Get the free Schedule 2: Governmental Funds Summary

Get, Create, Make and Sign schedule 2 governmental funds

Editing schedule 2 governmental funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 2 governmental funds

How to fill out schedule 2 governmental funds

Who needs schedule 2 governmental funds?

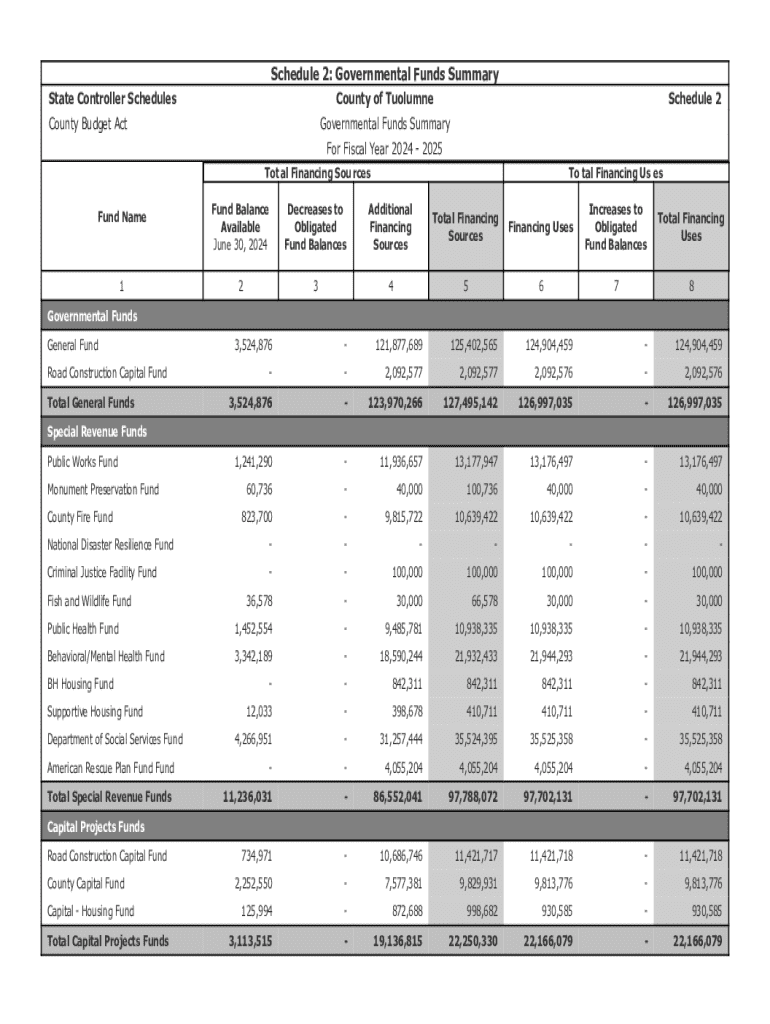

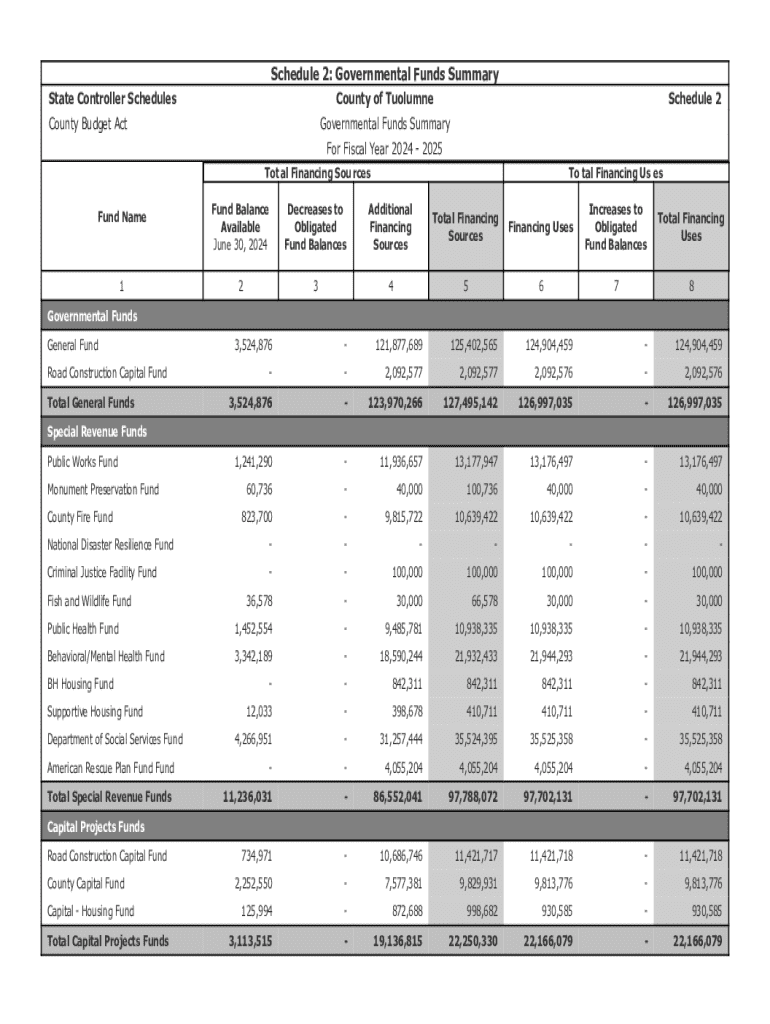

Understanding the Schedule 2 Governmental Funds Form

Overview of governmental funds

Governmental funds are essential components of the public finance structure, designed to manage and track the financial resources allocated to governmental entities. These funds are classified based on their intended use and revenue sources, ensuring that public money is appropriately utilized for various programs and services.

The significance of governmental funds lies in their role as a framework for transparency, accountability, and effective service delivery. Each type of fund caters to specific operational functions and contributes to the overall financial health of governmental entities. The primary types include:

Understanding Schedule 2

Schedule 2 is a vital reporting tool within governmental accounting frameworks. It specifically focuses on detailing the financial activities of various governmental funds, providing clarity on revenues, expenditures, and fund balances.

The importance of Schedule 2 cannot be overstated. It helps in ensuring accurate financial reporting, promoting standards compliance, and enabling better decision-making processes at various governmental levels. Despite its crucial role, some misconceptions persist, such as confusion about its submission timeline and misinterpretations of its data requirements.

Key components of the Schedule 2 governmental funds form

Understanding the specific sections of the Schedule 2 form is critical for accurate reporting. Every section serves a distinct purpose and encompasses necessary financial data.

Each section requires specific details, including revenue sources, amounts spent, and remaining balances, which collectively provide a comprehensive view of a government's financial position.

Step-by-step instructions for completing the Schedule 2 form

