Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding the Form 990 Form: A Comprehensive Guide for Nonprofits

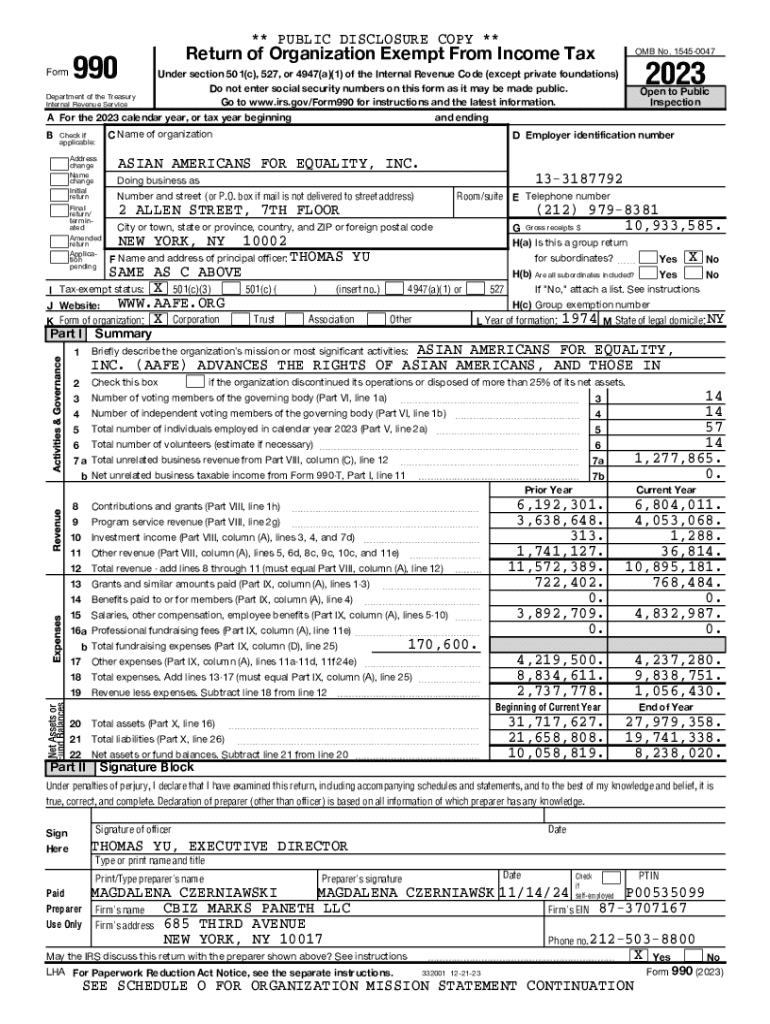

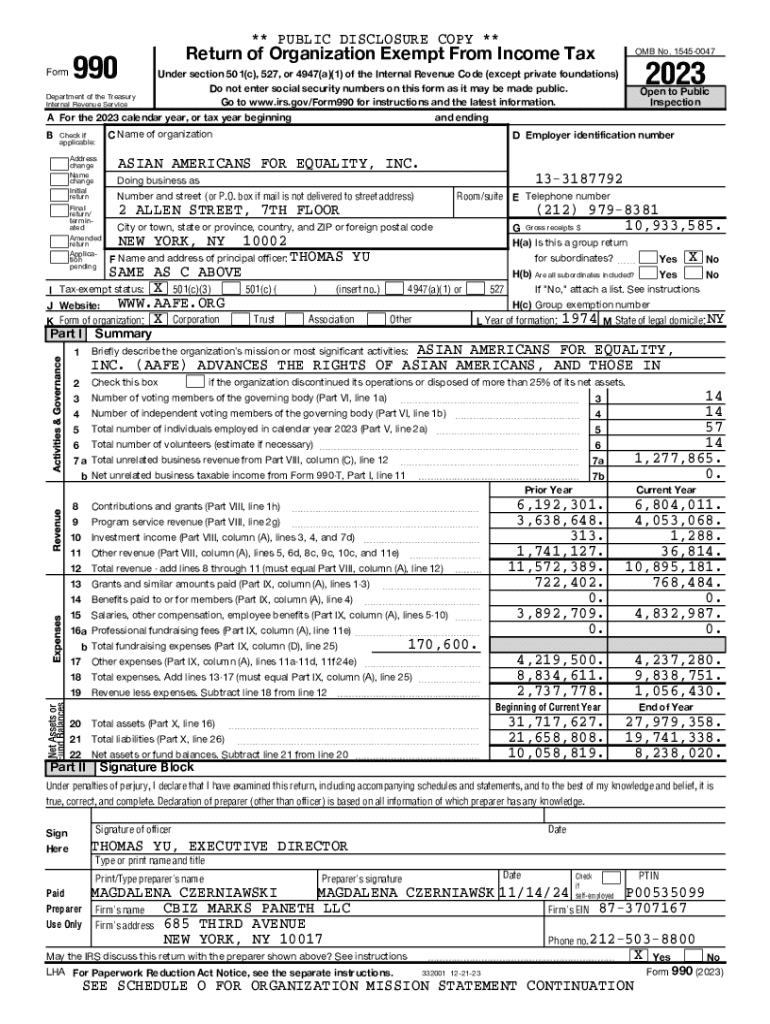

Understanding Form 990

Form 990 is not just a tax document; it's a vital tool that contributes to the transparency and accountability of nonprofit organizations. This form serves as an annual information return that most tax-exempt organizations, including charities and private foundations, must file with the IRS. It presents a comprehensive view of a nonprofit's financial health, operational activities, and governance structure.

The importance of Form 990 cannot be overstated. It helps the IRS monitor whether nonprofits meet the requirements for tax-exempt status. Additionally, donors and the public can review this information to evaluate the credibility and financial health of organizations before giving. The data collected in Form 990 include details regarding revenue, expenses, programs, and executive compensation, which can shape public perception and inform funding decisions.

