Get the free United States Bankruptcy Court Document

Get, Create, Make and Sign united states bankruptcy court

Editing united states bankruptcy court online

Uncompromising security for your PDF editing and eSignature needs

How to fill out united states bankruptcy court

How to fill out united states bankruptcy court

Who needs united states bankruptcy court?

United States Bankruptcy Court Forms: A Comprehensive Guide

Overview of bankruptcy court forms

Bankruptcy court forms are essential legal documents that individuals or businesses must complete when filing for bankruptcy in the United States. These forms effectively serve as an application to the bankruptcy court, outlining the petitioner's financial status, assets, liabilities, and overall situation. They play a crucial role in determining eligibility and the appropriate bankruptcy chapter under which the filer may seek relief.

Choosing the correct form is vital; using an inappropriate form can lead to delays or even dismissal of the bankruptcy case. Given the complexities of bankruptcy law, understanding the various types of cases and their respective forms is necessary for successful filing, ensuring that all required information is accurately disclosed.

Understanding the different types of bankruptcy

Bankruptcy in the United States is primarily classified into three main chapters, each with distinct processes and requirements. Understanding these distinctions helps individuals and businesses determine which form to use based on their unique circumstances.

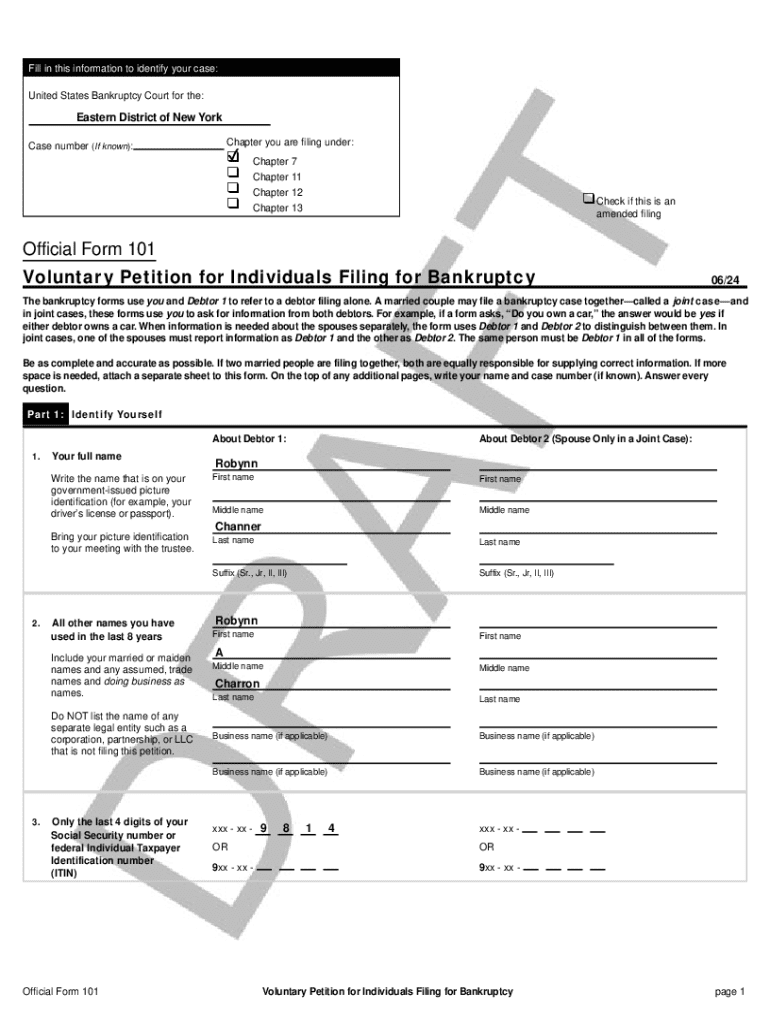

Chapter 7 bankruptcy is a liquidation process where assets are sold to pay off debts. It typically requires completing forms that detail the debtor's financial situation, and eligibility is often determined by a means test. In contrast, Chapter 11 involves reorganization, allowing businesses to restructure their debts while continuing operations, necessitating comprehensive forms that must be approved by creditors and the court. Lastly, Chapter 13 involves setting up a repayment plan for individuals to pay back debts over time, requiring forms that outline the debtor’s income and proposed repayment strategy.

