Get the free Form Itr-v and Form Itr-ack

Get, Create, Make and Sign form itr-v and form

Editing form itr-v and form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form itr-v and form

How to fill out form itr-v and form

Who needs form itr-v and form?

Understanding Form ITR- and its Role in Tax Filing

Overview of Form ITR-

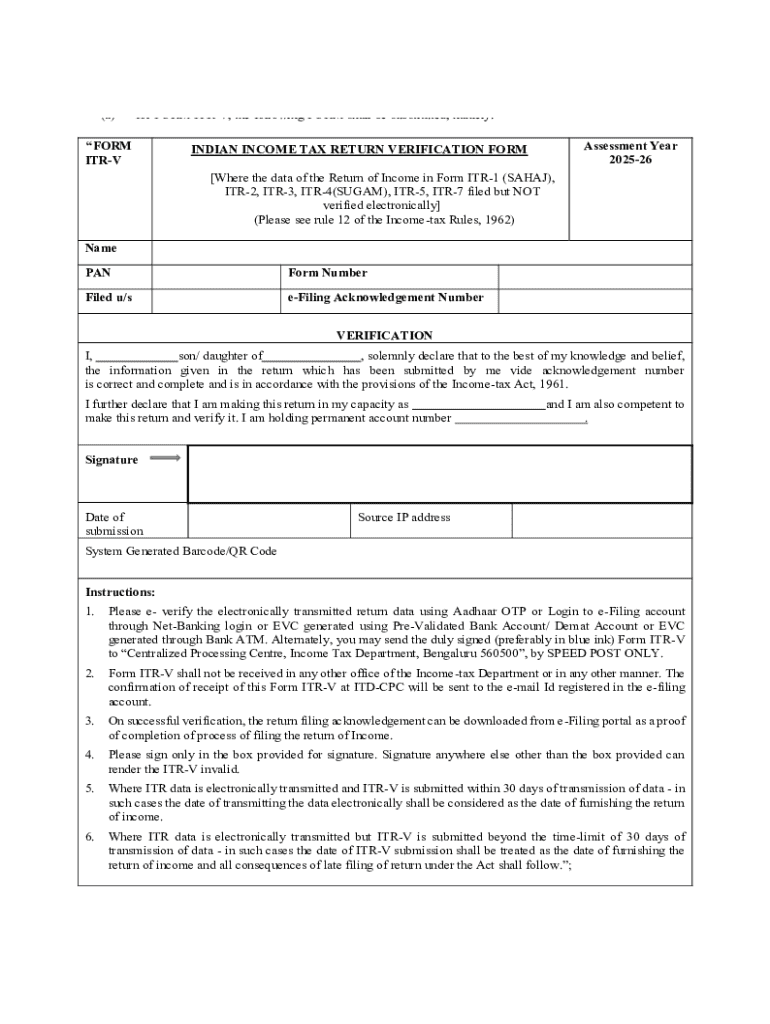

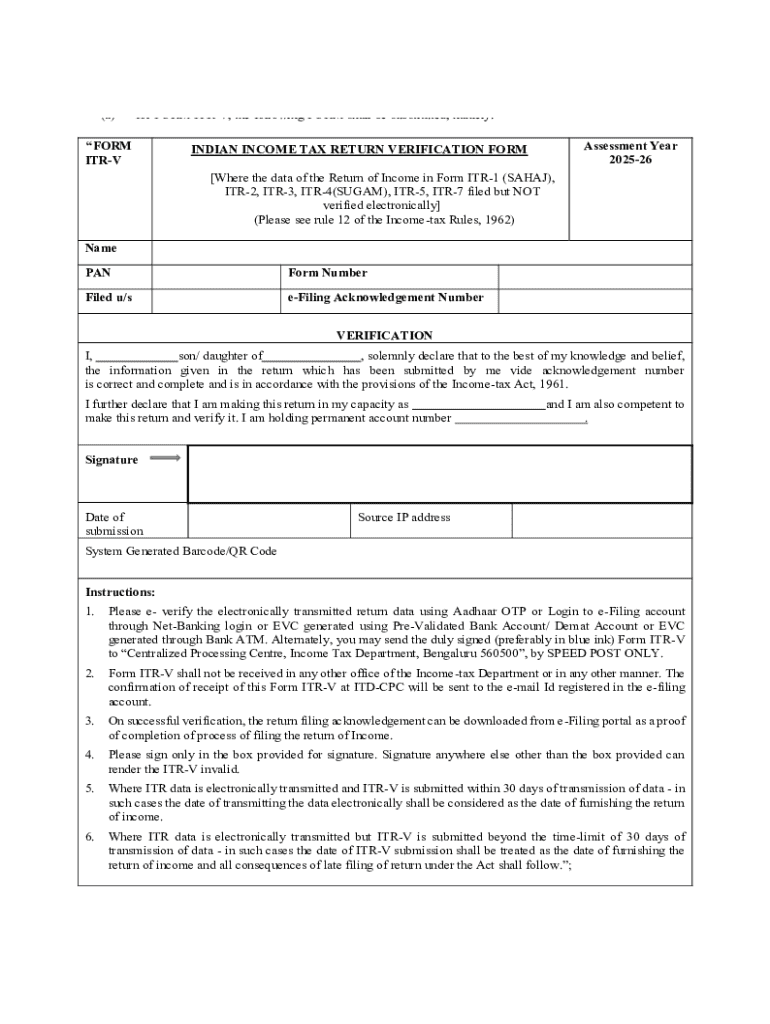

Form ITR-V, also known as the Income Tax Return Verification Form, is an essential document for individuals filing their income tax returns electronically in India. The primary purpose of this form is to confirm the authenticity of the information submitted through the online ITR forms, thereby ensuring that taxpayers can verify their submitted returns efficiently. Without the completion of this process, the filed return remains incomplete, which can lead to penalties or delays in processing.

The significance of ITR-V lies in the fact that it serves as proof that an individual has filed their tax returns. It is particularly vital for assessments conducted by income tax officials, ensuring a transparent tax filing process. Taxpayers, particularly those who choose the e-filing route, must understand whether ITR-V is applicable to them and how to properly utilize it during their tax filing journey.

Understanding the relationship between ITR forms and ITR-

Various Income Tax Return (ITR) forms cater to different categories of taxpayers, including individuals, Hindu Undivided Families, and corporations. Common forms like ITR-1, ITR-2, and ITR-3 have specific purposes and are designated for distinct income sources. While ITR forms effectively collect necessary tax information, ITR-V is integral to completing the e-filing process, ensuring all submissions are verified and authenticated.

ITR-V complements various ITR forms by acting as a confirmation slip that needs to be submitted after e-filing is complete. Upon submitting an ITR form online, taxpayers receive an acknowledgment that includes a unique acknowledgment number, which is referenced in the ITR-V. By doing so, ITR-V effectively safeguards taxpayers against potential discrepancies or disputes related to their filed returns.

