Get the free Official Form 201

Get, Create, Make and Sign official form 201

Editing official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

A Comprehensive Guide to Official Form 201 Form

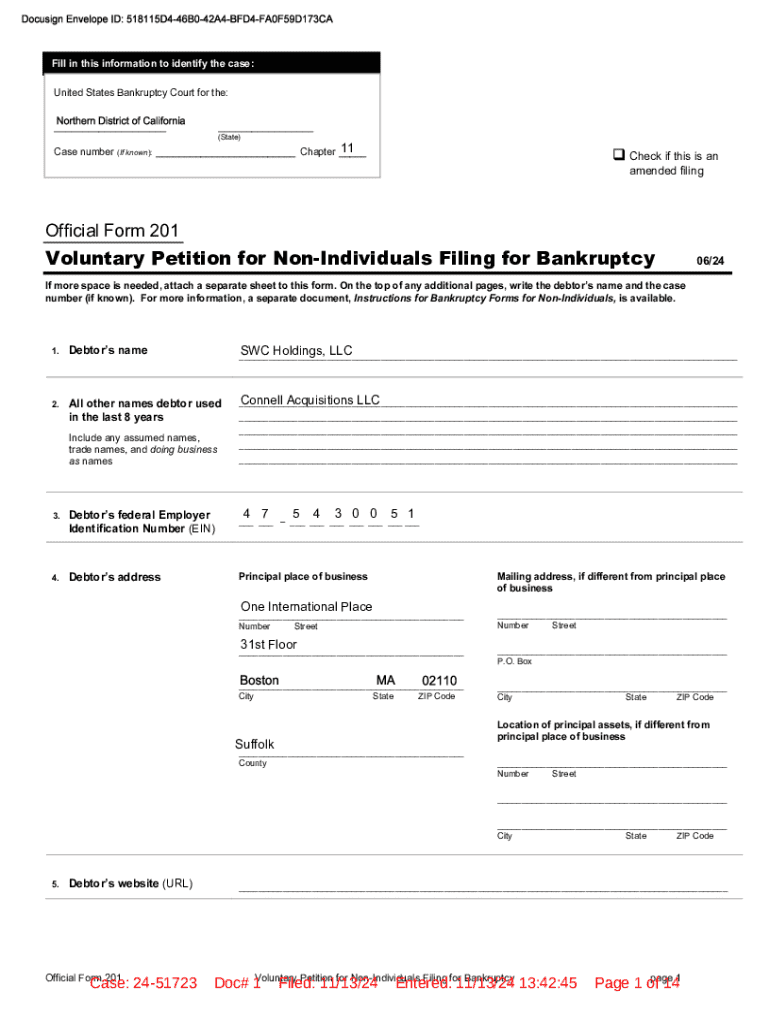

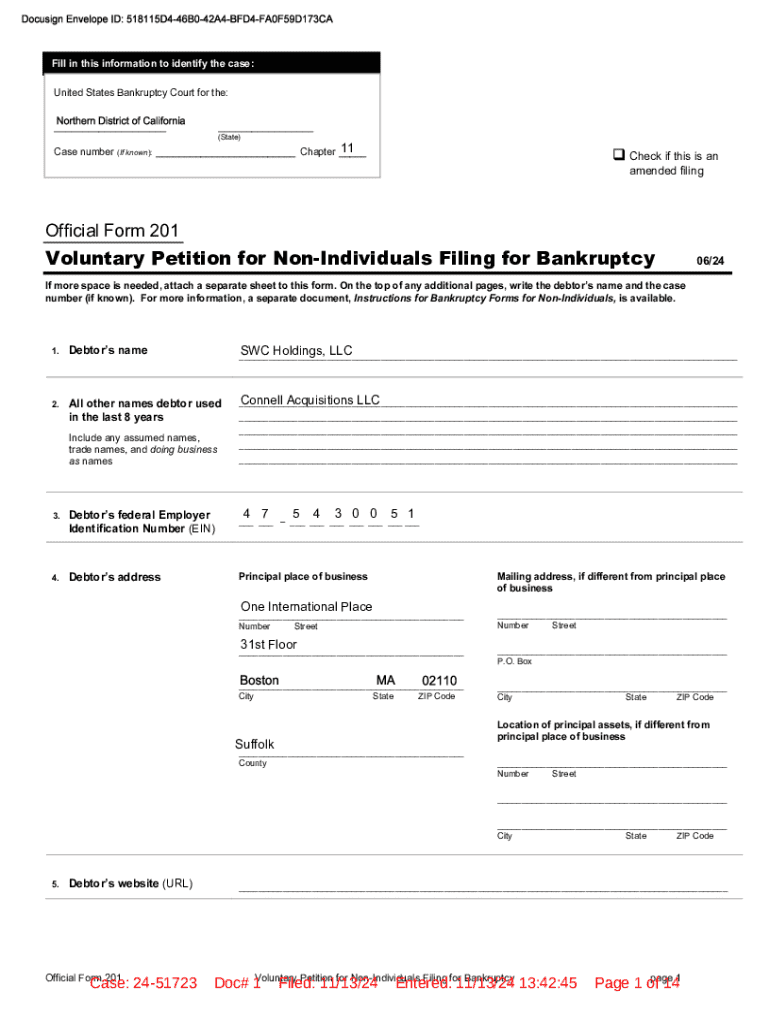

Overview of the Official Form 201

Official Form 201 is a crucial document used primarily in legal and administrative processes. This form serves to streamline operations, ensuring that all necessary information is collected systematically. Each field in the form plays a pivotal role in shaping the outcome of various transactions, legal proceedings, or administrative activities.

Understanding the importance of Official Form 201 is essential for individuals and teams. Proper completion of this form can directly impact legal outcomes or administrative decisions, fostering transparency and accuracy in documentation.

Understanding the components of Official Form 201

The Official Form 201 is made up of several key sections designed to capture distinct categories of information essential for processing an application or request. Each section serves a purpose and requires careful attention.

Filling out each section accurately is vital; however, many face challenges when completing the form. Some common mistakes include misplacing personal digits, confusing legal identifiers, or failing to provide comprehensive financial details. Ensuring clarity in these sections is paramount for successful submissions.

Step-by-step guide to completing Official Form 201

Completing Official Form 201 requires a systematic approach. By breaking down the process into manageable steps, users can minimize errors and enhance the accuracy of their submissions.

The meticulousness you apply will reflect in your submission's fate, as incorrect information can lead to delays or dismissal.

Special considerations

Submitting incorrect information on Official Form 201 can have serious legal implications. Misrepresentation or inaccuracies can lead to penalties, additional inquiries, or even legal action. It's critical to approach this task with diligence and attention to detail.

Moreover, being aware of deadlines is equally important. Each application or request associated with Official Form 201 may come with strict submission dates. Missing these deadlines can jeopardize your legal standing or administrative benefits.

