Get the free Certified Statement of Fund Utilization - CA Certificate

Get, Create, Make and Sign certified statement of fund

How to edit certified statement of fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certified statement of fund

How to fill out certified statement of fund

Who needs certified statement of fund?

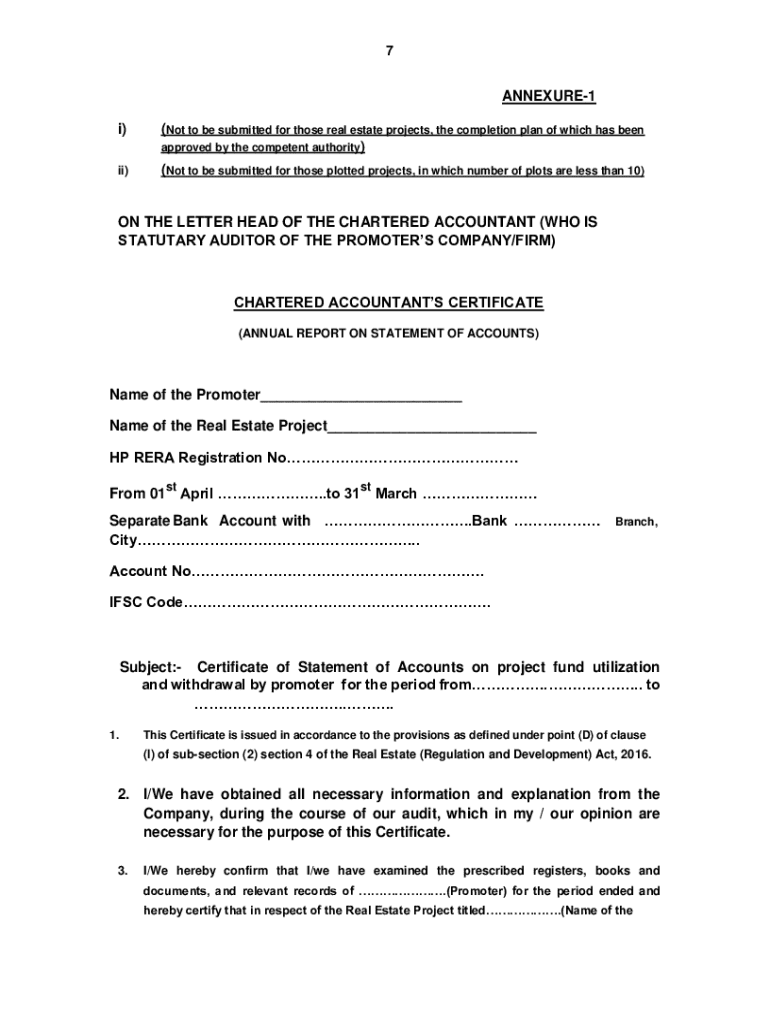

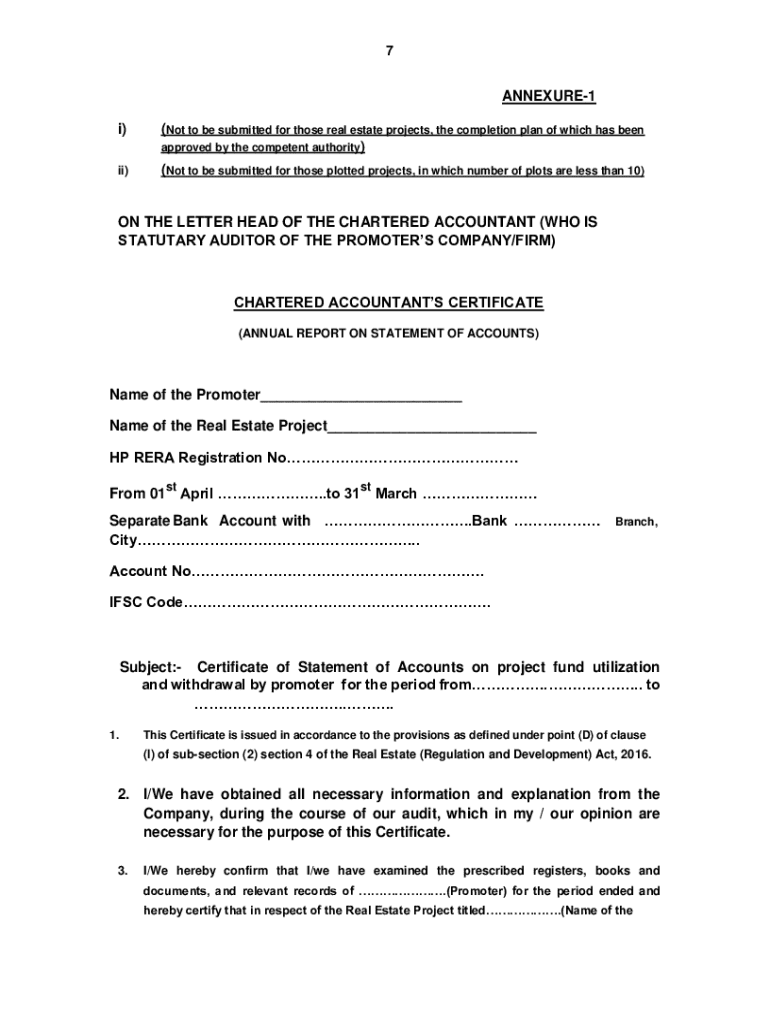

Understanding the Certified Statement of Fund Form

Understanding the certified statement of fund form

A certified statement of fund form is a crucial document used to confirm the availability and authenticity of specified funds. It serves as an official declaration, often required for various financial transactions such as loan applications, grants, scholarships, and investment activities. This form attests not just to the numerical value of funds but also to their intended use, ensuring transparency in financial dealings.

The importance of the certified statement in financial documentation cannot be overstated. It provides necessary assurance to financial institutions, investors, and regulatory bodies that the information presented by an individual or business is credible and verified. Various scenarios may require this form, such as when applying for a mortgage, seeking a business loan, or confirming funds for educational expenses.

Key components of the certified statement of fund form

The certified statement of fund form is structured to capture essential information. The primary components include personal identification details, fund source and amount, and clearly defined purposes for the requested funds. This level of detail is crucial for ensuring that all parties involved understand the context and legitimacy of the funds.

Additionally, specific terms and conditions may also be included in the form to outline the responsibilities and expectations of both parties involved. This might consist of repayment terms, usage restrictions, or timelines, depending on the purpose of the funds.

Step-by-step guide to completing the certified statement of fund form

Completing the certified statement of fund form can seem daunting, but following a clear step-by-step approach simplifies the process significantly. Start by gathering all the necessary documentation, such as proof of identity, bank statements, and any other paperwork that verifies your claim to the funds.

Signing and certifying your statement

Once you've filled out the certified statement of fund form, the next critical step involves signing and certifying the document. By electronically signing the form, you confirm that all information is accurate to the best of your knowledge, and that you understand the implications of the statement you're making.

