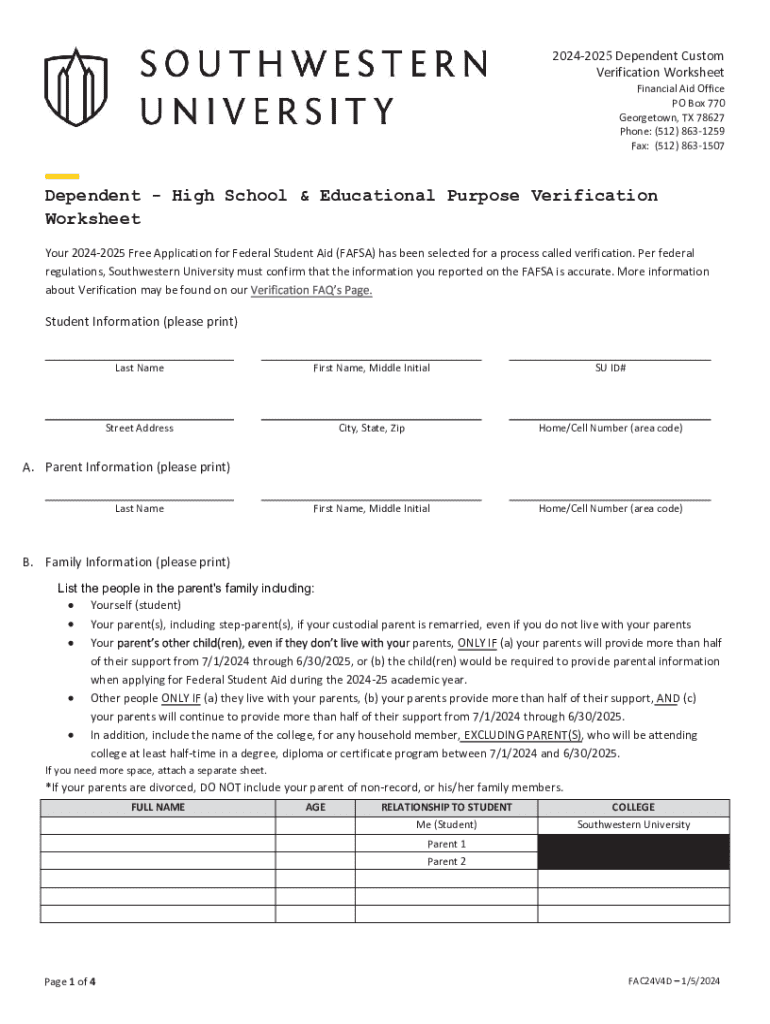

Get the free 2024-2025 Dependent Custom Verification Worksheet

Get, Create, Make and Sign 2024-2025 dependent custom verification

Editing 2024-2025 dependent custom verification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024-2025 dependent custom verification

How to fill out 2024-2025 dependent custom verification

Who needs 2024-2025 dependent custom verification?

Comprehensive Guide to the 2 Dependent Custom Verification Form

Overview of the 2 dependent custom verification form

The 2 dependent custom verification form serves as a crucial document for individuals and families seeking financial aid or benefits associated with dependents. This form is essential for confirming the eligibility of dependents as part of various programs, including school enrollment and financial assistance from educational departments.

Filling out the 2 dependent custom verification form ensures a streamlined process for verifying the financial and familial circumstances of applicants. Its purpose extends beyond just meeting requirements; it aims to provide authentic verification leading to appropriate assistance for students and their families.

Who needs this form?

The 2 dependent custom verification form is primarily intended for families and individuals whose dependents are applying for financial aid or need verification of their status for school enrollment programs. It is especially relevant for applicants looking to secure funds from grants or scholarships that require proof of dependent status.

This includes diverse groups, such as parents applying for their children’s educational grants, guardians seeking assistance for their dependents, and students who wish to validate their household circumstances. The target audience is broad, with anyone connected to a dependent's educational or financial aid process benefiting from this form.

Key updates for the 2024 version

With every new academic year comes updates and enhancements to essential forms. For the 2 dependent custom verification form, users can anticipate several changes that refine the verification process. These updates aim to make the form more user-friendly while ensuring compliance with the latest regulations concerning financial aid and dependent verification.

One significant update includes a simplified format that reduces the complexity of providing required information. Additionally, the submission process has been streamlined to ensure timely processing, allowing families to receive feedback and assistance more efficiently.

