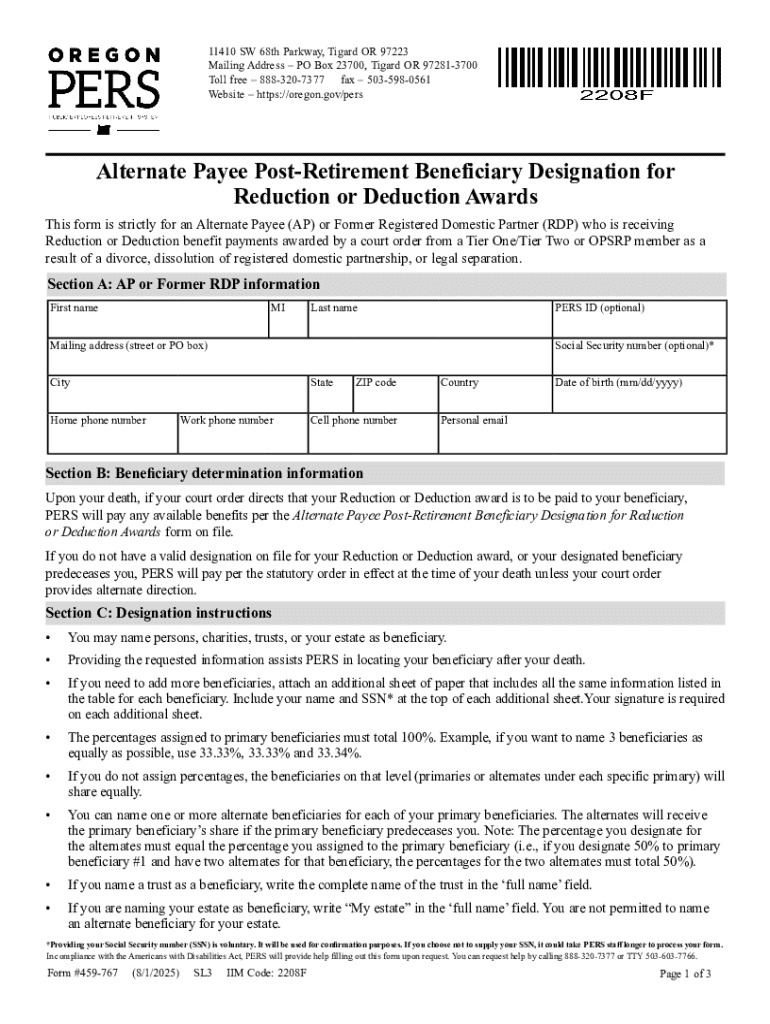

Get the free Alternate Payee Post-retirement Beneficiary Designation for Reduction or Deduction A...

Get, Create, Make and Sign alternate payee post-retirement beneficiary

How to edit alternate payee post-retirement beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alternate payee post-retirement beneficiary

How to fill out alternate payee post-retirement beneficiary

Who needs alternate payee post-retirement beneficiary?

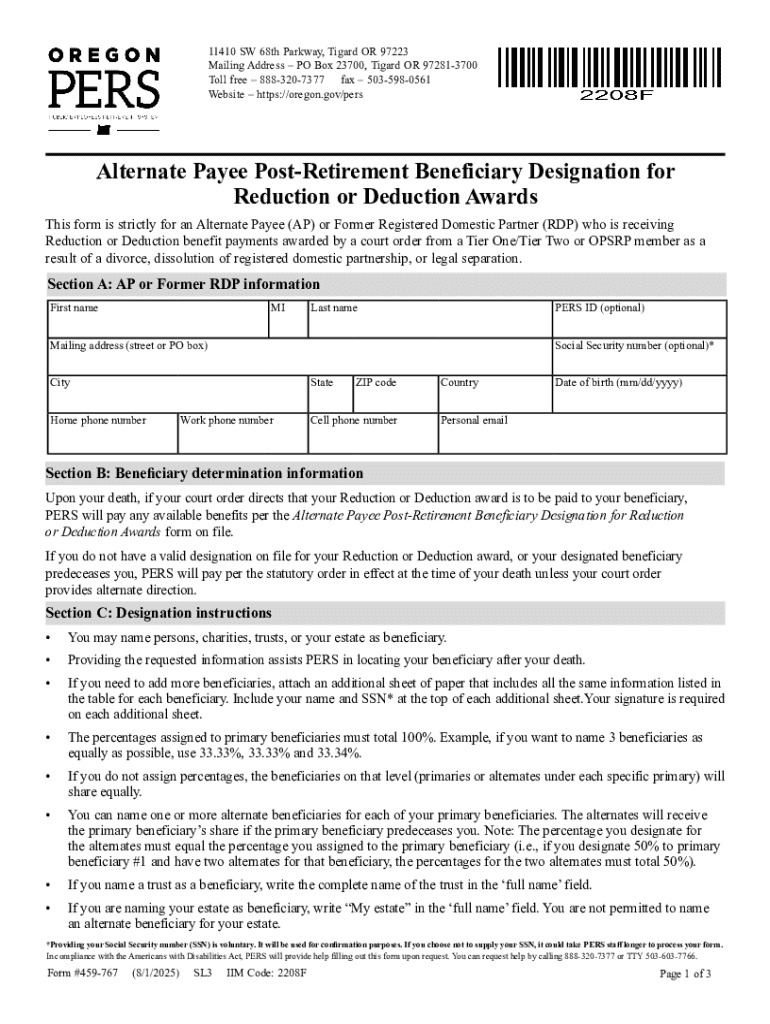

Understanding the Alternate Payee Post-Retirement Beneficiary Form

Understanding the alternate payee post-retirement beneficiary form

The alternate payee post-retirement beneficiary form is crucial for managing how retirement benefits are distributed post-retirement. This form allows retirees to designate alternative beneficiaries who will receive benefits in the event of their passing. Its purpose lies in ensuring that the retiree's intentions regarding their benefits are honored and that their loved ones are provided for, in accordance with their wishes.

