Get the free Bridging Loan Application for Individuals

Get, Create, Make and Sign bridging loan application for

Editing bridging loan application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bridging loan application for

How to fill out bridging loan application for

Who needs bridging loan application for?

Bridging Loan Application for Form: A Comprehensive Guide

Understanding bridging loans

Bridging loans are short-term financing solutions designed to 'bridge' the gap between two transactions, such as buying a new property before selling an existing one. These loans enable borrowers to access quick funds, typically for a duration of a few weeks to a few months, allowing them to seize opportunities that require immediate cash.

There are primarily three types of bridging loans: residential bridging loans, commercial bridging loans, and development finance. Residential bridging loans cater to homeowners needing temporary financial support during property transitions. Commercial bridging loans serve businesses seeking to acquire new properties or invest in real estate quickly, while development finance is aimed at property developers to fund new projects or renovations.

When to use a bridging loan?

Bridging loans are particularly advantageous in several scenarios where speed is essential. For instance, if a homeowner wishes to purchase a new property before selling their current one, a bridging loan can provide the necessary funds to facilitate the purchase without lengthy waits associated with traditional mortgages.

Additionally, during property refurbishments and renovations, a bridging loan helps cover immediate costs, allowing homeowners to enhance the property efficiently. Finally, urgent purchases requiring quick funding can greatly benefit from bridging loans, enabling individuals to secure desirable properties as opportunities arise.

