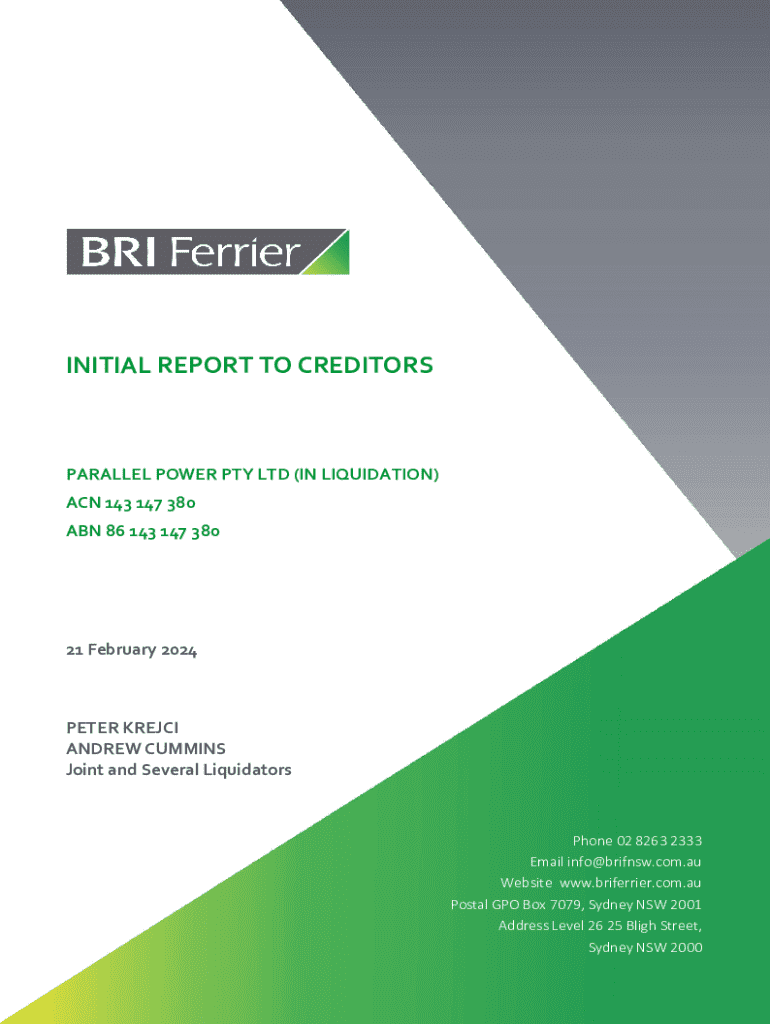

Get the free Initial Report to Creditors

Get, Create, Make and Sign initial report to creditors

How to edit initial report to creditors online

Uncompromising security for your PDF editing and eSignature needs

How to fill out initial report to creditors

How to fill out initial report to creditors

Who needs initial report to creditors?

Initial Report to Creditors Form: A How-to Guide

Understanding the Initial Report to Creditors Form

The Initial Report to Creditors form is a crucial document used primarily in debt recovery situations. It serves to inform creditors about an individual or business's current financial status, outlining liabilities, assets, and proposed actions for handling outstanding debts. This report is vital because it provides a structured approach to transparency and establishes a formal communication channel between debtors and creditors.

In both individual and business contexts, this form is essential in the debt recovery process. It helps set expectations and can facilitate negotiations by providing all parties with a clear understanding of the financial landscape. Key stakeholders involved in this process include debt collectors, creditors, and legal counsel, all of whom rely on this document to make informed decisions.

Overview of the document

The Initial Report to Creditors form is typically structured to capture all pertinent details regarding the debtor's financial situation. Each section of the form is designed to gather specific information, which assists creditors in assessing the viability of debt recovery efforts.

Key sections of this document include basic information about the debtor, a comprehensive financial overview detailing income, assets, and liabilities, and a proposed plan of action for debt management. This structure allows creditors to assess risk, understand the debtor's capacity to repay, and determine potential next steps.

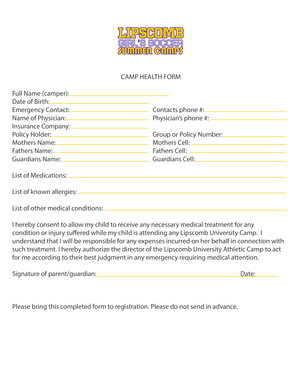

Preparing to fill out the form

Before completing the Initial Report to Creditors form, it's essential to gather all necessary documentation that supports the information you will provide. This helps ensure accuracy and credibility in your report. Start by collecting identification documents, such as government-issued IDs, which validate your identity.

Next, compile detailed financial statements that outline your income sources, asset valuations, and a list of your liabilities. Additionally, any correspondence you have had with your creditors could offer insights into your financial interactions and previous agreements.

