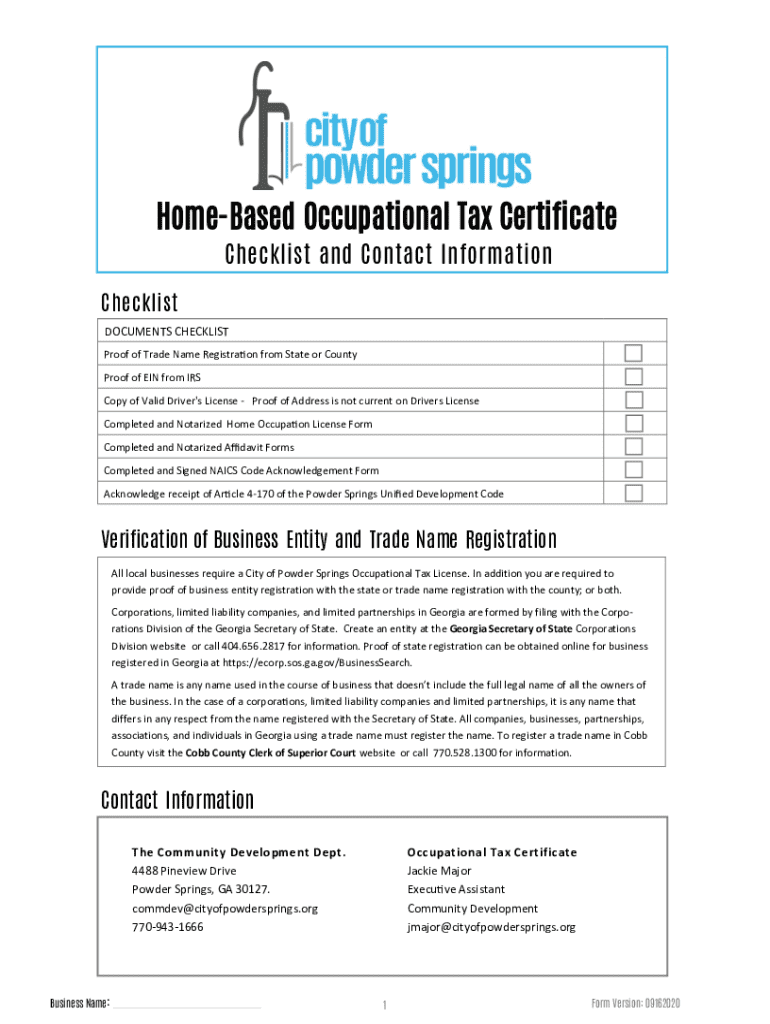

Get the free Home-based Occupational Tax Certificate

Get, Create, Make and Sign home-based occupational tax certificate

How to edit home-based occupational tax certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home-based occupational tax certificate

How to fill out home-based occupational tax certificate

Who needs home-based occupational tax certificate?

Home-Based Occupational Tax Certificate Form: A Comprehensive Guide

Understanding the home-based occupational tax certificate

A home-based occupational tax certificate is a legal document required by many municipalities for individuals operating a business from their residence. This certificate serves as official permission for local businesses to operate within a specified area, ensuring compliance with city ordinances and tax regulations. For home-based entrepreneurs, obtaining this certificate is critical as it legitimizes their business operations, provides access to necessary resources, and enhances their credibility among customers.

The importance of this certificate cannot be overstated; it not only allows for lawful business operation but also fosters transparency with local authorities. Compliance with such regulations helps avoid potential fines, legal issues, and interruptions in business. Different jurisdictions might have varying requirements, but generally, a home-based occupational tax certificate signifies adherence to local business licensing laws.

Eligibility criteria for applying

Determining who needs a home-based occupational tax certificate starts with evaluating the nature of the business. Typically, anyone engaging in commercial activities from their home—such as freelancers, artisans, and e-commerce sellers—should apply for this certificate. Most cities require this certificate for any home-based operation that serves clients or the public directly, including those selling products or services online.

Eligibility criteria may vary by location, and some common factors include the type of business being conducted and zoning regulations of the area. For instance, businesses that produce noise or generate traffic may face additional scrutiny. A common misconception is that only large businesses need this certificate; in reality, even small, informal startups are often required to obtain one to operate legally.

