Get the free Invoice

Get, Create, Make and Sign invoice

Editing invoice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invoice

How to fill out invoice

Who needs invoice?

Comprehensive Guide to Invoice Forms

Understanding invoice forms

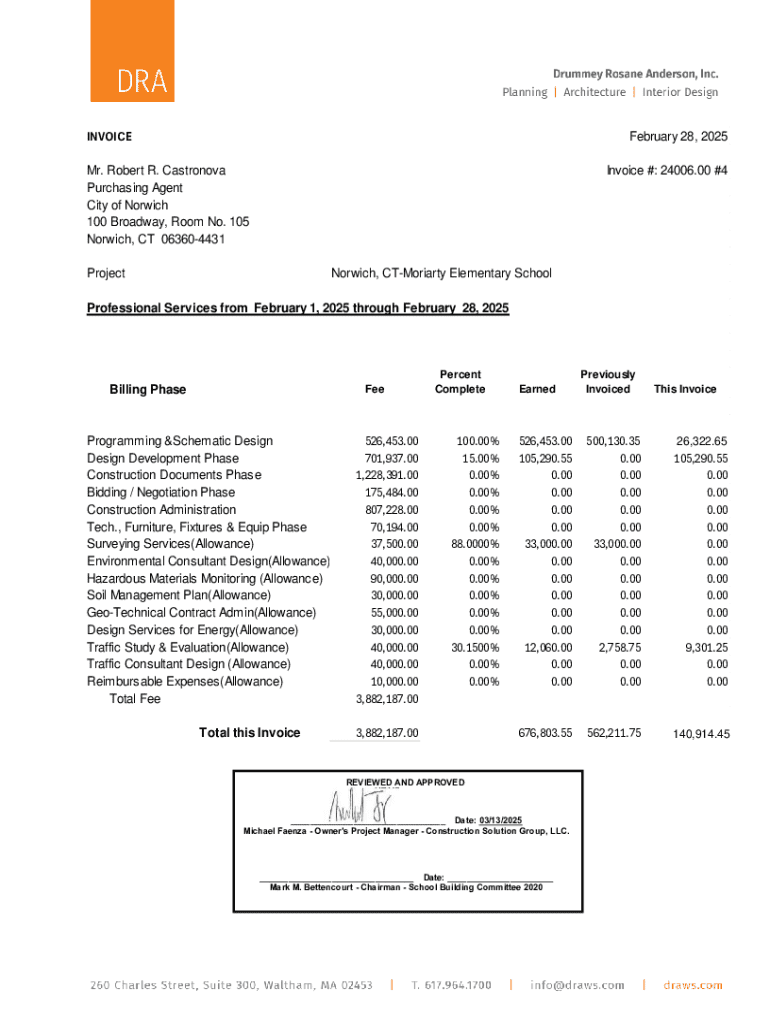

An invoice form is a crucial document that serves as an official request for payment from a buyer to a seller. Its importance cannot be overstated, as it ensures that both parties have a clear understanding of the transaction details, ultimately facilitating timely payments. Invoice forms protect the interests of businesses, freelancers, and service providers, offering a detailed account of goods or services rendered, payment amounts, and deadlines.

Key components of an invoice typically include the seller's and buyer's information, a unique invoice number, date of issue, itemized list of products or services, total amount due, payment terms, and methods accepted. A well-structured invoice not only aids in getting timely payments but also acts as a record for accounting and tax purposes.

Types of invoice formats

Invoice formats vary depending on the nature of the transaction. Understanding these types can help in choosing the right template for specific needs.

Invoice forms by industry

Different industries may require unique formatting and details in their invoices to comply with legal or business standards.

Invoice forms by region

Regional differences can greatly affect the format and requirements of invoices, necessitating awareness of local regulations.

Additionally, consider language variations for multilingual invoices, making it easier for clients from different backgrounds to understand the document clearly.

How to create an invoice form using pdfFiller

Creating an invoice form is streamlined with pdfFiller, which offers a variety of templates to suit different needs. Here's a step-by-step guide to creating your invoice using their platform.

Best practices for filling out an invoice form

Filling out an invoice form accurately is crucial for ensuring clarity and prompt payment. Here are several best practices to follow:

Interactive tools for invoice management

pdfFiller offers interactive features that enhance invoice management, transforming a standard form into a dynamic tool for your business.

Common mistakes to avoid with invoice forms

Invoicing errors can lead to delayed payments and misunderstandings between clients and service providers. Here are common mistakes to avoid:

Ensuring compliance and accuracy in invoicing

Compliance with local regulations is paramount when generating invoices. Different jurisdictions may have unique requirements regarding content and formatting.

Frequently asked questions about invoice forms

Answering common inquiries can clarify confusion around invoice processes and ensure everyone is on the same page.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my invoice in Gmail?

How do I edit invoice on an iOS device?

Can I edit invoice on an Android device?

What is invoice?

Who is required to file invoice?

How to fill out invoice?

What is the purpose of invoice?

What information must be reported on invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.