The significance of this official certification cannot be understated, as it holds legal weight. In many cases, obtaining a Certified Accountant (CA) certification may be required to validate financial claims officially, ensuring that the statement adheres to accounting standards.

Frequently asked questions (FAQs)

Clarifying common queries can help demystify the certified statement of fund form. For instance, individuals often wonder about its primary uses, which can range from securing loans to confirming funds for educational purposes.

Examples and samples of certified statements

Examining real-life examples of completed certified statements can provide clarity on best practices and potential pitfalls. A well-executed form typically includes all required information correctly and is free of errors or ambiguity.

Alternatives to the certified statement of fund form

In certain situations, other forms of financial documentation may be accepted instead of a certified statement of fund form. These can include simple bank statements, proof of income letters, or affidavits of support, based on the institution's requirements.

Advantages of using pdfFiller for your certified statement needs

pdfFiller offers numerous benefits for users needing to create, edit, and manage their certified statement of fund forms. One of the primary advantages is accessibility; this cloud-based platform allows you to fill out the documents from anywhere, on any device.

Navigating legal and regulatory requirements

Understanding the legal implications of submitting a certified statement of fund form is crucial, as inaccuracies or misleading statements can incur serious consequences. Users must adhere to prevailing compliance standards set forth by financial authorities to avoid penalties.

Next steps after submission

After submitting the certified statement of fund form, it’s vital to stay informed about the status of your request. Follow-up actions typically include checking for confirmation of receipt and understanding what to expect from the reviewing institutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify certified statement of fund without leaving Google Drive?

Can I create an electronic signature for signing my certified statement of fund in Gmail?

Can I edit certified statement of fund on an iOS device?

What is certified statement of fund?

Who is required to file certified statement of fund?

How to fill out certified statement of fund?

What is the purpose of certified statement of fund?

What information must be reported on certified statement of fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.