Get the free 2021 Tax Rate Calculation Worksheet

Get, Create, Make and Sign 2021 tax rate calculation

Editing 2021 tax rate calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 tax rate calculation

How to fill out 2021 tax rate calculation

Who needs 2021 tax rate calculation?

2021 Tax Rate Calculation Form: Your Comprehensive Guide

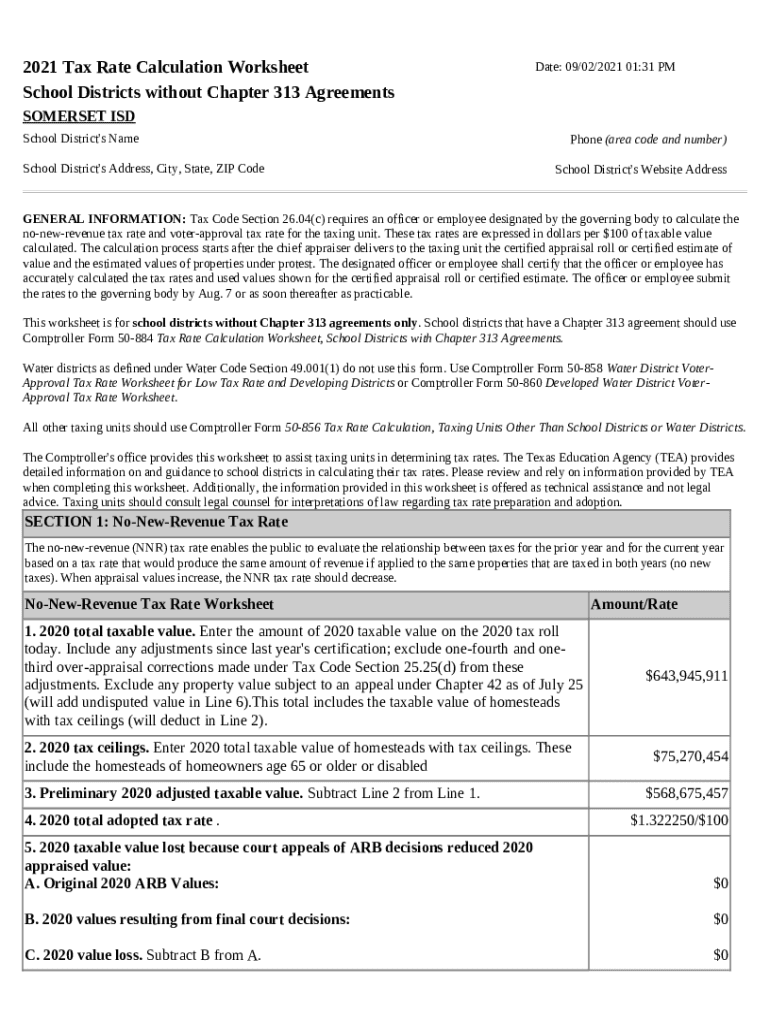

Overview of the 2021 tax rate calculation

Understanding your tax obligations is crucial, and the 2021 tax rate calculation form represents a key tool for ensuring accurate financial reporting. The calculations derived from this form will directly influence your tax liability, potentially resulting in either refunds or payments. Familiarity with tax regulations and the structure of the 2021 rates is necessary to navigate the filing process effectively.

Essential terms include 'filing status,' which categorizes the individual into brackets like single, married filing jointly, or head of household, and 'gross income,' which encompasses all income before deductions. Having a clear grasp of these concepts not only simplifies the process but can also lead to optimized tax savings.

How to access the 2021 tax rate calculation form

To begin the tax calculation process, you need to access the 2021 tax rate calculation form. A straightforward method is through the pdfFiller platform, which offers comprehensive tools for document management and tax preparations.

Follow these steps to access it:

Detailed instructions for filling out the 2021 tax rate calculation form

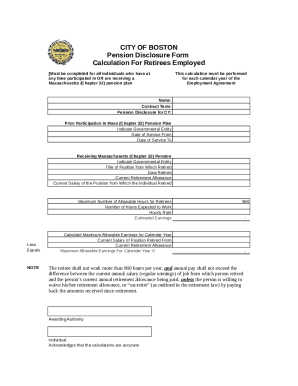

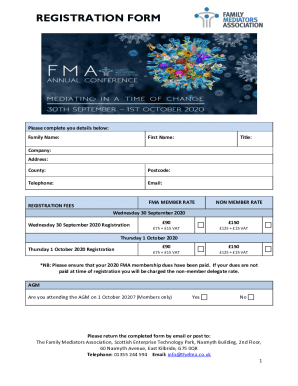

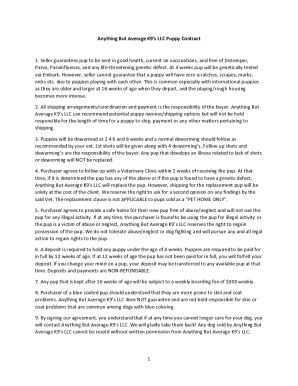

Completing the 2021 tax rate calculation form involves several sections, each requiring careful consideration and accurate data entry. The format is designed to collect necessary information to calculate your tax liability correctly.