Designating beneficiaries after retirement is vital, as life circumstances change. With the potential for health-related issues or unexpected changes in familial relationships, ensuring the right person is listed can prevent conflicts and emotional distress later on.

Key considerations before completing the form

Before filling out the alternate payee post-retirement beneficiary form, certain key considerations must be addressed. Understanding the eligibility criteria for alternate payees is fundamental. Typically, alternate payees may include current spouses, ex-spouses, children, or dependent individuals, but specifics can vary by retirement plan.

Retirement plans often determine alternate payees based on the legal stipulations outlined in the initial retirement documents. Common reasons for designating an alternate payee often include changes in marital status, children reaching adulthood, or simply reconsidering who should be the beneficiary due to shifts in relationships or financial needs.

Navigating the alternate payee post-retirement beneficiary form

The alternate payee post-retirement beneficiary form typically consists of various sections designed to gather essential information. First, you will encounter personal information fields for the retiree, followed by sections aimed at detailing the beneficiaries being designated. Understanding key terms within the form—like 'alternate payee' and 'primary beneficiary'—is vital for correctly completing the document.

To obtain the form, you can typically find it on your retirement plan's website or request it from HR. It often comes in a PDF format for convenience. Instructions provided will guide you through filling it out correctly, be sure to follow them carefully to avoid delays.

Step-by-step guide to filling out the form

Step 1: Personal information entry

Begin by providing your name and address. These details should match what is recorded in the retirement plan to mitigate potential discrepancies. This ensures the retirement plan can accurately identify you.

The ETF member ID is also critical; it serves as a unique identifier for your account. This ensures your benefits are processed swiftly and accurately, preventing administrative errors that could delay processing.

Step 2: Designating beneficiaries

Designating beneficiaries involves specifying who will receive benefits after your passing. You can categorize beneficiaries as either primary or alternate. When listing, be clear about the relationship of each beneficiary to you—this includes spouses, children, or other dependents.

Step 3: IRS codes and implications

Review relevant IRS codes that may apply to your situation. Understanding tax implications is essential, especially if your beneficiaries are withdrawn from a tax-advantaged account. Make sure to familiarize yourself with how this may affect the tax responsibilities of those you designate.

Step 4: Providing required documentation

You will likely need to submit documentation alongside the form, such as marriage certificates, divorce decrees, or proof of dependency for additional beneficiaries. Ensure these are secure and meet any specific requirements your retirement plan has outlined for submission.

Common challenges and questions

Filling out the alternate payee post-retirement beneficiary form can lead to common issues, from misinterpretation of terms to missing information. Troubleshooting often involves double-checking each section for accuracy and completing all required fields to avoid delays in processing.

Frequently asked questions often center around the distinction between primary and alternate beneficiaries, as well as how to handle complex family situations such as blended families. Consult specialized resources to clarify any confusions or regulations applicable to your individual circumstance.

Post-submission: What to expect

Once your alternate payee post-retirement beneficiary form is submitted, it undergoes processing, which can take several weeks. You can typically check the status of your application by contacting your retirement plan's customer service directly or through their online portal.

After approval, you will receive confirmation of your designated beneficiaries. If the form is rejected, you will be informed about the reasons and can rectify any issues that led to the rejection, allowing for swift resubmission.

Maintaining and updating beneficiary designations

It’s important to review and potentially update your beneficiary designations regularly. Changes in marital status, the birth of children, or the death of a beneficiary are all crucial triggers for updates. Regular reviews ensure your wishes align with your current circumstances.

To modify an existing designation, a new alternate payee post-retirement beneficiary form must typically be completed and submitted. Documenting changes keeps clear records and makes it easier for your beneficiaries to claim benefits after your passing.

Interactive tools and resources

For ease of access, you can utilize fillable PDF templates on pdfFiller for the alternate payee post-retirement beneficiary form. These templates allow for easy editing and include interactive elements designed to streamline the completion process.

Additionally, pdfFiller offers eSignature options and collaborative features that facilitate efficient document management. This makes it easy for you to edit, sign, and manage documents from anywhere.

Tips for seamless document management post-retirement

Managing retirement documents effectively is crucial for peace of mind. Best practices include storing them securely and backing up digital copies in cloud services. Regular audits of your document collection can help ensure nothing is overlooked.

Leveraging pdfFiller can enhance your overall document organization, allowing for efficient searching and editing. It’s a comprehensive solution for document creation, management, and compliance, ensuring your post-retirement affairs are orderly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit alternate payee post-retirement beneficiary from Google Drive?

How do I make changes in alternate payee post-retirement beneficiary?

How do I fill out the alternate payee post-retirement beneficiary form on my smartphone?

What is alternate payee post-retirement beneficiary?

Who is required to file alternate payee post-retirement beneficiary?

How to fill out alternate payee post-retirement beneficiary?

What is the purpose of alternate payee post-retirement beneficiary?

What information must be reported on alternate payee post-retirement beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.