Important dates to remember

It is essential to stay informed about deadlines associated with the 2 dependent custom verification form. Key dates will vary by institution, but generally include submission deadlines for both the fall and spring semesters. Missed deadlines can lead to complications in receiving financial aid or might delay enrollment for new students.

Make sure to regularly check updates from your educational institution’s department of education to stay ahead of submission deadlines. Typically, submission will be due at least a few weeks before the start of the new term.

How to access the custom verification form

Accessing the 2 dependent custom verification form is simple and can be done via pdfFiller, which offers a user-friendly platform for all your document needs. To begin, navigate to the pdfFiller website, where the form can be easily located through the search function.

Once located, you can download the form in several formats, including PDF or Word. Having it in a digital format allows for easy editing and filing, catering to your specific requirements.

Detailed instructions for filling out the form

Filling out the form correctly is vital to ensure a smooth verification process. Here are the key steps involved:

Step 1: Basic information

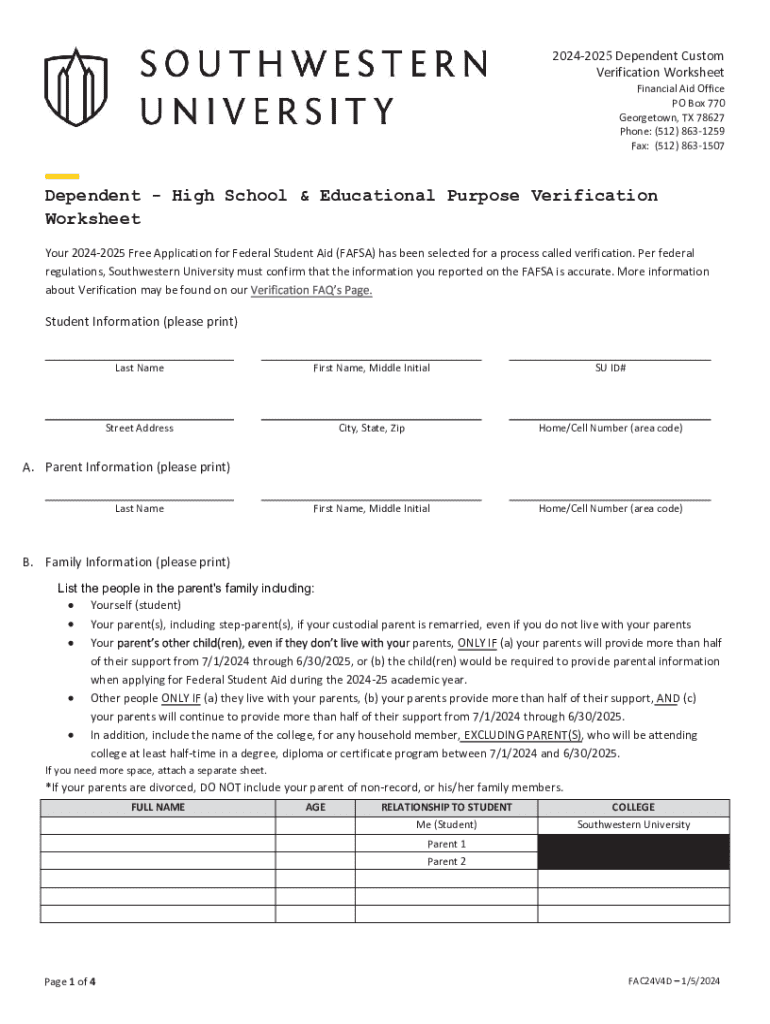

The first section of the form requires basic applicant details such as name, address, contact information, and any identification numbers assigned by educational departments. Accurate information reduces processing delays.

Step 2: Dependent information

Next, provide detailed information about each dependent. This includes their full names, ages, and relationships to you, the applicant. Ensure you include any documentation that proves their qualifying status, such as birth certificates or adoption papers.

Step 3: Income verification section

An essential part of the 2 dependent custom verification form is the income verification section. You must include financial information for the past year, often provided through tax documents, such as IRS tax returns or recent pay stubs. Be prepared to submit accepted forms of proof to substantiate your income claims.

Step 4: Additional information

Lastly, there may be optional sections where you can provide additional explanations or context that supports your verification request. Use this space wisely to clarify any complex situations regarding your dependents or your financial standing.

Interactive tools for form completion

One significant advantage of utilizing pdfFiller for your 2 dependent custom verification form is its suite of interactive tools that enhance the document-filing experience. The platform allows for simple editing, reordering, and adding of additional pages as necessary. You can easily input your information without worrying about formatting issues.

