Get the free New Hire Payroll Set-up Package Instructions

Get, Create, Make and Sign new hire payroll set-up

Editing new hire payroll set-up online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new hire payroll set-up

How to fill out new hire payroll set-up

Who needs new hire payroll set-up?

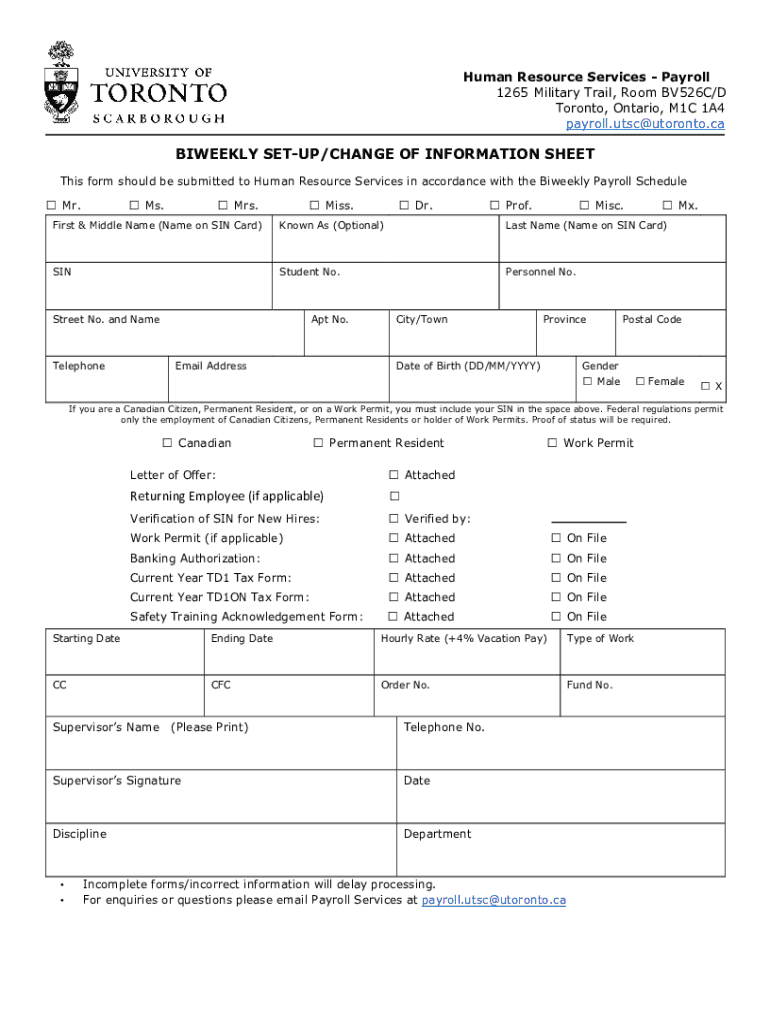

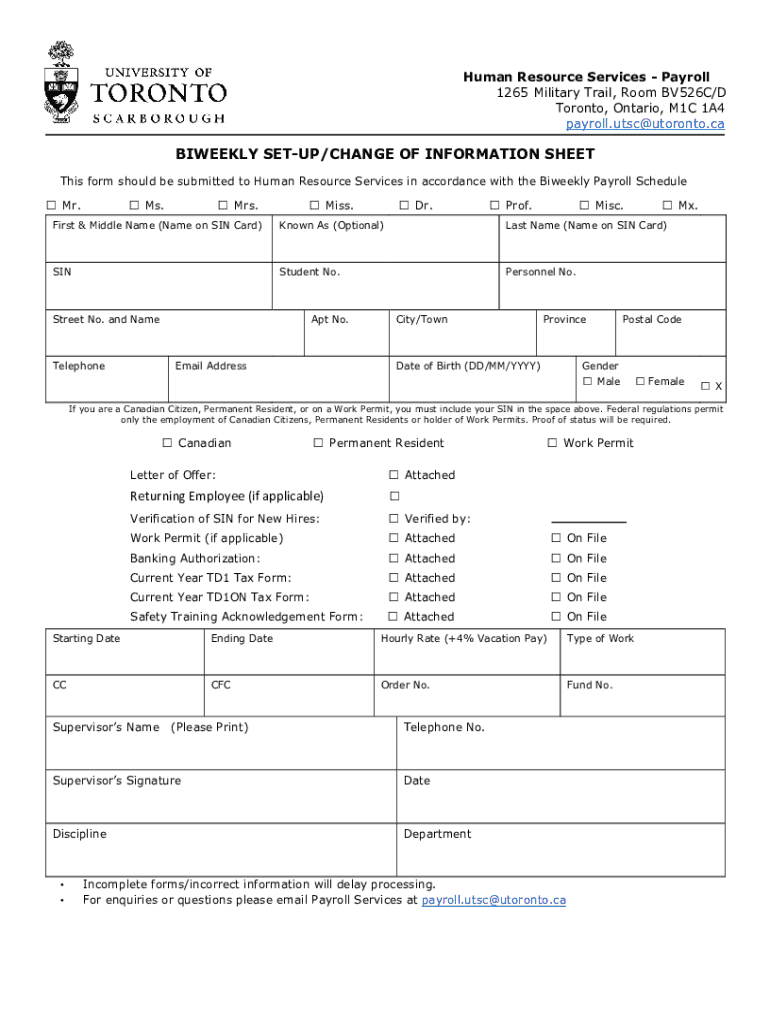

New Hire Payroll Set-Up Form: A Comprehensive Guide

Overview of the new hire payroll set-up process

Efficient payroll set-up for new hires is paramount for any organization. A seamless onboarding experience not only helps in setting employee expectations but also ensures compliance with legal obligations. Utilizing a structured and user-friendly platform like pdfFiller allows HR teams and new employees to complete the payroll set-up process promptly and effectively, minimizing errors and delays.

Streamlining the payroll set-up through a cloud-based solution enhances accuracy and efficiency. Platforms like pdfFiller facilitate easy access to necessary forms, providing step-by-step guidance for completion. This ultimately leads to a more satisfactory onboarding experience, creating a positive impression on new hires.

Essential documents required for payroll setup

Completing the new hire payroll set-up form typically requires several essential documents, each serving a critical purpose in ensuring compliance and accuracy in employee data management.

Employment eligibility forms