Understanding common terminology associated with debt and insolvency is equally important. Familiarize yourself with terms such as 'creditor' (the party owed money), 'insolvency' (the inability to pay debts), and 'claims' (demands for payment concerning the debts owed). Being well-versed in this terminology ensures clarity when filling out the form.

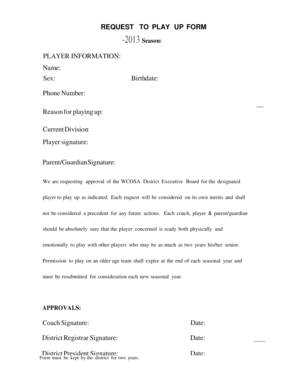

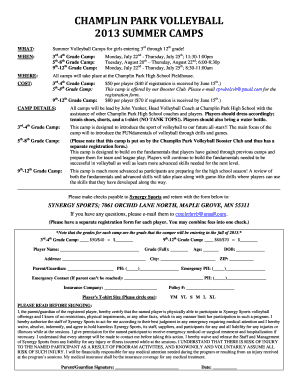

Step-by-step instructions for completing the form

Completing the Initial Report to Creditors form can be straightforward when broken down into manageable sections. Start with Section 1, where you will provide essential basic information. This includes identifying details about the individual or business, such as the legal name, address, and contact information.

Moving on to Section 2, you will delve into financial details. Outline your assets, including any real estate, vehicles, or savings accounts, and detail your liabilities, such as loans, credit card debt, and other financial obligations. Ensuring accuracy in this part is crucial for maintaining credibility with your creditors.

In Section 3, document any actions you’ve taken or propose actions for debt management. This could include payment plans, asset liquidations, or negotiations with creditors to reduce debts. Finally, Section 4 covers submission guidelines—indicating where and how to submit the form, whether electronically via platforms like pdfFiller or through other methods.

Editing and signing the Initial Report to Creditors form

Once the form is filled out, it's essential to review and edit the document for accuracy before submission. pdfFiller’s editing tools make this process seamless; you can easily correct any errors or update information as needed. This software allows users to add comments or annotations, making it collaborative and user-friendly.

Additionally, signing the form electronically is an option that enhances convenience. PdfFiller supports electronic signatures, ensuring that the document can be signed quickly and securely, which is especially beneficial when time is of the essence. Collaboration features also allow stakeholders, such as legal counsel or financial advisors, to review the report before finalization.

Managing your Initial Report after submission

After submitting your Initial Report to Creditors, tracking the submission status is crucial. If you submit electronically via pdfFiller, you can access real-time updates on your document's status, providing peace of mind and clarity. This ability to monitor progress means you can promptly follow up as needed.

Responding to creditor inquiries promptly is essential for maintaining a positive dialogue. Using pdfFiller for ongoing document management also allows you to store and retrieve important files easily, helping you manage correspondence and necessary follow-up actions effectively.

Frequently asked questions (FAQs)

Upon submitting the Initial Report to Creditors, several questions may arise. The most common one is what happens next. Generally, creditors will review the report, and you'll be informed of their response regarding payment arrangements or negotiations. Keeping the lines of communication open is critical during this period.

If your financial situation changes after submission, you may need to update the Initial Report. This often requires you to fill out a revised form and re-submit it. Make sure to clarify any changes in writing to your creditors to ensure alignment.

Additional support and resources

For those needing assistance, pdfFiller offers robust customer support to help users navigate any challenges they may encounter while filling out the Initial Report to Creditors form. Resources are available that can guide you through the entire process, from preparation to submission.

Access to related forms and templates is also available on the pdfFiller platform, making it easy to compile all necessary documentation. Furthermore, community forums provide a space for individuals to share experiences and advice, enhancing your understanding and equipping you with practical insights.

Real-life examples and case studies

Seeing a sample completed Initial Report to Creditors can greatly enhance your understanding of how to fill it out correctly. This transparency allows you to visualize the process and consider best practices. Mock cases highlight how proper documentation has positively impacted debt recovery efforts, demonstrating the importance of diligence and accuracy.

Success stories from others who have navigated this process show that correct completion of the Initial Report can lead to negotiated settlements, debt reductions, and paved pathways back to financial stability. These examples reinforce the necessity of approaching the task thoughtfully and with care.

Final tips for navigating creditors communications

Engaging with creditors post-submission requires confidence and clarity. Best practices for maintaining this communication include responding promptly to inquiries, being transparent about your situation, and showing willingness to negotiate. Establishing a clear line of communication builds trust and partnerships with creditors.

Utilizing pdfFiller for ongoing document needs further enhances this relationship, allowing you to manage paperwork and correspondence effortlessly. Continuous documentation and record-keeping becomes significantly simpler, providing you with an organized framework for successful negotiation and recovery efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit initial report to creditors from Google Drive?

Can I create an electronic signature for the initial report to creditors in Chrome?

How do I complete initial report to creditors on an iOS device?

What is initial report to creditors?

Who is required to file initial report to creditors?

How to fill out initial report to creditors?

What is the purpose of initial report to creditors?

What information must be reported on initial report to creditors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.