Get the free Mortgage Loan Insurance

Get, Create, Make and Sign mortgage loan insurance

Editing mortgage loan insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage loan insurance

How to fill out mortgage loan insurance

Who needs mortgage loan insurance?

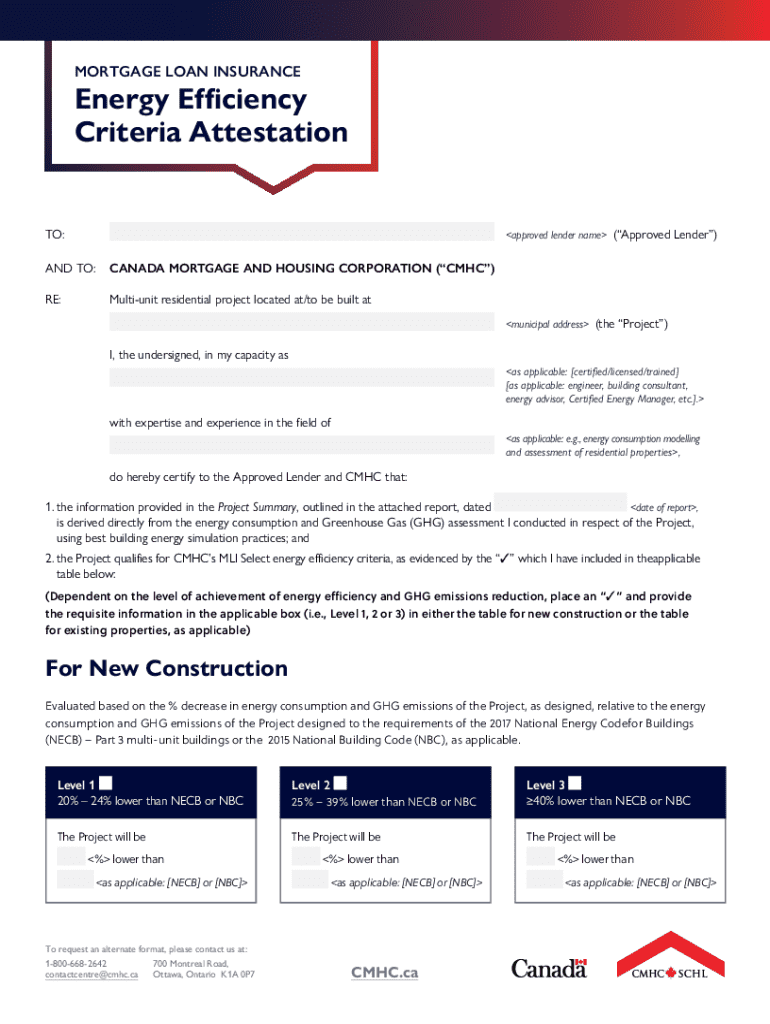

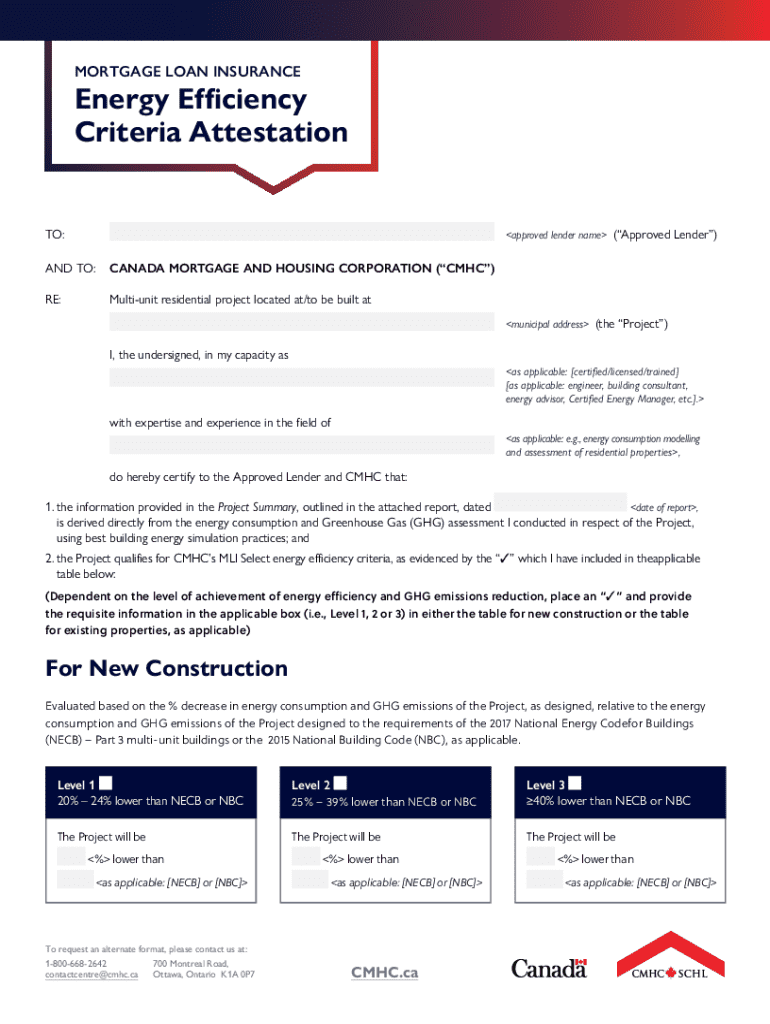

A Comprehensive Guide to the Mortgage Loan Insurance Form

Understanding mortgage loan insurance

Mortgage loan insurance is a financial safeguard for lenders when borrowers are unable to provide a substantial down payment. Specifically, it protects the lender against potential losses in case the borrower defaults on the loan. Typically, mortgage loan insurance is required when the down payment is less than 20% of the home’s purchase price; this type of coverage reduces the risk for lenders, making it easier for individuals to qualify for a mortgage.

Importance cannot be overstated in the home buying process, particularly for first-time buyers or those with limited savings. By allowing lower down payments, mortgage loan insurance opens the doors to homeownership for a larger segment of the population. Understanding the different types, such as traditional mortgage insurance (often required for conventional loans) and high-ratio insurance (more common with government-backed loans), can guide purchasers toward responsible financial decisions.

Key components of the mortgage loan insurance form

The mortgage loan insurance form serves as the foundation for obtaining this essential insurance. This form generally requires personal information, property details, and financial specifics. Accurate completion is critical as errors could delay the processing of the insurance or potentially jeopardize loan approval.

Key information required includes:

Understanding the terms and conditions of the form is also critical. This section outlines the obligations, potential fees, and legal implications, which every borrower must thoroughly review.

Step-by-step guide to filling out the mortgage loan insurance form

Completing the mortgage loan insurance form can feel daunting, but armed with a checklist, the process can be much more manageable. Here’s a step-by-step guide to help you through.

Key tips for avoiding common mistakes include double-checking social security numbers for accuracy and being careful with property details to ensure everything is correct.

Editing and managing your mortgage loan insurance form

Once the mortgage loan insurance form is submitted, you may find that revisions are necessary. It’s vital to understand how to manage and edit the form effectively.