Types of Form 990

There are several variants of Form 990 tailored to fit different types of nonprofit organizations. The main types include Form 990, Form 990-EZ, Form 990-N (e-Postcard), and Form 990-PF. Each variant has specific eligibility requirements based on the organization's size and revenue.

Selecting the appropriate form for your organization involves assessing your gross receipts and asset size. Understanding these distinctions will help ensure compliance and streamline the filing process.

Filing requirements for Form 990

Not all nonprofits are required to file Form 990, but understanding who must file is crucial. Generally, organizations that are recognized as tax-exempt by the IRS must comply with specific filing requirements. Charitable organizations, certain private foundations, and other tax-exempt entities face different regulations based on their financial sizes and structures.

Filing deadlines vary depending on the organization’s fiscal year-end. Most organizations adhere to the 15th day of the fifth month after the close of their fiscal year. However, nonprofits need to explore exemptions and special cases that may alter these standard deadlines.

Consequences of non-filing

Failing to file Form 990 can lead to serious repercussions for nonprofits. There are monetary penalties for late or non-filing that can significantly impact the organization’s financial standing. The IRS imposes fines that may accumulate with continued neglect.

Moreover, a prolonged failure to file can result in the loss of tax-exempt status, causing organizations to revert to taxable status with potential tax liabilities. This situation can produce a cascading effect, affecting donor trust and public perception, as Form 990 is a public document available for inspection by anyone. Transparency is key, and non-filing reflects poorly on an organization’s integrity.

Preparing to file Form 990

Preparation for filing Form 990 is crucial for accurate reporting and compliance. It's essential to start by organizing financial records, which includes maintaining meticulous records of income, expenses, donations, and contributions throughout the year. Using accounting software or spreadsheets can facilitate this process, allowing nonprofits to track their finances effectively.

Gathering required documentation, such as financial statements and board meeting minutes, is vital. Identifying key sections of Form 990 to address will streamline the completion process and help avoid last-minute scrambles. Tools and software, like pdfFiller, can assist in managing documentation, making it easier for teams to collaborate and prepare effectively.

Step-by-step guide to completing Form 990

Completing Form 990 involves several steps aimed at ensuring the accuracy of the information provided. The first step is understanding each section of the form, which includes financial data, governance practices, and compliance with IRS regulations. Each part needs careful consideration to paint a full picture of the organization’s activities.

After completing the necessary sections, review and edit your form meticulously. Accuracy is crucial as common mistakes can lead to misunderstandings and penalties. Ensuring completeness before submission can save organizations from unnecessary issues in the future.

Submitting your Form 990

Form 990 can be filed either electronically or via paper submission, with electronic filing increasingly becoming the preferred method for efficiency and expediency. Employing electronic submission reduces processing times and lowers the likelihood of errors associated with manual handling.

To ensure timely submission, set internal deadlines well in advance of the filing date. Monitoring compliance through reminders and task management tools can help keep organizations on track. After submitting, organizations should retain proof of submission as IRS acknowledgment for future reference.

Understanding Form 990 data

The data reported in Form 990 is invaluable for evaluating nonprofits. Researchers, funders, and institutional partners analyze this information to shape funding decisions and assess organizational effectiveness. Having access to standardized data allows for benchmarking against similar organizations.

Public inspection regulations require that Form 990 is available for scrutiny by the public, thereby enhancing transparency within the nonprofit sector. Nonprofits can leverage this accessibility by presenting their data strategically, showcasing their mission and impact to foster trust with potential donors.

Expert tips for navigating Form 990

Collaborating with a nonprofit tax professional can provide significant advantages. Experts can guide organizations through complexities, ensuring compliance while optimizing the available deductions and credits. This expertise is invaluable, particularly when tackling inconsistencies or navigating changes in tax regulations.

Utilizing resources like pdfFiller can simplify the document management process. Features like eSigning and real-time collaboration allow nonprofit teams to work on Form 990 together, leading to improved efficiency and reduced errors. Editing PDF forms with ease further streamlines the preparation process.

Resources for further assistance with Form 990

Various third-party resources are available to assist nonprofits with Form 990. Organizations such as Guidestar and the National Council of Nonprofits provide extensive guidance on compliance and best practices. These platforms often feature comprehensive guides tailored to nonprofit organizations.

Additionally, exploring frequently asked questions about Form 990 can clarify common concerns and enhance organizations' understanding. Accessing these resources expands knowledge and ensures proper adherence to legal requirements while maximizing the benefits of tax-exempt status.

How to leverage Form 990 for organizational growth

Form 990 offers insights that can drive organizational growth. By utilizing the data reported, nonprofits can improve transparency and accountability, which fosters trust and can translate into enhanced donations. Understanding trends and patterns in the data empowers organizations to make informed strategic decisions.

Moreover, analyzing donor behavior as reported in Form 990 can unlock new strategies for engagement. Tailoring outreach based on insights and building relationships with contributors will not only bolster support but also inspire community involvement and partnership.

Case studies and real-life applications of Form 990

Nonprofits that have successfully leveraged their Form 990 data demonstrate how effective this tool can be. For instance, a nonprofit focused on environmental conservation utilized insights gained from their Form 990 to launch a targeted fundraising campaign aimed at specific donor demographics, which significantly increased their annual contributions.

Conversely, organizations that faced challenges in filing Form 990 often experienced setbacks in donor trust and public credibility. Lessons learned from these situations underscore the importance of timely and accurate filing and underscore the correlation between compliance and organizational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 in Chrome?

Can I create an electronic signature for signing my form 990 in Gmail?

How do I fill out form 990 using my mobile device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.