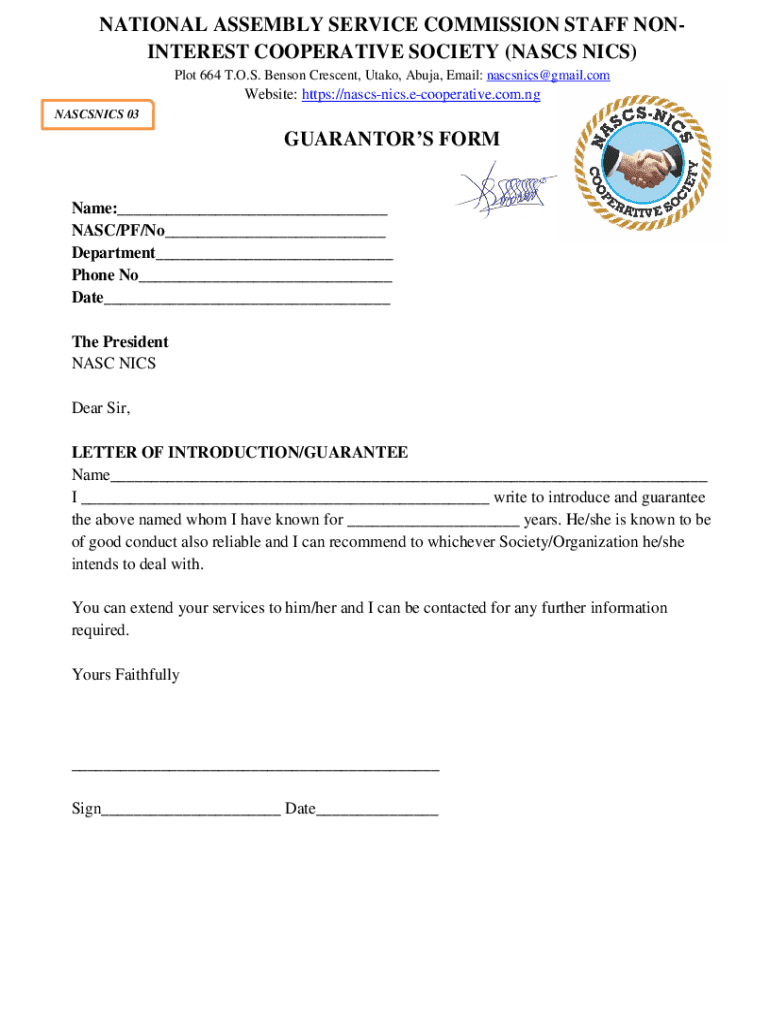

Get the free Guarantor’s Form

Get, Create, Make and Sign guarantors form

How to edit guarantors form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guarantors form

How to fill out guarantors form

Who needs guarantors form?

A Comprehensive How-to Guide on Guarantors Form

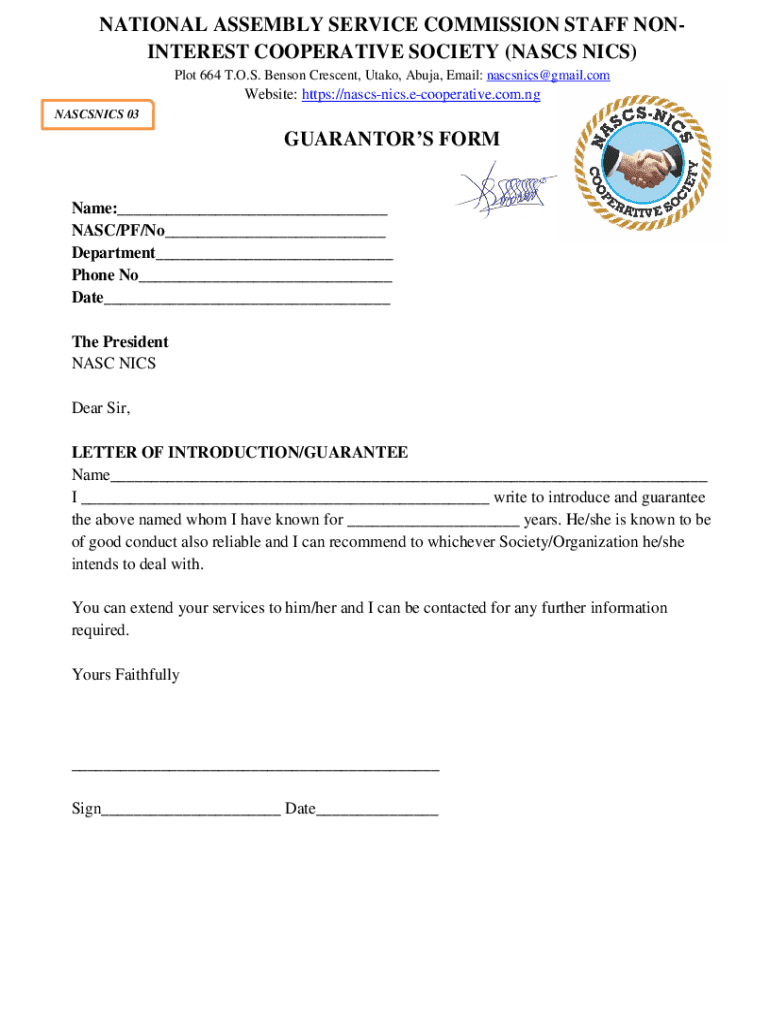

Understanding the guarantors form

A guarantors form is a vital document used primarily in rental agreements, designed to provide assurance to landlords regarding the lease obligations of tenants. This form guarantees that in the event of a tenant defaulting on their rent, the guarantor will step in to fulfill the financial responsibilities. Its significance cannot be understated; as it serves both legal and moral purposes, creating a safety net for landlords and instilling confidence in potential renters.

