Get the free Lgst 51-a

Get, Create, Make and Sign lgst 51-a

Editing lgst 51-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lgst 51-a

How to fill out lgst 51-a

Who needs lgst 51-a?

Comprehensive Guide to the LGST 51-A Form on pdfFiller

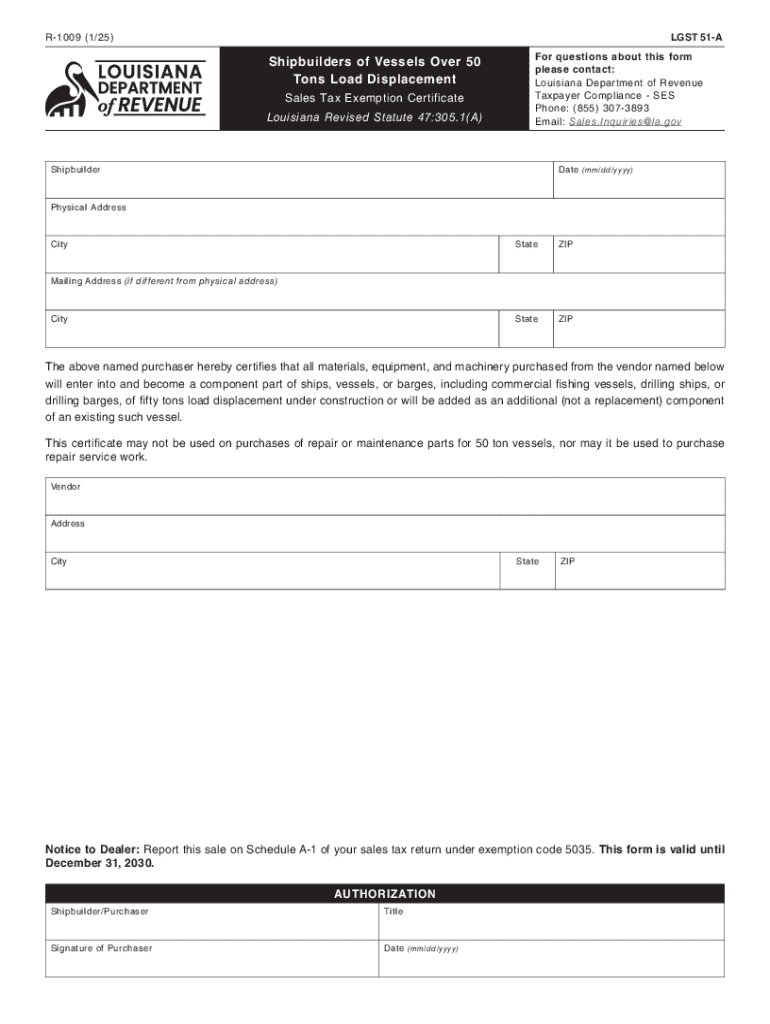

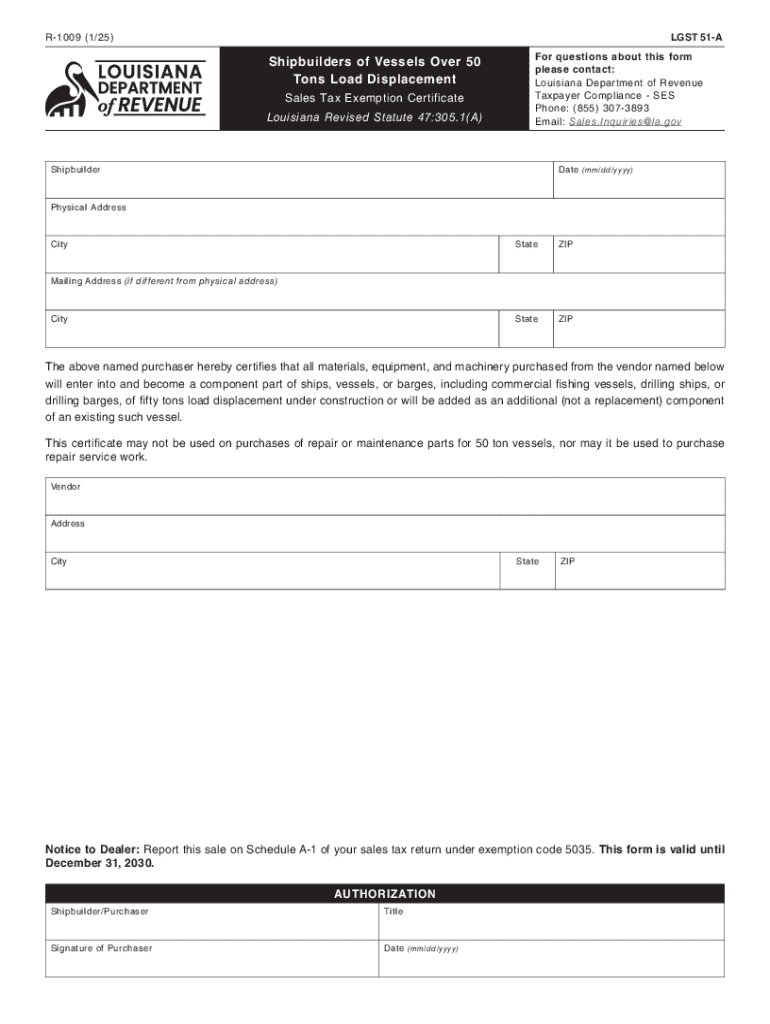

Overview of the lgst 51-a form

The lgst 51-a form is a crucial document used primarily within regulations governed by the respective local laws. This form serves as a vital tool for individuals and businesses in ensuring compliance with specific requirements, mainly in the realm of taxes and regulatory submissions.