Here's a breakdown of the essential sections:

Be mindful of common mistakes, such as incorrect Social Security numbers or mathematical errors. Double-checking entries can mitigate these issues and ensure accuracy in your calculations.

Understanding 2021 tax brackets and rates

The 2021 federal income tax brackets establish the rate at which your income is taxed. Understanding where your income falls within these brackets is paramount for determining your overall tax liability.

As of 2021, the tax rates are broken down into seven brackets, ranging from 10% to 37%. Here's how to determine your tax bracket based on your total taxable income:

Use an interactive calculator available on the pdfFiller website to estimate your tax obligation based on your inputs.

Specific deductions and credits for 2021

Understanding deductions and credits is crucial, as they can significantly reduce your tax liability. For the 2021 tax year, taxpayers have the option between standard deductions and itemized deductions.

The standard deduction for individuals is $12,550, while married couples filing together enjoy a deduction of $25,100. Itemizing deductions may yield better savings if your eligible expenses exceed the standard amount.

Additionally, tax credits such as the Earned Income Tax Credit (EITC) and the Child Tax Credit provide substantial benefits:

Advanced tax topics for 2021

For taxpayers with more complex financial situations, advanced tax topics such as the Alternative Minimum Tax (AMT), Qualified Business Income Deduction, and capital gains taxation might apply.

The AMT ensures that individuals who benefit from certain deductions still pay a minimum amount of tax. Understanding the Qualified Business Income Deduction allows business owners to take a deduction of up to 20% of qualified business income, which can substantially lower their tax burden. Lastly, capital gains tax rates are critical when selling investments, distinguishing between long-term and short-term capital gains.

State-specific tax implications

In addition to federal taxes, state tax regulations can greatly impact overall tax obligations. Every state has its own income tax rate, which can vary widely depending on local laws.

Resources such as your state's Department of Revenue website can provide detailed tax brackets and specific deductions. Being aware of these state-specific aspects is crucial in achieving an accurate overall tax rate calculation.

What our users are saying: testimonials and case studies

Many users have found the 2021 tax rate calculation form offered by pdfFiller to be a game-changer in simplifying tax calculations. Real-life testimonials reveal the effectiveness of the platform in managing complex taxation needs.

For example, one user highlighted how the ease of data entry and the interactive calculator allowed them to accurately estimate their tax, ultimately leading to a significant refund they weren't anticipating. These real-life cases illustrate the practical benefits of using pdfFiller for tax documentation.

Keeping up to date: future tax rate changes

Tax laws can evolve quickly, impacting future tax rates and benefits. Anticipating changes for 2022 and beyond is necessary for individual financial planning. It's essential to stay informed about legislative updates that might affect individual circumstances.

Engage with reliable tax news sources or follow the IRS website for updates that can help you prepare for upcoming tax seasons.

Frequently asked questions (FAQs)

As users embark on their tax-filing journey, they often encounter questions related to the tax rate calculation process. General inquiries about what constitutes taxable income and how deductions are claimed frequently arise.

Moreover, specific inquiries about using pdfFiller for tax documentation point towards commonly encountered user scenarios, such as how to save, edit, and eSign filled forms securely on the platform.

Additional tools and resources for effective tax management

Utilizing the range of tax calculators available on pdfFiller can assist users in determining their obligations with greater accuracy. The platform's features provide comprehensive document management, making it easier to create, edit, and comment on tax forms.

Leveraging pdfFiller not only simplifies tax preparation but also enhances collaborative workflows, allowing teams to work together on financial documents seamlessly, regardless of location.

Feedback and continued learning

Feedback from users allows the pdfFiller team to improve user experience continually. Sharing insights on the tax calculation process can lead to better practices and innovation in tools provided.

Continuing education related to tax regulations is also advised, ensuring that both individuals and teams are equipped with the latest knowledge and tools for efficient tax management each season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2021 tax rate calculation online?

Can I create an eSignature for the 2021 tax rate calculation in Gmail?

How do I edit 2021 tax rate calculation straight from my smartphone?

What is tax rate calculation?

Who is required to file tax rate calculation?

How to fill out tax rate calculation?

What is the purpose of tax rate calculation?

What information must be reported on tax rate calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.