Get the free Death of Investor Request to Close Account(s)

Get, Create, Make and Sign death of investor request

Editing death of investor request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out death of investor request

How to fill out death of investor request

Who needs death of investor request?

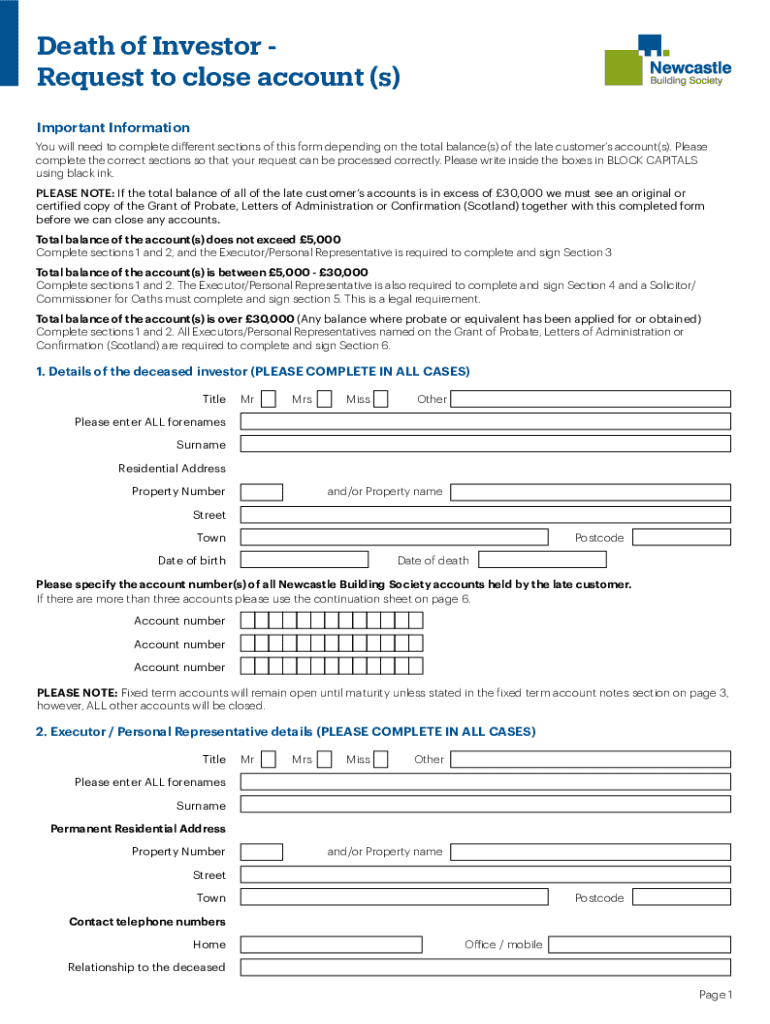

Understanding the Death of Investor Request Form

Overview of the death of investor request form

The death of investor request form is a critical document that individuals and financial institutions use in the event of an investor's passing. This form streamlines the process of transferring or accessing investment accounts after an investor has died, thus ensuring that the deceased's financial affairs are handled efficiently and in accordance with legal requirements.

Its primary purpose is to facilitate the settlement of the deceased investor's estate by providing necessary information to financial institutions, ensuring lawful management and distribution of the deceased’s assets. By utilizing this form, executors and beneficiaries can prevent unnecessary delays and complications in the administration of the estate.

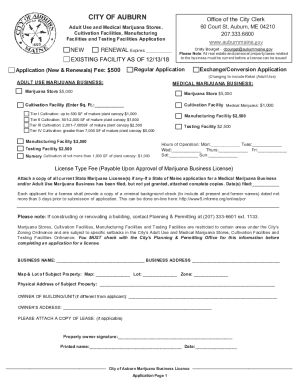

Key regulations and legal considerations

A variety of legal frameworks govern the handling of estates and the execution of wills and trust instruments. These include state laws that dictate how estates are probated and how assets are distributed among heirs. Compliance with these regulations is vital, as any oversight could lead to legal complications or delays in accessing the deceased's investment accounts.

Moreover, understanding the implications of tax laws and potential estate taxes is essential for proper estate management, which can significantly impact how an investor’s assets are distributed. Proper use of the death of investor request form allows all parties involved to navigate these complex regulations seamlessly.