Essential United States bankruptcy court forms

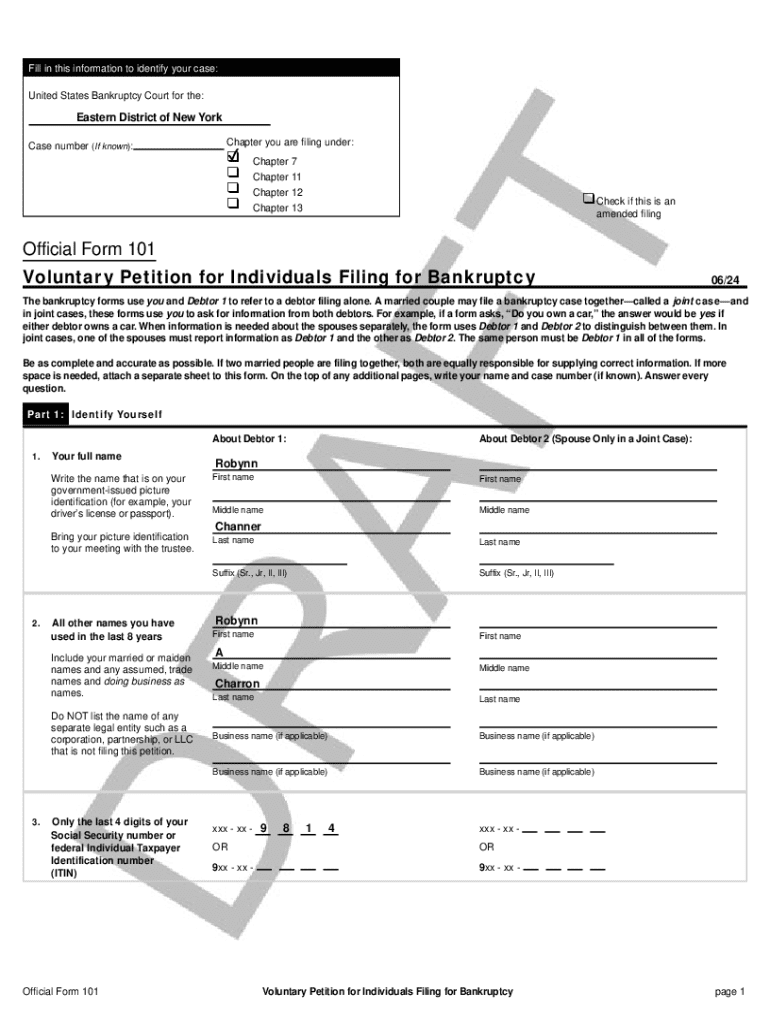

The most crucial forms within the United States Bankruptcy Court system facilitate the declaration and processing of bankruptcy cases. Among these, Official Form 101, the Voluntary Petition for Individuals Filing for Bankruptcy, is fundamental as it initiates the process. Additionally, Official Form 206 outlines the Schedules of Assets and Liabilities, providing an intricate view of the debtor’s financial landscape. Lastly, Official Form 410, the Proof of Claim, is necessary for creditors to assert their right to payment during the bankruptcy proceedings.

Accessing these forms is made easy through the United States Courts website, where filers can find federal forms applicable in all states. Some states may have unique variations or additional forms specific to local jurisdiction rules, which should also be taken into consideration during the filing process.

Step-by-step instructions for filling out bankruptcy forms

Filling out bankruptcy forms requires careful preparation, particularly in gathering personal financial information. Start by collecting necessary financial documents, including bank statements, pay stubs, tax returns, and a list of debts. This comprehensive approach ensures no relevant information is omitted, helping provide an accurate depiction of your financial status.

