Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 form – A comprehensive how-to guide

Understanding Form 990

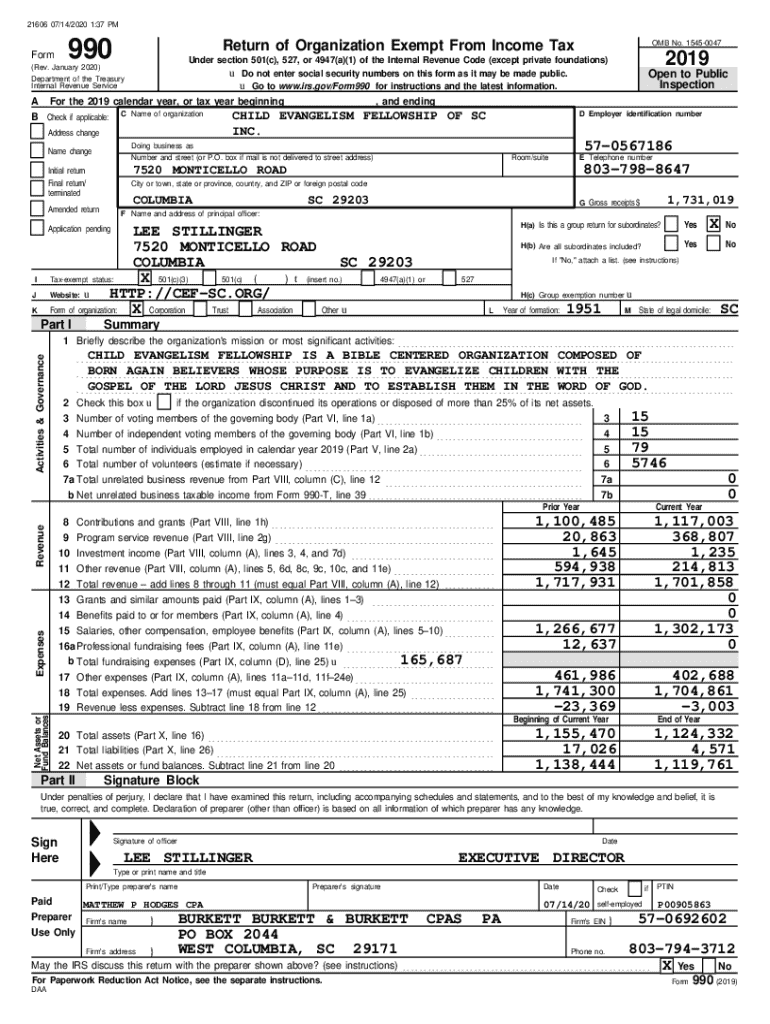

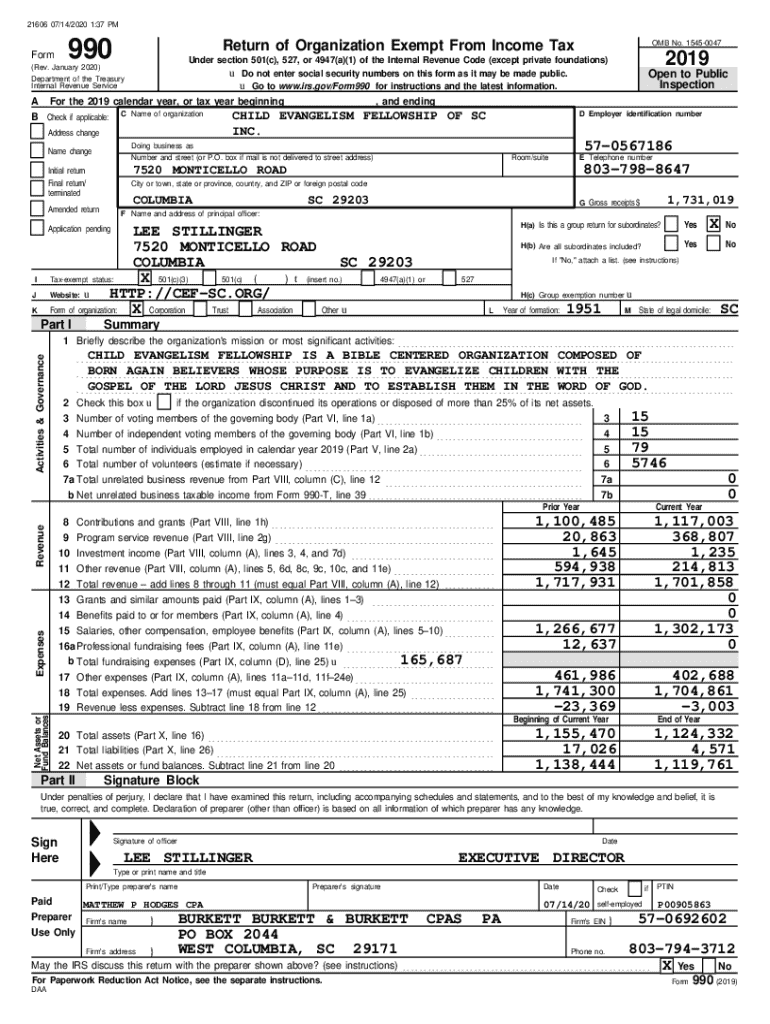

The Form 990 form is the annual information return that tax-exempt organizations in the United States must file with the Internal Revenue Service (IRS). This form serves multiple purposes: it offers the IRS a clear picture of the organization's financial health and reveals to the public how much a nonprofit relies on contributions, government grants, and other revenue types. For anyone involved with a nonprofit organization, understanding the fundamentals of Form 990 is crucial for ensuring legal compliance and maintaining transparency.