Who should use the death of investor request form?

The intended users of the death of investor request form include a distinct blend of individuals and professionals involved in estate management. Individual investors who were beneficiaries or heirs to the estate of the deceased need to utilize this form to claim their entitlements appropriately.

Estate executors or administrators are obligated to use this form as part of their duties to settle the deceased’s financial affairs. Financial institutions and investment firms also play a crucial role in this process as they require this documentation to release funds or transfer accounts posthumously.

When to use the form

A need for the death of investor request form arises in specific scenarios, primarily following an investor's death. This includes instances when heirs are looking to liquidate investment accounts or transfer them as part of the estate settlement process.

Not utilizing this form can lead to significant delays in asset distribution, aside from potential legal consequences tied to improper handling of the estate. Therefore, understanding when to initiate the use of this form is pivotal for all parties involved.

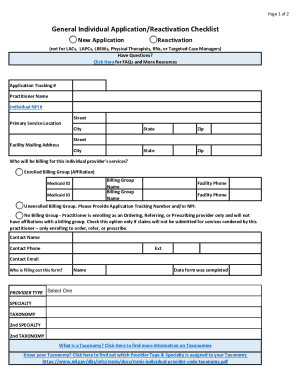

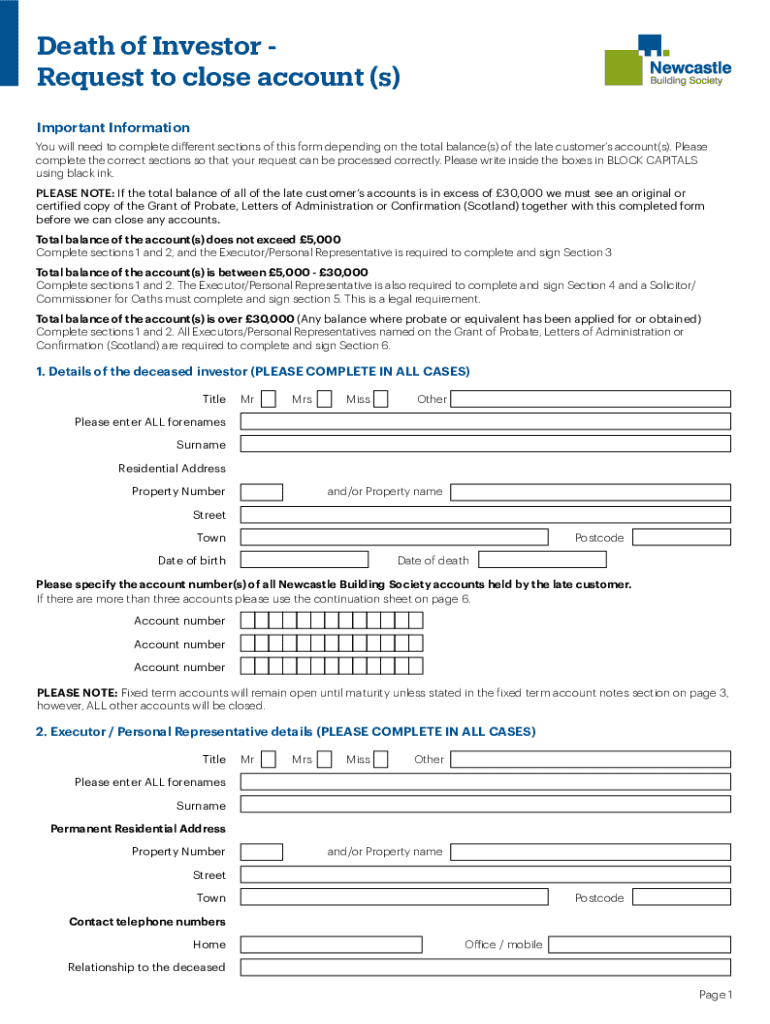

Key sections of the death of investor request form

Understanding the critical elements of the death of investor request form is essential for accurate completion. The primary components usually include identification details of the deceased investor, who they were to the submitter (executor or beneficiary), and specifics regarding the investment accounts in question.

