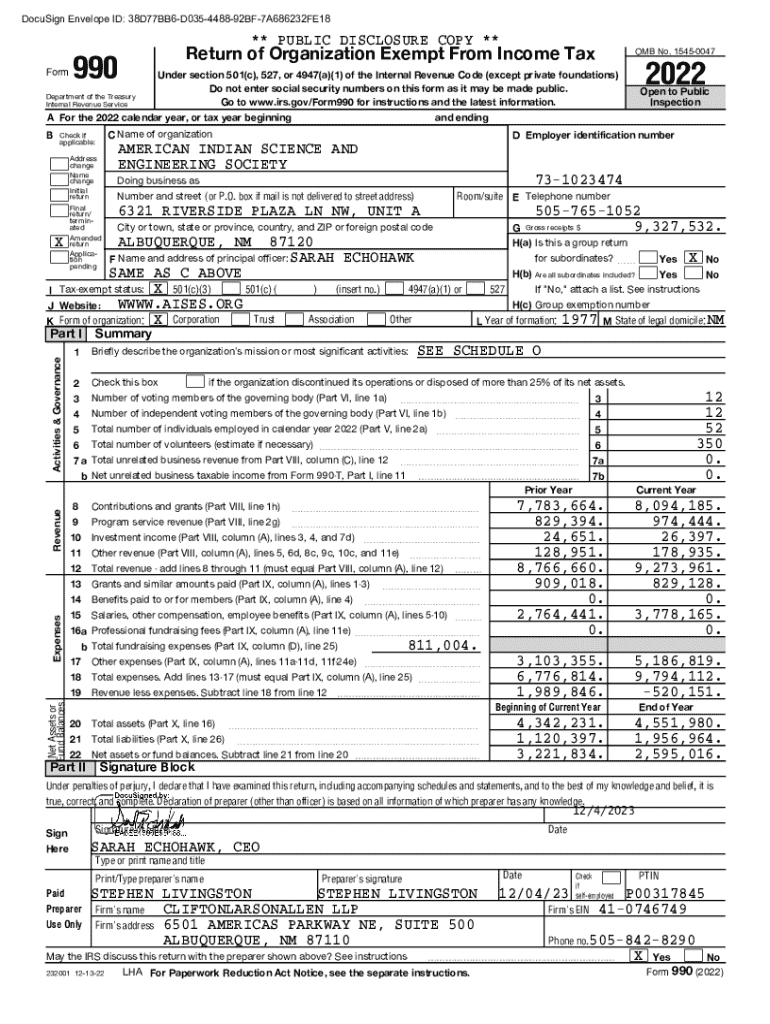

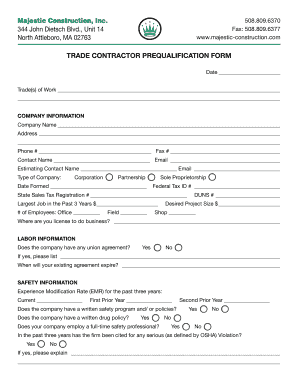

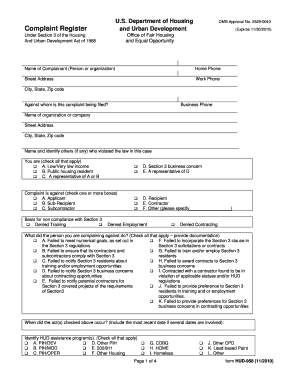

Get the free Form 990 (2022)

Get, Create, Make and Sign form 990 2022

Editing form 990 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 2022

How to fill out form 990 2022

Who needs form 990 2022?

