Get the free Form 5500

Get, Create, Make and Sign form 5500

How to edit form 5500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500

How to fill out form 5500

Who needs form 5500?

A Comprehensive Guide to Filling Out Form 5500

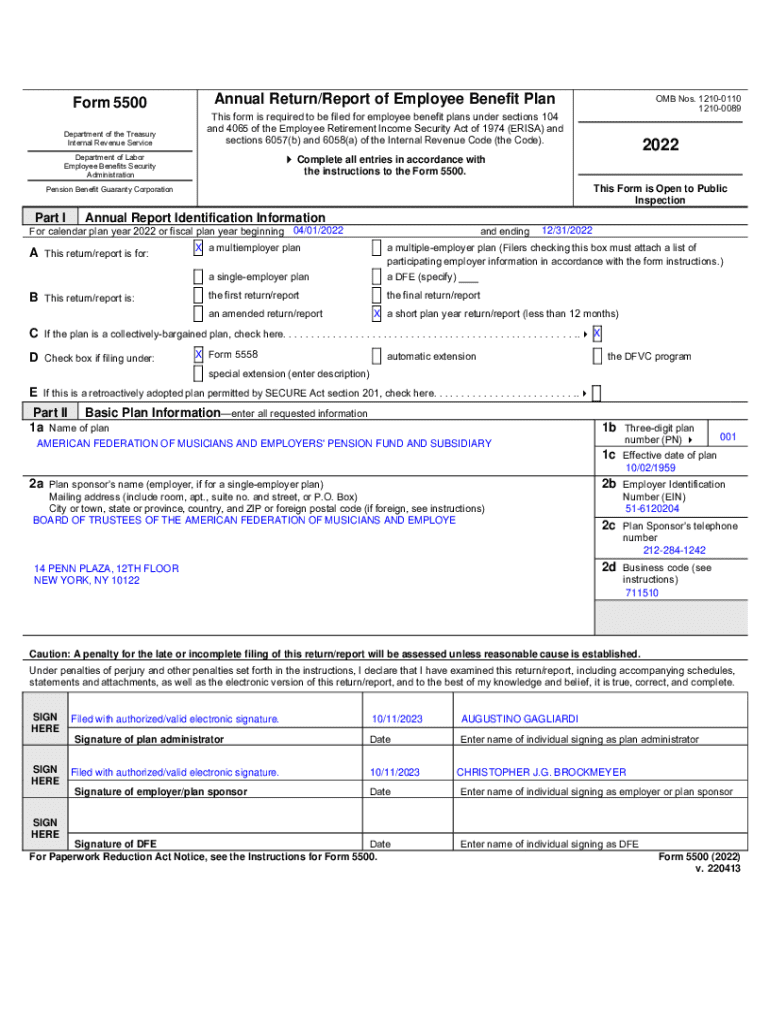

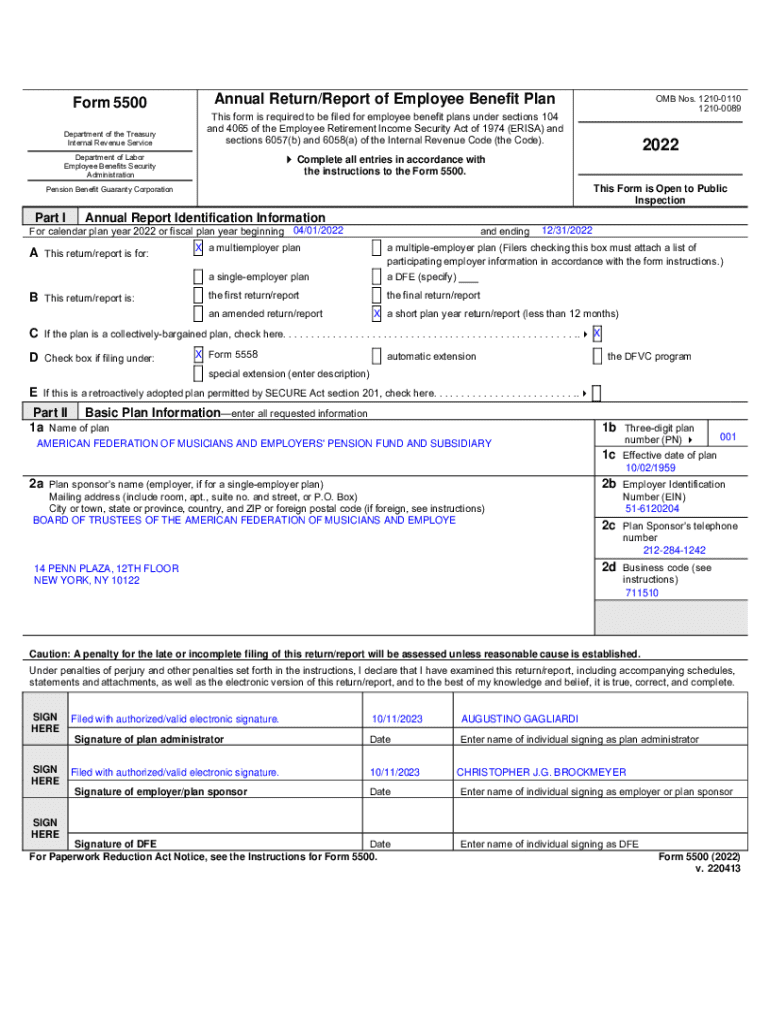

Understanding Form 5500

Form 5500 is a critical document that must be filed annually by certain employee benefit plans under the Employee Retirement Income Security Act (ERISA). Designed to provide transparency, this form is essential for both the Department of Labor (DOL) and the Internal Revenue Service (IRS) to monitor compliance and ensure that plans are operating in the interests of plan participants.

The main purpose of Form 5500 is to collect financial information about the employee benefit plans along with details regarding plan governance, operations, and participant data. This information formulates an essential database used for reporting and compliance checks, ensuring that the rights of employees are safeguarded.

Who needs to file Form 5500?

Certain businesses and plan sponsors are required to submit Form 5500 depending on the type of employee benefit plans they offer. These include defined benefit plans, defined contribution plans, and health and welfare plans, among others. Generally, employers with a minimum of 100 participants must file this form annually.

Exemptions exist for some small plans, including those with fewer than 100 participants during the plan year, or for plans that are fully insured. Furthermore, specific governmental and church plans are not required to file Form 5500. Determining whether your plan is subject to these regulations is crucial to avoid potential penalties.

Types of Form 5500

Form 5500 has several variations tailored to different types of plans. The standard Form 5500 is used by most plans with 100 or more participants. Meanwhile, Form 5500-SF (Short Form) is intended for small plans that meet certain criteria, particularly those with fewer than 100 participants and that are not subject to an audit. Lastly, Form 5500-EZ is specifically designed for one-participant plans, making it suitable for sole proprietorships or single-owner LLCs.