This form is not just a tax obligation; it plays a significant role in nonprofit accountability. By requiring disclosure of financial data, governance, and operations, it enables stakeholders, funders, and regulators to evaluate how effectively organizations are operating. The IRS considers Form 990 essential in evaluating tax-exempt status, and its requirements significantly impact nonprofit management.

Types of Form 990

Organizations must select the appropriate version of the Form 990 form based on their specific characteristics. Here are the most common variations:

Choosing the right form is critical. Smaller organizations often benefit from filing the EZ or N forms, while larger organizations need to use the standard 990 to meet IRS standards and maintain their nonprofit status. The right form will depend heavily on the organization's size, revenue, and structure.

Filing requirements for Form 990

Not every tax-exempt organization is required to file the same form. The filing requirement for Form 990 often depends on the organization's size and type. Generally, all nonprofit organizations with gross receipts exceeding $50,000 must file some version of Form 990. However, organizations under this threshold may be exempt, especially if they file Form 990-N.

Options for submitting the form include traditional paper filing or e-filing, which is encouraged by the IRS for quicker processing. It’s crucial to note that an organization may request a six-month extension if necessary.

Step-by-step guide to preparing Form 990

Preparation for Form 990 filing is essential to ensure accuracy and compliance. Start by gathering necessary financial documents, such as balance sheets, income statements, and any other relevant financial records. Collaboration within your organization will foster accountability and facilitate the collection of needed information.

Filling out the Form 990 involves navigating multiple sections, and each serves a unique purpose. Here’s a detailed breakdown of what to expect:

Utilizing pdfFiller for efficient completion is recommended. The platform offers a user-friendly experience for editing and completing Form 990 online, along with features for data entry and eSigning. Its cloud-based design ensures that you're never far from your important documents.

Common pitfalls when filing Form 990

Mistakes during the filing process can have serious consequences. It’s vital to understand the common pitfalls to avoid costly errors. One of the most frequent mistakes is underreporting or overreporting revenue, which can lead to audits or penalties from the IRS. Incorrectly classifying expenses is also a common error; each expense should be documented accurately to reflect its true nature.

Filing errors may attract penalties ranging from financial fines to legal ramifications, including loss of tax-exempt status. Organizations should exercise diligence and review their Form 990 thoroughly to avoid these issues.

Legal and regulatory considerations

Public inspection regulations are critical for maintaining transparency and accountability. Nonprofits are legally obligated to make their most recent Form 990 available for public inspection, which promotes trust with stakeholders, including donors and beneficiaries.

Moreover, understanding state-specific regulations related to Form 990 is important, as some states may have additional requirements regarding nonprofit filings. Nonprofits should stay informed about both federal and state regulations to ensure full compliance.

Analyzing Form 990 for strategic insights

Interpreting the data presented in Form 990 can reveal insights into the organization's financial health and operational effectiveness. Key indicators can help assess the scalability of programs and the overall sustainability of the organization. By analyzing the financial data, nonprofits can identify potential areas for growth, efficiency improvements, or program modifications.

Moreover, Form 990 data can play a crucial role in supporting fundraising and grant applications. Funders frequently review these forms to determine the viability and accountability of potential grantees. Leveraging the information effectively can significantly enhance the likelihood of securing funding.

Resources for assistance in filing Form 990

Organizations considering hiring a nonprofit tax professional should look for signs indicating that external expertise may be required. This includes complexities in financial structures, past filing issues, or simply needing peace of mind during the filing process.

There’s great benefit in professional assistance, as it can simplify the complexity related to tax filings significantly and help in the strategic positioning of the organization.

Historical context and future trends

The evolution of Form 990 reflects a broader trend in increasing transparency and accountability within the nonprofit sector. Changes over the years have introduced additional reporting requirements, encouraging organizations to adopt more rigorous reporting practices. This evolution has been driven by increasing scrutiny from both the public and regulatory bodies.

Understanding these trends helps nonprofits prepare for adjustments in their reporting practices and remains proactive. Staying informed and adaptable will ensure that your organization stays compliant and competitive.

Best practices for managing Form 990 documentation

Effective record-keeping throughout the year not only simplifies the filing of Form 990 but also enhances accountability within the organization. Establishing a systematic process for maintaining records will pay off during the busy tax season.

Similar to these practices, creating a checklist for annual preparation can streamline the process. This checklist can include the following:

Regular practice of these best practices will enhance overall organizational efficiency during the filing period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I edit form 990 straight from my smartphone?

How do I fill out form 990 using my mobile device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.