Get the free Income & Banking Form

Get, Create, Make and Sign income banking form

How to edit income banking form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income banking form

How to fill out income banking form

Who needs income banking form?

Your Comprehensive Guide to the Income Banking Form

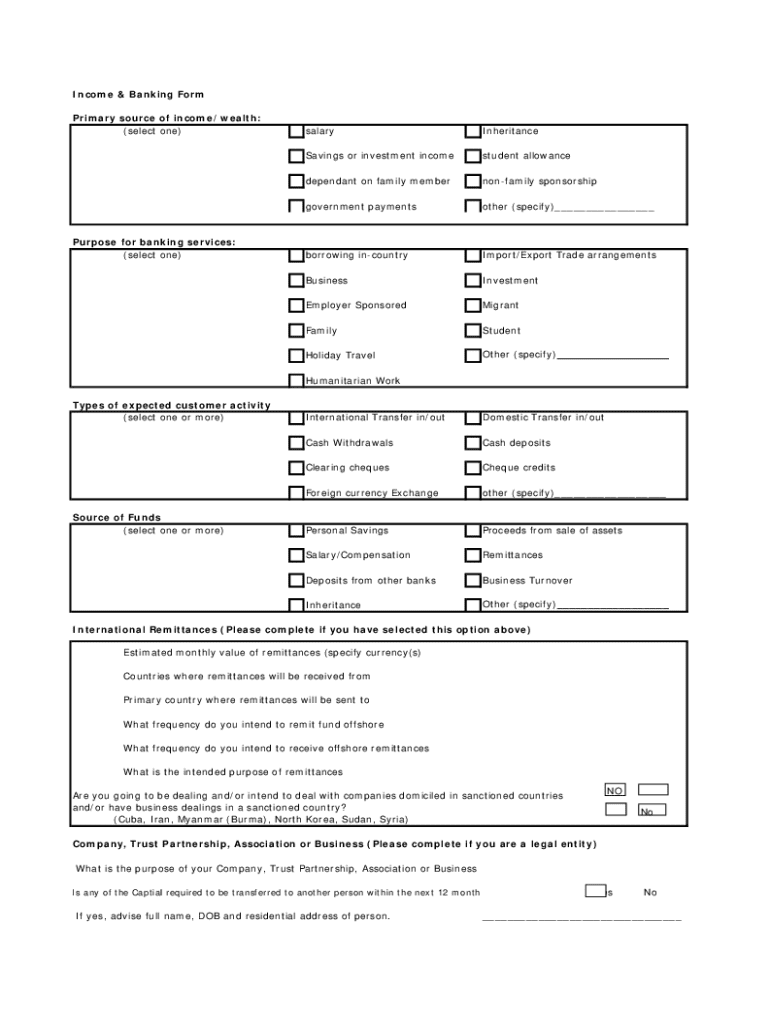

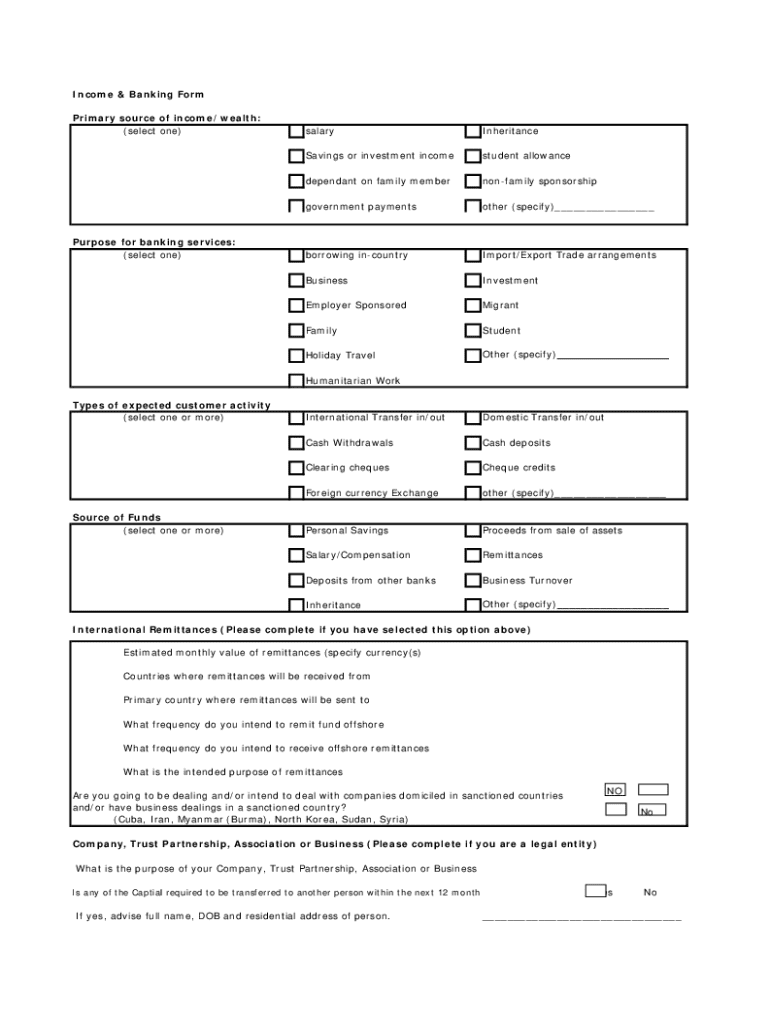

Understanding the income banking form

The income banking form is a vital document utilized in various financial transactions to verify and detail an individual's income sources. Primarily designed for lenders, landlords, and financial institutions, this form captures essential information required for decision-making processes regarding loans, mortgages, and rental agreements.

The importance of this form extends beyond merely documenting income; it provides evidence of financial stability and capability. Whether you’re applying for a new mortgage or seeking a rental agreement, the income banking form serves as a benchmark for financial evaluations, offering clear insights into an applicant's financial standing.

Components of the income banking form

Understanding the structure of the income banking form is crucial for accurate completion. Each section plays a specific role in providing necessary information.

How to effectively fill out the income banking form

Filling out the income banking form accurately is essential for a smooth processing experience. Here’s a step-by-step guide to assist you.

Editing and customizing your income banking form

Once you’ve filled out the income banking form, you might want to edit or customize it to better suit your needs. Utilizing pdfFiller’s editing tools can streamline this process significantly.

You can easily modify text, adjust fields, and even add specific notes or comments. Tailoring the form can help clarify your financial situation, making it easier for the reviewers to understand your data.

eSigning the income banking form