Additionally, the collaborative features enable multiple team members to work on the document simultaneously. This real-time collaboration means that families can communicate changes or updates instantly, making the completion of the form more efficient compared to traditional paper methods.

Submission process

Once you have completed the 2 dependent custom verification form, it's time to submit it. There are several methods for submission: online through the educational department’s portal, by mail, or in person at designated locations. Each method has its advantages, so choose the one that best suits your preferences and timelines.

After submitting your form, you should always receive confirmation, regardless of the method used. This confirmation can take various forms, including email receipts or mailed letters, indicating that your submission has been successfully received. Keeping this confirmation is crucial to ensure you can follow up if necessary.

Common verification issues and resolutions

Despite careful preparation, applicants may encounter issues during the dependent verification process. Common mistakes include missing documentation or discrepancies between reported income and tax documents. Such errors can lead to delays, and in some cases, a rejection of your application.

To resolve these issues, it is vital to double-check all entries for accuracy before submission. If problems persist, it’s advisable to contact the assistance hotline provided by your educational institution. These representatives specialize in handling verification issues and can offer specific advice on how to rectify your application status.

Verification policies and procedures

Understanding the verification policies associated with the 2 dependent custom verification form is crucial. These policies are not merely bureaucratic; they ensure the integrity of the information provided and safeguard both applicants and educational departments against fraudulent claims. Compliance with these regulations is mandatory.

Procedural guidelines also play a significant role in how verification applications are handled. Typically, these processes include initial review stages, potential follow-ups for missing documentation, and final decisions based on submitted completeness and accuracy. Sensitive handling of personal and financial data is strictly enforced throughout the process.

Acceptable documentation for verification

When filling out the 2 dependent custom verification form, providing the right documentation is critical. Various documents are acceptable, including birth certificates for dependents, tax returns for income verification, and identification cards for applicants and dependents alike.

There are also exclusions regarding unacceptable forms of proof. Items such as outdated or unofficial documents may not be honored. Therefore, it is crucial to check the list of acceptable documentation provided by your educational department to ensure nothing essential is left out.

In-depth look at AGI and income tax documentation

Adjusted Gross Income (AGI) is a pivotal element in assessing an individual’s financial capability when filling out the 2 dependent custom verification form. AGI essentially refers to an individual’s total gross income minus specific deductions. It is important for applicants to comprehend their AGI since it directly influences the eligibility for various educational benefits and financial aid.

To retrieve AGI, individuals typically refer to their filed tax returns, which can be obtained from tax software, financial institutions, or the IRS. Accurate retrieval and presentation of this documentation are vital to ensure that applicants meet eligibility requirements set by educational institutions.

Family size documentation requirements

Providing evidence of family size is a commonly overlooked aspect of the 2 dependent custom verification form. Educational departments require a clear demonstration of household composition, as this not only affects the verification process but also eligibility for certain financial aids.

Acceptable forms of documentation include birth certificates, custody agreements, and official family registries. Accurate representation of family size is crucial as it can determine the level of need-based financial assistance and support structures accessible to applicants and their dependents.

Frequently asked questions (FAQs)

As applicants navigate the process of completing the 2 dependent custom verification form, questions often arise. Common inquiries include how timely submission affects eligibility, the specific documentation needed for dependent verification, and what steps to take if a form needs revisions.

Providing clear answers to these questions not only empowers applicants but also helps alleviate the stress associated with the verification process. Reach out to your educational department or consult resources available at pdfFiller for immediate clarification and troubleshooting tips.

Conclusion and next steps

Completing and submitting the 2 dependent custom verification form is a critical step towards securing necessary assistance for dependents. Following submission, applicants should be aware of their rights and what to expect next, including processing times and possible follow-up communications.

Staying informed throughout this process ensures that applicants remain on track and adequately prepared for any challenges. Agencies and institutions tend to notify applicants regularly, and it is beneficial to maintain open lines of communication with educational departments for proactive navigation of future developments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2024-2025 dependent custom verification directly from Gmail?

How do I edit 2024-2025 dependent custom verification in Chrome?

How do I edit 2024-2025 dependent custom verification on an iOS device?

What is dependent custom verification?

Who is required to file dependent custom verification?

How to fill out dependent custom verification?

What is the purpose of dependent custom verification?

What information must be reported on dependent custom verification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.