When filling out forms, it's critical to follow each step methodically. Pay particular attention to precision in income reporting, asset descriptions, and the accurate listing of liabilities. Common mistakes include misreporting income, failing to detail all debts, and omitting relevant income sources. Double-checking your forms helps prevent any errors that could lead to complications.

How to submit bankruptcy forms

Once completed, submitting your bankruptcy forms is the next critical step. Filers can choose between electronic filing (e-filing) or traditional paper filing. E-filing often provides quicker processing and confirmation while allowing for greater efficiency. Regardless of the method, timeliness is essential; missing deadlines can complicate the case or lead to dismissal.

After filing, expect to receive information from the court regarding your case and any necessary follow-up actions. Being organized and ready to respond promptly can significantly impact the outcome of your bankruptcy case.

Editing and managing your bankruptcy documents

Managing bankruptcy documents can be daunting, but tools like pdfFiller provide convenient solutions for editing, signing, and collaborating on documents. By uploading bankruptcy forms to pdfFiller, users can edit entries easily, ensuring all information is current and accurate.

The platform affords features such as adding electronic signatures, which can save time and hassle when processing forms. Moreover, the collaboration capabilities allow users to share documents with co-counsel or financial advisors, streamlining the input and review processes while ensuring comprehensive preparation.

Frequently asked questions about bankruptcy forms

Many individuals have questions about the bankruptcy filing process and the use of forms. Common inquiries typically revolve around the types of bankruptcy forms to use, how to obtain them, and what to do in case of filing issues. It’s crucial for filers to understand that assistance is available, whether through legal counsel or educational resources tailored to demystify the process.

If issues arise during filing, troubleshooting can often involve checking for completed information, ensuring all attachments are included, or verifying electronic submission procedures. Utilizing legal aid or bankruptcy law clinics can provide additional support in navigating these complexities.

Interactive tools and resources

Many online resources enhance understanding and managing bankruptcy forms. Interactive calculators can assist individuals in budgeting for repayment plans or determining eligibility for various bankruptcy chapters. Video tutorials can serve as excellent guides for completing specific forms, offering visual demonstrations to simplify the process.

Additionally, bankruptcy law clinics and workshops can provide invaluable face-to-face learning experiences, offering personalized guidance for hopeful filers. These resources contribute significantly to demystifying the bankruptcy process and ensuring that filers are well-prepared.

Staying informed: news and announcements in bankruptcy law

The landscape of bankruptcy regulations is continually evolving. Staying informed about recent changes is critical for both filers and attorneys. Monitoring reputable legal news sources can help individuals and teams understand implications of new regulations or procedures for filing.

Participating in workshops and community events not only fosters knowledge but also cultivates connections with professionals in the field. Keeping abreast of such developments can empower filers to navigate their bankruptcy processes with increased confidence and understanding.

Additional support for bankruptcy filers

There are numerous resources available for individuals seeking assistance with bankruptcy filings. Local legal aid organizations can provide invaluable support, especially for low-income individuals requiring help navigating legal complexities. Also, understanding alternative resources outside of the main bankruptcy forms, such as possible loan modification applications or financial counseling resources, can bolster one’s ability to manage debt effectively.

Inquiries can often be directed to local court assistance desks that provide basic guidance on filling out forms and filing procedures. Such resources ensure that filers are not navigating this challenging process alone and have access to pertinent assistance when needed.

User feedback mechanisms

Creating a feedback loop among bankruptcy form users can greatly contribute to improving resources and tools. Opportunities for users to share their experiences with forms and the filing process can enhance community understanding and provide insights into common challenges faced during these processes.

User review sections for various supportive tools and resources also allow individuals to engage with communities, ensuring shared experiences can better inform others. Building a supportive network through ratings and feedback can create a beneficial ecosystem for all stakeholders involved in the bankruptcy process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find united states bankruptcy court?

Can I edit united states bankruptcy court on an iOS device?

How can I fill out united states bankruptcy court on an iOS device?

What is united states bankruptcy court?

Who is required to file united states bankruptcy court?

How to fill out united states bankruptcy court?

What is the purpose of united states bankruptcy court?

What information must be reported on united states bankruptcy court?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.