Steps for filling out Form ITR-

Prerequisites

Before filling out Form ITR-V, it's essential to gather all necessary information and documentation. You'll need your unique acknowledgment number, which is provided after filing your ITR online. In addition to personal details such as your name, PAN (Permanent Account Number), and address, make sure you have accurate tax information handy. This ensures that the form reflects all details correctly, reducing the chances of errors.

Filling out Form ITR-

When filling out Form ITR-V, start by entering your personal information, including your name, address, and PAN. Next, move on to tax computation which captures the overall tax amount owed or refunded. This section is fundamental, as it summarizes your tax obligations based on your income. Finally, ensure you fill in the verification details accurately, including the date and signature, verifying that the information provided is complete and true.

Common mistakes to avoid

Common errors while completing Form ITR-V can lead to significant issues down the line. It's crucial to double-check the acknowledgment number since it's pivotal for recognition. Misstating details like PAN or personal information can lead to your application being rejected. Additionally, not signing the form or unclear signatures can render it invalid, so ensure all sections are thoroughly reviewed before submission.

Editing and modifying Form ITR-

Using pdfFiller to edit ITR-

Editing ITR-V can be made simple with pdfFiller’s user-friendly platform. To modify your form, upload it into the system, which allows you to edit any of the fields directly. The intuitive interface provides easy navigation, enabling you to rectify mistakes in personal information or tax details accurately. Features for annotation and commenting are also available, ensuring that you can add notes or clarifications directly on the document.