Digital tools for Official Form 201

Utilizing digital tools can significantly enhance the efficiency of managing Official Form 201. pdfFiller offers a host of features designed to make the editing, signing, and submission process more streamlined.

Interactive tools, such as templates and calculators, are available to assist users in accurately completing the form.

Collaboration and support

When working on Official Form 201, collaborating with your team can prove beneficial. Leadership and cooperation can minimize errors and ensure everyone is on the same page. Using pdfFiller, team members can be invited to contribute directly to the form, allowing for easy tracking of changes.

Having reliable support can alleviate concerns and ensure confidence in the information being submitted.

Managing your completed Official Form 201

Once Official Form 201 is completed, maintaining organization and security of your documents is essential. Utilizing pdfFiller allows you to store documents securely and retrieve them easily when needed.

Effective document management before and after submission ensures a smoother process throughout.

Frequently asked questions (FAQ)

Individuals often have queries surrounding the use of Official Form 201. Understanding when and why this form is necessary can help relieve uncertainties.

Related forms and templates

Official Form 201 may sometimes be confused with similar forms used in various contexts. Knowing when to utilize each form can significantly impact the results of your submissions.

User testimonials

Real-world experiences can illuminate the power of using pdfFiller for Official Form 201. Users often share how the platform has facilitated smoother filing and enhanced collaboration.

What’s next?

For those looking to stay updated with best practices surrounding Official Form 201, subscribing to news and tips can be beneficial. Engaging with the pdfFiller community can also provide valuable insights and support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my official form 201 in Gmail?

How can I edit official form 201 from Google Drive?

Can I edit official form 201 on an iOS device?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.