Get the free Crs Self-certification Form for Entities

Get, Create, Make and Sign crs self-certification form for

How to edit crs self-certification form for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self-certification form for

How to fill out crs self-certification form for

Who needs crs self-certification form for?

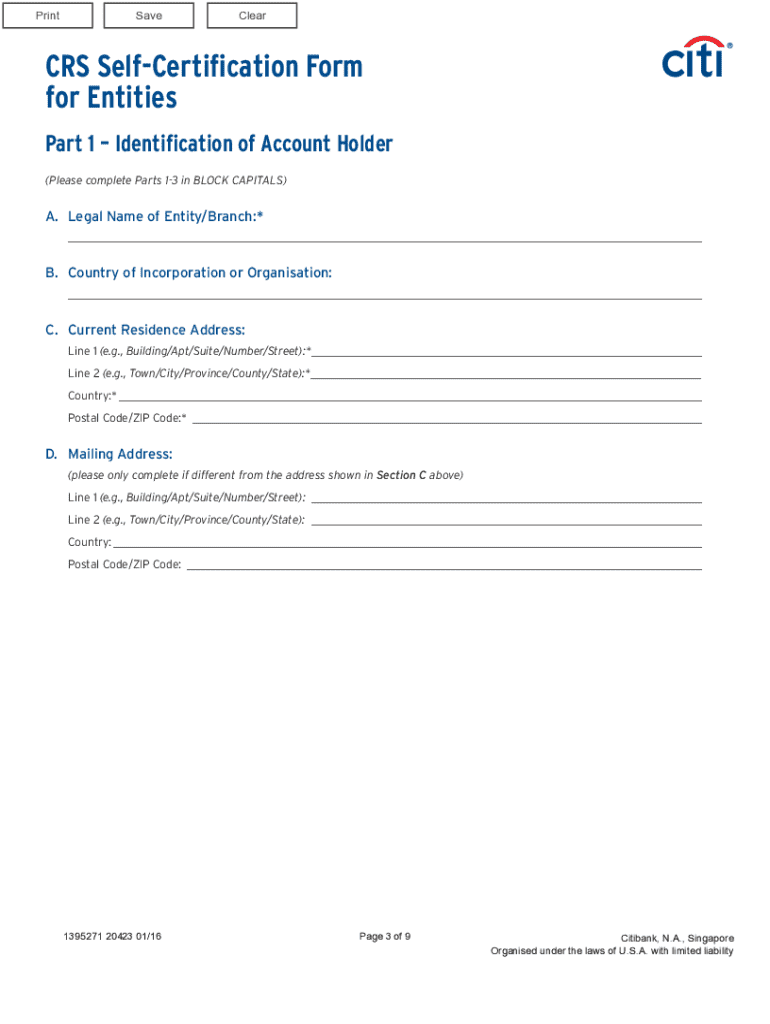

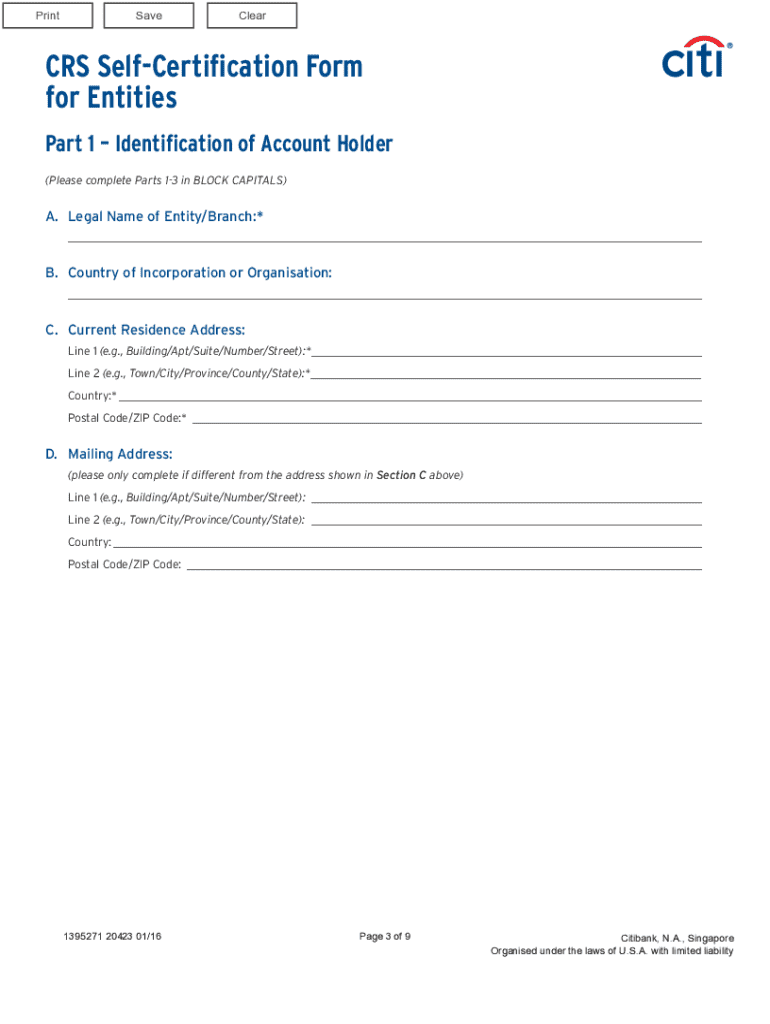

Understanding the CRS Self-Certification Form

Understanding the CRS self-certification form

The Common Reporting Standard (CRS) is an international standard aimed at combating tax evasion and fostering transparency in the global financial system. Developed by the Organisation for Economic Co-operation and Development (OECD), the CRS facilitates automatic exchange of financial account information between countries. This enables tax authorities to track assets held overseas, dramatically increasing the ability to enforce tax compliance. A critical element of this framework is the CRS self-certification form, which serves as a declaration of an individual's or entity's tax residency status.

Understanding whether you should complete the CRS self-certification form is vital. Typically, both individuals and entities that are tax residents in a participating country need to fill it out. This form provides essential details to financial institutions, enabling them to report such information to their respective tax authorities accurately.

Key components of the CRS self-certification form

The CRS self-certification form consists of several critical sections that individuals and entities need to complete accurately. Each section serves a distinct purpose and requires specific information.

Step-by-step guide to completing the CRS self-certification form

Completing the CRS self-certification form can be a straightforward process if approached methodically. Here’s a step-by-step guide to ensure you have everything covered.

Frequently asked questions about the CRS self-certification form

Navigating the CRS self-certification form may raise several questions. Here are some common inquiries and their answers to help clarify your obligations.

Leveraging pdfFiller for your CRS self-certification needs

pdfFiller offers an effective solution for managing your CRS self-certification form and supporting documents. With a range of features, it simplifies the often cumbersome process of form completion and signing.

Case studies and user experiences

To illustrate the effectiveness of the CRS self-certification form and how pdfFiller enhances this process, consider some real-life applications and experiences.

Next steps after submission

After submitting your CRS self-certification form, it’s essential to stay informed about the next steps in the process to ensure compliance and ease of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out crs self-certification form for using my mobile device?

How can I fill out crs self-certification form for on an iOS device?

How do I fill out crs self-certification form for on an Android device?

What is crs self-certification form for?

Who is required to file crs self-certification form for?

How to fill out crs self-certification form for?

What is the purpose of crs self-certification form for?

What information must be reported on crs self-certification form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.