Selecting the appropriate version of Form 5500 is vital because it determines the level of detail required, as well as the filing process. Understanding the specific criteria and eligibility for each type can simplify the filing and reduce the chance of errors.

Key components of Form 5500

When filling out Form 5500, certain essential components must be included to comply with regulatory requirements. Basic information about the plan, such as its name, type, and identification number, is crucial. Financial statements that elucidate the plan's fiscal health also need to be collected and accurately reported.

Furthermore, participant counts, particularly the number of active and retired members, must be detailed. Accurate data entry is paramount, as inaccuracies can lead to penalties and potential compliance issues. Utilizing tools for accuracy checks and validating data before submission is highly advisable.

Form 5500 filing requirements

Filing Form 5500 is subject to specific requirements that dictate how and when it should be submitted. Most importantly, electronic filing (e-filing) is mandated through the DOL’s EFAST2 system, with paper submissions not typically accepted anymore. Alongside the main form, various schedules and attachments may be needed, depending on the type of plan and its specific characteristics.

Timelines are also critical; the Form 5500 is typically due on the last day of the seventh month after the plan year ends, allowing for extensions in some cases. Knowing these deadlines and the necessary procedures for extensions can help prevent late filings and the associated penalties.

Preparing to file Form 5500

Preparing to file Form 5500 involves thorough collection and validation of necessary information. Start by compiling participant data, financial statements, and any required schedules. Create a checklist to ensure that no detail is overlooked, as every component is vital for compliance.

