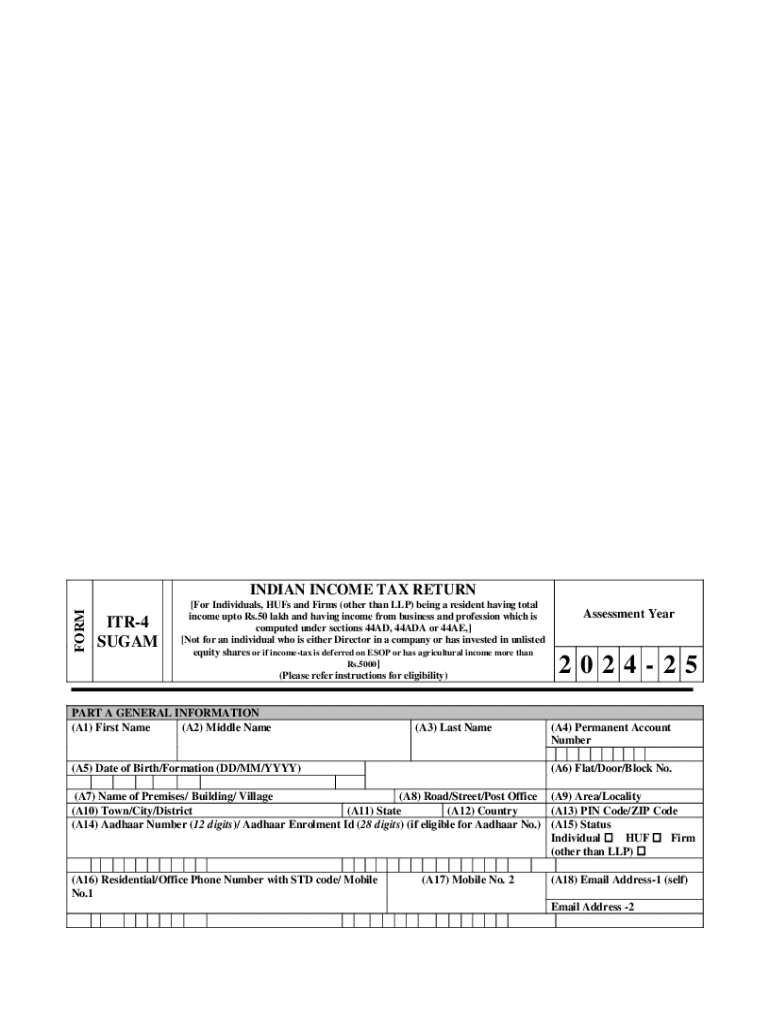

Get the free Indian Income Tax Return

Get, Create, Make and Sign indian income tax return

How to edit indian income tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indian income tax return

How to fill out indian income tax return

Who needs indian income tax return?

