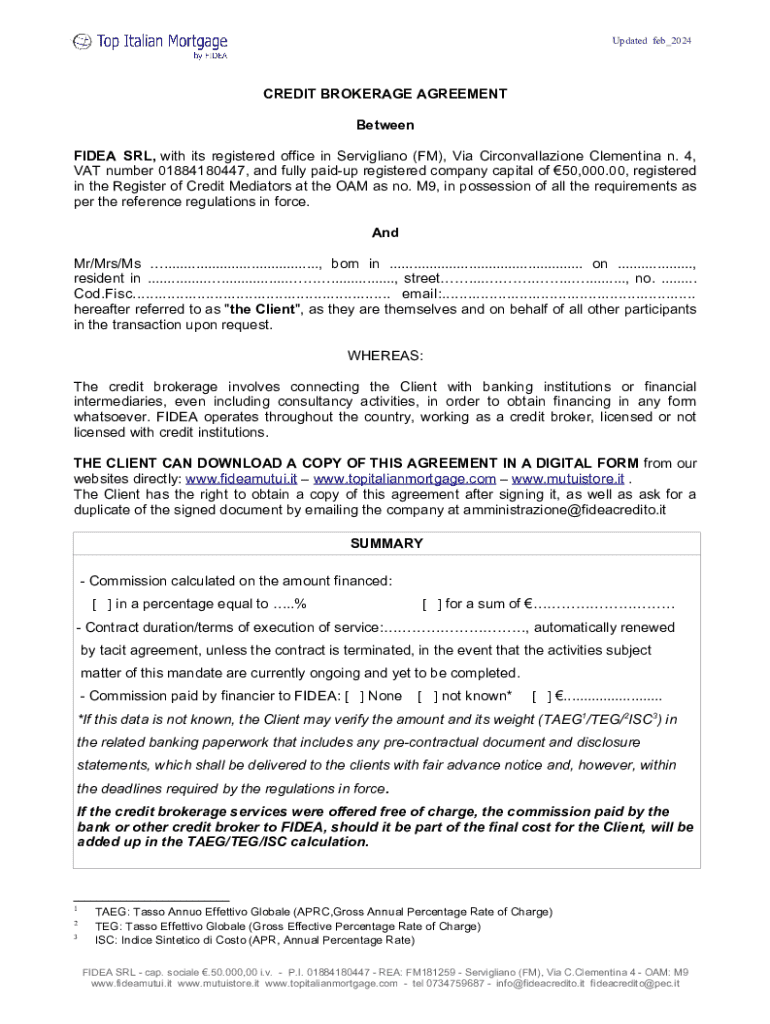

Get the free Credit Brokerage Agreement

Get, Create, Make and Sign credit brokerage agreement

Editing credit brokerage agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit brokerage agreement

How to fill out credit brokerage agreement

Who needs credit brokerage agreement?

A comprehensive guide to the credit brokerage agreement form

Understanding the credit brokerage agreement

A credit brokerage agreement is a crucial document that outlines the relationship and responsibilities between a client seeking credit and the broker facilitating that credit. This agreement serves multiple purposes—it establishes terms that protect both parties and ensures clarity in the broker's role in obtaining financing. Credit brokerage plays a vital role in various financial transactions, acting as the intermediary that connects borrowers with lenders in an often complex financial landscape.

The significance of having a well-drafted credit brokerage agreement cannot be understated. It outlines the expectations of both the broker and the client, stipulating how services will be rendered and what compensations will be due. By detailing responsibilities and legal commitments from the outset, unnecessary disputes can be avoided, making the whole process smoother for both parties.

Key elements of the credit brokerage agreement

When crafting or signing a credit brokerage agreement, several key components must be clearly defined. Firstly, the roles and responsibilities of the broker and the client should be explicit. This includes outlining the broker's obligations to source viable credit options, provide documentation, and assist through the application process, while simultaneously detailing what information and cooperation are expected from the client.

Legal terms and conditions in the agreement typically include clauses that explain the duration of the agreement and provisions for termination. Commonly, agreements will stipulate a fixed term or will remain in effect until the agreed objectives are met. Additionally, financial aspects, such as broker fees or potential commission rates, should also be clearly articulated to avoid any misunderstandings later on.

How to fill out the credit brokerage agreement form

Filling out the credit brokerage agreement form can be made simpler with a structured approach. Start with gathering personal information from both parties involved. This includes names, addresses, contact information, and any relevant identification details. Accuracy here is crucial as it establishes the legitimacy of the agreement.

Next, you will need to specify the credit services required. Depending on the needs of the client, this might include various options like loan sourcing, underwriting assistance, or other financial services. After that, reviewing and confirming the terms is essential. This is the stage where both parties should meticulously check any important clauses, including fees, responsibilities, and duration, before signing.

To facilitate this process, using pdfFiller can significantly enhance your experience. With user-friendly features, pdfFiller allows users to seamlessly fill out forms, ensuring each section is completed accurately. Accessible from anywhere, this platform simplifies managing credit brokerage agreements.