Filling out the Schedule 2 form involves several strategic steps. Proper preparation sets the foundation for accurate reporting.

Common pitfalls include overlooking significant transactions or misclassifying expenditures, both of which could lead to inaccurate reporting.

Interactive tools for facilitating the Schedule 2 process

Utilizing modern tools can greatly simplify the complexities involved in completing the Schedule 2 form. pdfFiller offers an intuitive platform that allows users to efficiently prepare and manage documents from any device.

Frequently asked questions about Schedule 2 governmental funds form

As governmental entities prepare to report via Schedule 2, several common questions often arise. Addressing these inquiries helps clarify the process.

Best practices for governmental fund reporting

Effective governmental fund reporting hinges on employing best practices that promote accuracy and reliability in financial statements.

Case studies: successful Schedule 2 reporting

Examining real-world examples of effective Schedule 2 reporting provides valuable insights into overcoming challenges and implementing best practices.

Future trends in governmental fund reporting

As we look forward, several trends indicate the direction of governmental fund reporting. Emerging technologies play a pivotal role, integrating advanced software solutions for streamlined financial management.

Valuable additional resources for governmental funds

A variety of resources are available to assist in navigating the complexities of governmental fund reporting. These facilitate understanding and compliance with ever-evolving standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete schedule 2 governmental funds online?

Can I create an electronic signature for signing my schedule 2 governmental funds in Gmail?

How do I complete schedule 2 governmental funds on an iOS device?

What is schedule 2 governmental funds?

Who is required to file schedule 2 governmental funds?

How to fill out schedule 2 governmental funds?

What is the purpose of schedule 2 governmental funds?

What information must be reported on schedule 2 governmental funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.