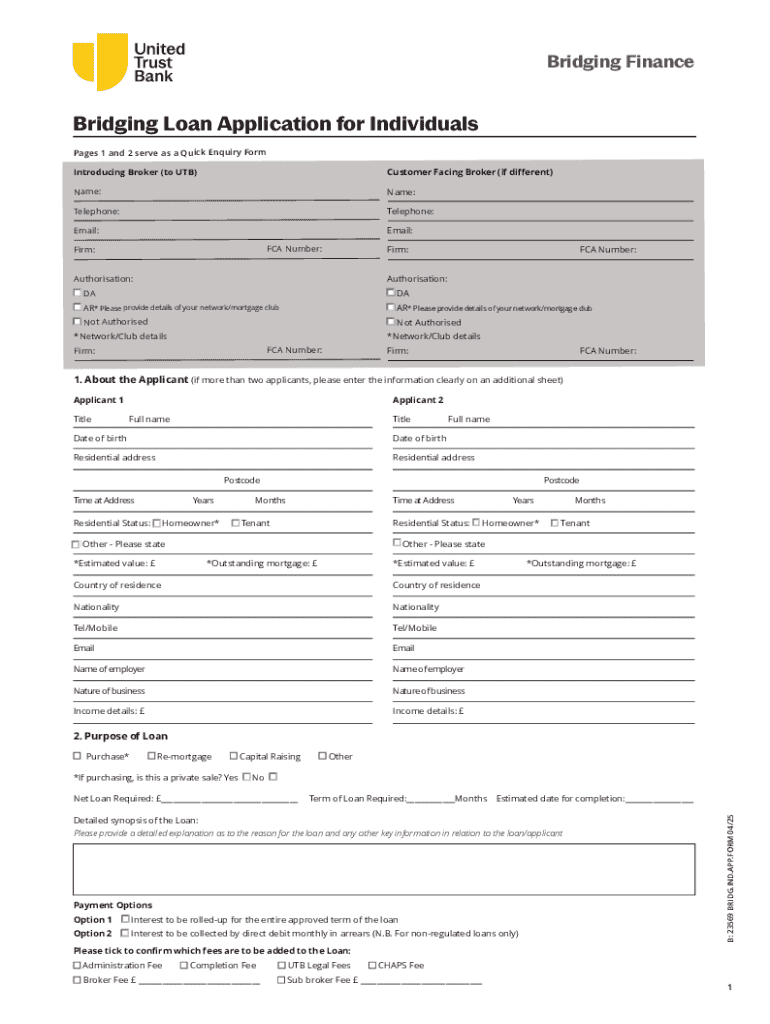

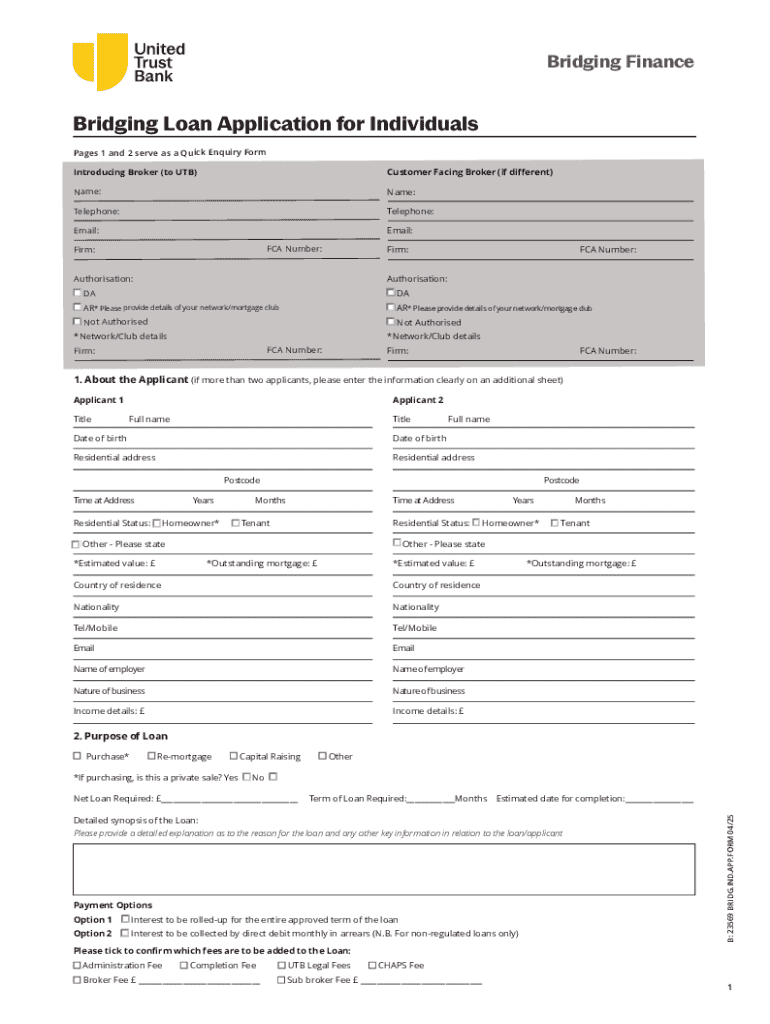

The importance of a bridging loan application form

Completing a bridging loan application form is the first step in securing a bridging loan. The application process typically involves submitting detailed information to lenders, which allows them to assess your financial situation and the property involved. A well-structured application can significantly enhance the chances of approval.

Key information typically required on a bridging loan application form includes personal information, financial details, and property details. Personal information covers identification and contact details, while financial details encompass income, expenses, and existing debts, enabling lenders to gauge repayment capacity. Finally, the property details will consist of the property's value, location, and any existing mortgages.

Navigating the bridging loan application form

To successfully navigate the bridging loan application form, gather all necessary documents beforehand. Start with proof of identity, which could be a passport or driving license. Next, provide proof of income such as payslips or bank statements, and don't forget property valuation reports to substantiate the value of the asset you want to mortgage.

Once you have your documents, you can begin completing the form. It’s crucial to follow any detailed instructions provided for each section. Pay attention to common mistakes such as misentering numbers or providing incomplete information, which can delay the application process.

After completing the form, don’t skip the review process. Double-check all entries to ensure accuracy, and conduct a self-audit by comparing the form against your documents to confirm that everything matches.

Interactive tools for managing your application

Managing your bridging loan application can be streamlined using tools like pdfFiller, which allows for easy PDF editing and form management. With pdfFiller, you can edit PDFs conveniently, ensuring all details are accurate before submission. Moreover, eSigning documents securely can save time, as you won’t need to print, sign, and scan any forms.

Collaborating with teams during the application process is another advantage of using pdfFiller. Multiple users can access and work on the same document, facilitating better communication and quicker resolutions of issues. Furthermore, pdfFiller allows you to track the status of your application directly, keeping you informed throughout the process.

After submission: what happens next?

After submitting your bridging loan application, it’s normal to wonder what happens next. Generally, lenders will start processing your application, which can take anywhere from a few days to a couple of weeks, depending on the lender and the complexity of your case. Understanding that each lender may have different timelines can help manage expectations.

Common follow-up procedures include receiving a request for additional information or clarification, particularly if any details in your application appear unclear or incomplete. Additionally, it’s essential to be prepared for approval conditions, which may require providing further documentation or fulfilling specific criteria outlined by the lender before finalizing the loan.

FAQs about bridging loan applications

As you navigate your bridging loan application, several frequently asked questions often arise. One common concern is whether it’s possible to apply for a bridging loan with bad credit. While having poor credit may limit your options, certain lenders may still consider your application based on other criteria.

Another frequent inquiry is the typical duration of the bridging loan application process. Generally, it can take anywhere from a few days to a few weeks. Ensuring your application is complete and accurate may help expedite this process. Finally, applicants often wonder about the costs associated with the application. Typical expenses should include arrangement fees, valuation fees, and legal costs, so it’s advisable to budget accordingly.

Additional documentation and forms

In addition to the primary application form, there may be other documentation required to support your bridging loan application. For example, a Schedule of Tenancies may be needed if you are applying for a loan on a rental property, which details existing tenancies and rental income.

Additionally, lenders often request a Fair Value Form to evaluate the property's market value accurately. Having these documents ready and understanding their significance can streamline your overall application process.

Getting help and support

If you encounter challenges while completing your bridging loan application, don’t hesitate to seek assistance. Various resources are available, including lender support lines and financial advisors who can provide expert guidance on navigating the process.

Using pdfFiller’s customer support can also ensure you navigate any technical issues efficiently. They offer comprehensive customer service to assist with document management and answering questions about the platform.

Stay updated with our news

Being informed about recent changes in bridging loan regulations is important for potential borrowers. Markets and rules change regularly, so staying tuned to industry news can provide insights into adjustments that may impact your financing options.

Additionally, aspiring borrowers can benefit from tips and strategies for securing successful bridging loans. Keeping abreast of market trends, interest rates, and lender preferences will empower you to make more informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bridging loan application for online?

How do I fill out the bridging loan application for form on my smartphone?

How do I complete bridging loan application for on an Android device?

What is bridging loan application for?

Who is required to file bridging loan application for?

How to fill out bridging loan application for?

What is the purpose of bridging loan application for?

What information must be reported on bridging loan application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.