Its importance cannot be overstated, as it can facilitate tax compliance, record-keeping, and provide necessary information for audits. Common use cases include submissions for tax deductions, benefits applications, and reporting income, making it essential for both individuals and teams operating in regulated environments.

Key features of the lgst 51-a form include its structured sections that require specific information to be filled accurately. This structured approach distinguishes it from other forms, making it easy to navigate as long as the user has a clear understanding of the information needed.

Understanding the structure of the lgst 51-a form

The structure of the lgst 51-a form is thoughtfully designed to capture all necessary information required for successful completion. Each section caters to distinct elements, such as identifying the applicant, providing necessary financial details, and any additional information that may be pertinent to the submission.

A keen understanding of the sections is vital to avoid potential pitfalls during the submission process. Individuals must familiarize themselves with what is required in each part of the form to ensure a seamless experience.

To ensure accuracy, review each component and cross-check against your documentation. Essential documents might include W-2 forms, 1099 forms, and other financial statements.

Step-by-step instructions for filling out the lgst 51-a form

Before diving into filling out the lgst 51-a form, preparation is key. Start by verifying your eligibility to apply using the correct form, and gather all necessary documentation, such as identification and financial records.

Attention to detail during this process is crucial, as inaccuracies can result in delays or rejections.

Common challenges and solutions

Individuals often encounter challenges when filling out the lgst 51-a form, commonly stemming from misunderstandings of the guidelines outlined. Additionally, overlooking required fields can lead to submission failures, necessitating correction and resubmission.

To combat these challenges, users should take time to familiarize themselves with the guidelines and ensure each section of the form is completely filled out before submission.

If mistakes are made, the best approach is to amend errors promptly. Many forms allow for corrections without penalty if rectified early, so a quick review can save time and hassle.

Editing and managing your lgst 51-a form

Editing tools available on pdfFiller enhance the user experience when dealing with the lgst 51-a form. With features that allow users to seamlessly correct mistakes, add additional information, or modify sections, the platform streamlines document management.

To effectively manage your lgst 51-a form, utilize pdfFiller’s collaborative tools to engage with team members when verifying data. These tools allow for real-time input, ensuring accuracy and collective involvement in the completion process.

Consistent updates and reviews help maintain the integrity of the data being submitted, thus reducing the chances of errors.

Signing and submitting the lgst 51-a form

Electronic signing options available through pdfFiller make the process of signing the lgst 51-a form both secure and efficient. Users can add their eSignature with ease, which is legally binding and compliant with local regulations.

After signing, the next step is to submit the completed form. This can usually be done online through designated submission portals, or by direct mail, depending on local regulations.

Tracking submission status is also viable through the online portal or direct contact with the respective authority, ensuring you stay informed on your application’s progress.

Collaborating on the lgst 51-a form

Collaboration is a game changer when it comes to completing the lgst 51-a form. pdfFiller’s collaboration features facilitate real-time sharing and feedback, allowing team members to work concurrently on the document.

When sharing for review, ensure that each collaborator understands their role in the process. Establish deadlines for feedback to keep the project on track, utilizing tools within pdfFiller to track changes made by various contributors.

Effective collaboration not only enhances accuracy but also fosters communication among team members, leading to quicker completion times.

Tips for revising and resubmitting the lgst 51-a form

Revisions to the lgst 51-a form may be necessary during the review process. Common reasons include incomplete information, changes in the applicant's circumstances, or feedback from regulatory bodies.

Addressing feedback promptly is critical. Be sure to follow any guidelines provided for making amendments to ensure compliance with submission standards.

The resubmission process typically mirrors the initial submission. Ensure all corrections are accurately reflected before sending.

Understanding the legal implications of the lgst 51-a form

The lgst 51-a form holds significant legal implications. Compliance with submission requirements is not just a matter of protocol but a legal necessity. Failing to provide accurate information can lead to legal repercussions such as fines or audits.

Users should be aware of the potential for legal issues arising from improper submissions. This makes it essential to handle the form with care and seek clarification when in doubt.

Developing an understanding of these legal implications not only ensures compliance but protects the individual or team from unnecessary complications.

Best practices for managing lgst 51-a forms

Efficient management of the lgst 51-a form extends beyond its initial submission. Organizing digital copies and ensuring secure archiving of submissions is vital to maintain integrity and easy access for future reference.

Maintaining an audit trail will also enhance transparency. It allows individuals or teams to track changes, providing context should inquiries arise later on.

By integrating these best practices, individuals and businesses can ensure a smooth process and safeguard their interests.

Real-life applications and testimonials

Success stories surrounding the lgst 51-a form highlight its critical role in achieving compliance and securing benefits. Users have frequently shared their experiences about how the form opened pathways to tax deductions and organized their financial documents.

For instance, a small business owner noted that the simple process of using pdfFiller to submit the lgst 51-a form significantly reduced time spent on taxes, allowing them to focus more on their business operations.

Such real-life applications exemplify the effectiveness of the lgst 51-a form in facilitating necessary transactions, proving its value to users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get lgst 51-a?

How do I edit lgst 51-a in Chrome?

Can I sign the lgst 51-a electronically in Chrome?

What is lgst 51-a?

Who is required to file lgst 51-a?

How to fill out lgst 51-a?

What is the purpose of lgst 51-a?

What information must be reported on lgst 51-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.