Get the free Group Life Insurance Evidence of Insurability Form

Get, Create, Make and Sign group life insurance evidence

Editing group life insurance evidence online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group life insurance evidence

How to fill out group life insurance evidence

Who needs group life insurance evidence?

Understanding the Group Life Insurance Evidence Form: A Comprehensive Guide

Understanding group life insurance

Group life insurance refers to a single policy that covers a group of individuals, typically offered by employers to their employees. This type of insurance can provide a significant safety net for families, ensuring financial stability in case of an employee's untimely passing. The importance of group life insurance lies in its affordability and the benefits it offers, like coverage without medical exams for some participants.

Among the key benefits of group life insurance are lower premiums, simplified underwriting processes, and coverage for all eligible participants, which can include not just employees but also their families. Essential terminology in this arena includes 'beneficiary,' the individual designated to receive the benefits upon the insured's death, and 'coverage amount,' the total amount payable under the policy.

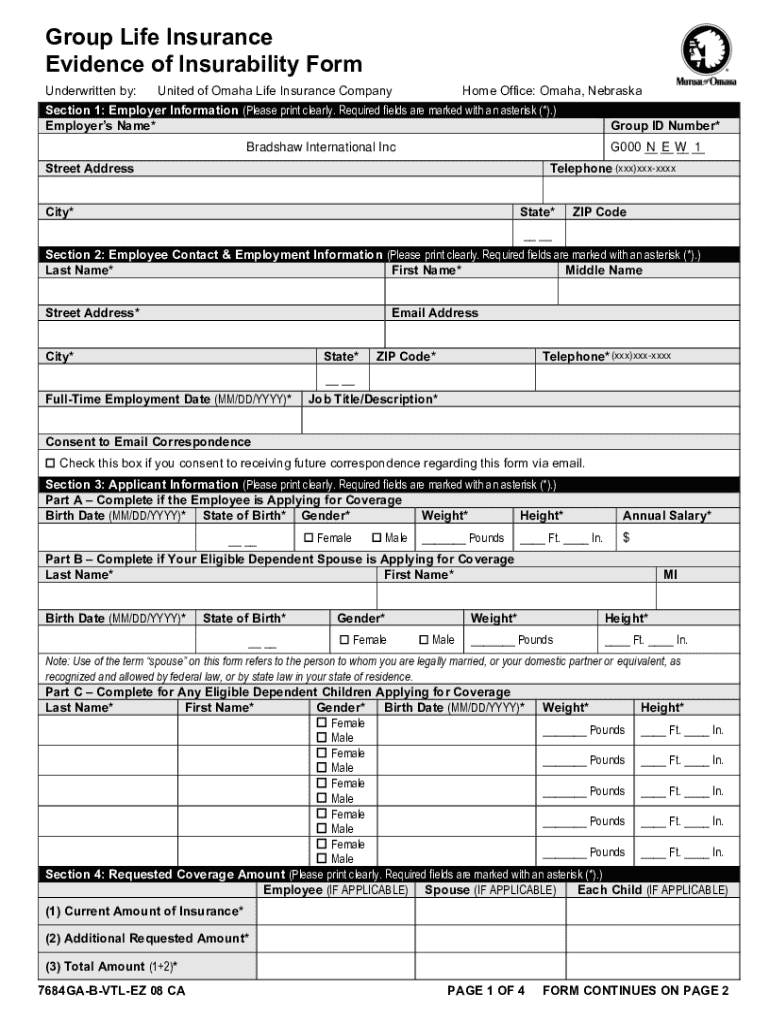

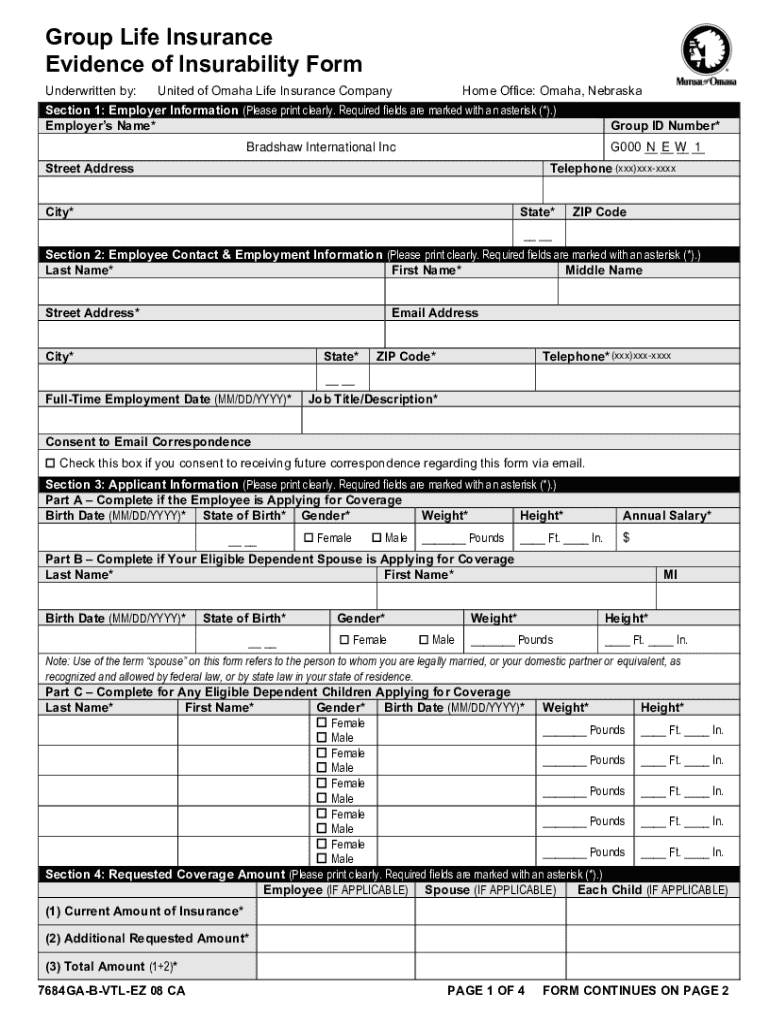

Overview of the group life insurance evidence form

The group life insurance evidence form is a pivotal document used to apply for coverage or to establish eligibility for benefits under a specific group policy. The primary purpose of this form is to gather necessary personal and health information, which assists insurers in determining the risk profile of applicants. It's essential for employees wishing to enroll, particularly during open enrollment periods or when changes in employment status occur.

Typically, individuals who need to fill out the form include current employees of the group policyholder, those converting policies when leaving an employer, or individuals seeking to increase their coverage. Common scenarios for submission include joining a new employer that offers group life insurance or when an employee experiences a major life event such as marriage or the birth of a child.

Getting started with the group life insurance evidence form

Accessing the group life insurance evidence form is straightforward. Typically, forms can be found through your employer's HR department or benefits portal. They are often available in multiple formats, including downloadable PDFs and fillable online forms, accommodating the needs of all applicants.

Before starting, have the following information ready: personal details including your full name and contact information, policy specifics like your group policy number, and details about your chosen beneficiaries. This preparation ensures a smoother completion process and reduces the likelihood of mistakes.

Step-by-step instructions for filling out the evidence form

Filling out the group life insurance evidence form can seem daunting, but by breaking it down into sections, you can manage it more effectively. Here’s a section-by-section breakdown:

When completing the form, be thorough but precise. Double-check your responses to ensure accuracy, especially with health questions, as these can significantly affect your coverage eligibility.

Editing and customizing your group life insurance evidence form

Using pdfFiller offers several advantages in editing and customizing your group life insurance evidence form. The platform's editing tools allow you to make necessary edits with ease. You can add electronic signatures, ensuring that your documents are fully compliant and legitimate.