Best practices for document collaboration

Collaborating on ITR-V can be seamless with pdfFiller. You can invite team members to review and input their suggestions on the document. Utilize the review features to track changes made by others, ensuring clarity and accuracy. Before finalizing the document to submit, review all changes collectively, reinforcing the validity and precision of the final submission. This collaborative approach not only enhances accuracy but also speeds up the process of completing and submitting your ITR-V.

Signing Form ITR-

e-signature options available

Electronic signatures are essential for streamlining the process of signing Form ITR-V. With pdfFiller, users can easily eSign their documents in compliance with existing regulations. The e-signature process is straightforward; simply click the designated area on the form to initiate the signing process. This method not only simplifies the traditional signing but also secures your document, ensuring it remains tamper-proof and valid for submission.

Legality of eSignatures for tax documents

Understanding the legality of eSignatures is crucial when dealing with tax documents like Form ITR-V. Legal frameworks in India recognize eSignatures as valid for several nationwide processes, including tax submissions. Engaging pdfFiller’s e-signature features guarantees compliance with such regulations, boosting your confidence while filing. Thus, utilizing eSignatures is a secure and legally acceptable way to finalize your Form ITR-V.

Managing your ITR- document

Saving and storing your ITR-

After completing and signing your ITR-V, it’s crucial to store the document securely for future reference. pdfFiller offers cloud storage options, allowing you to save your ITR-V in a safe digital environment. Best practices suggest setting up an organized folder system, categorizing documents by year and type, making retrieval seamless whenever required. This method can save you time and effort during subsequent tax seasons, when accessing prior documents becomes necessary.

Sharing your ITR- with tax authorities

Once your ITR-V is finalized, sharing it with tax authorities is the next step. pdfFiller makes it convenient to submit your ITR-V online. By following the instructions on the platform, you can ensure your document arrives at the correct destination. After submission, it’s advisable to confirm receipt from the tax department, thereby verifying that everything is in order and your filing is complete. This proactive approach can prevent potential issues that may arise during tax assessments.

Troubleshooting common issues with Form ITR-

Frequently encountered problems

Encountering issues while dealing with Form ITR-V is not uncommon. Common error messages might include problems with the acknowledgment number or mismatches in personal data. Such errors can lead to delays in processing or rejections, which can be frustrating for taxpayers. Understanding these potential pitfalls can help prepare users to handle them swiftly and efficiently.

Quick fixes and solutions

Resolving issues with Form ITR-V can often be achieved through careful reevaluation of the information provided. Double-check the acknowledgment number and ensure it aligns with the ITR filed. If discrepancies occur, revisiting the original ITR submission may reveal the source of issues. Should problems persist, consulting a tax professional can offer additional guidance and solutions, ensuring your tax filing is correct and on time.

Interactive tools for Form ITR-

Assessment tools available in pdfFiller

One of the standout features of pdfFiller is its interactive assessment tools designed for users managing Form ITR-V. These tools include autogenerated prompts that guide users through the necessary fields, ensuring that no vital information is overlooked. The user-friendly interface enhances the experience of dealing with tax documents, allowing for easier navigation through complex forms.

Comparison with other document management solutions

When evaluating different document management solutions for handling Form ITR-V, pdfFiller emerges as a superior option. Unlike many alternatives, pdfFiller allows seamless integration with various financial and tax software, enhancing productivity. Furthermore, the comprehensive support for e-signatures and cloud storage reinforces pdfFiller's position as a preferred choice for tax professionals and individuals alike.

Additional features offered by pdfFiller

Beyond essential features, pdfFiller includes advanced document management options, making it ideal for users navigating through tax documentation. It offers integration capabilities with other apps, which can streamline the overall filing process. Additionally, pdfFiller's access-from-anywhere benefits allow teams to work collaboratively in real-time without geographical constraints, ensuring a united approach to tax management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form itr-v and form to be eSigned by others?

How do I edit form itr-v and form online?

Can I edit form itr-v and form on an iOS device?

What is form itr-v and form?

Who is required to file form itr-v and form?

How to fill out form itr-v and form?

What is the purpose of form itr-v and form?

What information must be reported on form itr-v and form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.