to file business credit card authorized?

How to fill out business credit card authorized?

What is the purpose of business credit card authorized?

What information must be reported on business credit card authorized?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.