In addition to these identifiers, the form typically requires documentation that verifies both the identity of the deceased and the legitimacy of the request. This may include a copy of the death certificate, proof of the executor’s authority (such as court documents), and valid identification of the individual submitting the request.

Required documentation

To successfully use the death of investor request form, certain documentation is mandatory. This includes:

Step-by-step instructions for completing the form

Filling out the death of investor request form accurately is crucial for ensuring a smooth process. The first step, section one, involves gathering all necessary information. Before you begin, make a checklist to ensure that you have all required personal information and documentation at hand. This preparation prevents hiccups which might occur during the submission.

Section two involves filling out the form itself. Each section has specific requirements, from personal details of the deceased to account information. Take care to enter each piece of information accurately, as mistakes can lead to processing delays.

Finally, in section three, reviewing the form for accuracy is essential before submission. Whether you choose to submit electronically or via a physical copy, verify that all necessary documents are attached and that signatures are in place.

Common pitfalls and how to avoid them

When filling out the death of investor request form, common pitfalls include failing to provide complete information, not including supporting documentation, and forgetfully omitting signatures where required. To avoid these issues, triple-check every section and ensure all required materials accompany the form.

It may also be helpful to have someone else review the completed form. A fresh pair of eyes can spot mistakes or areas where additional clarification may be needed.

Editing and modifying the form

Once the death of investor request form is filled out, there may be instances where modifications are necessary. Using pdfFiller for document editing offers users an intuitive interface for making alterations. Start by uploading your completed form into the platform, allowing access to various editing tools.

Features such as e-signature and collaboration tools make it easy to finalize documents. This flexibility helps ensure that your submission stays compliant while also retaining clarity and accuracy, crucial for legal requirements.

Ensuring compliance while modifying

When modifying the death of investor request form, adhering to guidelines is essential to maintain legal validity. Each change should not affect the integrity of the initial information. It’s critical that any edits are tracked and documented, should questions arise later about the submission.

pdfFiller’S features make it simple to maintain the original versions of documents, retaining a historical record of edits if required. This is particularly helpful during any potential audits or inquiries about the estate.

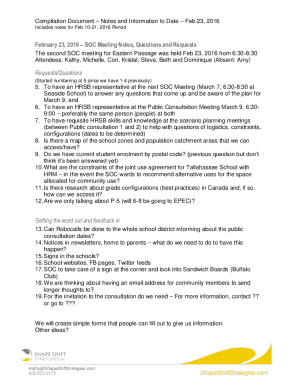

Managing the death of investor request form after submission

Post-submission, managing the death of investor request form effectively is crucial. Keeping accurate records of submitted documents ensures seamless communication and transparency among all parties involved. Organizing all investment documentation, including copies of the form and any correspondence from financial institutions, is key to preventing future misunderstandings.

Follow-up actions also play a pivotal role after submission. It’s vital to monitor the status of the request with the respective financial institutions regularly. Communication channels should remain open to hasten the process of estate settlement.

Frequently asked questions (FAQs)

To further assist users grappling with the complexities of the death of investor request form, here are some answers to common concerns:

Additional tools and resources available on pdfFiller

pdfFiller provides robust tools and resources to aid users in navigating the complexities of document management. The platform includes interactive document creation tools, offering templates for similar forms to assist in your needs. This streamlines the process of managing multiple legal documents efficiently.

The collaboration features available on pdfFiller ensure that teams can work collectively, reducing errors and increasing efficiency. Accessing customer support for any form-related queries can further enhance this process, as well as utilizing video tutorials available on the platform for additional guidance.

Importance of streamlined document management

Effective document management is fundamental when dealing with sensitive materials like the death of investor request form. Using pdfFiller enhances accessibility through its cloud-based structure, meaning you can access your documents anytime, anywhere. This eliminates the hassle of sifting through physical files.

Additionally, having a centralized platform for managing all aspects of your document workflow provides peace of mind, ensuring important documents are not lost or overlooked during the estate settlement process. Enhanced organization leads to increased productivity and smoother transitions during challenging times.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get death of investor request?

How do I edit death of investor request on an iOS device?

How do I complete death of investor request on an iOS device?

What is death of investor request?

Who is required to file death of investor request?

How to fill out death of investor request?

What is the purpose of death of investor request?

What information must be reported on death of investor request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.