Furthermore, utilizing tools and resources such as PDF software and cloud-based platforms like pdfFiller can streamline the preparation process. These tools offer templates and digital solutions for forms, aiding in collaboration among team members. Ensuring that everyone responsible for compiling the information is aligned can also mitigate miscommunications and mistakes in the final filing.

The filing process

Filing Form 5500 can be navigated effectively by understanding the requirements and the filing system. Create a Department of Labor (DOL) account to access EFAST2 for online submission. The filing process includes carefully entering the information, attaching the required schedules, and validating data to minimize errors.

Before finalizing the submission, proofreading the completed form is crucial. Look for inconsistencies or errors that could lead to penalties or disqualifications. Take your time to check the numbers, especially in financial statements, and ensure that all necessary documentation is in order.

Common mistakes in Form 5500 filings

Common errors in Form 5500 filings can lead to significant penalties and operational issues. A frequent mistake is inaccurately reporting participant counts, such as stating 'zero' when there are participants. This simple oversight can trigger compliance warnings.

Additionally, failing to include required schedules and attachments is a critical error that can invalidate the filing. Late submissions due to mismanagement of deadlines can also lead to penalties. Being aware of these common errors and implementing checks throughout the filing process will help mitigate risks.

Delinquent filing and correction options

If you miss the Form 5500 filing deadline, immediate action is essential. To mitigate penalties, you can file a delinquent Form 5500. Many plans qualify for the Delinquent Filer Voluntary Compliance Program (DFVCP), which allows plans to catch up on missed filings at reduced fees and penalties.

Understanding the steps to correct filings should also be a part of the process. If inaccuracies are identified post-submission, filing an amended Form 5500 can rectify these issues and help maintain regulatory compliance.

After submission: Next steps

After submitting Form 5500, monitoring the status of your submission is crucial to ensure compliance. Tracking confirmation of submission through your DOL account can provide peace of mind, knowing that the filing is processed. If errors arise or corrections need to be made, utilize the option to amend your submission appropriately.

Communicating with plan participants about the filing status and any relevant updates regarding their benefits is also vital. Keep transparency at the forefront to ensure participants are informed and confident in their benefit plan management.

Important considerations

When dealing with Form 5500, certain considerations can affect your compliance and reporting. One aspect often overlooked is whether a fidelity bond is required for your plan, dependent on its characteristics. Compliance checks and potential audits can also occur, emphasizing the need for meticulous record-keeping throughout the year.

Moreover, it’s essential to understand that Form 5500 filings are publicly accessible, raising the importance of accurate and truthful reporting. Planning adequately for future compliance needs will help maintain the integrity of your employee benefit plans.

Frequently asked questions

Individuals often have numerous queries surrounding filing Form 5500. For instance, many wonder about the specific employee benefit plans that require this form. Generally, defined benefit and defined contribution plans are included, but health and welfare plans may also be subject to disclosure requirements.

If a business offers multiple plans, a separate Form 5500 must typically be filed for each plan. Furthermore, understanding penalties for late filings and common errors that may surface during the filing process is essential for maintaining compliance.

Utilizing innovative document solutions

Utilizing a platform like pdfFiller can significantly enhance the Form 5500 filing experience. With easy editing capabilities for PDFs, users can fill out forms quickly and ensure all necessary components are included. eSignature capabilities allow for a seamless signing process, which is crucial for compliance.

Additionally, pdfFiller’s cloud-based access facilitates collaboration among teams, allowing multiple individuals to contribute and validate data efficiently. Leveraging these features can streamline the filing process, reduce errors, and ensure that plans comply with regulations.

Related topics to explore

Exploring related topics can help deepen understanding of Form 5500 and its implications for employee benefit plans. For instance, an understanding of the Employee Retirement Income Security Act (ERISA) and its impact on plan requirements is vital for compliance. Evaluations of employee benefits and comparison of plan quality can also provide insights into optimizing benefit offerings.

Finally, keeping abreast of any upcoming changes to filing regulations and requirements can ensure future compliance and strategic planning. By integrating this knowledge, businesses can optimize their approach to benefit plan management while meeting all necessary requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 5500 online?

Can I sign the form 5500 electronically in Chrome?

Can I create an electronic signature for signing my form 5500 in Gmail?

What is form 5500?

Who is required to file form 5500?

How to fill out form 5500?

What is the purpose of form 5500?

What information must be reported on form 5500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.