The convenience of electronic signatures (eSignatures) cannot be overstated when it comes to submitting your income banking form. eSigning provides numerous benefits, including faster processing times and enhanced security.

Collaboration and sharing

In situations where teamwork is necessary — for example, when multiple members are involved in the financial application process — pdfFiller facilitates easy collaboration.

Managing and storing your completed income banking form

Once your income banking form is complete, focusing on its management and secure storage is vital. pdfFiller offers robust cloud solutions for organization.

Common use cases for the income banking form

The income banking form is versatile, with several practical applications in everyday financial transactions. Understanding its uses can streamline your processes.

Troubleshooting and FAQs

Even with preparation, you might encounter questions or issues while processing your income banking form. Familiarizing yourself with common queries can save time.

Staying compliant with banking regulations

Adhering to compliance requirements during the completion of your income banking form is essential. Every institution has specific guidelines that must be followed.

Leveraging income banking form insights for financial planning

Data from the income banking form isn't just for financial applications—it can also play a crucial role in personal financial planning.

Exploring related documentation and forms

Beyond the income banking form, many other essential banking forms exist that may also be pertinent to your financial dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my income banking form in Gmail?

How do I edit income banking form on an iOS device?

How do I complete income banking form on an Android device?

What is income banking form?

Who is required to file income banking form?

How to fill out income banking form?

What is the purpose of income banking form?

What information must be reported on income banking form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.