Get the free Form 8849

Get, Create, Make and Sign form 8849

How to edit form 8849 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8849

How to fill out form 8849

Who needs form 8849?

Form 8849: How-to Guide

Understanding Form 8849

Form 8849 is a key document used by businesses and individuals to claim refunds for certain excise taxes that have been paid. Understanding this form is crucial for anyone involved with goods that are subject to these taxes.

The primary purpose of Form 8849 is to provide a means for taxpayers to request refunds or credits for federal excise taxes that they have either overpaid or for which they believe they are entitled to a refund due to special circumstances, such as qualified fuel use or other specific scenarios.

This form covers various excise taxes, including but not limited to taxes on gasoline, diesel fuel, alcohol, and environmental taxes. Knowing which taxes apply to your situation can significantly influence your eligibility for a refund.

Those required to file Form 8849 typically include businesses engaged in activities where excise taxes are applied. However, it may also be relevant for individuals who have incurred such taxes in specific situations.

Eligibility to file Form 8849

Eligibility to file Form 8849 primarily hinges on your involvement with excise taxes. Any business or individual who has paid federal excise tax on gasoline, highway use fuel, or certain other products can utilize this form to request a refund.

Conversely, if you have not paid any excise tax or if your activities do not pertain to those covered by Form 8849, filing this form is unnecessary. For example, an individual purchasing regular gasoline for personal use may not need to file if no federal taxes are paid.

Special cases may arise for tax-exempt organizations and government entities that purchase fuel without paying excise tax upfront. In such cases, it may be prudent to consult with a tax professional or the IRS directly to understand your filing requirements.

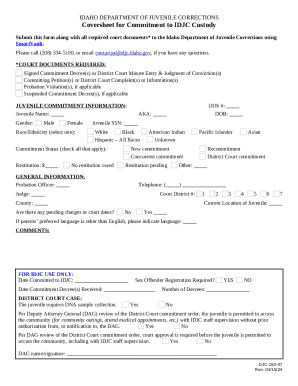

Information required to complete Form 8849

To complete Form 8849 accurately, you will need comprehensive personal and business information, such as your identification details, business name and address, and employer identification number (EIN) if applicable.

Moreover, you’ll also be required to include specific schedules that correspond with the type of excise tax refund you are claiming. The key schedules include Schedule 1 for alcohol and tobacco, Schedule 2 for fuel taxes, and Schedule 3 for other excise taxes.

Step-by-step guide to filling out Form 8849

Completing Form 8849 requires a series of well-defined steps to ensure accuracy and compliance with IRS regulations. Follow these steps carefully:

Each step is crucial for ensuring your refund claim is processed without delay. Utilization of pdfFiller can streamline the completion process.

Filing deadlines & extensions for Form 8849

Filing your Form 8849 requires adherence to specific deadlines, typically dictated by the type of tax you are claiming a refund for. Generally, the IRS provides a three-year period from the date of the tax payment in which you can submit Form 8849 for a refund.

In case you cannot meet this deadline, requesting an extension may be possible by contacting the IRS directly or following their guidelines based on your specific situation.

Common mistakes to avoid when filing Form 8849

Many errors can complicate the process of filing Form 8849. Awareness of these common errors can help you avoid potential pitfalls and enhance your chances of a successful claim.

Frequently asked questions about Form 8849

Once you have submitted Form 8849, you might have several questions regarding the subsequent processes and outcomes. Common queries include what happens after submission, how to check the status of your submission, and the possibility of amending a filed form.

Benefits of using pdfFiller for Form 8849

Utilizing pdfFiller for Form 8849 can significantly ease the process of filling out this crucial document. This platform not only allows you to edit PDF forms seamlessly but also provides the functionality to eSign them directly from anywhere.

Moreover, pdfFiller offers collaborative tools that enable team members to work together efficiently on Form 8849, ensuring all necessary information is gathered promptly.

Special considerations for filing Form 8849

Filing Form 8849 can attract the attention of tax audits, making it crucial to maintain thorough and accurate records. Keeping well-organized documentation will save you potential headaches during any potential audit processes.

Additionally, staying updated on tax laws and regulations related to excise taxes is vital. Changes in laws can affect your eligibility and the way refunds are handled, so keeping abreast of IRS updates is advisable.

Helpful resources

Numerous resources can assist you with Form 8849, from the IRS guidance pages to comprehensive instructions provided by tax professionals. Utilizing these resources can enhance your understanding and effectiveness in filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8849 without leaving Google Drive?

Can I create an eSignature for the form 8849 in Gmail?

How do I fill out form 8849 using my mobile device?

What is form 8849?

Who is required to file form 8849?

How to fill out form 8849?

What is the purpose of form 8849?

What information must be reported on form 8849?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.