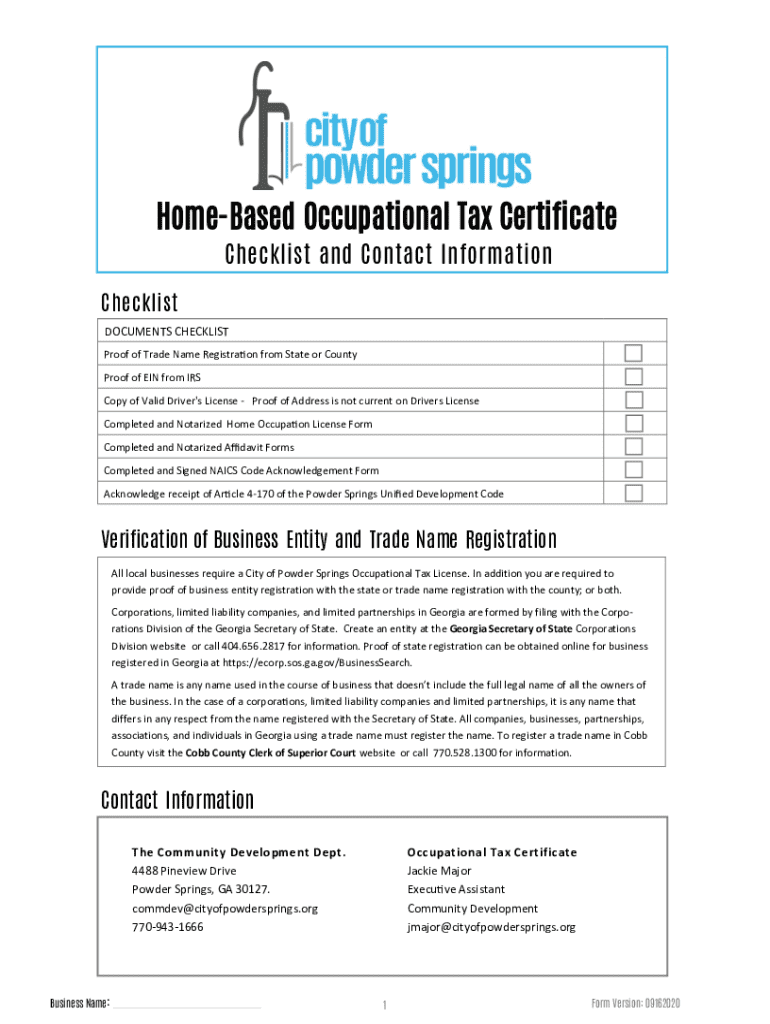

Document preparation: What you need to get started

Before filling out the home-based occupational tax certificate form, thorough preparation can ease the application process. Firstly, applicants should gather all necessary documents such as identification, proof of residence, a business plan detailing the nature of their business, and any existing compliance documents. Depending on the jurisdiction, other information such as financial projections or additional permits may also be required.

Compiling this information beforehand not only streamlines the form-filling process but also minimizes errors that could delay application approval. A helpful tip includes checking with local business offices for specific requirements related to your particular area; this ensures you are fully aware of what documents will be expected of you during the application process.

Step-by-step guide to completing the form

Completing the home-based occupational tax certificate form can appear daunting, but following a structured approach simplifies the process. Start by accessing the form, which is available online, including platforms like pdfFiller, where it can often be filled out electronically for convenience.

As you fill out the form, begin with your personal information and ensure its accuracy—this will be critical for the approval process. The form typically requests details such as your name, address, contact information, and the nature of your business activities. Be thorough and clear in describing what you do.

Next, you will provide additional details, such as the anticipated volume of business and hours of operation. Don’t forget to include all necessary signatures, as a missing signature can lead to processing delays. Once everything is filled out, take time to review your form for any inaccuracies before submitting it.

Upon verifying all entries, you have the option to submit it electronically via pdfFiller, where you can easily sign and ensure it reaches the appropriate local office. If you prefer traditional methods, you can print the form and submit it via mail or in-person at your local business office.

Editing and managing your home-based occupational tax certificate

After submission, managing your home-based occupational tax certificate becomes essential, especially if any changes occur. Using pdfFiller enhances flexibility, as you can easily edit your form if your business evolves or if you relocate. The platform allows for straightforward edits to your documents, enabling you to update information without starting from scratch.