New hires must provide identification documentation to verify their employment eligibility. This includes submitting Form I-9, which must be completed accurately. The form requires individuals to present two types of ID, such as a driver's license and a Social Security card or a passport. Familiarizing oneself with acceptable documents on the I-9 form and ensuring timely submission is critically important, as failure to comply can lead to penalties for the employer.

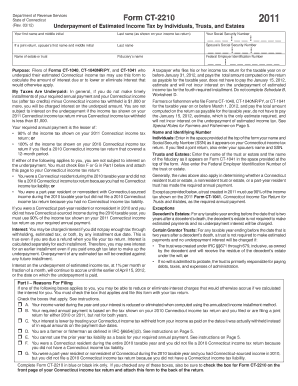

Tax forms

Completing tax forms, particularly Form W-4 for federal tax withholding, is a vital step in the new hire payroll set-up process. Employees must provide details on their filing status and any additional allowances or deductions. It's equally essential to check the state-specific tax requirements since some states have their own employee tax withholding forms to complete.

Direct deposit information

Many employees prefer direct deposit for receiving their paychecks, necessitating the completion of a direct deposit form. This includes entering bank account information such as the account number and routing number. New hires must ensure this information is accurate to avoid payment delays. Guidance regarding this process is typically provided by HR.

Emergency contact form

Completing the emergency contact form allows the organization to be prepared in case of workplace emergencies. Employees should provide up-to-date contact information for relatives or friends whom HR can reach out to if needed. This step is crucial not only for compliance but also for ensuring employee safety.

Employee handbook acknowledgment

Acknowledge the employee handbook by signing a form that confirms familiarity with the company’s policies and procedures. This ensures that employees understand workplace expectations, including disciplinary actions and benefits, leading to better job satisfaction.