If you need to make changes after submission, contact your lender as soon as possible. They might provide options for corrections or adjustments.

Utilizing tools like pdfFiller makes editing and management streamlined. Features include:

eSigning your mortgage loan insurance form

eSigning has become a vital component of document management in today’s digital age, making the process more efficient and secure. An eSignature can provide the same legal standing as a traditional handwritten signature when executed properly.

To eSign your form with pdfFiller, follow these steps:

Collaboration features for teams

For professionals working in teams, sharing the mortgage loan insurance form with others is crucial for effective collaboration. pdfFiller offers collaborative features that allow multiple users to interact with the form dynamically.

Real-time collaboration is made easier with features that include:

Frequently asked questions about mortgage loan insurance

As you navigate the mortgage loan insurance process, you may find yourself with questions. Below are answers to some commonly asked queries.

Tools and resources for mortgage loan insurance

To make informed decisions regarding mortgage loan insurance, there are various tools and resources available.

Reporting issues and seeking help

If you encounter issues with your mortgage loan insurance application, addressing them quickly is important. Reporting errors or seeking help can ensure a smoother process.

Simply contact your lender or the support team for assistance with your form. They can guide you in correcting any discrepancies and navigating issues that arise.

Staying informed about changes in mortgage loan insurance

Staying updated with current trends and market insights regarding mortgage loan insurance is critical in ensuring you’re making the best decisions for your financial future. This includes understanding shifts in policy and insurance requirements that can affect your home loan.

Related topics and best practices

Understanding how mortgage loan insurance fits into the broader context of real estate and investment strategy is vital. Connecting with NHA approved lenders will also help streamline your insurance process, enhancing your chances of securing the best terms.

Best practices include:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mortgage loan insurance?

How do I execute mortgage loan insurance online?

Can I create an eSignature for the mortgage loan insurance in Gmail?

What is mortgage loan insurance?

Who is required to file mortgage loan insurance?

How to fill out mortgage loan insurance?

What is the purpose of mortgage loan insurance?

What information must be reported on mortgage loan insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.