Additionally, pdfFiller offers features that support digital signatures and collaboration, allowing you to share forms with team members or advisors seamlessly. Tracking your application status directly through pdfFiller provides peace of mind, ensuring you remain informed about your submission’s progress.

Common challenges and how to overcome them

When applying for a home-based occupational tax certificate, applicants often encounter several common challenges, including misunderstanding guidelines and submitting incorrect information. These issues can lead to application delays or denials, which can be frustrating for new business owners eager to start operations. To prevent such scenarios, it’s advisable to read through local regulations thoroughly and seek clarification when needed.

Another frequent challenge is dealing with submission errors that may arise during electronic submissions. If you experience technical issues, pdfFiller offers robust customer support for troubleshooting. Don’t hesitate to reach out for assistance; local business support agencies can also provide guidance on documentation and compliance, ensuring you're navigating the process effectively.

Resources for home-based business owners

As a home-based business owner, having access to the right resources can significantly enhance your operational effectiveness. Numerous online platforms, including pdfFiller, provide access to additional forms and certificates that may be required alongside the home-based occupational tax certificate. It is beneficial to familiarize yourself with local governmental resources that offer information about business licenses, tax obligations, and further compliance requirements.

Also, consider exploring community-oriented websites that provide FAQs related to home-based occupational taxes. These platforms often feature valuable insights and networking opportunities, connecting you with other local entrepreneurs who can share experiences and best practices. Finding a local community development office can also provide links to relevant resources and programs aimed at supporting home-based business growth.

Getting assistance with your application

Navigating the application process for a home-based occupational tax certificate should not be a solitary journey. Utilizing customer support from platforms like pdfFiller can provide direct guidance on how to complete forms properly. Their help desk can assist with any questions regarding the features of the platform, ensuring that you maximize your use of the tools available.

In addition to online customer support, many local business communities also offer forums and chat options. Engaging with fellow entrepreneurs can be an invaluable resource for answering questions and sharing tips. For particularly complex cases, considering professional consultation with a business advisor or a legal expert may provide the necessary guidance to ensure your application meets all regulatory requirements.

Engaging with your community: Networking and growth opportunities

Engaging with local business communities can significantly benefit home-based entrepreneurs. Joining associations, attending workshops, and participating in networking events not only provides opportunities for collaboration but also fosters a sense of belonging within the entrepreneurial ecosystem. These activities can lead to partnerships, mentorship opportunities, and valuable insights that contribute to business growth.

Beyond networking, local business groups often host seminars and events focused on skills development specifically tailored for home-based enterprises. These workshops can cover various topics, including marketing strategies, financial management, and operational efficiency. Investing time in community engagement can yield substantial returns as you grow your business and tap into collective expertise.

Navigating changes in regulations

For home-based business owners, remaining aware of changes in local occupational tax laws is critical. Business regulations can shift based on economic circumstances or government initiatives, necessitating ongoing education to remain compliant. Utilizing resources like local business associations, news outlets, and compliance workshops helps to stay informed.

pdfFiller can assist in adapting to these changes with its suite of tools designed for easy document updates and edits. Their platform allows users to swiftly amend forms according to the latest regulations, ensuring continued compliance without significant delays. Regularly checking for updates and engaging with local resources can equip you with the knowledge necessary to adapt your business practices effectively.

Contact us for more information

For individuals seeking further information about the home-based occupational tax certificate form or needing assistance with the application process, reaching out to customer support has never been easier. Accessing pdfFiller’s support can provide tailored guidance to help navigate the form-filling process and stay compliant. Additionally, sharing experiences with fellow entrepreneurs can yield fresh insights and foster community.

Feel free to connect with us on social media platforms for updates and tips tailor-made for home-based business owners. Engaging with pdfFiller across various channels ensures that you remain equipped with the latest knowledge and tools necessary to succeed in your business journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute home-based occupational tax certificate online?

How do I edit home-based occupational tax certificate on an iOS device?

How can I fill out home-based occupational tax certificate on an iOS device?

What is home-based occupational tax certificate?

Who is required to file home-based occupational tax certificate?

How to fill out home-based occupational tax certificate?

What is the purpose of home-based occupational tax certificate?

What information must be reported on home-based occupational tax certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.