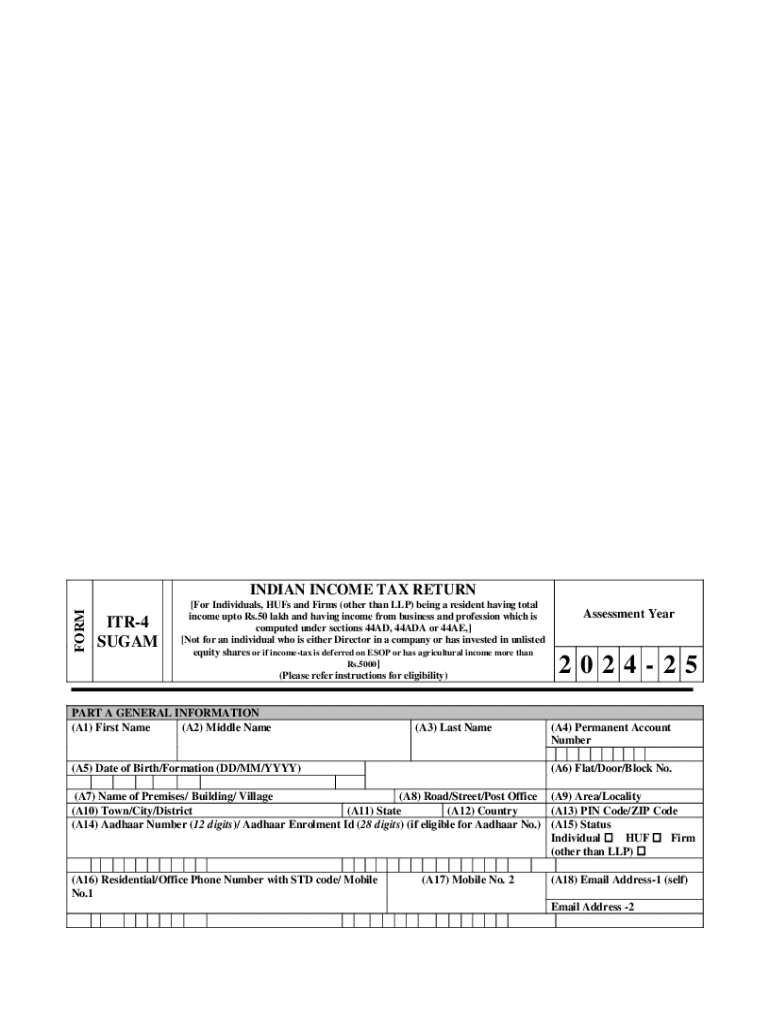

Understanding the Indian Income Tax Return Form

Understanding Indian income tax return forms

In India, filing an income tax return (ITR) is a legal obligation for individuals earning a specific income threshold. The income tax return form serves as a document to report income, calculate tax obligations, and claim any eligible deductions or credits. The importance of filing income tax returns cannot be overstated, as it is essential for maintaining financial integrity, ensuring compliance with tax laws, and eventually affecting one’s credit rating and loan eligibility.

Types of income tax return forms in India

The Income Tax Department of India offers various income tax return forms, known by the abbreviations ITR followed by a number—ITR-1, ITR-2, ITR-3, and so on. Each of these forms caters to different taxpayer profiles, based on sources of income and the type of assessment applicable.

When and how to file your ITR

Filing deadlines are crucial for every taxpayer to keep in mind. Typically, the due date for individual taxpayers is July 31 for the assessment year immediately following the financial year. Missing this deadline can lead to penalties. Following is a step-by-step guide to filing your income tax return online.

Supporting documents required

To facilitate a smooth filing process, taxpayers should be equipped with essential documents that validate their income, deductions, and tax payments. The primary documents include salary slips, Form 16, bank statements, investment proof, and proof of tax payments like challans or receipts.

Accurate documentation ensures that you can back your claims for deductions and credits, potentially reducing your taxable income and tax liabilities. Missing documents or errors could lead to delays in processing your return or even penalties.

Common pitfalls and how to avoid them

Filing income tax returns can be cumbersome, leading to various mistakes, particularly among first-time filers. Some common pitfalls include choosing the wrong ITR form, incorrect personal details, and overlooking eligible deductions.

Understanding the penalties for late filing

Failure to file your income tax return on time can incur significant penalties. From April 1, 2018, the late payment penalties vary based on how late the filing occurs. For instance, a delay of up to three months may incur a penalty of ₹5,000, while delays exceeding three months could lead to ₹10,000.

Late submissions also have lasting impacts, including the potential to restrict certain tax benefits and affect future returns adversely. It’s advisable to keep track of deadlines each financial year.

Interactive tools and resources

Managing tax documents can be made easier with interactive tools available online. pdfFiller provides a cloud-based platform where users can create, edit, eSign, and manage tax-related documents effortlessly. These functionalities help streamline tax preparation and ensure that everything is in order before submission.

Utilizing such tools lets you organize paperwork, eSign tax forms, and keep track of deadlines to minimize errors and foster compliance.

Special provisions and concessions

Various concessions exist for salaried individuals to reduce their tax liabilities. Under several sections of the Income Tax Act, taxpayers can claim deductions for investments, health insurance premiums, and education expenses, among others.

Frequently asked questions (FAQs)

Taxpayers often have questions about the intricacies of the Indian income tax return form. One common query is about income that needs to be disclosed. All sources of income must be reported, including salaries, investments, and rental income. Another frequent question is about the necessity of filing returns even if one’s income is below the taxable limit—this is advisable for record-keeping and future financial proof.

Resources for further assistance

For those who need additional help with filing their Indian income tax return form, numerous resources are accessible online. The official Income Tax Department website offers detailed guidance on the different ITR forms, eligibility criteria, and filing procedures.

Consider consulting tax professionals or chartered accountants for personalized advice, especially if you have complex tax situations or multiple income streams. They can help optimize deductions and ensure compliance with tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit indian income tax return straight from my smartphone?

How do I fill out indian income tax return using my mobile device?

How do I complete indian income tax return on an Android device?

What is indian income tax return?

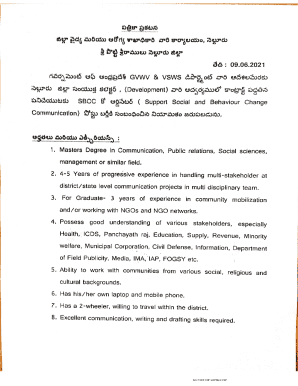

Who is required to file indian income tax return?

How to fill out indian income tax return?

What is the purpose of indian income tax return?

What information must be reported on indian income tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.