Additionally, pdfFiller's collaboration features let multiple team members work on submissions simultaneously, making it easier for human resources or management teams to gather all information for one submission. Users can save their documents in various formats for easy sharing and exporting.

Common mistakes to avoid

Submitting a group life insurance evidence form can be straightforward, but common pitfalls can cause delays. Key mistakes to avoid include:

What happens after submission?

After you submit your group life insurance evidence form, the insurer will begin a review process where they evaluate your application and the health disclosures provided. This process typically takes a few weeks, but times can vary based on the insurer and the volume of applications they are processing.

It's advisable to follow up with your HR department or the insurance provider if you experience delays beyond the expected timeframe. They can provide updates and clarify any potential issues with your submission.

Frequently asked questions about the group life insurance evidence form

Users often have questions navigating the group life insurance evidence form. Here are some common queries:

Interactive tools for managing your documents

Utilizing pdfFiller's cloud-based platform provides robust tools for managing your group life insurance evidence form. Users can track changes, manage document versions, and collaborate with team members in real-time. These functionalities make document management more cohesive, especially in larger organizations.

The ability to collaborate ensures that everyone involved in the documentation process can make necessary amendments and share feedback instantly, streamlining the process significantly.

Importance of securely managing your group life insurance evidence form

Maintaining the security of your group life insurance evidence form is paramount due to the sensitive information contained within. Data privacy and security features provided by pdfFiller ensure that your documents are protected against unauthorized access and breaches.

Employing best practices for document management, such as using strong passwords and ensuring that documents are shared only through secure channels, can further enhance your protection.

Additional support resources

If you're facing challenges or have questions while filling out your group life insurance evidence form, pdfFiller offers a range of support options. Customer support is available for queries, while tutorials and guides on their website can help you navigate the platform effectively.

Engaging with community forums and user groups can also provide valuable insights from others who have gone through similar processes, fostering a sense of shared experience and learning.

Summary: Empowering your documentation journey

Utilizing pdfFiller's platform for completing your group life insurance evidence form simplifies the often tedious documentation journey. By leveraging interactive tools, robust security features, and support resources, users can manage their documentation with confidence.

Incorporating these efficient processes encourages individuals and teams to focus on the broader implications of their life insurance coverage, ensuring financial peace of mind for themselves and their families.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the group life insurance evidence electronically in Chrome?

Can I edit group life insurance evidence on an iOS device?

Can I edit group life insurance evidence on an Android device?

What is group life insurance evidence?

Who is required to file group life insurance evidence?

How to fill out group life insurance evidence?

What is the purpose of group life insurance evidence?

What information must be reported on group life insurance evidence?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.