Editing and customizing your agreement

Once the credit brokerage agreement form is filled out, many users find it helpful to customize the document further. Various editing tools available on pdfFiller can assist in tailoring the agreement to meet specific transaction requirements. Features such as adding additional clauses or changing language to better reflect personal terms are readily accessible.

Additionally, collaboration features make editing and refining an agreement easier. By inviting team members or legal advisers to review the document simultaneously, users benefit from real-time input, which can improve the final output of the agreement. Having several eyes on the agreement before finalizing it can help catch issues that individuals might overlook.

Signing the credit brokerage agreement

The signing process has evolved significantly with technology, and electronic signatures have become a standard practice in modern transactions. Utilizing eSignatures for your credit brokerage agreement not only speeds up the process but also maintains a high level of security and legality. pdfFiller ensures that digital signatures are legally binding while providing additional security protocols to protect sensitive information.

To sign the credit brokerage agreement using pdfFiller, simply follow these steps: first, open the completed form on the platform. Then, select the eSignature feature and follow the prompts to create or add your signature. Once ensured that everything is filled in correctly, complete the signing process. This method affords users a swift and legal way to finalize their agreements, no matter where they are located.

Managing your completed agreement

Once the credit brokerage agreement is signed, proper document management is crucial. It’s best practice to save and store agreements securely in a reliable digital format. Digital storage solutions, such as those provided by pdfFiller, are advantageous as they allow for easy organization and retrieval of agreements whenever needed. This feature prevents potential losses and ensures quick access during follow-up with lenders or clients.

Additionally, sharing the completed agreement with relevant third parties, such as lenders or financial partners, should be conducted securely. pdfFiller offers various sharing options ensuring that sensitive information remains confidential while sharing is efficient, allowing for smooth communication between all parties involved.

Common mistakes to avoid

When filling out a credit brokerage agreement, several pitfalls can undermine the effectiveness of the document. Common oversights might include incomplete personal information, vague language regarding services, or failure to outline the full scope of fees. These errors can lead to disputes and misunderstandings later on, which is something every party wants to avoid.

A helpful checklist to utilize before signing includes: ensuring all personal information is accurate, confirming the clarity of terms and conditions, double-checking fee structures, and ensuring both parties have agreed to all clauses mentioned. Setting aside time to review these elements thoroughly can help safeguard against potential issues.

FAQs about credit brokerage agreements

As with any legal document, questions often arise regarding the specifics of credit brokerage agreements. For instance, what should you do if you need to change terms after the agreement is signed? Generally, amendments can be made by both parties if they agree on the new terms; however, it's essential to document any changes formally to remain in compliance with regulations.

Additionally, clients sometimes ask if a credit brokerage agreement can be terminated early. Most agreements include specific termination clauses that detail the process and any consequences of early termination. Lastly, it’s crucial to recognize that credit brokerage agreements differ from other financial contracts, primarily in terms of the focus on broker-client relationships and the details of services rendered.

Case studies and real-world examples

Real-world case studies highlight both the effectiveness and challenges of credit brokerage agreements. For instance, a successful case involved a small business owner who secured favorable terms by utilizing a comprehensive agreement that clearly stated the responsibilities of the broker in sourcing optimal financing options. This detailed approach led to a beneficial outcome for all parties involved.

Conversely, a poorly constructed agreement led to a misunderstanding over fees, resulting in dissatisfaction and a termination of services. Such examples illustrate the importance of being thorough and clear when creating and entering into these agreements. Taking the time to ensure that every clause, term, and role is defined can save unnecessary complications down the line.

Final thoughts on using credit brokerage agreements

Credit brokerage agreements are an indispensable tool for any individual or organization seeking credit. The importance of clarity and legal compliance within these agreements cannot be overstated. Users must be empowered with knowledge to enter into or create these agreements confidently. Utilizing platforms like pdfFiller ensures that the process of filling out, customizing, and managing these agreements is efficient and uncomplicated.

Engaging with this tool not only simplifies document management but also fosters a greater understanding of responsibilities, both for brokers and clients. With the right resources at hand, parties can approach the credit brokerage process informed, ready to secure the best financial outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit brokerage agreement?

How do I edit credit brokerage agreement online?

How do I edit credit brokerage agreement in Chrome?

What is credit brokerage agreement?

Who is required to file credit brokerage agreement?

How to fill out credit brokerage agreement?

What is the purpose of credit brokerage agreement?

What information must be reported on credit brokerage agreement?

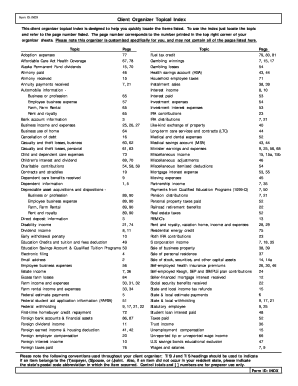

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.