Form form: A Comprehensive How-to Guide

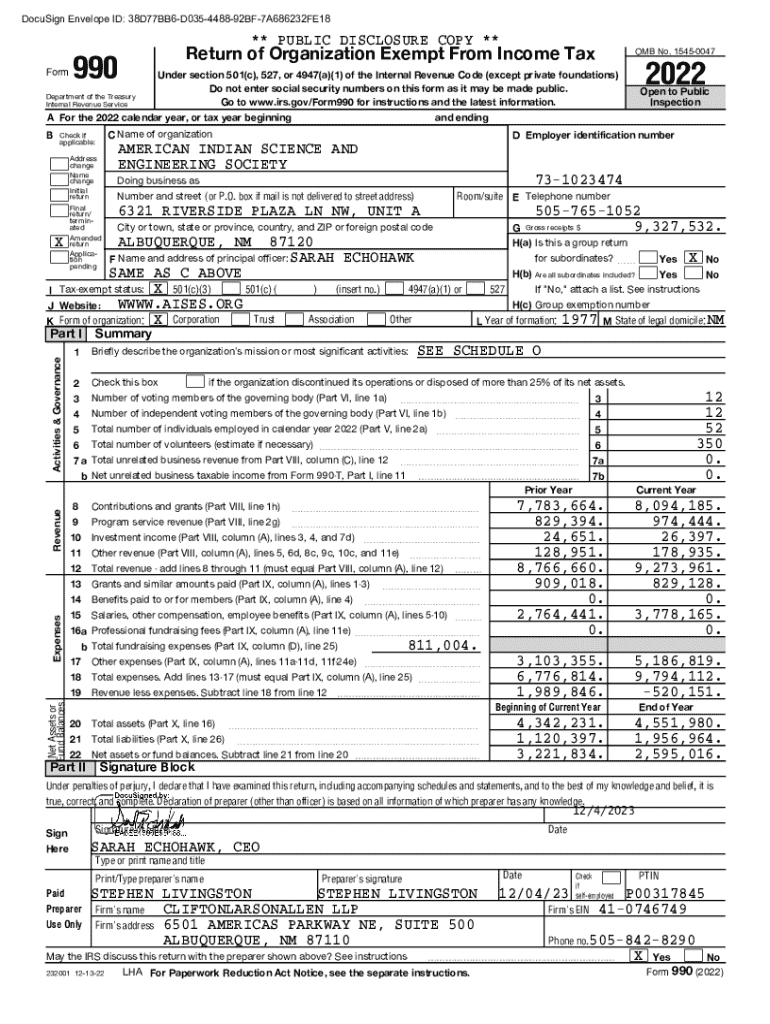

Understanding Form 990

Form 990 is a critical document for nonprofit organizations in the United States, acting as a public disclosure form that provides transparency on the financial activities and governance of these entities. Its primary purpose is to inform the IRS and the public about a nonprofit's mission, governance, and financials. The information disclosed is used by potential donors, grant-making entities, and the public to evaluate organizations' performances and compliance with regulations.

Filing Form 990 is essential for tax compliance, as it helps nonprofits maintain their tax-exempt status. Transparent financial reporting fosters trust with stakeholders and encourages potential contributions, allowing nonprofits to sustain their operations and pursue their missions effectively.

Who is required to file Form 990?

Nonprofit organizations with annual gross receipts that exceed $200,000, or total assets over $500,000, are generally required to file Form 990. However, smaller organizations may qualify to file the simpler Form 990-EZ or Form 990-N, depending on their revenue and assets. It’s essential to understand the specific filing requirements relevant to the type of nonprofit entity, which can range from public charities to private foundations.

Key components of the 2022 Form 990

The 2022 version of Form 990 introduces several enhancements and clarifications to aid nonprofits in reporting their financial information accurately. The form is divided into 12 parts, each focused on different aspects of an organization's activities. For instance, Part I provides a summary, while Part II focuses on programming accomplishments.

In addition to the core parts of the form, nonprofits must also pay attention to the various schedules that provide further detail, such as Schedule A, which addresses public charity status and public support, and Schedule B, which details contributions from major donors. It’s crucial to familiarize oneself with the entire form and identify what applies specifically to your organization.

Step-by-step instructions for completing Form 990

Completing Form 990 requires careful preparation and accurate data entry. Start by gathering the necessary documents, such as your financial statements, previous tax returns, and any supporting documentation related to program services and expenditures.

Once you have your documents in order, you can proceed to fill out each section methodically. Here’s how to approach completing specific parts of the form.

Part : Summary

This section provides a high-level overview of your organization’s financial performance. Present key figures such as revenue, expenses, and net assets in a clear and concise manner. Be diligent in cross-referencing these figures with the supporting documents you’ve gathered.

Part : Statement of Program Service Accomplishments

Here, describe how your organization’s programs have impacted the community. Focus on quantitative results where possible, as well as qualitative achievements. Make it engaging by using narrative to tell the story of your organization's mission in action.

Part : Functional Expenses

This part details your organization’s expenditures, categorized into program services, management, and fundraising. Accuracy is key here, as misreporting can lead to questioning of financial integrity.

Tools for completing Form 990

Utilizing tools such as pdfFiller can significantly enhance your experience when completing the Form 990. This platform offers features including easy PDF editing and collaboration, which allows multiple stakeholders to review and make changes as needed.

As a cloud-based document management solution, pdfFiller enables seamless access from anywhere, which is particularly useful for organizations with distributed teams. The templates available within the tool can streamline the process, ensuring that no critical sections are missed.

Navigating changes in 2022 Form 990

The 2022 Form 990 includes new requirements and questions not found in previous versions. Awareness of these changes is vital for accurate filing. For instance, the form may ask for additional details about revenue sources, specifically donations, and grants.

To prepare for filing, review previous submissions and update your systems accordingly. This process may involve training staff or revising existing internal documentation to align with the new format.

Common mistakes to avoid when filing Form 990

Filing Form 990 can be complicated, and errors can lead to ramifications for your organization. Common mistakes include misreported figures, failing to include required schedules, and underreporting revenue or expenses.

To enhance accuracy, it’s advisable to conduct a thorough review before submission. Engaging multiple team members in the review process can help catch discrepancies that can often go unnoticed.

eSigning and submitting your Form 990

To sign Form 990 electronically, you will utilize the eSignature functionality provided by platforms like pdfFiller. This method not only enhances the security of your submission but also streamlines the process, allowing for quick approval and submission.

After eSigning, it’s crucial to follow the IRS procedures for electronic filing. Ensuring compliance with all requirements will facilitate a smooth submission, potentially avoiding common filing issues.

Post-filing: How to manage your Form 990 documentation

Proper documentation management after filing is essential for future evaluations and compliance reviews. Organize and store your Form 990 and its supporting documents in a safe, easily accessible location.

Maintaining a digital copy in pdfFiller or a similar platform allows for easy retrieval when preparing for future filings. Being proactive can greatly enhance your efficiency when the next filing deadline approaches.

FAQs about Form 990

Addressing common concerns about Form 990 can alleviate stress associated with filing. Key questions include understanding filing deadlines, required attachments, and how to amend a filed form if needed. Many nonprofits also inquire about the consequences of late submissions or inaccuracies.

Fortunately, resources are available through the IRS and platforms like pdfFiller that can guide you through the filing process, providing clarity on regulations and compliance necessities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 2022 to be eSigned by others?

How do I edit form 990 2022 in Chrome?

Can I edit form 990 2022 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.