Understanding the structure of rental agreements requires familiarity with some key terms. Firstly, a guarantor is a person (or entity) who commits to paying rent or covering damages should the tenant fail to do so. A tenant is an individual who leases or rents a property, while a lease agreement is the legal contract between the landlord and tenant detailing the terms and conditions of the rental arrangement.

When to utilize a guarantors form

Certain situations often necessitate the use of a guarantors form. For instance, first-time renters, or those without prior rental history, may find it difficult to secure a lease without a guarantor to back them up. Individuals with low credit scores can also be seen as high-risk tenants by landlords, making a guarantor's commitment essential. Students renting apartments are particularly common users of this document, as many do not have established credit histories and may lack steady income.

Additionally, some states or rental markets may have legal stipulations that require a guarantors form under specific circumstances, reinforcing the need for both tenants and landlords to be well-informed about when and why this form should be utilized.

Who qualifies to be a guarantor?

Qualifying as a guarantor typically hinges on several key characteristics. An ideal guarantor should exhibit financial stability, demonstrating they have a steady income or substantial savings that enable them to cover any potential tenant defaults. Creditworthiness is equally important; a good credit score signals reliability and provides reassurance to landlords regarding their likelihood of fulfilling rental obligations.

The age and residency requirements can also come into play; most landlords prefer guarantors who are of legal age and reside within the country. Common sources of guarantors include family members, friends, and sometimes employers, all of whom are expected to have a close enough relationship with the tenant to take on this significant financial responsibility.

Components of a guarantors form

A comprehensive guarantors form will include essential elements necessary for clarity and legal compliance. These elements typically comprise the guarantor’s personal information, which involves their name, address, contact details, and financial information. Tenant details should also be present, including their name and the specifics of the rental property.

Moreover, the form will elaborate on the agreement’s terms and conditions, including the duration of the lease and any financial agreements regarding rent or damages. Signatures from both parties, alongside the date, finalize the form. To enhance transparency, optional sections for financial documentation requests, or additional clauses for unique situations may also be included, thus allowing for a more customized agreement.

Step-by-step instructions for filling out the guarantors form

Filling out a guarantors form can seem daunting, but breaking it down into simple steps can make it manageable. Start by preparing to collect necessary information from all parties involved, ensuring you have accurate details ready at hand.

Editing and customizing the guarantors form online

To ensure efficiency and professionalism, many users turn to digital solutions like pdfFiller for editing their guarantors forms. Accessing and uploading the form on pdfFiller's platform is straightforward, allowing users to utilize editing tools designed to modify content seamlessly.

Furthermore, pdfFiller's platform allows you to save and share the updated document directly, eliminating the hassle of traditional paper filing. Additionally, integrating eSignatures into the document enhances legal compliance by ensuring that all parties can sign the agreement digitally, making back-and-forth negotiations more manageable and efficient.

Common mistakes to avoid with guarantors forms

While filling out a guarantors form, several common mistakes can create future complications. One major oversight is overlooking important details such as missing signatures, which can render the form ineffective. Inaccurate information, whether regarding the guarantor or tenant, can lead to disputes and potentially violate lease agreements.

Errors made in the form can have serious repercussions, including legal challenges or financial burdens if the guarantor is required to fulfill obligations for which they were unprepared. It’s crucial to double-check all entries and to ensure both parties clearly understand their commitments.

Frequently asked questions (FAQs) about guarantors forms

Potential users of the guarantors form may have several questions about its functionality and implications. Can a guarantor be a business entity? Yes, in some instances, businesses can serve as guarantors, provided they meet the financial and legal criteria outlined by the landlord. What happens if a tenant defaults on a lease? The guarantor is typically responsible for covering all unpaid rent and any damages incurred.

Additionally, many people wonder how a guarantor can revoke their agreement. Revocation processes usually require formal written notice to the landlord and possibly the tenant, along with any specific terms regarding the timeline. Lastly, individuals may ask if alternatives to using a guarantors form exist; options include paying higher security deposits or securing a co-signing arrangement, though these options typically carry their risks.

Best practices for managing guarantors

Effectively managing the guarantor relationship is paramount for both tenants and landlords. Clear communication can prevent misunderstandings, so keeping guarantors informed about lease obligations and any relevant updates is essential. This includes changes to rental terms or the need for additional financial information, should the tenant’s situation change.

Moreover, it’s vital to document any changes or agreements to provide legal protection for all parties involved. Utilizing document management solutions like pdfFiller can significantly streamline this process, ensuring that records are accurate and easily accessible whenever needed.

Legal implications and considerations

Understanding the legal implications of guarantor agreements is critical. Each state may have different regulations influencing the validity and enforceability of a guarantors form, warranting attention to local laws before finalizing any agreement. Consulting with a lawyer can provide clarity, particularly for complex cases, ensuring that the agreements conform to legal standards and protect both the tenant and landlord’s interests.

A lawyer’s role can also include helping to draft and review forms, ensuring that all provisions are fair and clearly articulated. By being vigilant about legalities, all parties can proceed with confidence that the guarantors form will hold up as expected, safeguarding against potential disputes in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send guarantors form to be eSigned by others?

How do I complete guarantors form online?

How can I fill out guarantors form on an iOS device?

What is guarantors form?

Who is required to file guarantors form?

How to fill out guarantors form?

What is the purpose of guarantors form?

What information must be reported on guarantors form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.