Step-by-step guide to completing the new hire payroll set-up form

Completing the new hire payroll set-up form can seem daunting, but with the right guidance, it becomes a straightforward process. Following a step-by-step approach is essential to ensure all necessary information is included and accurately entered.

Accessing the form

To access the new hire payroll set-up form on pdfFiller, simply log in to your account, navigate to the ‘Forms’ section, and search for ‘New Hire Payroll Set-Up Form’. Once located, click to open the form for editing.

Filling out personal information

Begin by entering your personal information, including your full name, address, and contact number. Ensure all details are accurate to avoid discrepancies during the payroll processing. It's also advisable to double-check for any typos in this information.

Tax information section

Accurately filling out the tax information section is crucial for proper withholding calculations. Provide the necessary details as per Form W-4 and any state equivalents, including your filing status and number of allowances. If unsure, refer to IRS guidelines or consult HR for assistance.

Bank details for direct deposit

For direct deposit setup, fill in the bank account information exactly as it appears on official bank statements. This includes the bank name, account number, and routing number. A brief misunderstanding in these digits can lead to misdirected payments, so confirm that all entered numbers are correct.

Signing and submitting the form

Using pdfFiller’s eSignature feature, you can sign the form directly within the application. This electronic signature saves you time and ensures compliance with legal standards. After signing, submit the form to HR for processing and keep a copy for your records.

Tips for new employees: best practices in payroll setup

To ensure a smooth payroll setup experience, new employees should adhere to best practices when filling out forms. Awareness and attention to detail play a vital role in this process.

Managing new hire documentation with pdfFiller

Once your forms are submitted, managing your new hire documentation within pdfFiller becomes crucial for maintaining organization and accessibility.

Editing and updating forms

If your information changes after submission, pdfFiller allows you to edit your forms easily. Simply access the stored document in your account and make the required updates. This flexibility ensures that your information is always current.

Storing and organizing documents

Utilize pdfFiller’s cloud storage features to keep all your documents organized in one place. By categorizing forms by type (e.g., payroll, tax documents), you improve your ability to retrieve them when needed.

Collaboration tools for team involvement

Sharing the payroll set-up form securely with your HR team or colleagues is made easy through pdfFiller’s collaboration features. By inviting others to view or edit the document, you enhance teamwork and ensure everyone is on the same page regarding onboarding.

Tracking the payroll setup process

After submitting your new hire payroll set-up form, it’s essential to track your submission and monitor its status with HR. A proactive approach helps identify any issues before they become major setbacks.

Following up with HR after a couple of days can confirm whether your documents have been processed, ensuring payroll runs smoothly from the outset. Good communication helps mitigate confusion and allows timely addressing of queries.

FAQ section

As you embark on your new position, you may have questions regarding the payroll set-up form and the overall process.

Next steps after completing the payroll set-up form

Once your payroll setup is finalized, it’s important to familiarize yourself with accessing payslips online. Most companies will provide a secure portal for employees to view their payment history and manage their tax withholdings.

You should also review the benefits package offered to employees, as eligibility may begin after onboarding. Understanding your benefits can lead to better financial planning and a more positive work experience.

Conclusion: The importance of a smooth payroll onboarding experience

Utilizing pdfFiller for your payroll set-up forms greatly enhances the onboarding experience. By streamlining the document management process, new employees can focus more on integrating into the team rather than getting bogged down by paperwork.

Encouraging new hires to utilize the tools available within pdfFiller creates an environment of efficiency and clarity, allowing for a seamless transition into their roles and fostering satisfaction from the very start.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new hire payroll set-up to be eSigned by others?

How can I edit new hire payroll set-up on a smartphone?

How do I edit new hire payroll set-up on an iOS device?

What is new hire payroll set-up?

Who is required to file new hire payroll set-up?

How to fill out new hire payroll set-up?

What is the purpose of new hire payroll set-up?

What information must be reported on new hire payroll set-up?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.